Update: One or more of the cards offers in this post are NO longer available.

Time for a credit card inventory. Over the years, my collection of credit cards has grown. I now have 29 credit cards to my name.

(I did have 30, but closed my Citi ThankYou Premier last week. Because the Chase Sapphire Reserve is better for the same 3X categories. And Citi is changing the Prestige and AT&T Access More cards next month – which is causing me to significantly rethink my relationship with them.)

And, I’m paying annual fees on many of my cards. So I thought I’d put the complete list together to take stock of what I have – and what I’m getting in return. I’ll write a little snippet for each card, but will try to keep it brief. 29 cards is a lot!

Let’s jump right in.

Amex

I’m pretty much tapped on out this bank. I’ve earned most of the sign-up bonuses at least once. There may be a couple here and there I haven’t had. But for the most part, I am done with Amex.

1. Blue Business Plus – $0 – 1 year – Keep

My newest card. I got it last week. This is the one I think I’ll transition to using for Airbnb rent, mortgage, and HOA dues. 2X Amex Membership Rewards points on the first $50,000 each calendar year? Yes, please! AND no annual fee. I also got no hard pull for opening this card.

But, I’m going to make sure my AT&T Access More card is indeed getting 1X on Plastiq after July 22nd, 2017 – just to be 100% sure. 2X Membership Rewards points isn’t ideal. But I think it’ll still be worth it.

2. No annual fee Hilton – $0 – 1 year – Keep

I love this little card. Not only does it get my access to Amex Offers, but it’s free to keep and helps age my overall credit lines – as do all of my no annual fee cards. That’s the biggest reason why I think everyone should have at least one card without any annual fees. I got it for the sign-up bonus, but will keep it long-term.

3. Hilton Surpass – $75 – 1 year – Cancel

This one’s newish, too. I got it last month for the 100,000 point sign-up bonus. And just completed the minimum spending.

It comes with a free weekend night certificate on the 1st cardmember anniversary. After I get the cert, I’ll likely cancel this one.

4. Mercedes-Benz Platinum Card – $475 – 2 years – Keep

I just renewed this card, because I was locked into the previous annual fee (it’s currently $550 per year for all personal Platinum Card versions). After that, if the Ameriprise version of the card is still around with a $0 annual fee the first year, I’ll dump this one and get that one instead.

I keep this one for Amex Offers, and access to the fantastic Centurion Lounges. My very favorite lounge is the one at DFW – my home airport! So I plan on keeping at least one version of this card at all times.

Oh, and I just got my cert to get $100 in Mercedes-Benz gear. #weekendtrip

5. Starwood personal – $95 – 2 years – Keep

- Link: Starwood Amex

Got it for the 35,000 point sign-up bonus. But currently keeping it because I’m getting more than $95 back from Amex Offers. I tend to get really good offers on this card for some reason.

6. Starwood business – $95 – 2 years – Keep

- Link: Starwood biz Amex

Ditto here. But I’ll keep it because it gets me access to Sheraton lounges. Saved my whole life in Prague. I still need to write about that, crap. #alwaysbehind

Barclaycard

I’m semi-interested in getting another American Airlines Aviator card (I had it before but canceled it). And I may get a Miles & More or Wyndham card in the future. I try not to mess with them too much, because at their core, they’re a very conservative bank.

10. Arrival – $0 – 2 years – Keep

Downgraded from the “Plus” version of the same card. Keeping primarily to keep $13,000 credit line intact, help age my accounts, and keep a relationship with Barclaycard in case I ever want more of their cards.

Chase

By far my most difficult relationship with any card issuer. I would love to get my hands on a Freedom Unlimited card. But I’ll never slide under 5/24 because… I just won’t. So barring some sort of freak pre-approval, I’ll likely never have it. *wipes tear*

I could always pick up another Hyatt or IHG or British Airways card… maybe I will. Hmmz.

11. Freedom – $0 – 15 years – Keep

No annual fee. Keeping forever for quarterly 5X categories. Can’t beat that with a stick.

It’s also my oldest card. So it helps tremendously with aging my accounts.

12. Hyatt – $75 – 3 years – Keep

Keeping forever. $75 for a free night at a Category 4 hotel each year is a no-brainer.

13. IHG – $49 – 3 years – Keep

Also a forever keeper. $49 for a free night at ANY IHG hotel in the world? Yes, please.

