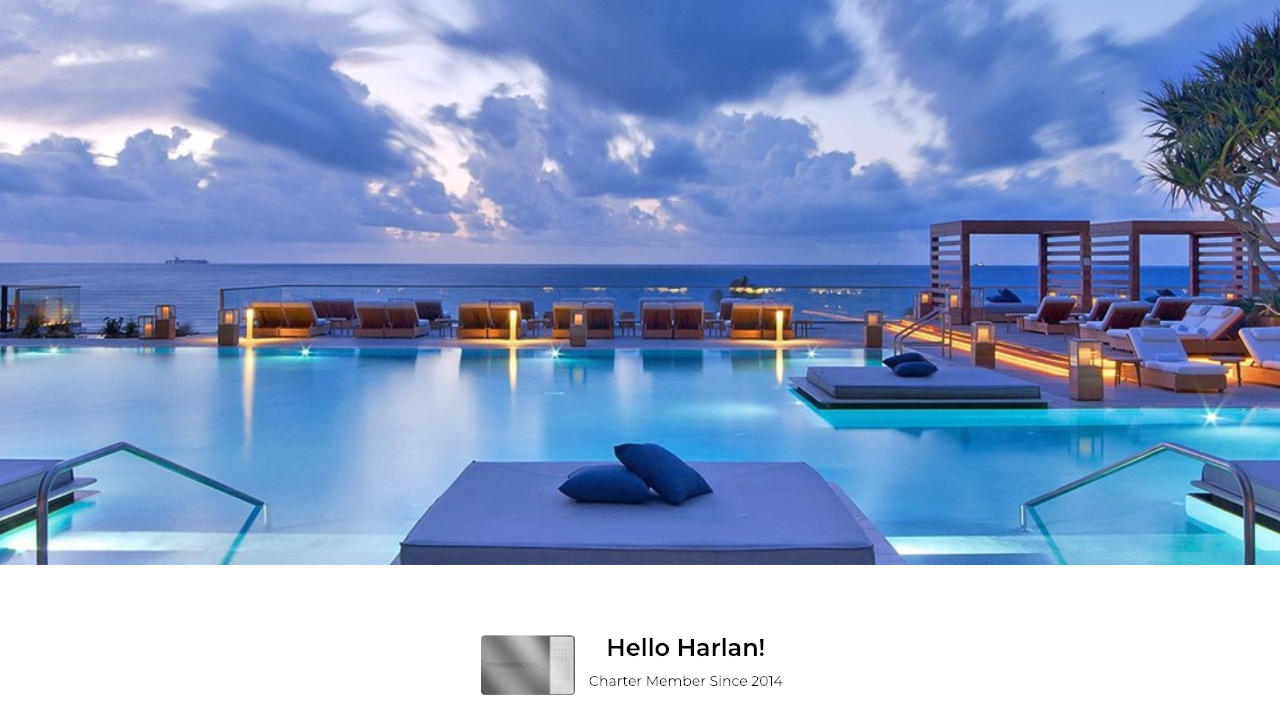

I recently emptied my Citi ThankYou points account. Yup, I burned every single last point to stay at the Hyatt Ziva Puerto Vallarta. For my 4-night stay, I could’ve spent:

- 80,000 Chase Ultimate Rewards points (because it’s 20,000 Hyatt points per night)

- ~131,000 Citi ThankYou points (with the 4th night free thanks to Citi Prestige)

I asked a friend which would be the better option. “Whichever is easier for you to replenish,” was her advice.

