I’ve had the Acorns app as a complement to my usual Fidelity investment accounts since 2017. I use it to generate a little funny money – and most of it is completely free.

The website and app interface are easy to use and nice to look at. Over the past couple of years, I’ve grown to like what Acorns has to offer, and recommend it as a way to get started with investing. Even if you typically invest elsewhere, Acorns is still worth a download.

I wasn’t sure if I’d keep the Acorns app long-term, but at this point I’ll likely keep it forever

If you sign-up with my link, you’ll get a free $5 added to your account.

Here’s what I like about my experience with Acorns so far.

Everyone should give the Acorns app a download

A couple of years ago, Acorns and Stash appeared around the same time. Both focus on micro-investing with cheap index funds, have no account minimums, and cost $1 per month to use. Since then, both companies have put out debit cards.

Acorns focuses on keeping investing dead simple, and has partnerships to earn free money. Whereas Stash lets you choose a “cause” to invest in, and recently introduced a “stock-back” debit card (which isn’t very good, btw).

But Acorns has the edge.

1. Earn free money to invest at Simply Spend merchants

Acorns has a section of their app/website called “Found Money.” Here, you’ll find find a few hundred merchants they’ve partnered with. When you spend, the merchant awards cashback that Acorns invests in your account. It works two ways:

- Some merchants require you to click through, then shop or sign-up for their offering

- Whereas others give you free money for spending any amount on any credit or debit card

That latter category is called “Simply Spend,” and the partners frequently rotate. In the past, they’ve had H&R Block, BarkBox, Rover, Uber, and Sam’s Club, to name a few.

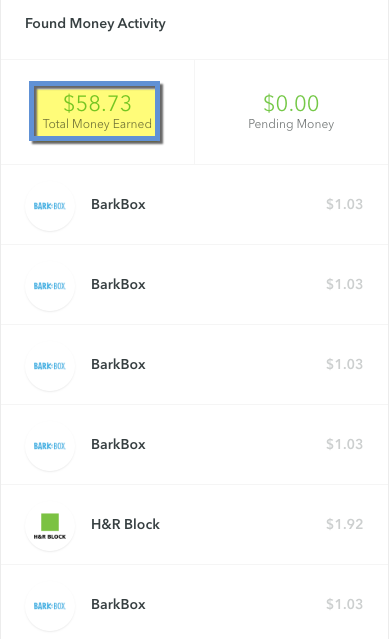

So far, I’ve earned ~$59 to invest completely free from Simply Spend merchants.

All my free money has added up!

All’s you gotta go is link your external banks and card accounts. When you spend at any Simply Spend merchant on any of your linked cards, the money you earn will automatically appear in your Acorns account, where it’s invested into the portfolio you’ve selected.

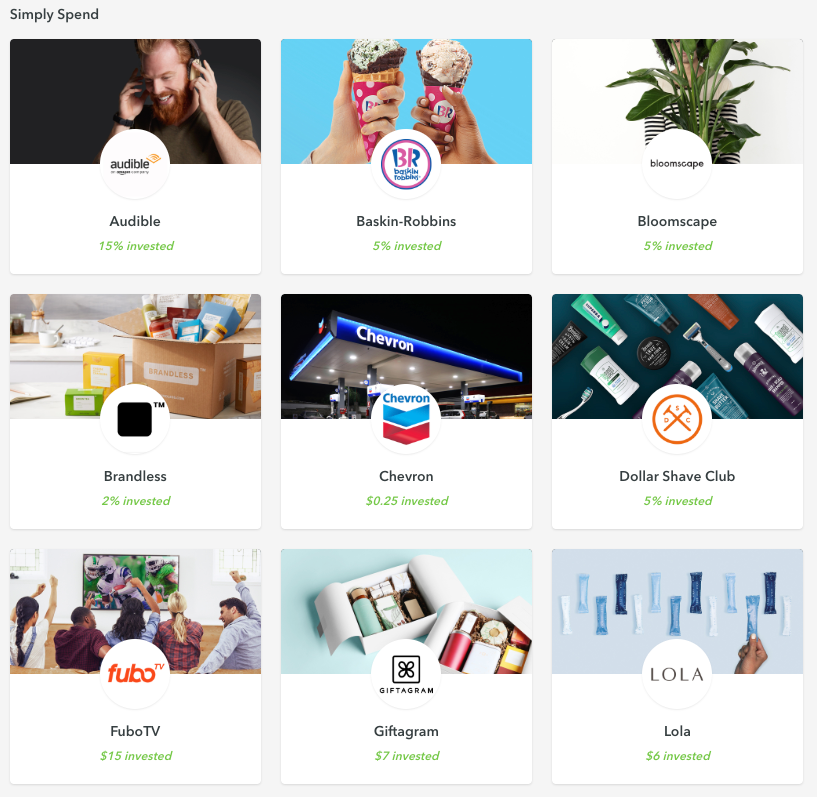

Right now, current Simply Spend stores include:

- Brandless

- Chevron

- Dollar Shave Club

- Squarespace

- Total Wine

Earn free cash for spending on any linked card at Simply Spend merchants

Don’t like ’em? Just you wait. They’re always changing, and there’s almost always a couple that are good. I’ve consistently gotten a few bucks each month just for shopping like normal.