14. Ink Plus – $95 – 3 years – Keep

Keeping as long as I can to get that sweet 5X at office supply stores. And on my internet and phone bills. I generate thousands of Ultimate Rewards points from this card. As long as it stays as-is, I will keep it.

15. Sapphire Reserve – $450 – 1 year – Keep

I will totally keep this card thanks to the 3X categories of travel and dining. And the $300 annual travel credit. The Priority Pass Select membership is nice, too. Just a solid card all around.

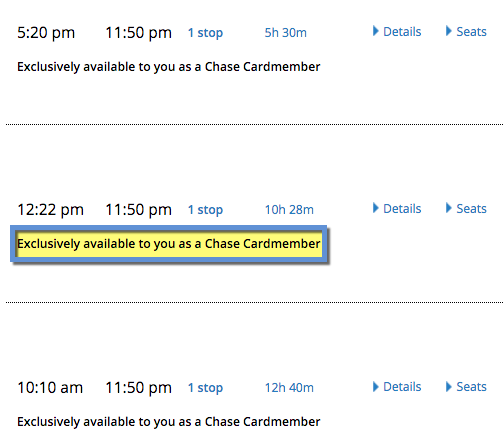

16. United Explorer – $95 – 1 year – Keep

- Link: Chase United Explorer

I like how this card gives me an extra 25% bonus through the MileagePlus X app (which I still use quite a lot).

Plus, United finally confirmed in writing what we all knew: Chase United cardholders get more award space. Sometimes the difference is hugely dramatic. I personally love this benefit. The extra miles and award seats justify the annual fee for me.

Citi

17. American Airlines Amex – $75 – 5 years – Keep

I love that this card no longer exists. I use it a lot to sync Amex Offers via Twitter. I also keep it to get 10% of my redeemed miles back (up to 10,000 miles per year). 10,000 American Airlines miles is worth $200 to me, so that along with the Amex Offers makes it a keeper.

18. American Airlines MasterCard – $95 – 1 year – Cancel

Got this one for the sign-up bonus. Redundant card bennies. Will cancel.

19. AT&T Access More – $95 – 2 years – Keep

The fate of this one remains to be seen. But, I shop online enough that the 3X for online purchases may be its saving grace. Very much a “wait and see” situation. But on thin ice!

20. Diamond Preferred – $0 – 1 year – Keep

I just got this one to alleviate my student loan debt. But if it’s free to keep, why the heck not?

21. No annual fee Hilton – $0 – 1 year – Keep

I got this one for the 75,000 point bonus. But the card is no longer open for new signups. And might be discontinued later this year. If it were up to me, though, I’d keep it forever.

22. Prestige – $450 – 2 years – Keep

Super super on the fence about this one. I heard a rumor Citi will be adding new benefits to this card next month. And even with the upcoming devaluations, the 4th night free perk is worth its weight in gold – if you use it. I saved over $3,000 with this card the first year.

And with the $250 airline credit considered, have already recouped the annual fee this year, too. So I might as well keep it if it’s going to be worth more than its fee. Wait, I think I just convinced myself. Well that’s settled.

US Bank

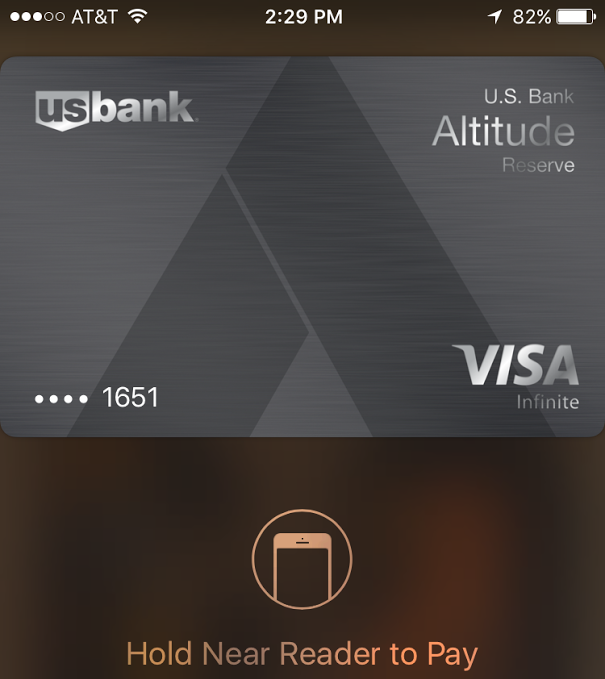

25. Altitude Reserve – $450 – 1 year – Cancel

Another newish card. US Bank is an extremely conservative bank.

