Also see:

I wrote how I bought a car with credit cards in early 2016. It was a used 2004 Subaru Forester. And it fit my needs at the time.

I swore I’d never buy a new car. It’s a badge of honor within the FIRE (financial independence, retire early) community to have an old car with tons of miles on it. It means you’re frugal. And saving. And “doing it right.” A quick search on Reddit returns more opinions than you can ever filter through.

There’s even a rap song called “No Car Note.” (“I love my ’98 Honda!”)

But after running the numbers, I broke my own rule. And bought a 2017 Nissan Versa Note. With a car note.

New or used car? Why I went new

The short answer is: to swap unpredictable expenses for predictable ones.

The car had 144,000 miles on it. Which isn’t good or bad, just saying. But it was starting to need significant repairs.

For starters, the undercarriage was completely rusted. It’s from the Northeast, and most of the cars there rust because of salt on the roads in winter. The longer it snows, the more salt eats through your car.

The exhaust pipe fell off once. I got it welded back on for $100. But the next time it happened, I knew I’d likely have to replace the whole exhaust system – for at least $1,000.

The other thing was the head gasket and timing belt. Older Subarus are notorious for this. It started to leak. There were little drops of oil under the car when I’d park for a couple of days.

That repair would cost $3,000+. But, it would probably give the car 100,000 more miles of life.

I only paid $4,500 for the car – and didn’t want to put $4,000+ of work into it. For that price, I could buy a whole new car.

So I pondered my options.

Holy crap, should I get a new car?

- Link: New Cars and Auto Financing: Stupid, or Sensible? – Mr. Money Mustache

For the $4,000 I knew I’d have to spend one way or another, I could either:

- Buy another used car

- Stick the money into a new car

I must’ve read this Mr. Money Mustache article 15 times while pondering my decision. He’s smart, thoughtful, and I respect his opinions. It basically says it doesn’t make sense to buy a new car. Because all things considered, you can invest the money you save and come out way ahead in the end. (This Reddit thread was a lot of food for thought as well.)

Now, I didn’t know when I’d have to spend that $4,000 (probably within the next year). Or if it would be more or less. But I knew it would happen. And it bugged me to sit around and wait to pay.

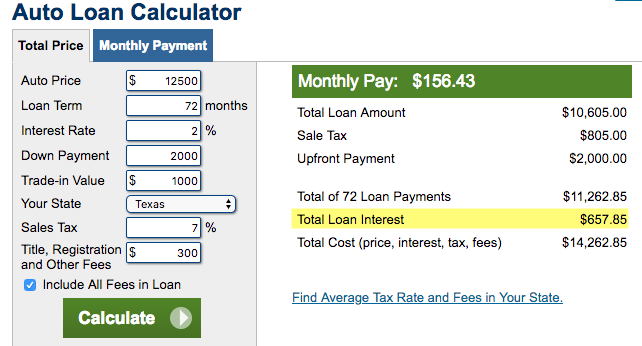

$4,000 / 12 = $333. Heck, even $3,000 / 12= $250 a month. I played around with some auto loan calculators.

I figured if I could put down around $2,000 and get $1,000 trade-in for my old car, I could get a $12,500 car for a little over $150 a month. And with a low-rate auto loan, I’d only pay ~$658 in interest, even if I broke down the financing over 6 years (~$110 per year). But of course, I’d pay more each month to knock out the amortization on that baby. So the interest rate was kinda moot, in a way.

A new car wouldn’t need as many repairs as an old car. And I could pay a set amount of month instead of waiting to pay for a big-ticket repair at a random time.

But was it the smart thing to do?

I did it

The thing that got me wasn’t the repairs I knew were coming down the pipeline, but the ones I didn’t.

My baby was 14 years old, rusted underneath, and due for some major repairs. But I couldn’t anticipate what else it would need.

Would something else pop up? I was tired of pouring money into it just to keep it going. And on top of all that, I didn’t want to push it by driving it any further than within town.

It seemed the entire financial independence community didn’t mind fixing up an old car and driving it forever. But I found it unnerving.

I wanted reliability over unpredictable repairs. Plus, I’d be out a car for several days with the more serious ones. Everybody said to zig, but I had to zag.

The interest wasn’t much, the repairs would be minimal for at least a couple of years, and I could keep a new car for (hopefully) 15+ years.

