Also see:

- Airbnb by the Numbers: An Update for 2016

- How I Made an Extra $60K from Airbnb in 2015

- Airbnb: Us and Them

Thought it was time to do an update on my Airbnb hosting. And the state of it. Mostly because if the numbers look good, I might get another one.

Long ago, I started my Airbnb operation in New York, which was a smashing success. Until it wasn’t. I no longer have properties in New York, as of last month.

So far it’s going well in Dallas. I have two here. They’re easy to track and manage for what they are because they’re on two separate profiles.

In my opinion, a side business is the best way to maximize credit card points these days. I easily put $6,000+ of expenses on my cards each month – and the bulk of that is in bonus categories.

I recently found out some rent payments code as 3X for “travel” with the Chase Sapphire Reserve. So that’ll keep me with an extra ~20,000 Chase Ultimate Rewards points per month – a handy ransom (if they all code as 3X)!

Airbnb hosting by the numbers

Airbnb makes it dead easy to track your stats these days.

#1

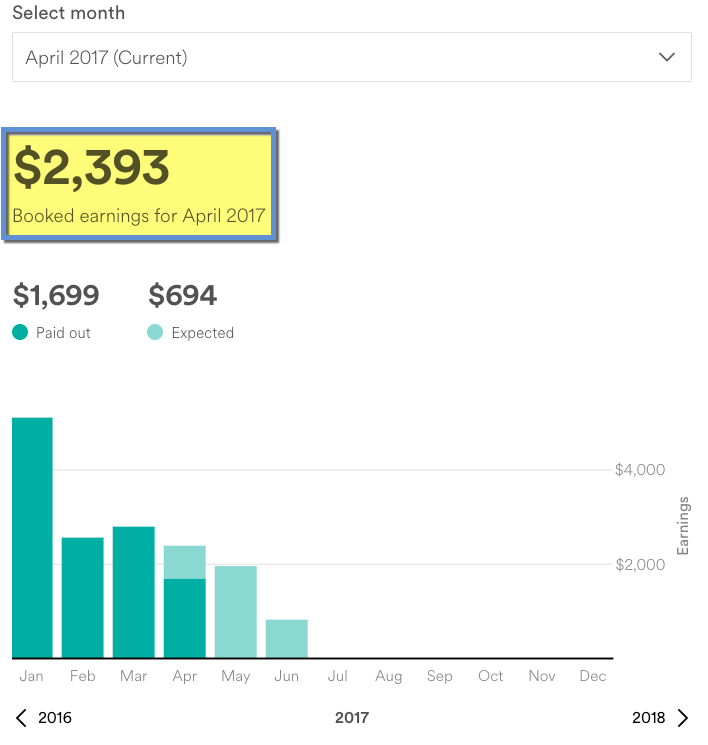

So let’s look at my downtown Dallas Airbnb this year:

The numbers for January are skewed because I had two places on this profile. I’ll correct below.

The rent for this one is $1515 a month. The electric bill is ~$100. And the internet costs ~$35.

I also pay a house keeper $200 a month to clean it and keep it up. Supplies are cheap, maybe $20 a month? And I replace items here and there as needed.

So, $1515 + $100 + $35 + $200 + $20 = $1,870. That’s the breakeven point for me every month. So far in 2017, I made, in pure profit from this place:

- January – $1,442

- February – $695

- March – $928

- April – $523

The numbers are kind of all over the place, so it makes it hard to predict.

If I take the 4 months, add them up, and divide by four, I get $897 a month, on average from this place. Assuming it performs at that level all year, $897 X 12 is $10,764. Or about $11,000 a year in pure profit, after expenses.

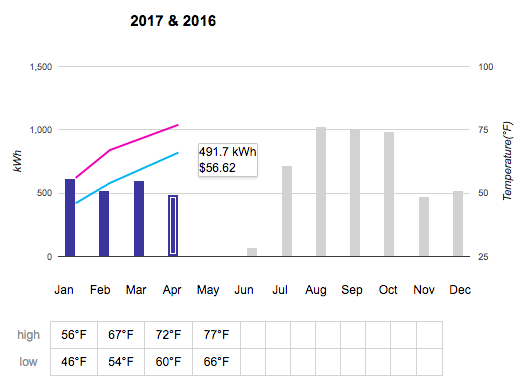

Some months electricity is only $60ish. Other months (the summer obviously), it’s $100ish. So there’s plenty of give and take going on. Despite the weather, this place tends to stay booked.

