Update 8/3/18: Fidelity now has the cheapest fees and NO minimums to start investing. Check out my full write-up!

Also see:

A couple weeks ago, I wrote about Acorns, an app I think is a great place to get started with investing (especially for millennials). Talking about investing is dicey. For one, because it’s personal (duh). For that reason, everyone has an opinion on it. And that’s where the confusion starts.

My view is: it doesn’t matter where you begin, so long as you do. You can always switch things around later. To that end, I feel Acorns has the most approachable interface for a beginner “despite” costing $1 a month. And there’s no minimum to start investing.

The best time to plant a tree was 20 years ago. The second best time is RIGHT THIS SECOND. Start NOW!

That said, it’s an app and doesn’t let you choose your own funds (you pick from their portfolios). Same with Stash, Wealthsimple, and Betterment. Of course, you’ll get the best deal with a self-directed account – but the minimums are dauntingly high for a beginner, with the exception of TD Ameritrade.

I’ll compare these companies for expenses, account and fund minimums, and quirky extras:

I am focusing on IRAs here – although they all have the option to simply be an investment account (which is why I excluded Robinhood – they do NOT have IRAs).

8 Best IRA Accounts Compared

Self-Directed Accounts

Expert-level: Fidelity, Vanguard, Schwab (Options 1, 2, and 3)

I am admittedly a Fidelity fanboy. I’ve reached the point in my investments where I qualify for lower expense ratios of .015% with the FSKAX Total Market index fund. And I put money into my account with the Fidelity Visa here and there. It’s what I like, what I’m used to, and where I started.

That said, you can start investing with as little as $1 with shares of the FZROX Zero Total Market index fund! Plus, there are no fees or minimums.

Compare that with Vanguard – you need at least $3,000 to start with their funds.

Schwab will waive the $1,000 minimum if you agree to a $100 monthly auto-deposit. And you can begin investing in their SWTSX Total Market index fund with only $1 (but really $100 with the auto-deposit, eh?).

So of the 3, Fidelity is the best place to start. Your money can grow without any fees and you can begin investing with any amount.

TD Ameritrade knocks my socks off (Option 4)

- Link: TD Ameritrade

So I didn’t know this before but… you can start investing with a single buckaroo in the Total Market index fund with the lowest expense ratio (the Schwab fund)!

There are no account or fund minimums with TD Ameritrade. You can literally set-up an account, choose a fund, and start investing.

This is as cheap and simple as it gets. They have a great website, an app, and excellent customer service. So what’s the hitch?

There are many schools of thought on asset allocation and which funds to select. Peeps get anxious about having to choose a fund (or funds). I recommend choosing a Total Market or S&P 500 index fund, and a total bond fund, and calling it a day.

That’s really all there is to it. Stick your money in there and let it sit for 5, 10, or 20+ years. Again, you can always switch things around later. But if you haven’t started yet, you have an out-of-control raging emergency. Start NOW. This or the Fidelity option above are both easy and simple places to begin investing.

Apps

Acorns (Option 5)

Here’s my full review of Acorns. This one is the one I recommend.

I was chatting with a friend who said, “Ugh, I hate talking about money. It stresses me out but I knew I needed to invest.”

She chose Acorns. Why?, I asked her. “It was the easiest. It plugs into my debit card. I never have to think about it. And I like their app.”

Fair ’nuff. I love geeking out on index funds, but realize not everyone does. Plus, when I dug into Acorns a little more, I loved their Round-Ups and Found Money features. Really easy ways to save consistently, which is the most important part about investing.

It costs $1 a month which is a high percentage ratio on a “small” account. But also on a practical level… it’s $1 a month. If this is the app that gets you to invest, I’m all for it.

You can get $5 for free to start and your first month free when you sign-up with my link.

They’ll select a balanced portfolio for you after you answer a few questions – that takes the stress and guesswork out of selecting funds. The whole process takes 5 minutes. Please open an IRA today if you don’t already have one (or a 401k). Your future is too important not to save.

Stash (Option 6)

- Link: Stash

Stash is basically the same as Acorns with regard to pricing and accessibility.

The biggest difference is the portfolio selection. You can invest in foreign markets, certain sectors (like green energy), or causes you believe in. If you want, you can also choose allocations like “Aggressive” or “Moderate,” which are pretty typical.

