American Airlines has a case of “too big for their britches,” as we say down south. They think they’re Delta – they’re not. They think their co-branded credits cards are too beneficial – so they’re cutting the best benefit.

As of May 1st, 2019, NONE of the American Airlines credit cards (from Barclays or Citi) will have a 10% rebate on redeemed miles, which was good for up to 100,000 redeemed miles per year (so you could get back 10,000 miles).

I maxed this out every year – and rarely use other benefits of the cards. I don’t check bags. Priority boarding is great, but whatever. I don’t buy airplane food.

And I get better earning rates with ultra-premium cards for all the bonus categories.

In a couple of months, I’m closing my American Airlines cards. Unless Citi wants to give me a big retention offer to keep one a while longer.

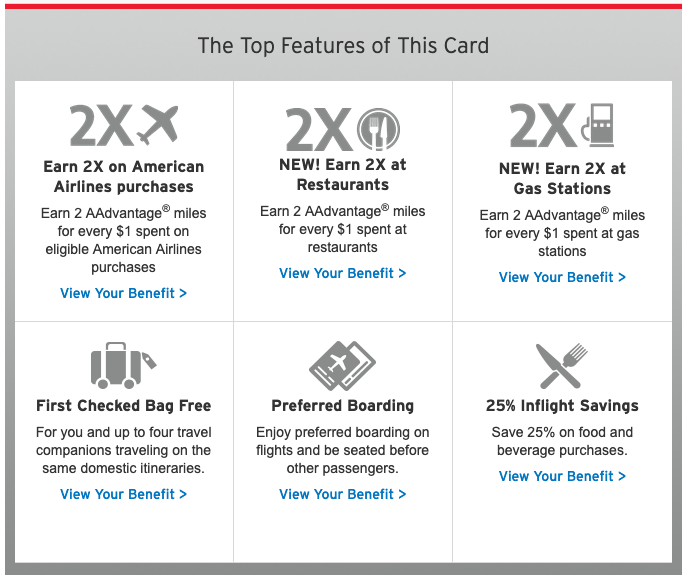

*eyeroll emoji* These are not meaningful to me

Even worse – Citi isn’t adding anything to make up for this loss (Barclays is at least trying). Sorry, but spending $20,000 to get a stupid $125 discount isn’t a tradeoff.

Bye bye, AA cards

For whatever reason, I find myself with 4 American Airlines cards:

- Citi Platinum Select Amex (kept it to add Amex offers, which is no longer possible)

- Citi Platinum Select MasterCard (got it for the bonus, kept it because of a good retention offer)

- CitiBusiness Platinum Select MasterCard (got for the bonus, will cancel)

- Barclays no-annual-fee card (will keep because it’s free)

You’d think I was Mr. American Airlines or something

My original plan was to close the two MasterCards and keep the Amex because the annual fee is only $85 (instead of $99). Because with it, I’d still get all the same bennies, including the 10% mileage rebate.

But now I have zero incentive to keep any of them.

Why they’re toast

As someone who flies AA semi-regularly, I don’t find value in the paltry spate of AA travel perks. And if I did fly AA a lot, I’d already get them as a function of elite status. Either way, there’s no reason to keep the cards unless you:

- Check bags and don’t have status

- Don’t have other cards that earn more points in the bonus categories

- Really like priority boarding and 25% savings in-flight (for me, yawn)

Because for flights and dining, I pay with Citi Prestige (which recently faced its own set of cuts and shakeups) for 5X Citi ThankYou points. And for gas, I’ll use my Blue Business Plus Amex for 2X Amex Membership Rewards points.

The only way I’d keep the annual fee cards is with a big retention offer (as I don’t expect to put any spend on any of the 4 cards, nor use any of the remaining benefits).

Heavy AA flyers would do better with the Citi AAdvantage Executive card or Barclays Aviator Silver card for better perks like access to Admirals Clubs, or $25 in food/drink credit each day you fly AA, respectively.

And casual AA flyers are better with a card that earns flexible points like the Chase Sapphire Preferred.

Bottom line

Citi seems focused on cutting their card benefits for whatever reason, but it seems this change came from American Airlines because it affects all their cards with the 10% rebate benefit.

Between AA about to lose Etihad, United working to step up, and Delta absolutely owning them operationally, I really wonder what’s going on at corporate. Because losing this rebate is absolutely a devaluation. Being Dallas-based, I’m semi hub captive, but don’t pay for flights enough to earn meaningful status on any airline.

This change further cements my “free agent” view of travel. The only airline worth being loyal to is Alaska (or maybe Southwest if you mostly travel domestically). And the best hotel chain is Hilton (or Hyatt if that’s your jam). Otherwise, loyalty is dead and credit cards are turning into a wasteland.

While I don’t really care about the loss of this benefit one way or another, I see it as something I was willing to pay for. Now that’s it’s gone, the rest of the cards’ benefits aren’t worth paying for. Simple as that.

