I’m sure it’s happened to you at some point. A friend asks, “How do you do it?” Take all these trips to places like Hawaii, Tokyo and Osaka, Dublin, Barcelona, and more. How do you get free hotel rooms that cost hundreds of dollars a night?

“I want to travel like you do,” they say. “Where do I start?”

And you have that moment where you’re thinking, “Well for starters, using that debit card for everything you buy isn’t helping anything.” *cough*

You ask about their spending habits. “Do you shop online?” Definitely use a shopping portal – get free miles for clicking a link.

You can stay at the Hyatt Ziva Puerto Vallarta for FREE with Chase Ultimate Rewards points

And sign up for dining rewards while you’re at it because you never know when you’ll get some extra miles in your account – especially if you live in a mid-sized to large city.

But as far as cards go… where to begin?

| Chase Sapphire Preferred® Card | bonus_miles_full |

|---|---|

| • 5X Chase Ultimate Rewards points per $1 spent on travel booked through Chase • 3X Chase Ultimate Rewards points per $1 spent on dining |

| • $95 annual fee • $50 annual hotel credit • 10% anniversary points bonus • Free DoorDash DashPass subscription | • $4,000 on purchases in the first 3 months from account opening |

| • The best card for beginners | • Compare it here |

Getting Chase Freedom Flex℠ is kind of pointless without the Sapphire Preferred… so I always trace my steps back to the same place.

The Chase Sapphire Preferred was my first points card – and I just got it again after all these years

Dang it, the best card to start with really is the Chase Sapphire Preferred® Card.

Why I recommend the Chase Sapphire Preferred® Card

Here’s what it comes down to:

- Easy, daily bonus categories

- Great sign-up bonus

- Easy to rack up points with ongoing spending

- Excellent shopping portal (and only one of its kind – Amex, Citi, and Starwood don’t have one)

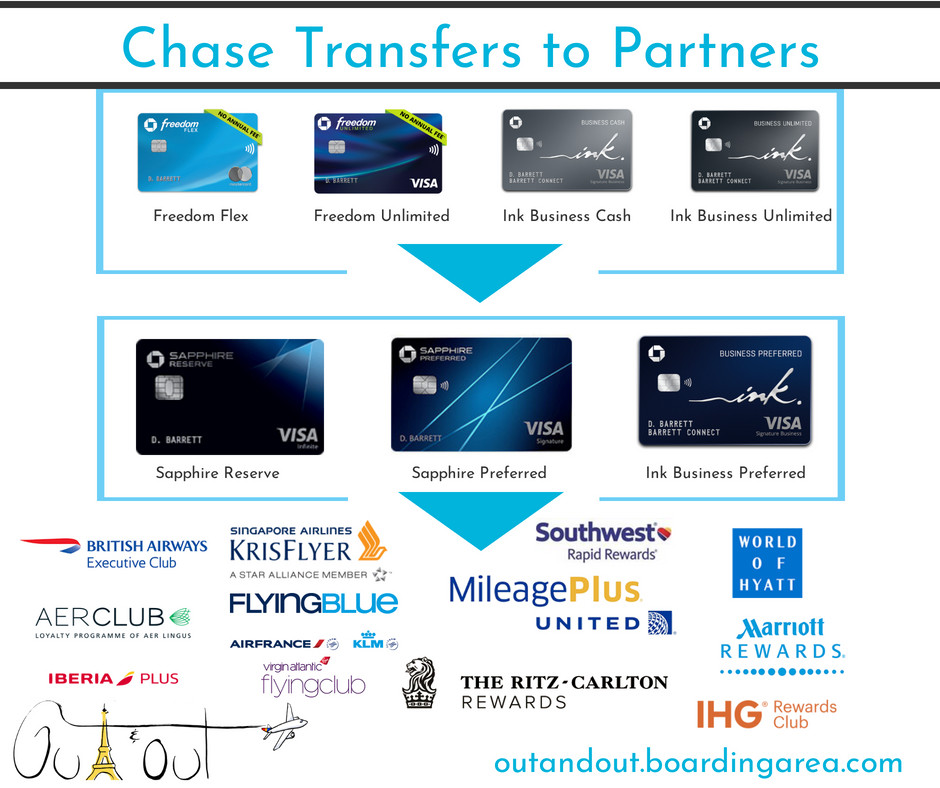

- Useful transfer partners with instant transfers – *this is KEY*

Pair Chase cards to earn even more points

About those travel transfer partners:

- 60,000 Chase Ultimate Rewards points are worth ~$840 toward Southwest flights

- Lots of United award flights are easily bookable on United.com

- Booking a Hyatt award night couldn’t be easier – just tick “Hyatt Gold Passport” to see how many points you need for a free night, then transfer

- British Airways is a great level 2

- From there, you can learn Flying Blue and Singapore when you’re ready to expand

Basically, this card is good for peeps who know nothing and need to have it easy. AND for those who don’t mind really geeking out and digging around in award charts.