You also get $5 free and your first month free when you use my link.

If you’re torn between Stash and Acorns, I’d recommend downloading them both and keep the one you like best. And delete the other. No love lost. They’re honestly very similar – just pick one and commit until your balance starts to grow – and it will, over time.

Roboadvisors

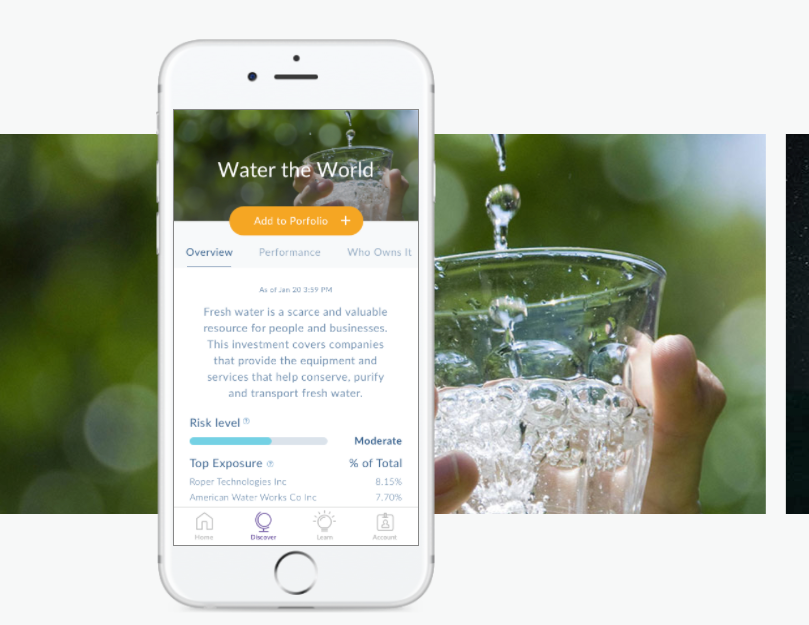

Wealthsimple and Betterment (Options 7 and 8)

- Link: Wealthsimple

- Link: Betterment

So what’s the difference between an app and a roboadvisor? With the former, you do everything within an app. With the latter, you can reach a real live human if you need more help managing things.

The fees are comparable. So if you think you’ll need guidance, go with a roboadvisor. Same dealio with the asset allocation: answer a few questions and they’ll generate a mix based on your horizon and risk tolerance.

If you want to check out Wealthsimple, you’ll get $50 when you invest $100. So you get a 50% bonus right away – this is exclusive to Out and Out readers!

Or, you can get 75,000 Drop points (worth $75 in gift cards) when you sign-up through Drop. But you must invest at least $500 to earn the bonus. And you can only use Drop points for gift cards.

You can get an additional $400 for becoming an Airbnb host. So sign-up with my link for $50 when you invest $100, or $75 in gift cards when you invest $500. Then get another $400!

DCTA has all the details on exactly how you can do this. It’s convoluted, but might be worth it. Some worthwhile comments on Doctor of Credit as well.

Lastly but not leastly, there’s Betterment, a perennial fave due to its ease of use, transparency, and straightforward fee structure. I can’t knock Betterment – I love what they’re doing.

Both Betterment and Wealthsimple are reputable, ethical companies devoted to financial good, which I love. They’re both geared toward “wealth management” as opposed to having a simple IRA account. That said, I think either would be fine if you want a human touch without exorbitant fees.

Bottom line

If this all sounds like gobbledy-gook, I’d recommend starting with Acorns and going from there. Remember, you can always make changes later while you give yourself time to research. But starting right this second is critical if you don’t have anything invested.

Don’t put off saving for your future because you’re waiting for some perfect moment – many of these options let you start investing with a single dollar. There’s no reason to delay. And you can set-up Acorns in 5 minutes.

If you want the best and cheapest option, I was blown away by Fidelity and TD Ameritrade – no account or fund minimums! But you’ll need to choose a fund to invest in, which can be overwhelming. Though I recommend the FZROX Zero Total Market index fund and calling it a day. 🙂

If you think you’ll want human assistance, consider Wealthsimple or Betterment. And if you already have a few thousand saved up, congratulations – you can also proceed directly to Fidelity, Vanguard, or Schwab if you’re comfortable choosing your own funds.

