Also see:

If you’re interested in upgrading your Barclays Red Aviator card (not open to new applicants), it might be possible to do so directly in online banking.

View from the Wing reported that Barclays was slowly rolling out the upgrades, and listed some reasons why you may NOT want to upgrade the card.

To Upgrade or to Not Upgrade, That Is the Question

Me, I’m not gonna do it.

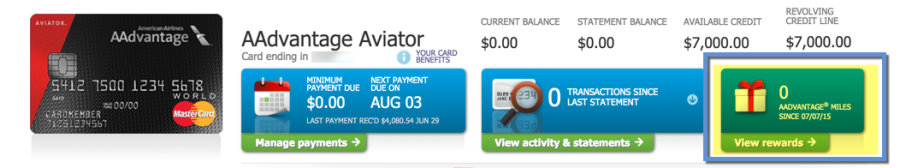

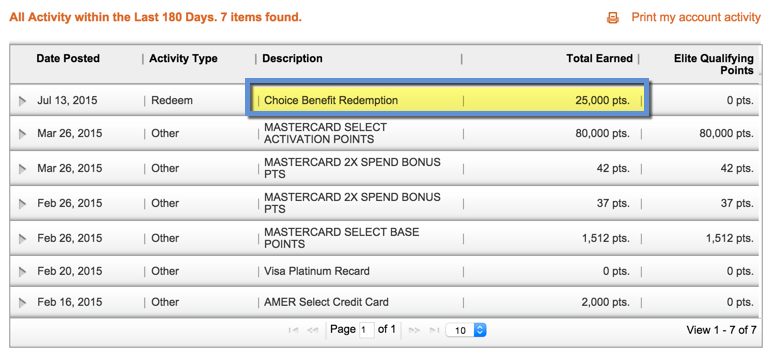

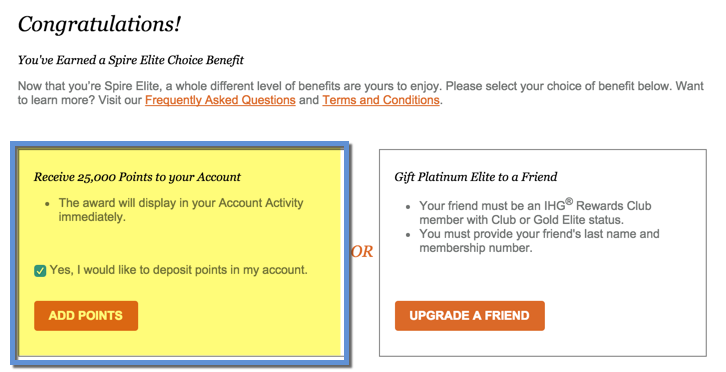

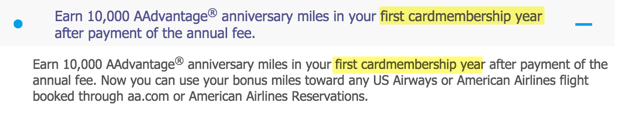

Because I have 10,000 American miles coming my way when I pay the annual fee again.

Here’s how you can tell:

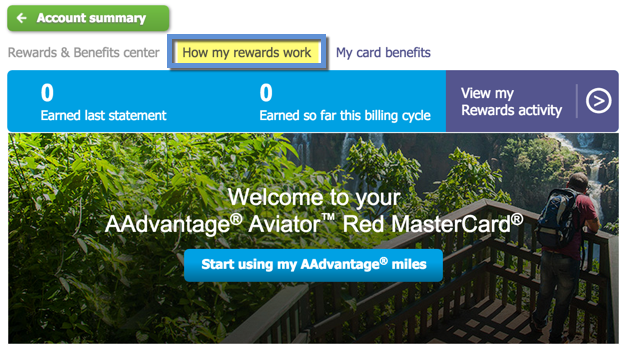

And then…

There, you’ll see something to this effect:

I only get one round of 10K. But others get 10K EVERY cardmember year. They should NOT upgrade to Aviator Silver

I’ll get the 10,000 AA miles once and then consider upgrading to Aviator Silver.

But if you don’t see such language, you might consider making the upgrade now.

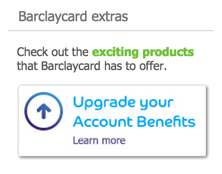

Check your account

In my account, the offer was on the right side, under Barclaycard extras:

It just says, “Upgrade your Account Benefits.”

