Just a quick note.

I was poking around last night and came across a mention on Rapid Travel Chai’s Week in Points about a new way to earn some extra points via manufactured spending from a service called Flint (HT to Miles Remaining – I just discovered the blog and loved it! I instantly subscribed on my feedly).

I toyed around with the idea of signing up for the service for about 1.5 minutes before I decided to go for it.

I downloaded the app, got my US Bank Club Carlson Visa Signature card ready, snapped it in, and ran up a purchase for $750 (the max daily allowance).

This was after I entered in my bank info for direct deposit.

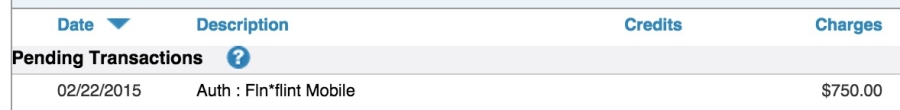

I saw the charge on the US Bank website. There it was, for $750, and it looked like it was gonna code as a purchase. Sweet. 18,000+ Club Carlson Gold Points for free? Yes, please.

So I was going to use the same plan as Miles Remaining to run $750 through 5 times in 30 days: on Days 1, 8, 15, 22, and 29.

And now, the warning

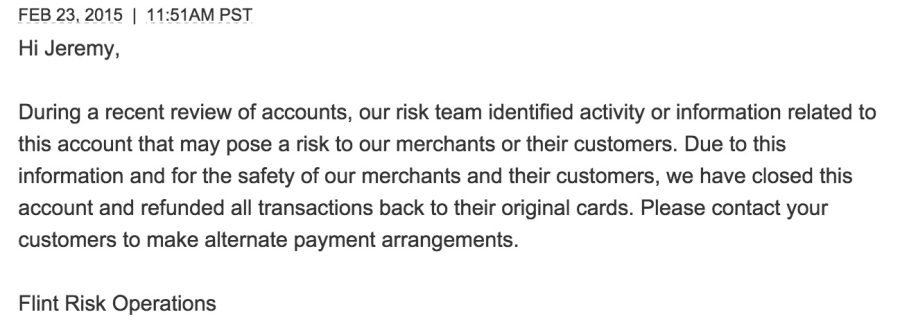

They’re on to us. I received an email this afternoon informing me that the charge would be reversed and that my account was already terminated.

Sheesh, that was fast. I didn’t even make it beyond day 1. Seems like they are really going through every transaction with a fine-tooth comb now. Though Miles Remaining was able to get all 5 transactions past them, it seems others have had the same issue as me.

The other thing is that they will issue a 1099-K form at the end of this tax year. Now, I get a lot of 1099s, so adding another one to the mix and putting together a Schedule C isn’t a big deal, and I was OK with it. But if you don’t want to deal with that, it might not be worth it for $3,750 in manufactured spend.

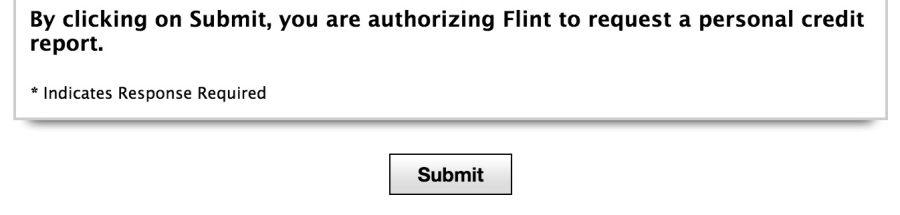

Other folks are reporting getting an email requesting scans of their drivers license, business license, supplier invoices, receipts sent to customers, and other personal info via this web page.

It also says, down at the bottom:

I personally am not comfortable with that. It has been verified that it is a soft pull, but I don’t want these people running my credit so I can run a few charges here and there through their iPhone app, sorry. Maybe if this was going to be my daily go-to, or a replacement for Square or PayPal. But not for this.

Bottom line

Just wanted to put this out into the world in case anyone else was thinking of jumping on it.

For all the info they’re requesting, combined with the soft credit pull and having to keep a rote eye on the calendar to get the 5 transactions in, it seems like more trouble that it’s worth to manufacture $3,750 in spend. I’d rather get $4,000 in PayPal cards at CVS. A little more work, but none of this calendar-watching, requests for info, and a credit pull – and it’s also free.

But, as always, it’s case-by-case. Just know this will probably happen if you run a charge through your own credit card and try to deposit it into your own bank account. If you have a partner, maybe two people could set up accounts and charge each other’s cards to generate the same amount of spend and earn the same amount of points?

My ship has sailed, though. The account is closed. I’ve already deleted the app and moved on. It was fun for about a day.

Sucks because I do sell my paintings from time to time and I would’ve been OK with eating the 2.95% fee to process a credit card transaction for a non-local customer who wanted to buy something.

Also, I was genuinely curious to see how the service would work in practical terms: how long it would take to get the deposit, what the charges looked like and how they coded, how the receipts could be filed, etc.

Great idea, but I didn’t even get in 1 transaction with them. Way to start off on the wrong foot, because I might’ve used the app for other things in the future, but after seeing how finicky (I just love that word lately) they are, I don’t wanna mess with them any more.

Anyone else have this experience so far? Was anyone successful?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply