November was the first month I got down and dirty with my new financial goals. Having them in mind gave the month shape and purpose – I felt for the first time in a while that I was working toward something urgent and real and palpable that I could measure.

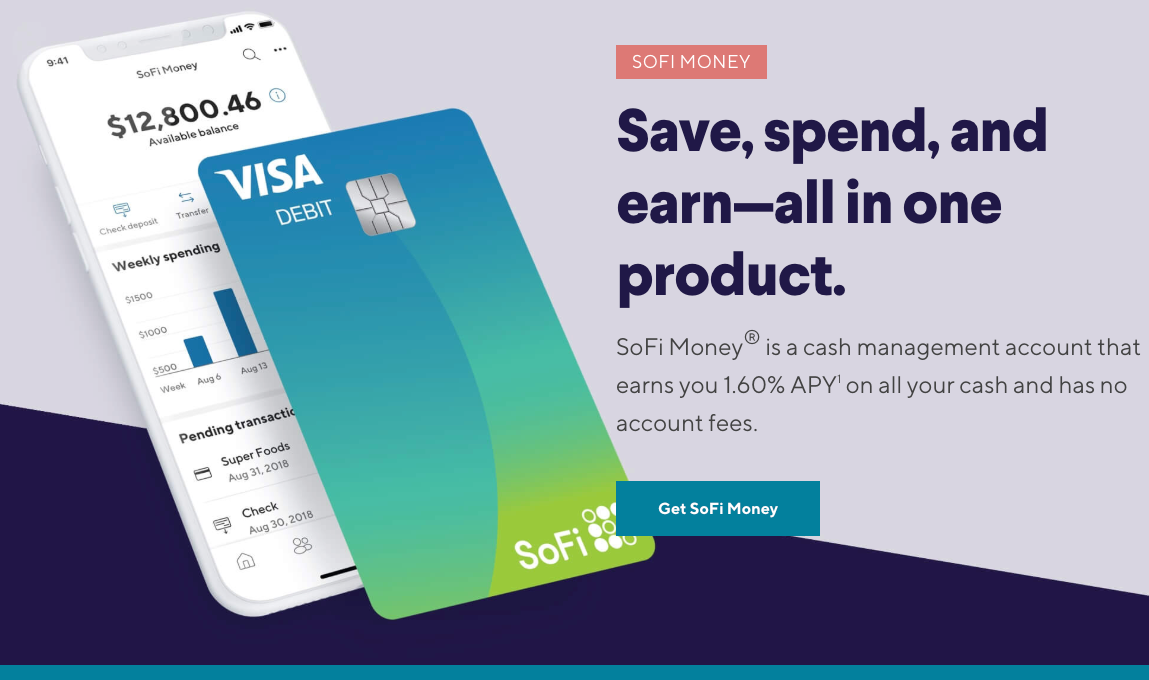

If naming things is empowering, creating a plan is getting superpowers. I watched as each dollar flowed into and out of my accounts.

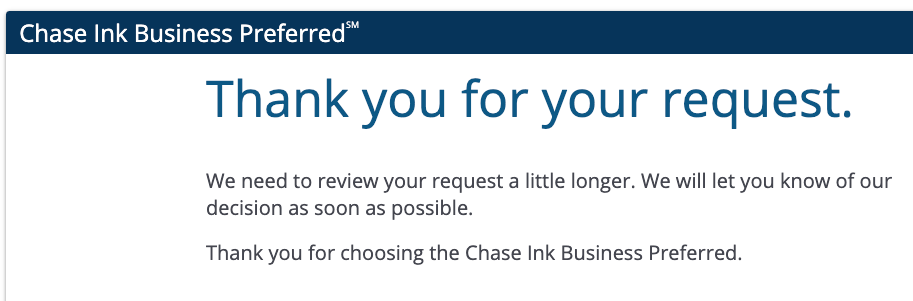

Slow and steady wins the race, but I have an out-of-control, flaming emergency! I have GOT to pay off my credit cards by April 2020 before the 0% APR rate expires. And I’ve got over $14,000 left to go.

Last month, a combination of strong market and aggressive payments boosted my overall net worth to $115,806 – a full $20,000+ increase.

And while it’s nowhere near the $500,000 goal I want to hit, it’s an awesome start. And to that end, this is my first Freedom update (Freedom is what I call money). I hope I look back on these posts and marvel at my progress. One day…

Getting started on my FIRE in a big way – getting rid of credit card debt is my #1 prerogative right now

I know “never say never” buuuut… I will NEVER have credit card debit ever again as long as I live. In the future, I’ll dip into my healthy savings account. Because this hurdle really freaking sucks.