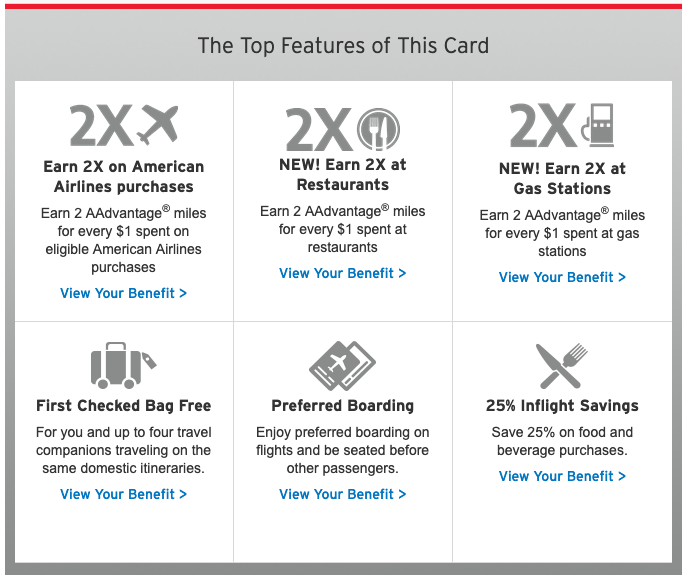

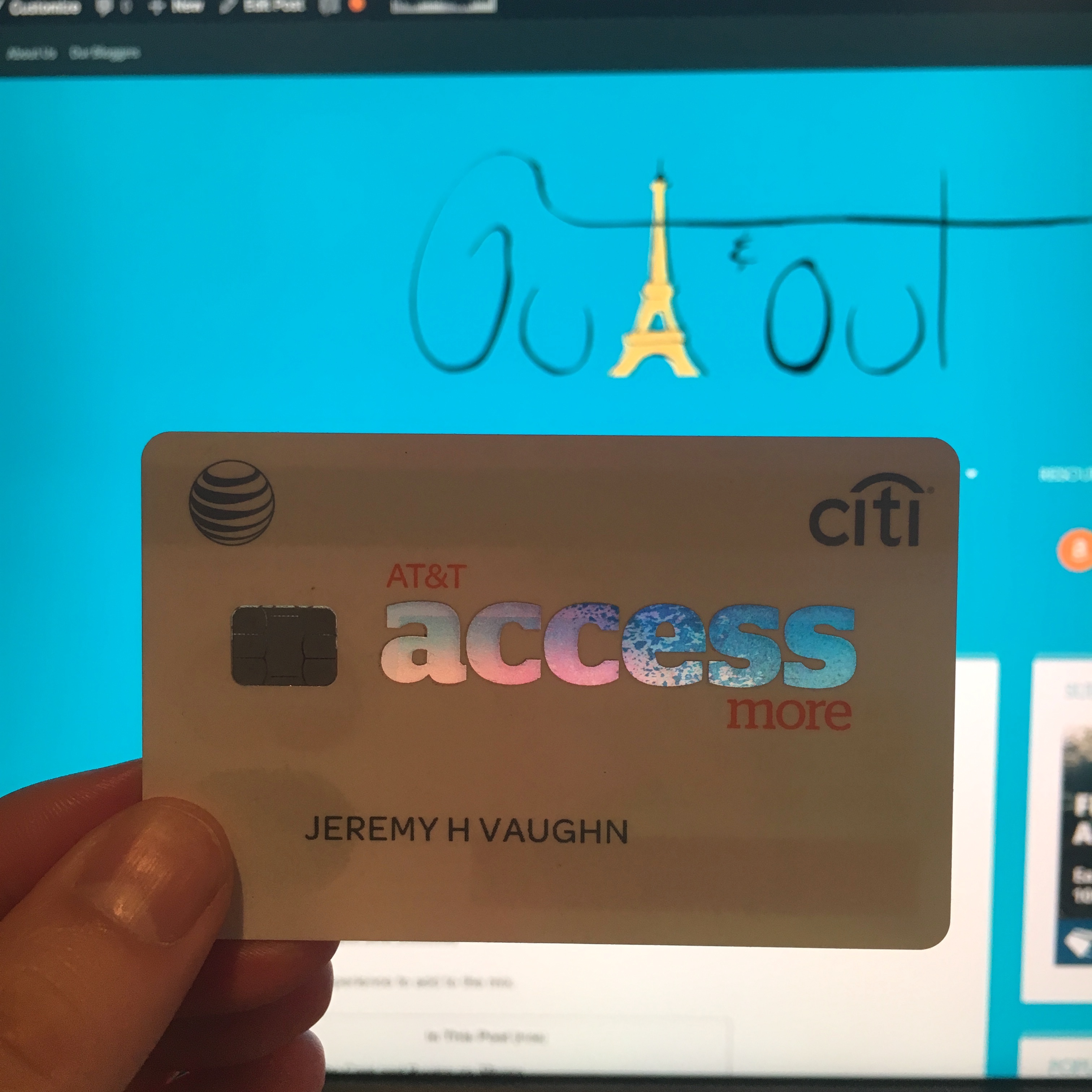

Within my Chase Ultimate Rewards portfolio, I spend most on my Sapphire Reserve for 3X, and sometimes my Freedom for 5X. Within my Citi ThankYou portfolio, I spend most on my Prestige for 5X, and sometimes my AT&T Access More for 3X. And the Prestige 5X category gets the bulk of my attention.

If I spend $10,000 on flights and dining:

- On Sapphire Reserve at 3X, I get 30,000 points

- On Prestige at 5X, I get 50,000 points

For my same spending, I get way more rewards. For the hotel stay above, the earn rate was actually equal (80/3 = 131/5). But for transfers to airline miles, that’s the difference between getting 1 award ticket instead of 2 for the same spend.

Match your spending to a 5X category and see what happens.

For views like this, just burn Citi ThankYou points if your 5X categories are similar to mine

If you buy a lot of airfare, and eat out often, you’d do well to earn 1.67 more points per $1 – they add up fast!