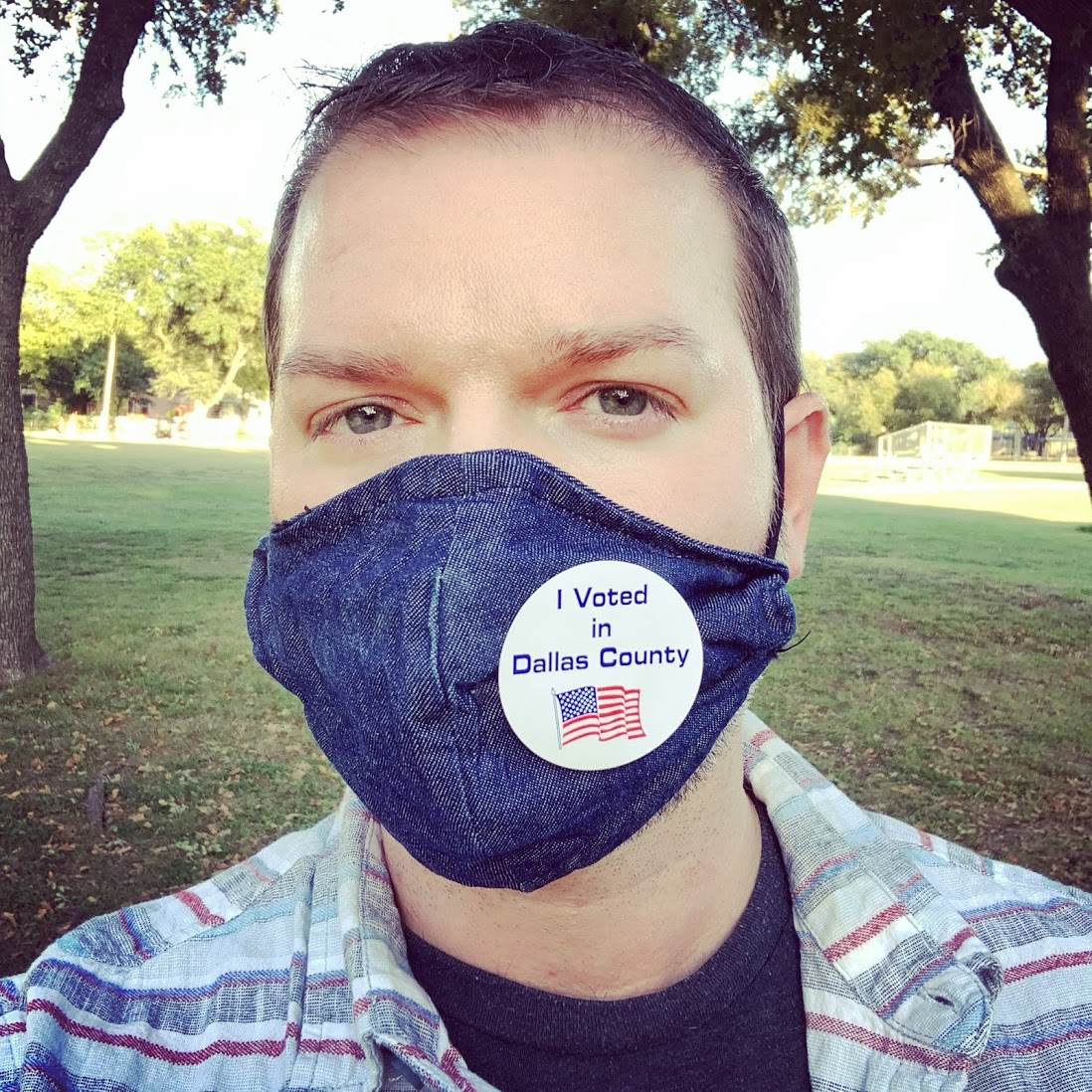

I spent most of last week partying in Austin, hiking in Big Bend National Park, and driving. Lots of driving. I drove over 1,000 miles last week. But let me tell you: West Texas is insanely gorgeous. I had no idea. I kept thinking, “This is Texas?!” as I hiked and drove around the Big Bend area, very much in the middle of nowhere.

I was also able to squeeze in the River Road drive between Lajitas and Presidio (on my way to Marfa), 67 miles of pure twisty mountainous highway considered to be the most scenic drive in Texas and one of the most beautiful in the country.

All the hiking and driving made me feel, at times, that I was perhaps the last person on Earth. It’s such beautiful nature out there. And at night, you can see thousands and millions of stars and glimpses of the Milky Way, which make you feel like you’re on the fringes of the galaxy – which you actually are. Absolutely cosmic.

At the terminus of Lost Mine trail, on the mountains… in Texas!

I wasn’t expecting so many mountains. Or to experience such biodiversity in Big Bend. For example, did you know there are bears in Texas? I sure didn’t. But sure enough, the park is populated with thriving black bears, along with mountain lions, deer, rattlesnakes, and lots of other critters that move between scorched desert to canyon to near-jungle, from cactus flowers to alpines.

Here’s more from the trip.