Hello my droogs. How quickly things change in a day.

I started this post with such excellent news to report: big gains, strong performance, and hard work paying off. As I write this, I fear I’m about to go into battle with my HOA over repairs that haven’t been made for a month – right before my (nearly free) Cabo trip. So I’ll try to put myself back into my previous headspace and vent about the rest later. Because I need to vent.

The good news is a continuous upward trend. Though I fear coronavirus is about to give my stocks a hell of a beating, I’ll have to see it as an opportunity to buy more at a discount. Because it’ll pass and that’s what it is.

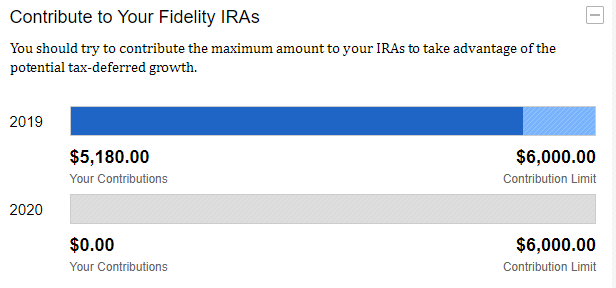

This month finds me almost done maxing out my 2019 Roth IRA. Then I can finish paying my credit cards and turn attention to the 2020 Roth IRA. All according to plan.

I’ll be back in Mexico at the end of this week, a lot further ahead than I was before – even if it doesn’t feel that way right now

The HOA stuff might throw a wrench in my progress soon, and I hate that. But life, right?

Sigh – going back to previous headspace again. As it stands now, my overall net worth is up to $137,885 – 28% of the way toward my $500,000 goal. Baby steps feel so good.

February 2020 Freedom update

I’ll keep this one brief. April 15th is creeping up which means:

- I have to file (and pay) my 2019 taxes

- The last day to max out 2019 IRAs is approaching

I wasn’t in a great place for a lot of 2019, and certainly didn’t max out my Roth IRA during the year. But I’m making up for it in a big way – and making tons of other progress, too.

Almost there for 2019 Roth IRA!

Of the $6,000 maximum, I’m $5,180 into the 2019 contribution limit.

Only $820 to go!

No matter what, I’ll focus on filling out the final $820 that’s allowed and sink it all into no-fee Fidelity index funds (FZROX is my fave).

I accomplished this by taking a break from paying down my credit cards. There’s no interest right now, but as soon as I’m done with the Roth IRA, I have to catch up in a hurry because my 0% promo rate expires in April 2020. That, or roll it over one last time with a new balance transfer offer. And my god, that’ll be the last one I ever do. (I swear!)

All this to say, I’m almost there. You know how they say, “Save till it hurts?” I’m officially hurting. Getting this far required every spare scrap I had. But almost there. And I don’t want to ease up.

It’s true that once you realize how far you can extend, you can always find a little more to squeeze (like an anaconda). That said, I don’t want to get so obsessed with saving that I forget to have fun – and this Mexico trip will put that back into focus. I have some things to say about that mentality too. (This is becoming a scratch pad for all the future things I want to write. Lord grant me more energy to pour into writing!) 📝

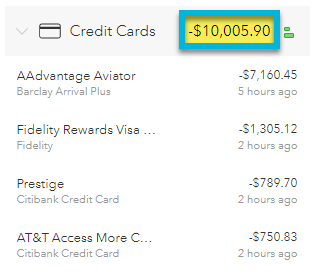

Credit cards are coming back into view

A thorn in my side, and a necessity to rid: credit card debt.

Did it to myself

I actually made a tiny bit of progress. But as soon as I finish maxing out that Roth IRA, I’ve gotta get back to taking this out once and for all. Depending how much progress I can make, I might consider one final balance transfer offer (I get them constantly). It will buy me a little more time and be cheaper than carrying a balance for a few more months. But once it’s done, I can get back to maxing out my 2020 Roth IRA and actually building my emergency fund for the first time in my adult life.

And that’s gonna feel like such progress.

But March will be a tricky month.

I don’t wanna pay fees or interest by trying to save too aggressively. In the next week or so, I have to figure out how to:

- Finish putting all I can into the 2019 Roth IRA

- Save on credit card interest before the 0% rate expires

- Pay down my current (regular recurring) charges

- Navigate what will surely be unexpected charges – will have to just allude to this now and fill y’all in soon 😫

God, I don’t want to reverse my progress. But… we’ll see.

This was a good month

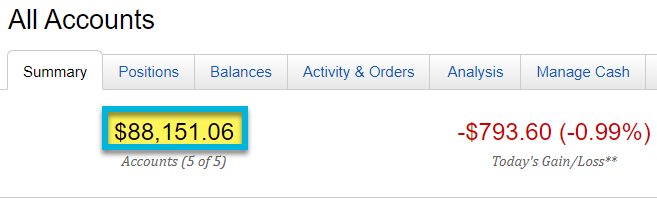

All in all, I’m up $10,565 compared to this time last month (!).