And hey look – I meant what I said about simply getting started. It’s easy to get lost in all the options. But your future is too important to keep putting off. If you’ve never invested, the earlier you begin, the more you’ll have in the long run. Even one extra year of compound interest can translate to thousands more down the road.

Hopefully this gives you an overview. Any questions, recommendations, or experiences with these investment companies? Please share in the comments!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

A couple things to point out. You can invest in ETFs instead of mutual funds to lower expense ratios and improve tax efficiency. I’d like to also point out the Roboadvisor WiseBanyan, which has no fee. I have a referral as well.

That’s awesome! Any ETFs you’d recommend?

And feel free to share your WiseBanyan referral link!

It’s hard to go wrong with VTI.

WiseBanyan Referral:

https://wisebanyan.com/?ref=YN0yph

Looks like they use VTI for some of their investments but you can’t really select particular funds (which is fine, just something to note). Love the fee structure! 😉 Very cool! I signed-up with your link.

Correct, it’s a Roboadvisor so they pick for you. You can adjust how aggressive or conservative you are, which will affect allocation. They primarily use Vanguard and iShares. You can pay for tax loss harvesting as well.

We Bogleheads are big fans of Vanguard. Things to note:

1) You never pay a commission when you buy and sell Vanguard mutual funds and ETFs in your Vanguard account.

2) No maintenance fees

3) Once you reach $10000 in a fund, they automatically upgrade it to the Admiral version, which has a lower expense ratio. So VTSMX becomes VTSAX and the expense ratio goes down to an incredible .04% !!!

I’ve just always been into Fidelity for some reason. They have a similar set-up: once you reach $10,000 in FSTMX (https://fundresearch.fidelity.com/mutual-funds/summary/315911404) you’re upgraded automatically to FSTVX (https://fundresearch.fidelity.com/mutual-funds/summary/315911800), which has a .035% expense ratio. Also no load fees or commissions. So a very similar setup. I think they’re both great!

I think what got me hooked was having the Fidelity Amex (now a Visa) and being able to get 2% cashback on my rent with Serve back in the day. That was a nice boost to my IRA back then. And I stuck with it because the expenses/fees are so low. I also LOVE their Cash Management account (my review: http://outandout.boardingarea.com/best-no-fee-checking-accounts/) and like having all my banking in one place (checking, credit card, IRAs, investment account).

But all that said, whatever gets people to invest is great! And you’re right, Vanguard certainly does have a near-mythical following from the Bogleheads! 🙂

The Bogleheads Wiki doesn’t rule out their investing strategies just because you use Fidelity, Schwab, Merrill, etc. Their wiki informs you how to invest like one at those brokerages as well. Competition from Vanguard has forced down the ER’s at Fidelity and Schwab. However, Vanguard is owned by the Investors of the funds, whereas the others are companies trying to make money. I see it more like Vanguard is a credit union and the others are banks. To each his own though.

I usually use Vanguard ETFs, but I do so through Merrill because I get free trades through the Preferred Rewards program. Combining this with the BoA Travel Rewards or Premium Rewards makes the Fidelity card obsolete as you’re guaranteed a higher rate of return if you have enough invested with them (Up to 2.625% everywhere).

You’re so right, investing is personal, but these are all great options! I started with Acorns, then Betterment, and now I’m looking into other options. Thanks for sharing!

Second direct Vanguard if you’re completely DIY, only downside is having to start with a few thousand dollars.

Second WiseBanyan because they’re free and you can also start with $1.

I need to call Fidelity to see if I can improve the performance of a couple of old 401ks from old employers that have let the funds sit there. In theory I was getting a better return because it was part of a larger pool of assets.

As for the advisor who bought the franchise, I’ve never paid him, and it was pulling teeth to get them to accept an IRA conversion which then the parent company refused to process anyway. He replied back that he’s a fee-based advisor, but if the people holding funds can’t process a simple IRA to Roth IRA conversion, I sure don’t want to pay them to drop the ball elsewhere after I start paying them.

Downside – I now have to start shopping for replacement life insurance, because I’m not going to pay $700 a year to get advice on how to manage funds inside of an insurance policy.