Update: As of 5:32 pm Eastern time, PFS Buyers Club is not letting anyone else opt-in to the offer. DEAL IS DONE.

Congrats to those who got in on this! Signup for PFS Buyers Club so you don’t miss the next deal when it pops up!

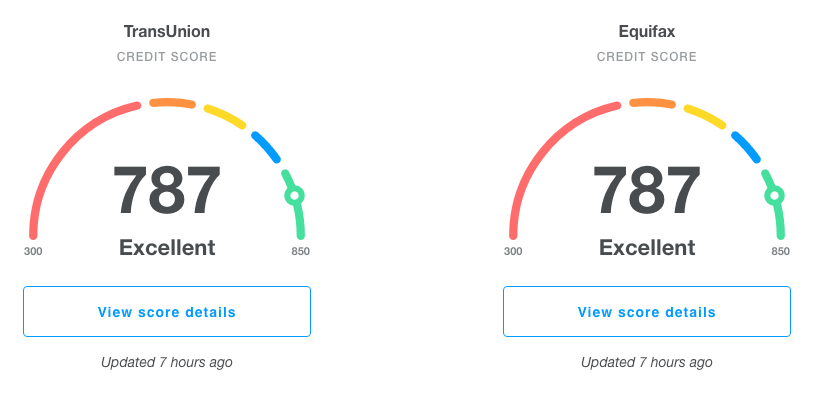

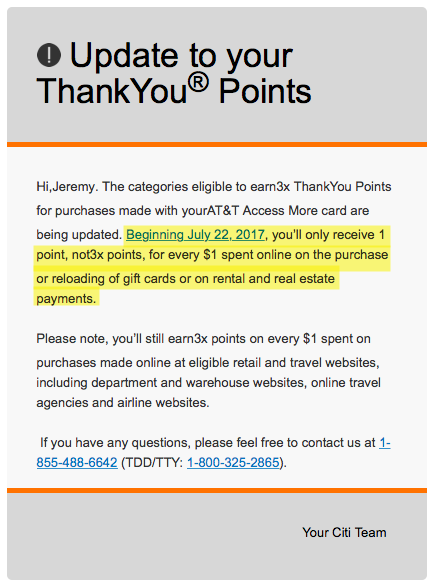

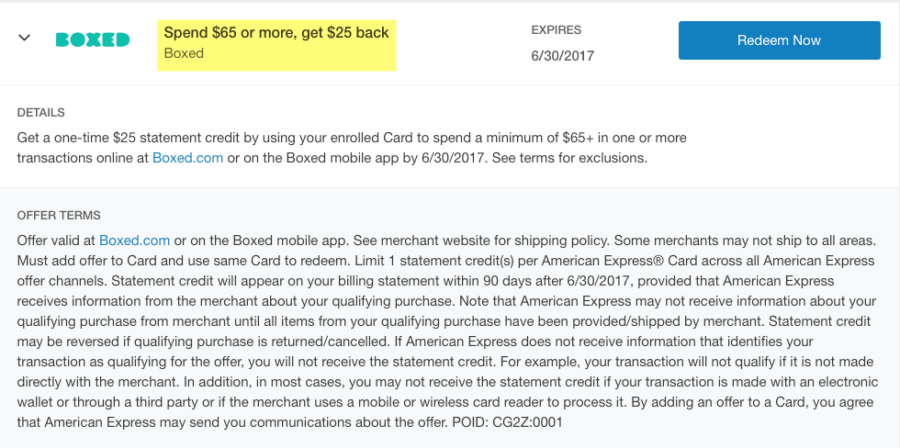

Via my friend Meghan, you can purchase a Platinum coin from the US Mint tomorrow for $1,300 + $4.95 in shipping, then get paid $25 a week later. And yes, you can use a credit card.

The coins become available at exactly 12:00 pm Eastern time tomorrow, July 6th, 2017. Sometimes these deals go within minutes, so set a reminder for 11:50 am so you can be ready, if you’re interested. And be sure to opt-in (details below).

Then, PFS Buyers Club will send you a pre-paid label and pay you $1,330 for your effort – which yields a profit of $25. They send a check or PayPal payment within 7 business days of when you send them the coin.

Here are a couple of tips if you’re interested in this deal.