UPDATE: One or more of these offers are no longer available. Click here to see the latest deals!

Through May 31st, 2017 (this Wednesday), the Hilton Surpass Amex has its best-ever sign-up bonus. Yes, it’s offered 100,000 Hilton points before. But this go-around, you also get a free weekend night certificate after your first cardmember year.

I wrote how 120,000 Hilton points can easily be worth over $700. But throw in the free night cert, and you’re approaching $1,000 in value from a single sign-up bonus.

Plus you get Hilton Gold elite status with the card which means… free breakfast! (My fave perk lol.)

I was low on Hilton points and am becoming intensely interested in a trip to Mexico City this year. There are lots of lower-category hotels there – and you get the 5th night free on any award stay.

In general, Hilton points go further at low-tier hotels. But it’s all about how you like to use them.

The Hilton Surpass Amex is worth it if you’ve never had it

- Link: Hilton Surpass Amex

I was light on Hilton points after burning them for a trip to Honolulu with my family this past September.

I’m loyal to Hilton lately because I:

- Can’t stand IHG

- Have absolutely no faith in Starwood beyond 2017 and earning their points is a real chore

- Am “meh” about Marriott

- Find Hyatt’s new program too weird and limiting

Hilton’s no angel, either. They don’t have an award chart, for one. But they treat their elites well with suite upgrades and free breakfast. And they throw points at you via promotions, stays, and credit cards.

The Hilton Surpass is actually my 3rd Hilton card – I have the no annual fee cards from Amex and Citi. I’ve had consistently good service with Hilton and have no reason not to give them my loyalty.

In the points and miles world, they’re as maligned as Delta once was – but the others have matched them, mostly. So as a free agent, I find Hilton to be the best choice.

Even if you’re not a Hilton fan, you can do well with 100,000 Hilton points.

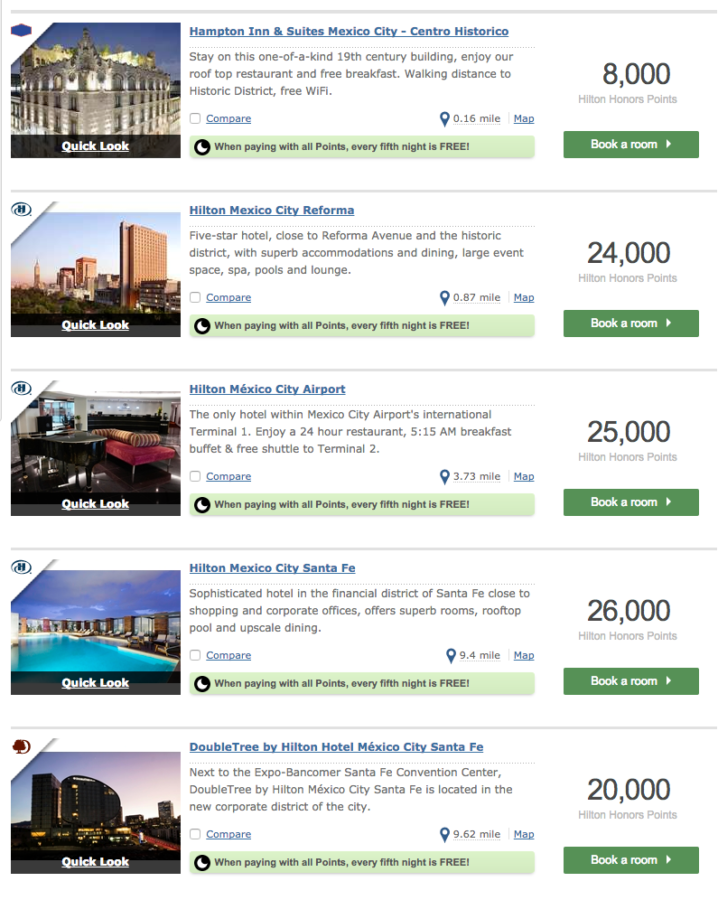

For example, I’m thinking of spending 5 days in Mexico City. Here’s what I found:

Considering you get the 5th night free, you can easily spend 5 free nights with 100,000 Hilton points. And then use the free weekend night certificate somewhere really expensive.