I ended up with a 2017 Nissan Versa Note that fully met my criteria. For ~$160 a month, the price is more than reasonable. And I won’t have to think about when I’ll have to randomly drop $1,000 or $3,000+ on repairs.

By the numbers

I went to the car dealer with a list of cars in mind (Toyota Yaris, Nissan Versa, or Honda Fit – can you tell I have a thing for Japanese cars?). I wanted to:

- Finance $10,000 @ 2% interest rate or less

- Get $1,000 for my trade-in

- Put $2,000 down – on a credit card

I dug up my car’s title and cleaned it out. Took it to the car wash. Gathered up all the repair records. And headed to a dealership.

I also knew I wasn’t willing to go over $170 a month. Out the door.

The first place I went had a huge selection – all my wishlist cars were there. I spotted a 2017 Nissan Versa Note for $14,000. That’s a little higher than the Kelley Blue Book value, but not by much.

It was clean, no dings or scratches, and drove great. A perfect car for zipping around town (I don’t need anything fancy).

I got the usual car dealership runaround. But god as my witness, I test drove the car, completed the trade-in paperwork, secured the financing, and drove out of the lot in my new car within 3 hours.

I was ready to make the deal and they gave me a great one:

- $10,459 financed

- $1,000 for the trade-in

- $2,000 down payment on my Blue Business Plus Amex (it currently has a 10,000 point sign-up bonus!)

In the end, I paid $13,459 for my new car. And my payments are ~$160 a month. Plus, my insurance only went up $30 a month to get full coverage with collision. That’s still less than I would’ve paid for replacing the exhaust system and getting new head gaskets and a timing belt on my old Subaru. And I won’t even crack 20,000 miles for a long time.

I’m paying more than the minimum payment each month, so I’m working the principal down at a good clip. But the interest rate is so low that I’m basically paying for it at cost.

I don’t care about depreciation because I intend to keep this car for 10 to 15 years. By that time, I would’ve gotten more than enough use (and value) from it.

Plus, these cars do hold their value pretty well. But I’ll think about all that next decade. 😺

Bottom line

I couldn’t deal with the stress of having an older car that needed a lot of repairs. I knew I could be driving down the road one day, break down, and have to pay $3,000+ to fix it. Considering I paid $4,500 for it, having to put at least that much back into it wasn’t worth it.

Instead, I put the cash into buying a new car with a low interest rate.

Did I do the right thing? I think so. This is in direct opposition to most of the FIRE community.

In the end, I’ll have more control of my cash flow, not care about depreciation, and have transportation for the next 10 to 15 years. I couldn’t say that about my 2004 Subaru Forester. In the end, I paid for reliability and peace of mind.

Would you consider buying a new car? Or are you a firm believer in driving till the wheels fall off?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Should have bought a Hyundai, Kia or Mitsubishi… they all have 5 year/60k bumper-to-bumper warranties and 10 year/100k powertrain warranties.

I got a nice warranty on mine as well. Heard good things about Hyundais. Excellent tip to know, though. Perhaps others will get some ideas if they’re ever in the same boat. I’ll certainly keep it in mind in the future, too.

Thank you so much for sharing that, Mike!

100% agree with your analysis. The problem, at least in my personal experience, is that low end Nissan’s can be a total POS (it’s hit or miss). I had a terrible experience with my brand new $10k Nissan Sentra in college. I ended up trading it in on a brand new accord, that 12 years later I still have and love. New cars aren’t all that bad financially if you do it right. Enjoy the car!

I heard great things about Accords and Civics. Funny enough, my first car was a Nissan Sentra. I loved seeing the speedometer click over 200K miles. I think I had it until it had between 215K and 220K miles on it – that car was a total beast! I’ll see how this one goes. Next car might be a Honda – although I certainly hope that doesn’t happen for a very long time. Thanks for reading and commenting! <3

Tip from a former car salesman: Never wash your car before having it appraised for trade-in value, it makes it much easier to see any dings or scratches

Oh wow, I thought it would make it look nice and shiny! I hope others see this and take the advice!

Glad it worked out – they still gave me what I wanted to get from it. Whew!

Congrats! I think its a perfect decision! Plus dont you get 50,000 miles warranty? That is a huge extra. Also, what interest rate did you get?

