Also see:

- Link: Axiom for Bank Points and Airline Miles

- Link: I Use Miles Because I Won’t Pay Revenue Prices… Right?!

Peeps conceptualize their points & miles in various ways. I’ve heard the argument they’re worth as much as you’re willing to pay in cash – logic that has always failed me. I use points because I won’t pay cash… right?

If I get a $10,000 Business Class flight for say, 50,000 miles – but I’m only willing to pay $1,000 in cash for the flight, does that mean the miles were worth the retail value of $10,000… or my “willing to pay” price of $1,000?

To me, they’re worth up to the cash cost because I typically travel for pleasure. Even though I value most points & miles at 2 cents each (at least!). Which in this case, 50,000 miles would be worth at least $1,000 but actually much more because of the retail price.

Knowing the selling price is the thrill of the deal. That’s the point of points in the first place (or First Class). And often, I use points & because only because of the retail value, despite what I’m “willing” to pay.

So I set my minimum value at 2 cents each because under that, you might as well use a 2% cashback card for the same (or better) result. I collect points for those times when I get outsized value – that’s what makes it worth it. And why I set the points value at – benchmark low – 2 cents each. But it all depends.

What’s your points value?

The fact that we swap points for award flights or hotel nights means we give them and get something back. That’s the definition of a currency.

And knowing the retail price is always the deciding factor on whether to pay cash or use points.

In the earlier example:

- 50,000 miles got a flight worth $10,000

- I value 50,000 miles for $1,000

- If the flight cost less than $1,000 (say $900), I’d just pay cash for it

- So are 50,000 miles worth $900 to me (my willing to pay price) or $10,000 (the retail value of the flight)? Or what I value them for?

Do you need it?

The other factor is need-based.

Say this is the only seat on the flight but it’s also the last flight of the day and YOU NEED TO TAKE IT. On this day, you only have $500 to spend. So your “willing to pay price” is $500.

The miles let you access a flight selling for $10,000. On this day, did the miles save you $10,000? Or are they only worth $500 because it’s all you have in this case?

Or do you just want it?

Finally, the decision is pleasure-based.

Say you stumble across this flight and it’s to a cool place you’ve kinda always wanted to visit but wouldn’t necessarily plan a trip for. You hit up your buddy and say hey, award flights to XYZ are wide open for 50,000 miles – wanna take it? So you do. You’d never pay cash for it. The street price is still $10,000. Are your miles now worth nothing because it’s a trip you’d never use cash for?

This exact scenario has played out for me with recent visits to Mexico to stay at the Hyatt Ziva in Puerto Vallarta and the Hyatt Zilara in Cancun. Both times my criteria went something like:

- Kinda wanna go somewhere easy, free, and warm

- Don’t wanna pay for it, would rather stay home in that case

- I’ll use miles if it brings my cost next to $0

- But I won’t just use my miles unless the trip meets my 2 cents each criteria

- Again, are my points worth 2 cents each, the value of the trip, or nothing because my willing to pay price is $0?

I base it on trip value

For a trip like Cancun or Puerto Vallarta, if it was close to 2 cents each, I might not take the trip at all unless I was getting real, outsized value – something like 6 to 10 cents each.

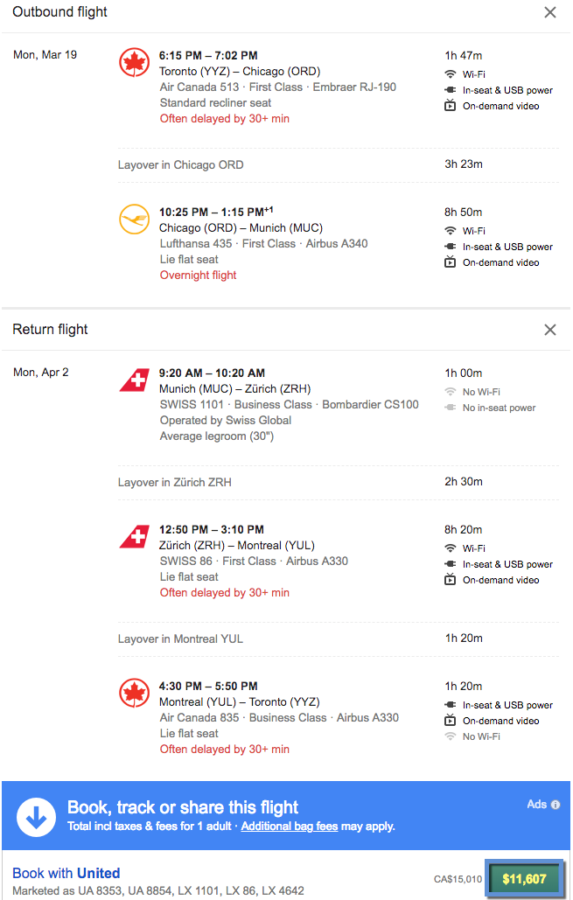

I wouldn’t pay to fly from Toronto to Munich in Lufthansa and Swiss First Class. But heck yeah, I’d use miles for the experience

I did the same thing when I flew Lufthansa First Class to Munich for Oktoberfest. Did I NEED to take that trip? No. But I wanted to. Would I have booked it if the points value were low? No.

Because I mostly take trips for pleasure – not out of need – I base the worth of my points on the retail cost of the trip.

For the rare times I’ve NEEDED to take a flight for an emergency, I’m willing to charge an insane amount to a credit card if an award flight isn’t available. If an award flight IS available, I’ll book it. Did my points value fluctuate based on need instead of pleasure? Absolutely.