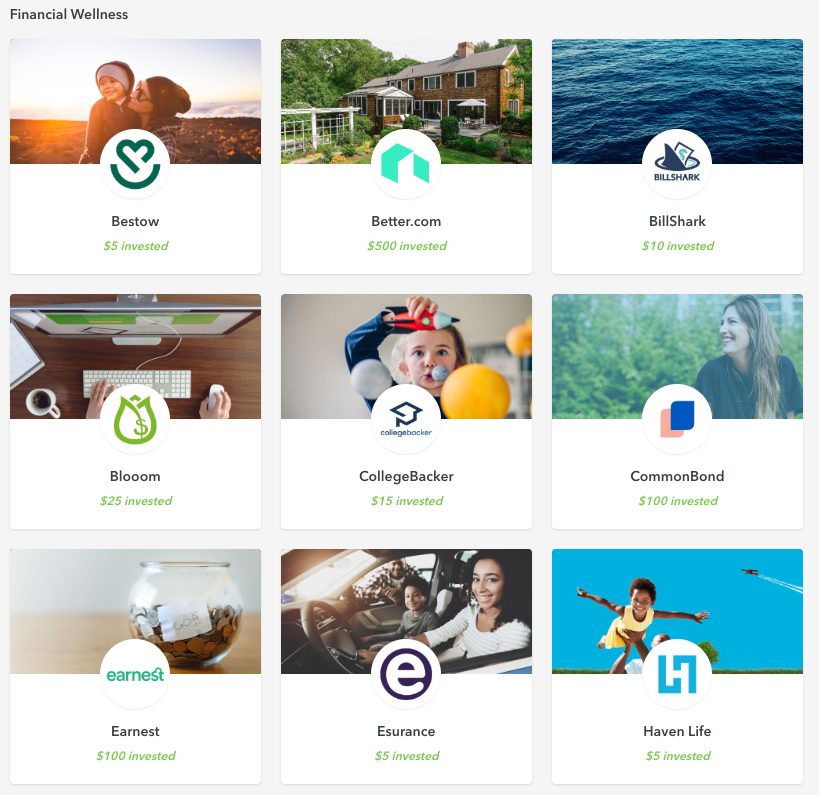

2. Take advantage of bonus offers for new services

A step beyond Simply Spend, you can earn between $5 and $100 for taking advantage of a new service. Most are financial service products, but others include wine and dinner subscriptions, using new apps (like GrubHub and Uber Eats), and being a new customer to several other places.

Wanna try a new service? Get up to $100 invested along the way

Granted, you can get similar offers with other apps, so definitely compare. And remember, you have to click the link inside your Acorns account to get credit.

That said, I’ve found a couple new things in here I wanted to try anyway and didn’t find listed anywhere else, so I went for it. In my case, I got a $25 boost – for free.

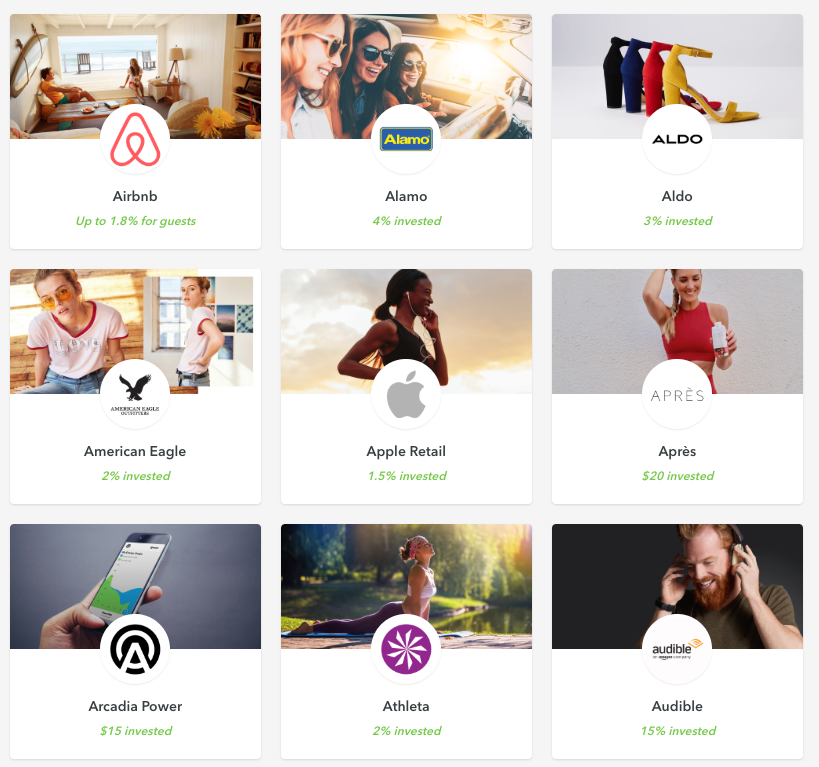

3. Use Found Money like a shopping portal

Continuing with more FREE money from Acorns, you can click through and shop like an ordinary shopping portal, and earn cash when you shop.