I flew to Dublin in Business Class by transferring my points to British Airways

Southwest, United, and British Airways and more than enough if you want to travel domestically.

Important: Don’t even bother applying for this card if you’ve opened for than 5 other cards in the previous 2 years. If you’re a beginner, this shouldn’t be an issue – and it’s a good place to start.

That first transfer

My friends ask, “So I just transfer the points? And they show up on the other side?”

Ah, I remember my first award booking with points. Still so unsure and skeptical it would actually work.

Then, when I booked the flights, I felt somehow the flights weren’t “real” – that I’d be found out and have them taken away. How could that be possible? Free flights? Yeah right. Where’s the scam?

I stayed in Boston with Hyatt points – then flew back to New York on a free American Airlines flight with British Airways points – all transferred from Chase

It wasn’t until the 3rd or 4th award trip that I started to gain confidence in booking awards.

And having instant transfers is really so nice. You transfer to United, refresh the page, they’re in the account. Same for Hyatt, British Airways, Southwest, and the whole lot.

You can even call to book the award and transfer while you have someone helping you on the other end.

If you want “points training wheels,” this is an excellent place to begin – with a lot of power left over for advanced players.

Extra points for everyday spending

Most of my friends eat out too much and frequent too many bars. Sound like your friends? For the love of god, earn bonus points on it! (There’s nothing worse than seeing a debit card in a restaurant.)

The travel category is broad and includes airline tickets, hotel stays, tolls, train passes, bus fare, parking, and lots of other incidentals.

Plus you’ll earn 1X point per $1 spent on other stuff. It’s not a lot, but it’s also a lot better than what you’ll earn with a debit card: nothing.

New Orleans is dead cheap with Chase points – getting there and finding a hotel is easy, and the hotels are lovely

The biggest objection I hear is: $4,000?!?! I can’t possibly spend that in 3 months (to meet the minimum spending requirement). So that’s $1,333 per month for 3 months.

How much is your rent? Put it on a card and eat a small fee once or twice.

Use it when you have a big purchase coming up, like a new appliance, upcoming move, or big party to plan. I even paid my car down payment with a credit card.

Or, take your friends out, pocket their cash, and run the bill through your card. Or they can pay you through an app like Venmo, PayPal, or Cash.

There are plenty of ways to hit the minimum spending requirement, I promise ya.

Chase Sapphire Preferred® Card bottom line

Does this help to explain why I like this card so much for beginners?

The other thing I hear is “Oh, it’s all too much to keep track of.” Is it? In my view, I don’t mind “keeping track of it” because I know what it gets me – free travel! That’s really what it comes down to.

Travel is my life’s passion, my ultimate dangling carrot. So yeah, I will track the crap out of some points and miles.

I promise redeeming the points with travel partners isn’t too difficult. Just sign up for a loyalty account, copy and paste the number, and press “Transfer.” It will feel awkward the first time – but it’s easier the second time. (And effortless beyond that.)

And doing that over and over is the answer to the question of, “How do you do it?” That’s how I do it, since day one and up through to now.

And to my regular peeps, what card do you recommend when someone asks, “How do I travel like you do?” CSP, yeah?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Most folks would have more money in their pockets at years end with a 2% no annual fee cash back card. Please do the math and account for point earning bonuses (points per dollar spent), point redemption values ($ per point redeemed), total annual spend, the percentage of total annual spend on dining and travel, and the annual $95 fee. This card is touted heavily in the blogosphere because it generates big profits for Chase. Please note the financial analysis in comments of the The Points Guy pitch for the Chase Sapphire Preferred and Chase Freedom Unlimited card combination.

Do you have a link to that post?

Rough math tells me if you spend $5,000 in a month, you’d get $100 back with a 2% cashback card.

Even at 1 point per $1 spent, that’s 5,000 Ultimate Rewards points – already enough for a night at a Hyatt Category 1 hotel – which is likely worth more than $100. It’s also a healthy start toward a free short-haul one way on American thanks to British Airways – those flights tend to be expensive, so you’d do better with the CSP, even for a coach flight.

And, if your goal is a nice international trip in Business or First Class, there’s really no comparison to a cashback card, even with the $95 annual fee considered.

Again, this is ONLY is your goal is to get more travel. If you don’t want that, sure, go with a 2% cashback card. Still better than nothing.