Here’s the full view:

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

| Credit cards | $10,006 | $10,506 | -$500 | $0 | |

| Mortgage | $143,019 | $143,481 | -$462 | $0 | |

| Car | $5,965 | $6,147 | -$182 | $0 | |

| Roth IRA 2019 | $5,180 | $1,800 | +$3,380 | $6,000 | |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $6,673 | $5,425 | +$1,248 | As much as possible | |

| Overall investments | $88,151 | $82,212 | +$5,939 | As much as possible | |

| Savings | $533 | $532 | +$1 | $20,000 | |

| Net worth in Personal Capital | $137,885 | $127,320 | +$10,565 | $500,000 | Track your net worth with Personal Capital |

I hate losing progress to market dips – but that’s another thing I’ll have to learn to handle

Takeaways are:

- Credit card progress stalled – as explained above

- My investments continued to rock n roll

- I’m so close to $100K invested I can taste it

- I can’t wait to max out my 2020 401k limit

- Savings are at a standstill – and I can’t wait to have an emergency fund

- The next big project on my list is to rid myself of credit card debt forever

And it all came out to this:

Slow and steady wins the race

I don’t think I’ll ever shake the feeling that I’m “behind” or not making progress quickly enough. And then I check in and realize (over and over) how far I’ve really come. It’s incredibly humbling and an exercise in reminding myself to be more gentle, soothe the self-talk, stay kind and supportive of my own goals.

So while I know it might hurt to stall – or worse, reverse – progress, I’m the only one requesting a deadline or pressuring anything to happen at all. It’s time and waiting and plugging away. And also thrilling and empowering and again, humbling. I’m further along than a lot of peeps, and way behind others.

It burns a little to see people younger than me with more saved and declaring their own version of FI (financial independence) sooner. But I can’t compare my beginning to someone else’s mid- or end-point. Instead, I must be content with my own progress for what it is – or isn’t.

Learning the lesson is nearly as slow as accomplishing the goal. I wonder how it will feel once I’m at the end. Will I learn to be patient in time, or will it happen by default as a natural function of the process?

February 2020 Freedom update bottom line

Did you smile knowingly when I said I’d be brief? Because you know I’m incapable of having a short wind? How silly of me.

But one more note! The power of goal setting. I put my birthday in 2024 as my FI goal in my Momentum dashboard. I will be 40 then and it will have been five years on this financial path.

1,644 daze left to FI

That will be in 1,644 days. And to think there are 365 of them in a single year. It seems so manageable. But also stressy. Time is slipping and yet there’s still so much of it. What will I do with these 1,644 days I wonder. Will it be enough? And what happens if I don’t make it all the way?

The same answer as if I reach the goal early: nothing. Life will continue either way. And that… that really blows my mind.

So now the real bottom line? This is all one big mental experiment, and I’m both the actor and observer. It’s actually really amusing. Silly me. 🙃

That’s all I got for this month. Hope all is breezy in your world. 💌 #SWAK

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Keep going at it! I started my path to FI at 30 but that was because I just moved to the country. Still chugging along and throwing everything to Roth IRA, 401k and the HSA. I’ve never felt so poor lol

Stocks are really going down at the moment so I invested A bit in there too. Problem is nobody knows when the bottom will come so I ran out of money to invest lol

It’s the little steps, right? What made you come up with 500k? $20k in living expenses for the year (after the mortgage is paid down?)

Hey Ruby! How strange it is to read “nobody knows when the bottom will come” a month later lol. Definitely feel you on running out of money. And yup, $20K in expenses in a paid-off house is the goal. Will prolly move to a cheaper area (cheaper than Dallas, even).

I’m sorry it took so long to reply. I often feel vulnerable after posting these updates and it takes me a second to get back to them. But writing it all out helps a lot. And I’m so glad you are here and reading it.

Congrats on your new little one. I beyond thrilled for you. How are you doing? Sending you big virtual hugs.

-H.

Looks like you’ll get your chance to buy up some cheap stocks on sale! I’ve been struggling with being able to move funds into my investment account since it takes 2 transfers, but I’ve submitted documents and hoping they get their act together. This 5 day transfer time already made me miss out on today and I’m hoping the transfer completes tomorrow morning so I can buy more. I don’t care that I’m down nearly $6k in these past 3 days, because I’m going to buy as many dividend stocks on sale that I can. Love LOVE these opportunities that don’t come around too often.

Heck yeah! I maxed out my 2019 Roth IRA in the (k)nick of time this year. My stocks have taken a huge beating. Getting nervous about my job with all the layoffs and cutbacks lately. How are you and Kim doing? Hope y’all are safe!

Nice! Just keep paying down debt and investing and eventually your job income won’t be as crucial.

Been taking a beating here too, but I deployed $20k 2 weeks ago on the way down and then I got nervous and sat on the sidelines. Looks like Monday was the day to back up the truck, but I haven’t bought anything since 2 weeks ago. Merrill got my online transfers sorted so it’s only 2 days now. So much doom and gloom that I was waiting for things to go lower before getting back in and missed the bus this time.

We’re good for now at a pet sit in Carlsbad, CA so not in a big metro area. We were supposed to leave today but got lucky and our hosts decided to stay in Mexico till April 20th so we get to ride this out a little longer. How’s Dallas now?

Oh nice! Dallas is currently on lockdown and people are definitely freaked out but we have some semblance of normality. The stores are pretty well stocked and everyone’s being pretty civil. For the most part, it’s “business as usual” with added precautions. I’m actually enjoying this time tremendously. Working from home, can’t go out drinking all night, and getting caught up on my pile of books. I don’t wanna do it forever, but for now… it’s really really nice.

any update here?

Hey John! I just wrote all about it: https://outandout.boardingarea.com/march-2020-freedom-update/

OOF. How are you doing?