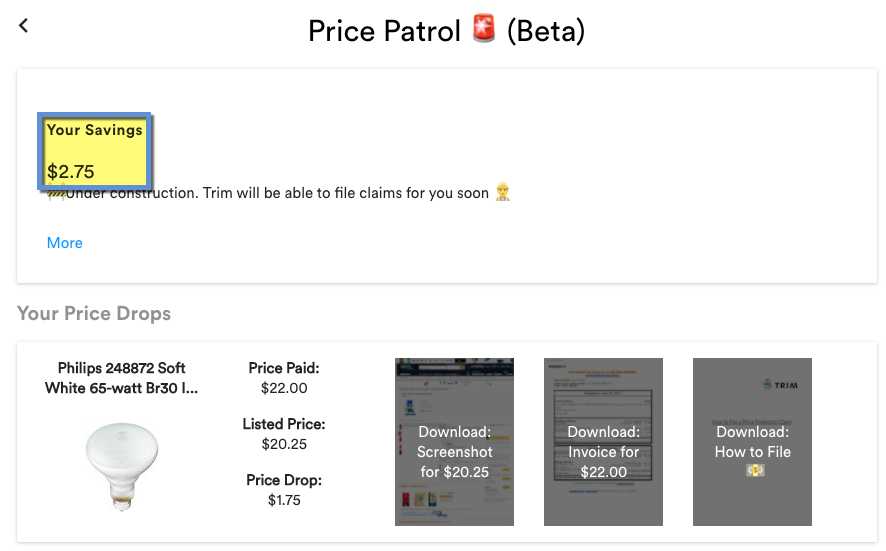

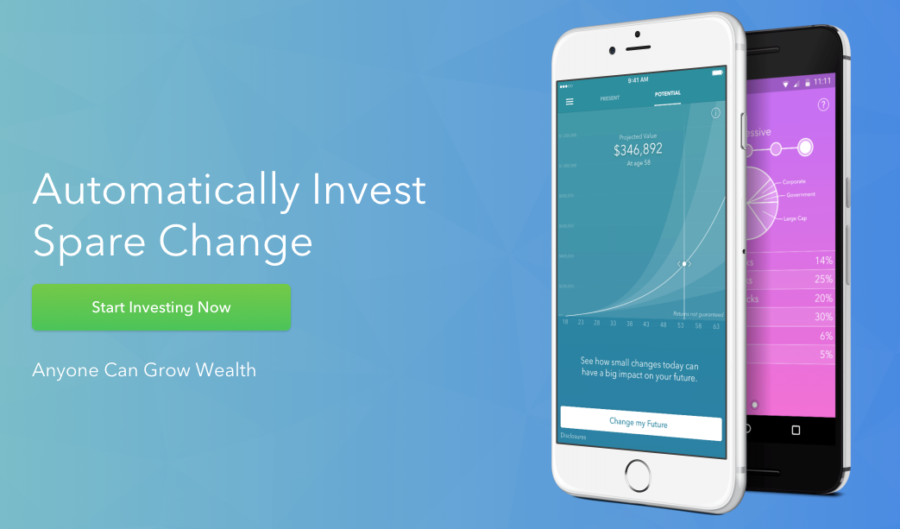

I wrote about Trim and Paribus to track price changes and get a refund from merchants. Now there’s Earny, which tracks price changes and uses price protection from many bank Visa and MasterCard credit cards – and files the claims for you automatically. In return, they take 25% of the bounty.

I shop online a lot with my Citi AT&T Access More card (no longer available although you can still product change to it). All Citi personal cards come with Citi Price Rewind, which puts the onus on you to file a claim if you find a lower price. But now Earny automates the work. After you link your cards, nothing else is required to file a claim when Earny finds a lower price.

If you shop online a lot, this could save you big bucks!