Yup, I got a warranty on it! The rate I got was 2% through Capital One. I’d love to get a 0% auto loan but they didn’t have any available. I still think 2% is acceptable after running the numbers, though. Any more than that and I might’ve been less eager to seal the deal.

I dont think the FIRE community is really talking about a Nissan Versa when they say never buy new. That car costs about 40% of what the average new car costs. Depreciation is a lot less significant when it is off of 13.5k instead of 35k (new car average). The relative cost differential over five years between a new versa and a used 100k Camry or keeping your Subaru on the road is very small. Piece of mind…..that is much more valuable. Also, the FIRE community doesn’t really understand used cars. On a whole they are much better but there is information asymmetry. You know way less than dealer does about the car. Almost impossible to figure out if it’s diaster waiting to happen without paying a skilled mechanic several hundred bucks to inspect it. With a new (affordable car) you can do all the maintenance, oil changes etc.. to keep it running well for a decade or more.

Yes! Reading through all the threads with the car talk, number crunching, and differing opinions had me so lost. Meanwhile, I knew big repairs were coming up and was like… “yeah, but what about all the other repairs it’s gonna need?”

It seemed a new cheap car would be just as efficient but without all the worry and random expenses popping up. Having a set cash outlay each month (and of course regular oil changes and all that) was much easier to manage. Plus with a newer car, I’ll know exactly where it’s been. Whereas when you buy a used car, who knows what it’s been through. And that rusted exhaust system was just a disaster waiting to happen. Was also kind of worried about the brake line. But no more – swapped that in for a new vehicle that’ll never have a salty winter. Hoping for a good 10+ years with it.

Thanks so much for the perspective, and for reading!

Smart.

What a lot of the “No Car Note. Buy a Beater used” types don’t tell you is their math works out because they turn their own wrenches and buy cars where parts are cheap. If that isn’t what someone wants, you did the right thing buying a cheap new car with a full warranty.

Yes, I get lost in all the car talk. I know some people love working on and collecting cars, but I only know the absolute basics and just want something that starts up and goes. I wouldn’t even know how to shop for a cheap car part. I could figure it out, but the interest just isn’t there, really. Thanks for the confirmation – really appreciate that!

Did you ever consider getting an EV and the savings in fuel and maintenance costs that would bring over the years? Or do your daily commutes go over some of their limited ranges?

The opposite, really. I don’t drive enough to really need an electric vehicle. I fill up maybe once a month. The EVs were way out of my price range. But if I *did* have a commute, I would’ve definitely considered it. Who knows, maybe in the future there will be great deals with tax credits and I can figure out a way to swap up. They are definitely on my radar and curious to see how low the prices drop once they become more popular.

Mr Money Mustache ended up buying and financing a new Nissan, but you probably saw that post. I really enjoyed this post and all the number crunching. I am interested in FIRE, but I don’t see it happening for another 20 years or so since I have several young children.

Ah, that’s right – the Nissan Leaf with the tax credits and 0% interest rate. That was at the peak of 0% – I don’t think any deals like that exist any more (or at least they don’t in Texas). Thanks for the reminder – I’ll see if he ever posted an update on that.

FIRE is definitely a long game full of tiny steps. 20 years is still a lot sooner than most! Thank you so much for reading and commenting!

I was in the exact same situation and bought a reliable used car, Honda Civic with 90K miles for 7K

Congrats on the new car! I totally agree with the new car approach. Yes, buying used will save you money, but used cars also won’t last as long… and you’re potentially inheriting someone else’s problems. And interest rates on new cars are much less than on used cars.

You can get a bit of the best of both worlds if you buy last year’s model new from the dealer. It will come with new car financing, yet the dealer will want to discount the car heavily to get it to move. That’s what I did with my Tahoe almost 9 years ago.

Yes, yes, yes. I was tempted by the Versa myself, despite the negative reviews (which seemed mostly focused on the lack of bells and whistles – fine by me). I actually liked the simplicity, as well as the spacious trunk and roomy back seat. And the price of course.

In the end, as I laid my ‘92 Honda Accord to rest (boo hoo!), I got a 2015 Honda Odyssey with less than 20k miles (to lessen that initial depreciation). Sad though I was, it’s a relief every day. My only regret was I didn’t shop around more for a lower interest rate (mine’s 3.5, but probably not worth refinancing).

Enjoy your new car! I look forward to hearing how it goes with it.

I prefer new cars over used ones also..