My little brother came to visit recently. We went to the mall because he wanted to buy a new pair of shoes – in cash. He’s one of those “sneakerheads” so his purchase was likely going to be around $100.

My little mind started wondering how to get some points out of the whole deal. Then I remembered MileagePlus X!

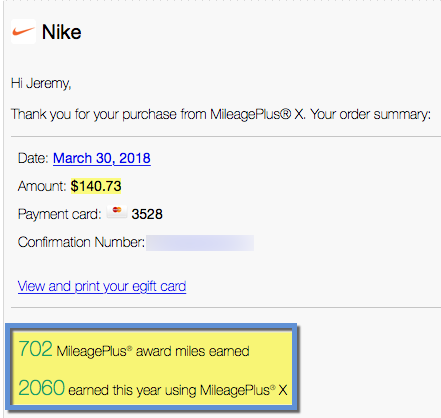

And because I have the Chase United Explorer card (see it here), I knew I could get a 20% mileage bonus on any gift card I purchased through the app – even if I didn’t pay with that card.

We went into a dozen stores – Nike, Finish Line, Journeys, Foot Locker, and a couple of department stores. I’m not much of a mall shopper, so my head was spinning. When he finally decided on a pair of Nikes at Finish Line, I licked my chops and bought a Nike gift card on the MPX app. But realized the second the transaction processed I was in the wrong store. Guh!

My brother paid cash and I… had a Nike gift card I couldn’t use. “It wasn’t that much,” I told myself. But then remembered… I could sell it online. Maybe that would make it OK – and at least break me even – with the points I’d earn in the mix.

I ended up selling the gift card on Raise. Here’s how it went!

My experience selling a gift card on Raise

- Link: Raise.com (Get $5 for signing up)

I researched a few gift card reselling sites (CardCash, CardPool, Gift Card Granny, and Raise) and entered what I wanted to sell and my expected payout.

After going through the motions, it seemed Raise offered the highest payout for my gift card and would sell the quickest. I wouldn’t get paid until someone bought the card – and wanted to offload it ASAP, even if it meant losing a buck or two in the process.

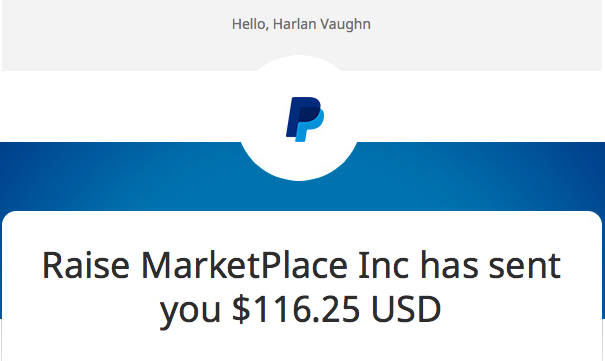

Raise had the best combination of payout and sell-ability. They offered me $116.25 for my $140.73 Nike gift card.

That was a loss of $24.48. Dang – a 17% hit! But again, I knew I messed up and had to pay the piper.

Within a few minutes, I had a new account on Raise, complete with payout info. I entered the gift card details (number, pin, and amount) and set it to sell!

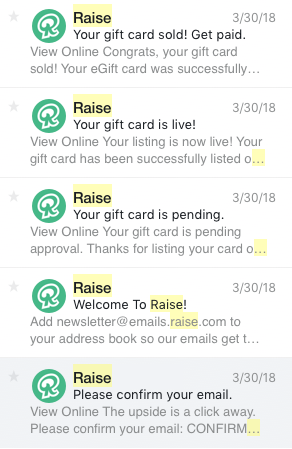

I couldn’t believe how quickly it all went. They made it so easy. Here’s the timeline:

- 7:56pm – Confirmed my email

- 7:58pm – “Welcome To Raise!” email received

- 7:58pm – Gift card sale pending

- 8:39pm – Gift card live for sale

- 11:15pm – Gift card sold, payout requested

Within a few hours, the gift card was approved, listed, and SOLD! I honestly couldn’t believe it, as I was expecting it to take at least a few days. So I logged back in, requested the payout, and had it in my PayPal account soon after (you can also request a check or direct deposit).