That’s why your points & miles – your currency – are worth what YOU want them to be worth.

Why 2 cents is the benchmark

- Link: Cashback rewards cards

Simply because 2% cashback cards exist, without annual fees. If you choose to earn points, you should get at least that in value. If you don’t, you should’ve just gone with a 2% cashback card and saved yourself the hassle.

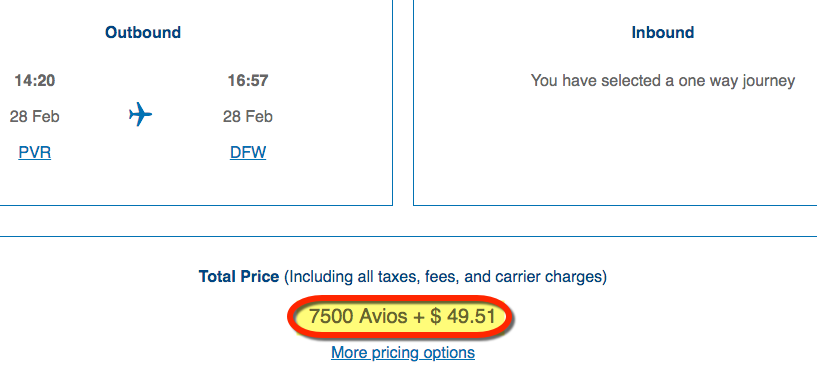

I love using 7,500 British Airways Avios points for $340 one-ways from Dallas, for example. I’d need 34,000 points with a 2% cashback card, which requires $17,000 in spending to earn.

At 1 point per $1 spent, I could also spend $7,500 and get the same flight. A stark difference. And a real example of the magic of points & miles. (In this case, each point is worth over 4 cents apiece.)

Exceptions to everything

Of course, there are promotions. Category bonuses. Sign-up offers. 3% cashback cards.

It’s easy for me to earn Citi ThankYou points. So there might be a time I redeem them for less-than-ideal value just because I don’t feel like paying cash. Yeah, I could pay cash. Or I could just use these points that are easy to replace.

Some cards have 2X, 3X, or 5X bonus categories. If you spend a lot in them, you earn more points. And you might decide to use them to save some cash – even for a cheap trip.

I used hotel points to visit my mom for Christmas. Did I get stellar value? Nope. Did I really care? Nope, cuz I got to see my mom

Some hotel points are worth much less than 2 cents each (Hilton and Radisson come to mind). So you might just burn ’em if they’re easy to earn.

There’s nothing wrong with that. But in that situation, you’ve made a snap judgement and set a lower value on your points currency. But if the trip makes you really happy, that’s the ultimate X factor, isn’t it?

Bottom line

Your points are a currency because you exchange them for things you want. But they’re unique because you get to decide their value. And that’s based on:

- Your minimum benchmark (which IMO should be 2 cents each)

- Whether you need to take the trip

- How much pleasure you’ll get from the trip

- How easily you can replace them

I’m definitely in the “pleasure” camp. And for that reason, my points are worth the trip price – which is usually much more than 2 cents per point.

Points valuation is a hot topic. I’ve heard every type of valuation based on what you “would” pay, a benchmark or selling price, or the retail rack rate. Those are all fine. But ultimately, it’s up to you.

And using points to take a trip because it makes you happy, to make memories with friends and family, or to experience something life-changing only adds to the value. That’s the ultimate valuation right there: priceless. And on top of it all, the price can change based on the situation. So it’s really all relative – although I do try to keep to my benchmark of 2 cents each.

I’d love to hear your thoughts on this. How do you personally value your points & miles? Do you have a minimum benchmark?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I agree with you almost across the board. I strongly disagree with the school of thought that argues premium redemptions (say, $10K first class airfares) are actually only worth what you’d pay for (say, twice as much as an economy ticket, or $1K) in cash. If someone offered you a Ferrari but you’d only ever buy a Honda Civic, does that mean the Ferrari is only worth a Civic to you? The value is somewhere between the Civic and Ferrari, based on your personal needs and wants.

I recently argued for buying SPG points at the 35% discount, because the price of a Marriott Travel Package is ~$2100 at that price (presuming you can buy 3 of them through various means). That means a round trip business class ticket to Asia or Europe, with the 7 days in a hotel as gravy, for around $2K. Anytime J class trips go on sale for $2,000 it’s big news, and it’s just as good to do it with points (better since you get choice in redemption, IMHO).

Totally agree with everything especially the SPG->Marriott 7-night cert. You can get crazy numbers like $0.24-0.36 per point if you redeem for first class (like JAL thru AA points) and find an expensive category 5 to stay in.

I also like to value my trips off the retail price because, come on, it just sounds way better!

The discussion about points value can be made much simpler if you introduce the concept of “opportunity cost”: the loss of potential gain from other alternatives when one alternative is chosen.

Let’s use an silly example: flying business class to Europe and buying a teapot. Both the business class ticket and the teapot can be bought for 140,000 points. The cash value of the business class is $2000, the teapot costs $200.

Would you rather spend $2000 + 140,000 points to obtain the ticket and the teapot, or would you rather spend $200 + 140,000 points to obtain the ticket and the teapot?

So, using points has NOTHING to do with the “perceived” value of the item. It has EVERYTHING to do with the ALTERNATIVE use of the points for something else than the item.