#2

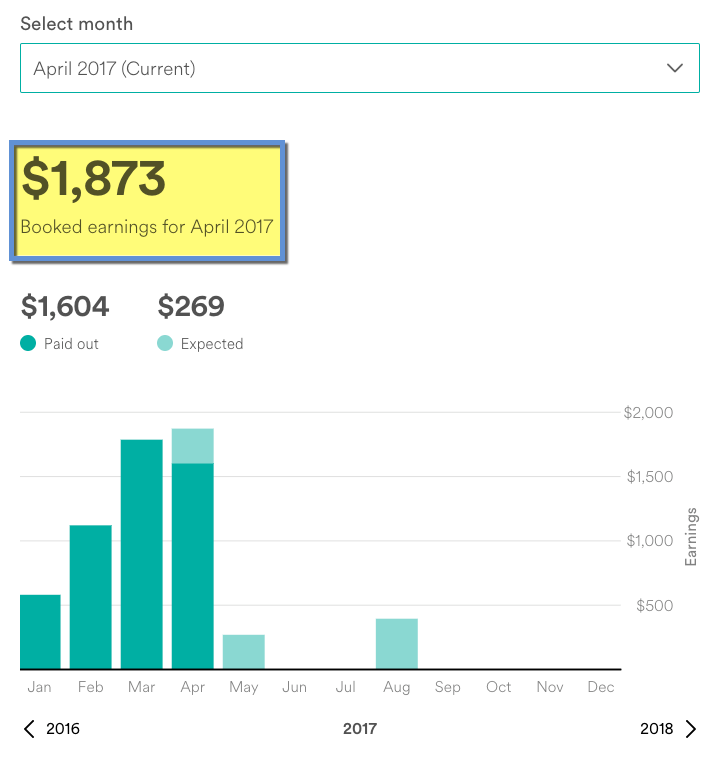

Here’s the second one, in Oak Lawn near where I live.

Everything about this place is smaller in scale. It’s physically smaller, for one. Also cheaper. The stays tend to be longer, so it gets fewer cleanings. And overall, it’s much easier to manage – less of my time.

The rent is $950, the electricity is billed through management and so far has been only $25ish a month, the internet is $35, and the cleanings are also $50 a pop. Same cost for supplies, too ($20 a month).

$950 + $25 + $35 + $150 + $20 = $1,180. I give this one 3 cleanings a month on average (that’s where the $150 came from).

In April 2017, I made $693 in pure profit. But, I’ve only had this February (technically, for a few days in January, but I’m subtracting those). So far, I’ve made:

- February – -$59

- March – $607

- April – $693

I’ll chop off February (the “getting started” month), and go with March and April. My Virgo-ness doesn’t like such a small sample size, but it’s all I have right now. Based on it, I get $650 a month or an extra $7,800 a year from this place. Not bad!

Risks and changes

I’m still newish to the overall Dallas market – but I like the results so far. Of course, they’re nowhere near New York-level returns. But I knew that going into it.

I risk, every month, losing money on these places if they don’t book up. It has only happened a single month so far while the places have been fully operational (see above) – and I don’t really count that.

This Q1 in Dallas is actually better than the Q1s I had in New York – I got really close to losing a lot of money those months in New York.

Airbnb will collect taxes for the City of Dallas starting next month (May 2017). So that will be new. And remains to be seen how or if that will affect business.

There’s also the possibility of being kicked out of these places. But it’s so low-risk in Dallas – all you face is eviction. It’s a chance I’m willing to take. And so far – touch wood – it’s been smooth sailing. So much so that I dare say I’m even… enjoying it!

Bottom line

This is, ashamedly, my first time taking a look at my raw numbers for 2017.