I like the $325 travel credit and the 12 Gogo in-flight passes (which I value at $240 alone). So why cancel this card? Simply because I don’t think I’ll make the most of the 3X categories. You can’t buy gift cards – period – and for travel, I’d rather spend on the Chase Sapphire Reserve.

I’m a bit on the fence. We’ll see how much I actually use the mobile pay. But my inclination at this moment is that I’ll cancel it next year.

26. Club Carlson Visa – $0 – 4 years – Keep

I used to love Club Carlson. But now they suck. I have a nice $16,000 credit line on this card, so I’ll keep it around to help my debt ratio. And who knows, maybe I’ll want another US Bank card in the future. I haven’t really messed with FlexPerks yet…

Others

27. Fidelity Visa – $0 – 4 years – Keep

I used to love love love this card. But lately, I’ve preferred Starwood points to cashback. Still, there have been a couple of promos lately. And it’s free to have, so why not keep it?

Plus, who knows what will happen with Starwood next year. I might want to rack up a little cashback and sock it away into my IRA.

28. Icelandair MasterCard – $0 – 10 years – Keep

I only keep this one because it’s old as the hills. I charge $5 on it every 6 months or so just to keep it active. This was my first miles card, back when I was a newbie. Awwww.

29. Kohl’s card – $0 – 3 years – Keep

I had some shame about getting this card. But let’s be honest, I freaking love Kohl’s. My limit on this card is only $700. But it gets me some nice discounts and lots of free shipping. I use it to by things for my Airbnbs. So for now, it’s a total keeper.

Bottom line

- Link: Apply for Card Offers

Of my current 29 (!) cards:

- 23 are keepers

- 6 will be canceled

Of the 23 I plan to keep, I’ll pay $2,124 in annual fees. But I’ll get $750 back in the form of statement credits ($200 from Amex Platinum Card, $300 from Chase Sapphire Reserve, and $250 from Citi Prestige). That brings my net cost to $1,374. I’ll also get:

- A free night at ANY IHG hotel (Chase IHG)

- A free night at a Hyatt Category 4 hotel (Chase Hyatt)

- 10,000 American Airlines miles back (Citi AA Amex)

- 10,000 Citi ThankYou points (Citi AT&T Access More)

- 10,000 Hilton points (Citi Hilton Visa)

- Sheraton lounge access (Starwood biz Amex)

- Centurion Lounge access (Amex Platinum Card)

- Priority Pass Select (Chase Sapphire Reserve and Citi Prestige)

- A free weekend night at nearly any Hilton hotel (Amex Hilton Surpass)

- 5X Chase Ultimate Rewards points at office supply stores (Chase Ink Plus)

- 25% more miles through MileagePlus X and more United award space (Chase United Explorer)

- 4th night free on all my paid hotel stays (Citi Prestige)

- Many, many Amex Offers

Not to mention so many bonus categories for nearly every dollar of my spending.

When I add up all I get, it’s definitely worth way more than $1,400 – probably many times more. I love to travel, so I consider these annual fees an upfront cost for all the cash I save by using points & miles. And it seems, to me, a small price of admission.

In writing this, I discovered I’ve actually been pretty judicious about what I keep and cancel throughout the years. And if I cancel 6 of my current 29 cards, that’s a ~20% reduction, which seems about right. Having 23 cards is still a lot. Plus, I’ll likely pick up a couple more to replace them. That’s how the game goes. Cycle in, cycle out.

Now I’m curious – how many cards do you have? Do you think it’s worth paying ~$1,400 in annual fees for all those travel perks? Or is it too much to keep track of?

And if you do decide to get a new card, thanks as always for using my links!

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Chase seems to be tightening up on credit as well. I’ve noticed that even though I was under 5/24 the last time I opened with Chase they decided to move around my existing credit instead of adding to it, all without asking me. They ended up taking it from a card I barely use, so it worked out. I currently have four personal and one biz card with them.

Now I’m wondering if I’m going to get a decline the next time I sign up, just because of too much credit. I’ve got my eye on the IHG and Freedom Unlimited cards.