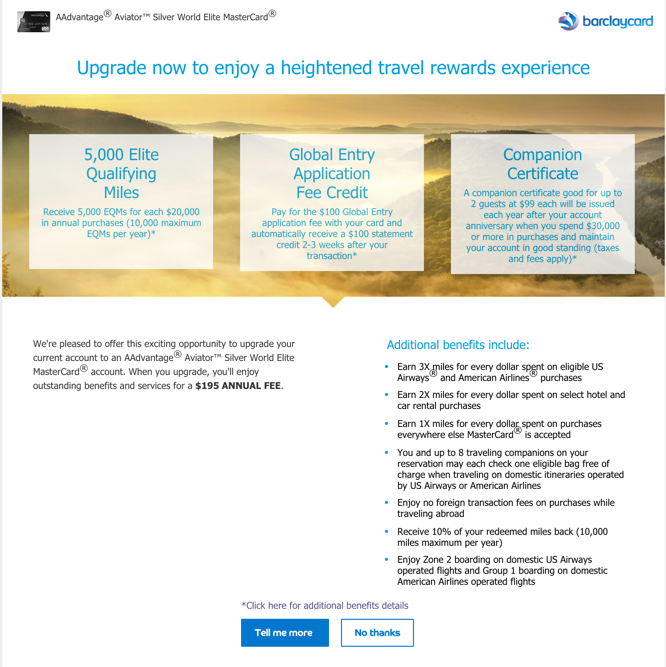

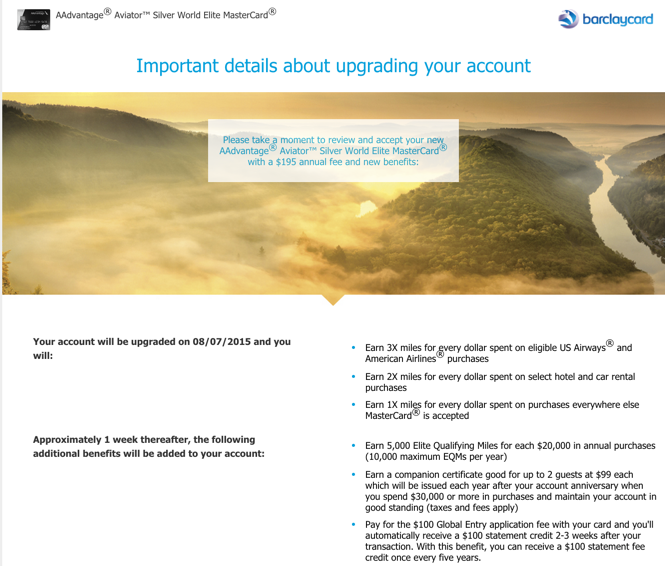

When I clicked through, I was invited to upgrade to Aviator Silver.

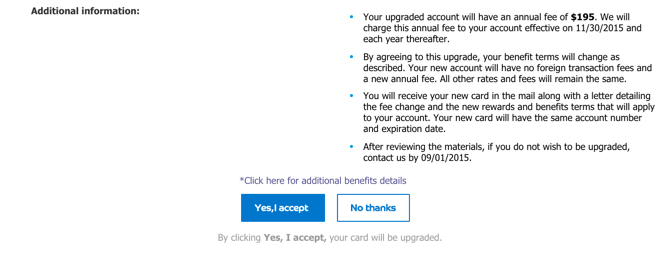

After I clicked, I got a long list of details. Including that the upgrade would happen on August 7, 2015.

If I’d clicked “Yes, I accept,” the card would’ve been upgraded and the annual fee charged on November 30, 2015.

Should you do it?

I’m holding off to get my 10,000 AA anniversary miles. But if I didn’t have that coming, I’d definitely be tempted by this offer.

When you upgrade, you get:

- 3X AA miles on AA flights

- 2X AA miles on hotels and car rentals

- 1X AA mile everywhere else

- 5,000 EQMs when you spend $20,000 annually (can get up to 10,000 EQMs)

- $99 companion certificate when you spend $30,000 annually

- Free Global Entry (as a statement credit)

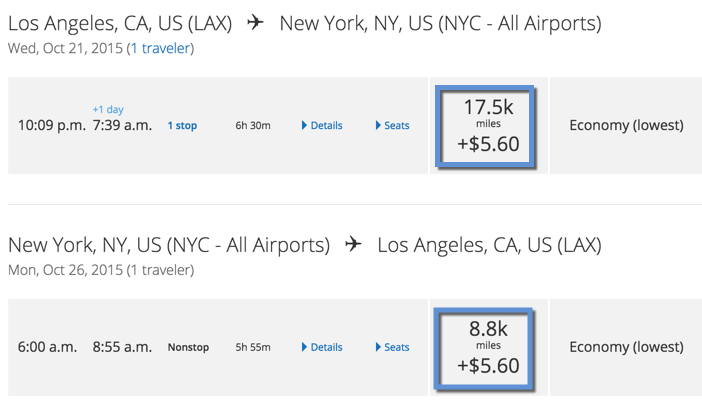

So this card is really only worth it if you have a lot of paid flights on American Airlines. Or if you want the opportunity to “buy” EQMs instead of fly to attain/retain status each year. Hey, 10,000 EQMs is 2 round-trip transcons!

$195 is pretty hefty for an annual fee. But no other card earns 3X AA miles, which are extremely valuable (for now). If you can met the various spending thresholds, EQMs are very valuable, too. And the $99 companion cert if a nice bonus – if you can actually use it.

So it’s a personal decision for a niche crowd. Also consider this card is not available to new applicants. So if you can get it now, go for it.

Bottom line

Barclays is finally loosening the requirements to upgrade from Aviator Red to Silver. I was able to do it in 2 clicks directly in my online banking.

This is great news for a select set of people to whom this card caters.

But if you can wring the benefits out of it, like the EQMs, 3X AA miles, and $99 companion certificate, it would be well worth the $195 annual fee.

Do you have the option to upgrade? If you do… will you?