But when I look at them as an average, I like them: $10,764 + $7,800 = $18,564.

$18,000+ a year for a low-stress side hustle that nets me plenty of bonus points is worth it to me.

Again, it’s nowhere near the $60,000 I made in New York in 2015. But those days are long gone with all the new regulations there.

So, I’m making less but also doing less and don’t have as much going on overall.

If I were to get another place in Dallas, I’d probably take the average of the two I already have – and assume about another $9,000 a year in profit. That would bring me closer to $30,000 a year, which is still damn good.

Huh. I think I just convinced myself to get another one.

Thanks to the readers who love geeking out on numbers and data as much as I do! 🙂

Any other ideas for side hustles I should ponder?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

This is awesome. I looked into this for FTW a few months ago and apparently they don’t allow anything like AirBNB at all so that’s out for me. Too bad, I was really looking forward to getting one of these.

FTW says no! But you could maybe do Irving or Euless, near DFW? Catch a lot of people on overnight layovers. Just an idea.

If you really wanted one in Dallas, I’m happy to help you look after it. Where there’s a will, there’s a way! 🙂

Didn’t even cross my mind, but that’s a great idea! We could stay in our own BNB too since we’ll be out in the boonies.

Heck yeah! Have you guys settled on an area yet? I’d love to help you do the BNB thing once you get settled.

Not yet. Most schools don’t start posting jobs till mid-May and then don’t begin interviews usually till early June. I hate cutting things that close and not knowing if she will have a job for next school year.

Neighbors here are driving me out of my mind. The mom lets her 6 year old jump off furniture, run the stairs and just generally be a total animal. No dad of course so she lets him do whatever he wants. And we share walls. Been thinking of moving out to stay with my parents for a month or so or with whoever will have me. If I don’t get out I am going to lose my mind, and I don’t need this constant stress in my life.

I remember being blown away by your NYC numbers. These are a lot lower. Thanks for the numbers tho it’s always interesting to see.

They are definitely much lower, but less risk and hassle too. I also had four in NYC and have only two here (so far).

That year in NYC was a blast but man, I was running around like a crazy person. It was worth it though – then and now.

Thank you for reading and commenting!

Interesting article. Curious about your cleaning expenses – how can you only clean 3 times per month, rather than after every guest? And how did u find someone willing to clean the other apt every day for only $200/month?

Both places are cleaned after each guest. Both places cost $50 a pop to clean. The first place tends to need 4 cleanings per month ($50 x 4 = $200). The second place has longer stays, so needs fewer cleanings. I also pitch in when I can.

Are cleanings normally fairly quick and easy or do they take a lot of time? Have you had anything stolen from any of your BNBs?

Normally quick and easy. Most important things are bed, bathroom, clean towels, floors done. I also start the dishwasher right when I walk in and unload it before I leave (when I do it). And just make sure everything else is in good order – throw out any leftovers in the fridge, etc.

NEVER had anything stolen. It’s honestly been a (mostly) smooth experience since I started.

Good deal.

Thanks, I really appreciate you sharing your numbers. I may have to consider getting into this!

Thank you so much for reading and commenting!

It def takes a certain temperament, but well worth it for a really decent side income (and points!) stream.

Harlan,

I think it’s super cool you do this stuff. I just had a question about the taxes…what kind of tax is owed on Airbnb income or what insights do you have on that aspect of this?

Thanks.

Thank you for reading and commenting!

It’s taxed as though you’re a 1099 employee. So I set aside 20% of everything in anticipation I’ll owe that much as tax.

I also have a W-2 job, so I set that to zero deductions. This past year, I actually got a little cash back, so it balanced out. Texas also doesn’t collect state income tax so that’s REALLY nice.

In New York, I kept strict records and had an accountant prepare everything. This past year, I was able to file it myself because it’s a lot more streamlined here.

But yes, taxes are definitely a concern. I’d say 20% is a good estimate based on my experience. And definitely keep track of everything you spend. I use Evernote to track all my receipts and it’s been an absolute godsend.

How much did you pay for these two properties and when did you buy?

I just lease them – don’t own. But that could be a viable strategy if the numbers work!