Update: This offer is no longer available. Click here for the best current offers!

If you haven’t jumped on this offer yet, time’s almost up. Citi will pull the chance to earn 60,000 Citi ThankYou points with the Citi ThankYou Premier card on October 11th, 2018. Each point is worth 1.25 cents toward travel (including airfare, hotel stays, cruises, and excursions), which makes this offer easily worth $800 after meeting the minimum spending requirement.

Even better, the annual fee is waived the first year. So you can see if you like the card for 12 full months before paying. Even then, Citi is excellent about retention offers for bonus points upon card renewal. I get them regularly.

This is also one of the few cards to earn 3X points on gas (and travel).

Citi ThankYou points helped me get to Prague. 60K is the best offer there’s been for the ThankYou Premier

I wish I could get this offer. You’re not eligible if you’ve opened or closed another ThankYou card in the last 24 months. Otherwise, there would be zero hesitation. This is the highest offer ever for this card.

Citi ThankYou Premier Bonus = $800

This card earns:

- 3X Citi ThankYou points on travel, including gas stations

- 2X Citi ThankYou points on dining and entertainment

- 1X Citi ThankYou point on all other purchases

The $95 annual fee is waived the first year.

I wrote how the signup bonus is actually worth $900 if you meet the minimum spending requirements with 3X categories.

Even if all your minimum spending is in the 1X category, you’d earn 64,000 Citi ThankYou points – which are worth $800 toward travel (64,000 X 1.25).

So no matter how you slice it, you’re gonna get $800 in value – at least – out of this deal.

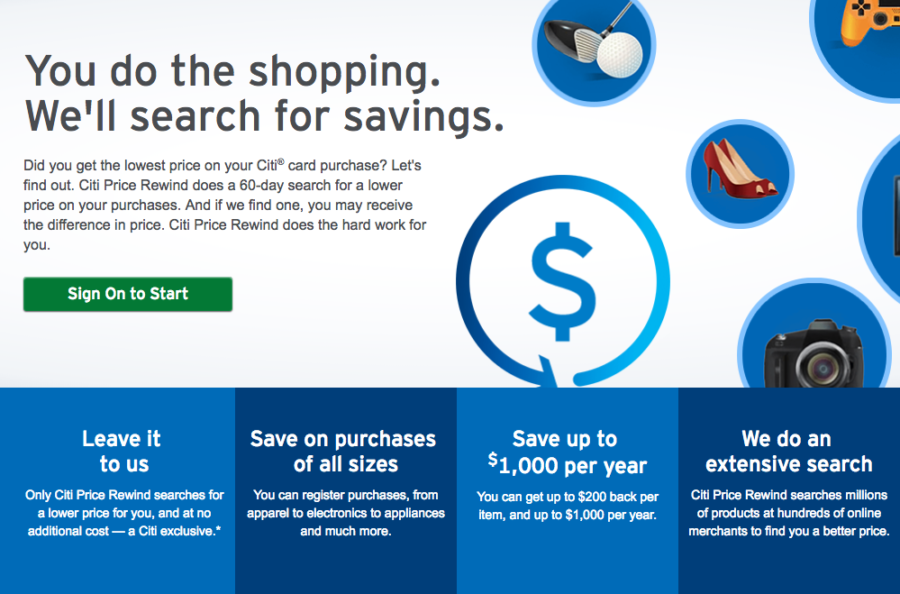

Citi Price Rewind is worth using

- Link: Citi Price Rewind

- Link: Earny

I use Citi cards for most of my online/Amazon shopping to take advantage of Citi Price Rewind. This will be especially important in the coming months, with Black Friday and all the holiday sales going on (I know, can you believe it’s almost Christmas again?).

Citi Price Rewind gets you back $200 per item, and up to $1,000 per year, on price drops within 60 days.

But filing a claim is for chumps. Instead, use an automated service like Earny, which does all the tracking and filing for you. All you ever see are random statement credits. Which is awesome.

Earny charges 25% of whatever you get back. But considering it does all the work for you at major retailers like Amazon, Best Buy, Kohl’s, Target, Macy’s, and Walmart, it’s basically free money you get back (unless you want to do all the price tracking yourself).

Pretty much everything you buy in November or December goes on sale in January, so this is a nice perk to have with an already excellent sign-up bonus. This would be a good card to use for holiday shopping – get gifts and meet the minimum spending all in one go. #twobirds

How to redeem Citi ThankYou points

You can book travel directly on thankyou.com, and use your points to pay for travel. Airfare is treated like a cash ticket, so you will earn miles and elite status credit.

This is NOT true for hotel stays. Hotel chains consider this a third-party booking and typically won’t let you use elite status perks.

So I personally use Citi ThankYou points mostly for flights, or at boutique hotels where I wouldn’t earn points anyway. Again, the bonus is worth at least $800 toward travel after you meet the minimum spending.

You can also transfer your points to:

- Avianca

- Asia Miles (Cathay Pacific)

- EVA Air

- Etihad Guest

- Flying Blue (Air France / KLM)

- Garuda Indonesia

- Jet Airways

- JetBlue

- Malaysia Airlines

- Qantas

- Qatar Airways

- Singapore Airlines

- Thai Airways

- Turkish Airlines

- Virgin Atlantic

These airline loyalty programs are for advanced players, mostly because none of them are domestic (except JetBlue). But you can get good deals to Hawaii, on domestic travel, or sweet spots within each program. There’s no reason why you couldn’t get award flights worth $1,000+ with the Citi ThankYou Premier’s signup bonus. A few ideas:

- Singapore Airlines and fly to Hawaii on United for 35,000 miles round-trip in coach (you can book this on Singapore’s site)

- Flying Blue for cheap domestic travel on Delta (price varies, but they have a calculator – you can book on the Air France site)

- Etihad for cheap hops to/from Brussels for 5,000 or 7,000 miles each way (must call to book and takes about a week for the transfer)

- Virgin Atlantic to fly from East Coast to London for 20,000 miles round-trip in coach (there are fuel surcharges, but could be helpful for expensive flights)

- Qantas for hops around Australia, or save your points and fly Emirates First Class

- Avianca for cheap flights with Star Alliance partners

Bottom line

I have major FOMO about this offer. It’s just so good. The best there’s been, in fact. Before now, it was 50,000 ThankYou points. There have even been periods with NO signup bonus at all.

If you want this deal with 60,000 ThankYou points, apply by October 11th, 2018. You’ll get an easy $800 to spend on travel, and potentially more, depending how you earn and redeem your points.

This is a great starter card for earning ThankYou points, too. Considering the annual fee is waived the first year, there’s really nothing to lose here. And even folks well over 5/24 report instant approvals.

You gonna take Citi up on this offer, or pass?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Can you get the bonus if you currently have a Citi Premier and it has been 24 months?

Thanks!

Yes, you can!