In my exploration of new MS techniques, I stumbled across something else that could be potentially useful for some.

I’ve written about the whole PayPal debit card/My Cash/RadPad combo.

As you guys know, the PayPal Business Debit MasterCard earns unlimited 1% cash back in your PayPal account. It does work with RadPad and does NOT work with Evolve Money (in the sense that you’re charged a 3% fee for using it).

But some peeps don’t like the PayPal-ness of it all, as they’ve been known to shut down accounts after sending warning emails.

So enter…

SmarterBucks and Radius Bank

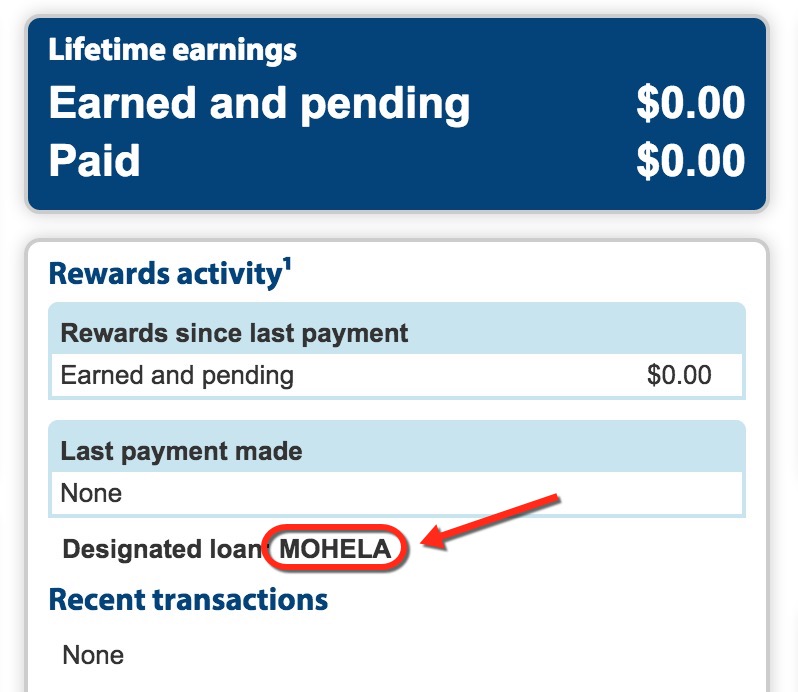

In my internet wanderings, I randomly stumbled across SmarterBucks.

It’s a site that earns cash rewards that are only good toward paying down student loan debt.

You can pay any student loan.

But you can NOT cash it out. You can only use the service for student loan debt repayment.

So far, they have:

- A shopping portal

- A place to take surveys

- A rewards checking account

Wait, what was that last one? A rewards checking account?

Radius Bank’s Unlimited 1% Cash Back

Normally I wouldn’t care about 1% cash back. But debit rewards cards are going the way of the dodo, and you guys know I’m on FIRE to pay off my student loans. So it was kind of a perfect storm/sign from universe to find this:

I had to investigate.

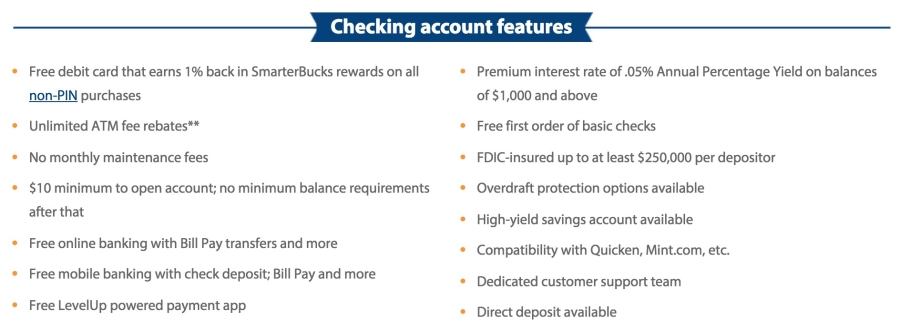

Here are the features of the checking account and debit card:

I really like no ATM fees and rebates, no monthly fees, and online bill pay.

I tried to find any hidden fees or “gotchas” and nothing was a red flag. It seems to be legit.

So then I thought about…

How this could be useful with RadPad and Evolve Money

These are assumptions. They may or may not work.

BUT.

- If the debit card works with RadPad, you could get 1% back from your rent

- If the debit card works with Evolve Money, you could get 1% back from bill payments

Assuming your rent is $1,000 per month and your other bills are $200, that’s $12 back per month, or $144 per year in free student loan payments.

Now, I use RadPad a lot to pay rent on my Airbnbs.

And, Mohela (my student loan company) is listed on Evolve Money.

So if it all works, I could get 1% cash back from paying my student loan – to pay more of my student loan.

For every $1,000, that’s a free $10.

No, it’s not earth-shattering. But if you’re paying your student loan out of a checking account, might as well get a little something. It falls into that “better than nothing” category.

Now the real kicker would be how to pay student loans and earn credit card points at the same time.

(That’s how I found SmarterBucks – I was by digging into the dark interwebs for new MS strategies.)

Deets you gotta know

If you’re thinking about opening this checking account, here are a few things you need to know:

- It’s a soft pull on your credit

- You must fund the account with at least $10 and you can use a credit card (no idea if it’s coded as a cash advance)

- To sign up, you must use the link on SmarterBucks (so you have you sign up for SmarterBucks, and then the checking account)

- To get the cash back, you have to use the card online or run it as a credit card

- You must accumulate $10 in cash back rewards for Radius Back/Smarter Bucks to make a payment to your loan

A couple of other things I want to share

Don’t do the savings

Radius Bank also offers a high-yield savings account. Don’t do it.

The APY is only .85%. You’re better off getting .90% with American Express or 1% with Barclays.

Unless you just really want all your funds together.

It all adds up

1% cash back doesn’t seem like a lot, but the truth is that everything counts. Even small payments can help.

Check with your loan company, but with mine, any extra payments are applied to the principal. So every $10 I pay is $10 I no longer have to pay interest on. So over time, that $10 is worth much more than $10.

Not that I want to have the loan forever or anything like that. But any progress is good. Even $10.

Don’t use their shopping portal

Earlier I mentioned that SmarterBucks has a shopping portal. Yeah, no. It’s not worth it.

Payouts are 1% in almost every case. For online shopping, I still want Chase Ultimate Rewards or American Airlines miles.

Or heck, if you really want to pay down your loans with online shopping, try Upromise. But not this one. There are better portals in the world.

Bottom line

SmarterBucks offers a checking account through Radius Bank that comes with an unlimited 1% cash back debit card. But you can only use the cash back to pay down a student loan.

Normally this is “meh” at best, but if it works with RadPad and Evolve Money, it could be scaled up and therefore be useful if you have loans to pay down.

Anyway, I signed up for an account so I’ll be testing it out with both services this month and will report back.

This will hopefully be useful to some!

What do you guys think about SmarterBucks and this cash back card?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Announcing Points Hub—points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Interesting stuff. FYI doctor of credit blog reports that CC funding is limited to $1k