Each bank has a limit of how much credit they’re willing to extend to you. You can usually solve it by moving credit around, so I wouldn’t worry about getting declined for the other cards you want. You can always call and ask them to do a little switcheroo.

Discover does not send 1099 for credit card cashback, even if it is matched. At least they did not for my $2000 cashback last year.

I def got a 1099 from them last year. The amount was a round number, though – not sure how they came up with it. One of my friends with the same card said she got one too – also with a round number.

No idea what their criteria is with that, but mentioned it just case.

I’ve lost count of how many cards I have… and it depends on the bureau. 🙂

It might be too late for the Citi Premier, but if you can convert a card, the Double Cash card can be useful for the 2%, and with no annual fee, it can age like a fine wine. I also use the Dividend, not available for new applications, but may still be available for PC.

When I closed the TY Premier, I asked them to move most of the credit to a different card to keep some available credit. They didn’t have any retention offers.

I still have my Prestige, so my TY points are all intact. If I ever don’t want it, I’ll def change it to one of the no AF cards. Totally agree with your thinking – let it age. 🙂

Funny how different bureaus report different account numbers!

Harlan, thanks for your post. It’s nice to see you’re rational for the cards you want to keep. I’m at 27 cards and going through some retention calls and decisions over the next month.

For Chase, I am way over 5/24 but picked up the Fairmont in Jan. It looks like that will get converted to CSP which I already have. So that may be my path to getting the Freedom Unlimited. Or I may convert it to get a 2nd Freedom. I really want that United card for the bene’s you mention but I would have to go on a 18 month diet for new cards. Thinking about a PC from CSP to CSR as you did. No bonus but might be worth it.

I may convert my ATT card to the no fee version with the demise of 3X Plastiq. Grant had a good spend analysis of comparing the two. What did you end up doing with your TYP’s? Between Prestige, Premier, ATT, I’m not sure what to do. I thought about moving all my TYP and then PC the Premier to the Dividend as Bill mentioned above. My Prestige is a definite keep.

Under consideration for my next card: Altitude, Flexpoints (Just heard about the 1.5 flat rate on FP though, Arrival+ (never had), Wyndham (45K offer back), Discover (never had).

Thanks as always for reading and commenting! 🙂

I’m almost kicking myself for not getting that Fairmont card – that would’ve been my path to FU, too. If you already have a CSP, I would def PC to a CSR. It’s so worth it, even without a sign-up bonus.

I transferred all my TYP into one account, so still have them all. If I don’t book some AA flights before the deval, I’m thinking I’ll just transfer them all to Etihad or Flying Blue, honestly. I still have a little hope my rent payments will trigger 3X, so I’ll try it in August and see how it goes. Beyond that, I think I’m gonna lay off Citi and TYP for a while and focus my spending on Chase and Amex.

I’d definitely recommend Discover It. No fee and the 10% the first year can’t be beat. The Altitude Reserve is worth it for the bonus, travel credit, and Gogo passes – the first year anyway. Both cards are very worthwhile.

Hope you get some good retention offers! They didn’t give me any lol. Keep me posted on what you decide, I’d be curious to hear!

I should call US Bank and ask / grovel for a reconsideration for the Altitude Reserve. My application was denied due to inquiries and new accounts, but was still over 740. I’d like to try out a US Bank card to see how it’s different – I have one of their business cards, but haven’t had a USB card other than when Elan servied the Toyota Visa. (now Comenity Capital Bank)

I’ll definitely keep you updated. Thanks for the input on CSR. My dining spend is more than it should be, a lot more, but work life isn’t making it easy to change that. The 3X there would be more than enough to pay for the AF difference.

Your net cost pretty much goes away when you factor in the cash back from Discover. One way to think of it is that the “Doublin'” (and the miles/points that you forego by using Discover instead of a different card) subsidizes the other travel benies (and ability to earn points on cards with fees). In that way, it’s not so different from the US Bank card that lets you apply points toward the annual fee.

I didn’t get a 1099 from Discover last year–hoping not to get one this year.

The only times I’ve seen a 1099 from Discover was when I earned a bonus from their checking or savings accounts.

For those of you who didn’t receive a 1099 for your “dublin”, did you check online to see if a 1099 statement was available? I had a 1099 from my savings account as Bill mentioned, but I didn’t receive by snail mail nor did I receive an email notification. I just checked online at tax time and it was there. I wonder why some do and some don’t.