So despite losing a little cash, I was happy to have most of the money come back to me. It definitely eased the pain of purchasing the wrong gift card in the first place.

The points haul

That day, Nike offered 4X United miles via MileagePlus X. And I got a 20% bonus. So the gift card earned me 702 United miles, which I value for $14 @ 2 cents per point.

Those were in my account within seconds. And that alone helped to offset Raise’s fees for listing the gift card. Which is fine, because hey, they have to take a cut, too.

I paid with my Citi AT&T Access More card (no longer available for new signups) and earned 3X Citi ThankYou points on this purchase – so 422 ThankYou points. I value those for $8 @ 2 cents each.

In the end, I:

- Paid $140.73 for the Nike gift card

- Got $116.25 from Raise

- Earned 702 United miles = $14

- Earn 422 ThankYou points = $8

In effect, I:

- Lost $24.48 in value

- Gained ~$22 from 1,124 points earned

So while I wouldn’t ordinarily earn points this way, earning a few more was further balm on the mistake gift card. And in the end, I broke pretty close to even. I lost $2 in the process, after selling on Raise and earning some points.

Lesson learned: don’t be so eager to take cash to earn points. And don’t get too excited and buy the wrong gift card!

Bottom line

- Link: Raise.com (Get $5 for signing up)

- Link: MileagePlus X App: Earn Bonus United Miles at Amazon, eBay, & More

It ain’t all easy wins when you’re trying to scrape together as many points as possible. Sometimes there are fouls – and buying the wrong gift card definitely was.

In the end, selling it on Raise got me back a huge portion of the paid value. And ~1,100 points from MileagePlus X got me to near break-even territory. I only “lost” ~$2. And got a great recovery from selling the gift card within a few hours.

If you’ve used Raise before, was your experience as smooth and fast as mine was?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

In general, I’ve found guaranteed sale sites to be much more lucrative. Raise’s marketplace style gets flooded with cards frequently and then they sit, sit and sit.

Oh wow, that’s great to know! Which sites do you like/prefer? Thanks for the tip!

It’s harc for me to justify using MPX when it’s so easy to buy actually discounted GCs while earning 4.5% with Apple Pay (Altitude Reserve). If MPX got into the discount market, that really would be a game changer.

If you actually do ever need Nike GCs in the future, I’d be happy to sell you some. Have been reselling a record number of those in the last couple of weeks due to deals from a multitude of sources.

Raise is never my selling platform of choice, as their fees are high and competition can be fierce. If you are seriously interested in reselling, working with private buyers is generally the way to go. That said, you did remarkably well with what you earned from Raise this time.

Wow, how cool – I already have that card in my canon! Getting into this is a whole other side of “the game” but I should look into it. I wouldn’t even know how to begin finding private buyers. But I suppose more avenues open up the more you do it, like anything.

Thanks for the word about Raise, too. Def open to other platforms. And always good to hear from you, of course! Hope you are well. 🙂

With giftcards.com cutting out entry portals for visa debit cards, I have got to start finding other relatively easy ways to earn points. Good article.

Thank you! I’ll post if I find a great angle that works.

It works because you have an inflated value of your United points (and maybe Citi points if you use other methods). For United you can often buy miles for 1.7-1.8 cents so valuing them at 2 cents doesn’t make sense. Citi points can be had for 1.5c

Ja, I always value my points for at least 2 cents each, because that’s my minimum redemption threshold. Even at your valuations, it’s only a loss of another couple bucks. Either way, the outcome was better than expected.

Thank you for commenting!

Agree with the earlier commenter. There is no way United miles are worth $0.02 each.

I wouldn’t redeem them for anything less than that. Otherwise, just pay cash for the ticket.

Does it take Raise 3 business days to send your direct deposit payout?