That’s not groundbreaking, but I’ve occasionally seen best-ever offers or certain places that were only listed here (like Airbnb bookings for 1.8% cashback and Postmates orders for 1% cashback).

Definitely scan the Found Money offers

Acorns are negotiating their own partnerships and payouts on their network – so they sometimes have different/better offers than the regular Cartera-powered portals. Always check Cashback Monitor to make sure you’re getting the best return.

Get $10 for making ANY purchase in this example – that might actually be the best deal for lower amounts

Speaking of returns, you might opt to shop through Acorns even if they’re not the best offer. Why? Compound interest, baby.

Not only is it the eighth wonder of the world, but if you let it sit there long enough, you can earn a formidable return.

4. Set and forget

Speaking of which, let all that free money just sit there and earn you dividends. That’s what I do. Free money earning more free money. All I do is shop like normal and occasionally check for special offers.

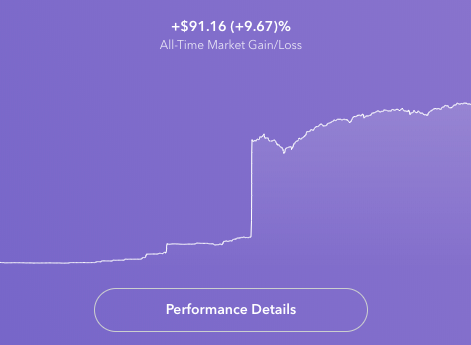

I’ve earned a respectable 10% return on my Acorns investments over time

But thanks to the Simply Spend partners from #1, you can literally link your banks one time and go about your life. Maybe peek in every once in a while to see how much you’ve earned.

While Acorns does cost $1 per month to use, I’ve never had a month where I haven’t earned more than that, either through free money or with dividend payouts.

5. Diversify your investments

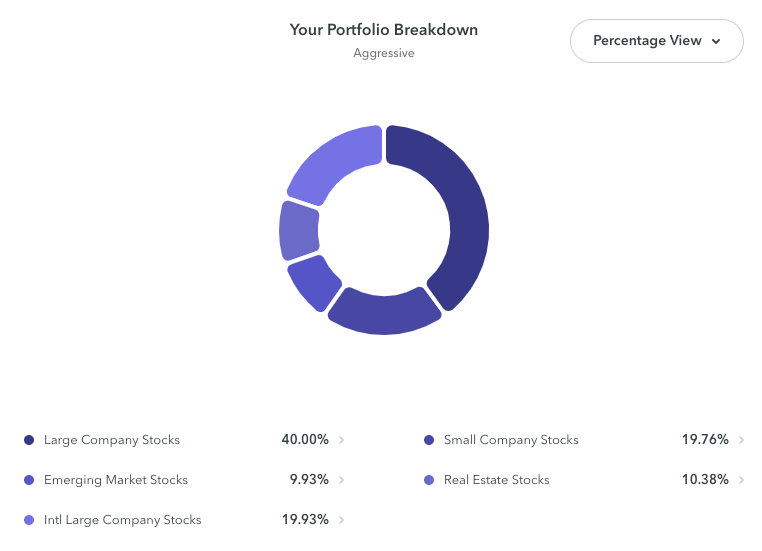

I have all my free money set to an Aggressive portfolio. *growls* 🐺🐾

And why not? It’s not like I have anything to lose. But more interestingly, my portfolio is a mix of investments I wouldn’t otherwise dabble in.

Yes, I like this

Things like emerging markets, small caps, and real estate. It’s a pretty cool blend, and not one I’d select myself. But because I’m letting Acorns pick the stocks, allocate funds, and rebalance for me, it’s nice to sit in the back seat and watch it all happen.

Bottom line

There ya have it – why the Acorns app is worth a download for most peeps, even if you usually invest elsewhere. I’ve even gotten my mom hooked on it. She likes shopping at Brandless and called me all excited when she saw the free Found Money appear in her account.

Of course, you can also set small recurring investments (the minimum is $5) and let them grow over time. Acorns does well at guiding you to your optimal portfolio. They do all the work selecting where the money goes. If this is the app that gets you to start investing, I’m all for it. Plus, they have IRAs where you can save for retirement. It’s a great way to get your feet wet.

I’m a little more seasoned, but still find value in maintaining my account. It’s fun to watch the interest compound and see how their index funds perform. Plus, free money here and there really adds up – especially after a year or two.

All in all, worth the download.

Do you already use Acorns? What’s your experience been?

Also see:

- Acorns: A Simple Way for Beginners to Invest (And You Should!)

- The 12 Best Card-Linked and Cashback Apps (10 Get You Completely Free Rewards)

- Best IRA Accounts: 8 Companies Compared (Self-Directed, Apps, & Roboadvisors)

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply