Update: Wow, instant response! Chuck from Doctor of Credit let me know this may or may not work. So for now, I think the best thing to do is start slow at your local Staples (like try $5 and see if it works) and go from there, should you decide to try this. Thanks all for any info you want to add!

I was poking around as I am wont to do and assembled an 8X combination that I think will work.

Now, I haven’t done this myself, but it seems totally do-able.

What you’ll need to get started is:

- The MileagePlus X app (which I’ve written about) AND

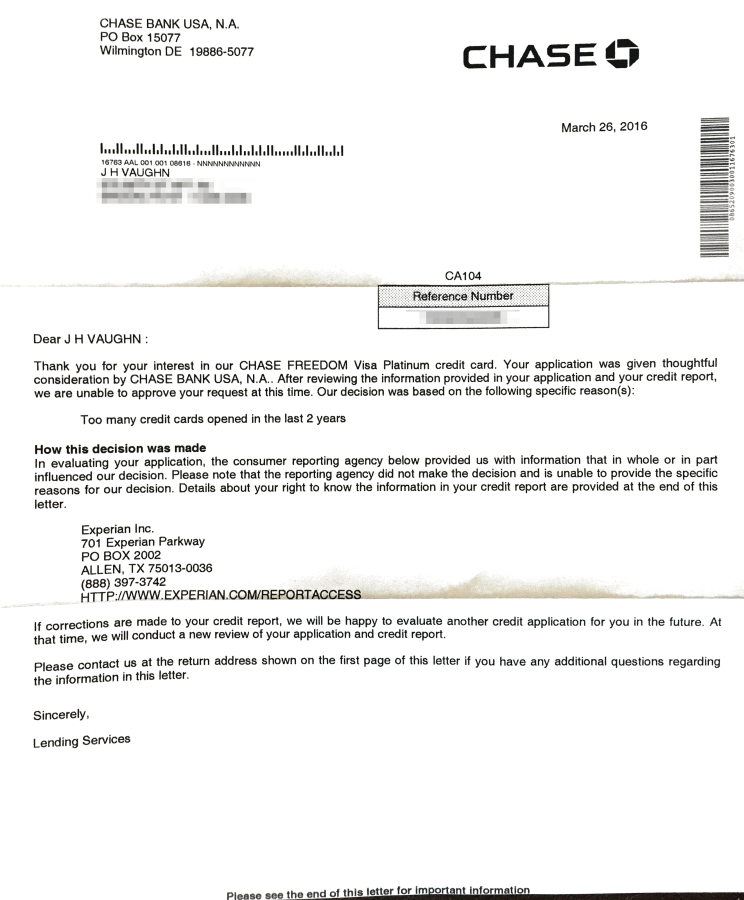

- If you want 8X points, a Visa or MasterCard that earns 5X at office supply stores

Such as:

You can also get 5X on top of what you’ll earn from any other card with the exception of a couple of Amex cards.

Or, if you’re trying to meet a minimum spending requirement and want to get an extra 3X at office supply stores, this should work nicely.