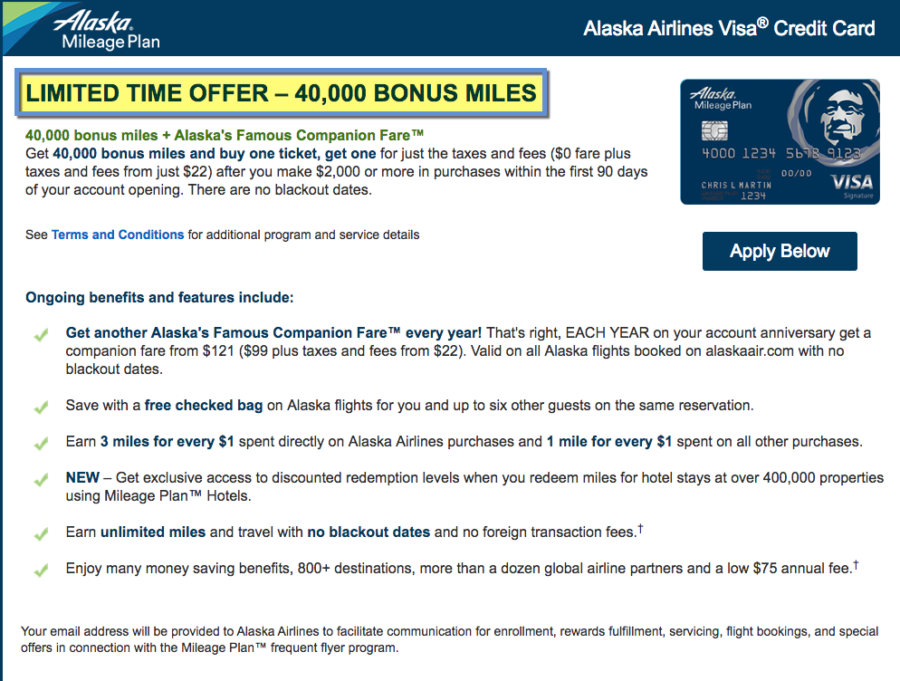

The typical signup offer on the Bank of America Alaska Airlines Visa is 30,000 Alaska miles after meeting the minimum spending requirements (usually $1,000 in the first 90 days).

We’ve seen offers for $0 companion fares, a $100 statement credit (tantamount to a 10% discount on the minimum spending), and a few highly targeted offers.

This latest deal is for 40,000 Alaska miles and a $0 companion fare after spending $2,000 within the first 90 days of account opening. There are a few steps to get the offer to show – but it’s worth it for 10,000 extra Alaska miles.

I was just instantly approved with a $17,000 credit line and I’m LOL/24. It’s clear by now I’ll never open another Chase card – so I went for it. Alaska miles are among the most valuable out there – and you can use the $0 companion ticket to anywhere Alaska flies, including Hawaii!

Here’s how to get the offer.