The only reason to get an American Airlines credit card is for the sign-up bonus. Then dump it, unless you want to upgrade to one of the ultra-premium AA cards mentioned earlier. Otherwise, they’re not even fit for a sock drawer any more.

Citi, you have 2 months to come up with something good. If the retention deals suck, I’m out.

As far as I’m concerned, Barclays is the sole issuer of American Airlines cards now.

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Sadly I’ll have to return my AA card and AA business credit card. I get 2 free bags on each flight so the 1 free checked bag does nothing. The 10% return on points was the best thing about this card.

Absolutely, 100% the truth. Glad to hear I’m not the only one. Totally agree.

We canceled our Citi AA cards but have the Barclay red card from US airways for many years.

I have questions please,

Can someone educate me about the following?

“If you are a legacy US Airways cardholder then you’ve continue to receive a bonus 10,000 miles each year at card renewal. Unfortunately this will also be removed. Card members will continue to receive one last 10,000 mile benefit the first time they pay a $99 annual fee”.?

We have the the card for many years and wife paid her fee a month ago and I was just charged AF $89. Don’t know why many are saying this card has $95 fee. We did receive 10k anniversary miles a month before AF came up. Is this right or we got the Anniversary 10k miles for paying the AF last year 11 months ago? Will I get the 10k bonus miles again next year? If NOT, I have to save AF and cancel the card. confused about the language.

Thanks

Same here.

So the old US Airways card was at $89 and you kept that even if you transitioned to Aviator Red. I’ve always received the 10,000 bonus miles on the day the statement closes, that’s *before* the statement in which the annual fee is charged. In my case, mine closed January 17, I got the 10k bonus that day, and my annual fee was charged on Jan 31 (which is the next statement period).

What they’re saying about the last 10k bonus is that the first time you pay $99 will be the last time you get your 10k bonus. Since *everyone* including those of us with old US Airways accounts will be moved to a $99 fee as of May 1, this effectively means that your next account anniversary after May 1 will be the last time you get your annual bonus. For me, again, since my anniversary is Jan 17, I’ll get my last 10k bonus next January and be charged a $99 fee at that time.

…and then I’ll promptly close the card.

Yes, that sounds accurate. Thank you Alex for breaking it down!

When did this become a thing? Which card gets you a $25 credit? I have both cards, fly AA pretty regularly, I’ve necervhrard this benefit mentioned

It will be a new benefit on the Barclays Aviator Silver Card starting May 1st, 2019:

• $25 in statement credits for inflight food and beverage purchases each day that you fly American Airlines operated flights

Along with other changes. Worthwhile if you fly AA often, IMO.

Hi i had the us airways card which got converted to red aviator card.. i pay annual fee of 89$ and i never got the 10k bonus miles.. they waived off the fee once and reduced it by half couple of times. Is the 10k credit is automatic or you have to call them before fee hits? Pls advise

There were 3 versions of that offer:

– No 10K each year

– 10K one time

– 10K for perpetuity

If you had it, it’s automatic. It sounds like your card didn’t have that offer attached to it, unfortunately.

What’s this about AA dropping Etihad redemptions? That’s the only reason I collect AA miles–to fly in business on Qatar and Etihad.

There’s a rumor Etihad will drop AA add a partner and join the Star Alliance pretty soon – which would be another blow to AA’S program. I’m inclined to believe it’s true.

trauma: like/love AAward booking because of free cxl within hold period; never gonna fly AA enuf to earn free bags, so use card for that; most points earned from AAshopping; AAirline is often handy to have available cause it often flies where i’m going; card benefits suck! Sounds like j. harlan and i are in same “hoping for retention offer” boat. bye-bye AAplastic.

Kinda sad. At least they were getting us to keep the card. With this cut, I’m out the door. Ah well, up and up.

The Citi Exec AA card dies for me later in 2019 when I can only access lounges when flying AA same day.

Ah right! I dunno man, these airlines really think people are gonna take endless cuts to service. Where’s the line? I’d almost forgotten about that restriction. Thanks for reminding!

Amazed you would have been willing to pay $99 for 10,000 AA miles when the AA Platinum mailer loophole is still open and printing 60-80k miles at a time. The 10k back was almost a rounding error to me.

I only got the AA cards last year for an aspirational redemption to Africa on Qatar biz. Don’t fly AA often enough to care about the bennies remaining. Byebye AA. Ps. thanks for the “too big for your britches” expression–my grandma used to use that one.

More Southern sayins should make a comeback – good lord willin and the creek don’t rise! 😉

Hmm. Aren’t these cards still offering 7,500-discounted awards?

They are. I have never used them, but that benefit will remain.

Why cancel them when you can convert them to Citi Dividend, Double Cash, AT&T Access More, or the new the Citi Rewards+ ?

Have the latter two, am meh about DC, don’t think you can do Dividend any more. The limits on these cards are pretty low, so it’s not a huge limit for my ratio or credit length. I might convert the oldest one to a DC and just let it sit… the others can go.

The AA card and benefits are useless. Use the card, have 70,000 miles on it and still seated in Groip 5.