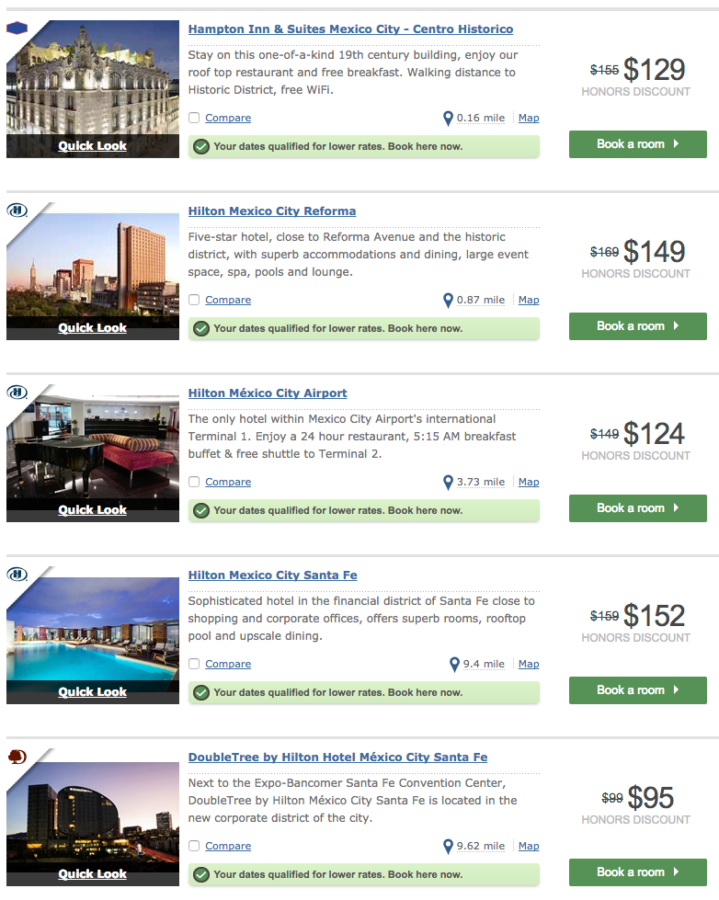

Here are the paid rates:

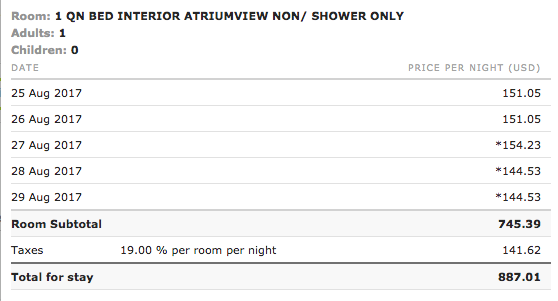

The first hotel, Hampton Inn & Suites Mexico City – Centro Historico, would cost nearly $900.

The kicker, though, is you’d only pay 32,000 Hilton points (8,000 X 4 + 5th night free) for this room. So you’d still have 70,000 points left over. Or you could spring for a different hotel. I regularly find these kinds of deals with Hilton points.

The Hilton Surpass Amex has a $75 annual fee, but you also get:

- 12X points at Hilton hotels (in addition to what you earn as a Gold elite)

- 6X points at US supermarkets, US gas stations, and US restaurants

- 3X points on all other purchases

And of course you get 100,000 Hilton points after spending $3,000 on purchases in the first 3 months of account opening.

The Gold elite status that comes with the card gets you 10X points per $1 spent at Hilton, plus 25% bonus points and welcome points (the amount depends on the hotel brand). So for stays at Hilton, there is no better card.

It has a ~3% forex fee though (can you freaking believe that?!), so don’t use it abroad. But overall, this card is def worth getting if you’ve never had it before (Amex sign-up bonuses are once per lifetime).

Why I Got It

Simply, there are few cards I can get these days. So when a good offer rolls around – and I’m actually eligible – I perk up.

It’s not hyperbole to say this is the best-ever offer there’s been on this card. For me, the free weekend night certificate adds at least $300 in value to the sign-up bonus. And if I can squeeze $1,000 in sweet travel out of a sign-up bonus, you best believe I’ll jump all over it.

Plus, I like to keep a stash of Hilton points – they can be incredibly useful from time to time.

Bottom line

- Link: Hilton Surpass Amex

This offer goes poof in 3 days, so get it while you can! Don’t let the naysayers steer you wrong about Hilton points – there are still plenty of ways to wring life out of them, especially if you’re judicious and plan carefully.

FWIW, I was approved instantly online. And this was my 5th Amex card (I also have the Mercedes-Benz Platinum, SPG personal and biz, and no AF Hilton cards – 4 credit and 1 charge).

With the free weekend night certificate thrown in, I couldn’t help myself and dove into this offer because I’d never gotten it before. I have my sights set on Mexico City sometime this year, so I’ll likely use the points there, where 5 nights can easily be $900+.

It’s always good to have a goal in mind. But I like having a stash of Hilton points anyway because they’re now my go-to hotel chain. Especially once the other shoe drops for Starwood in 2018.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Until you mentioned it, I didn’t even pay attention to the foreign transaction fees. I just took it for granted that it’s no cost, like the Citi equivalent. Odd in this day and age really. Thanks for that.

It IS odd – annoying, too! Thanks as always for reading and commenting! 🙂

I applied for the card the other day. I got an accepted page. Then the Amex site became ‘busy’ and wouldn’t load. Then I got an email saying my application was under consideration. It was all very odd. If I don’t hear back from them tomorrow I’m calling in because I know the fine print says I need to be approved by 5/31 or else miss out on the bonus.

Dont’ wait. Call them. The same thing happened with mine. It said they’d call me or I could in for an answer. It had to do identify verification. I have had the charge card for over 20 years but never applied for any credit card with them. Once they verified my identify, even called me back at my phone number on record, they approved the account instantly. I’d call them with the transaction number to get it sorted out today.

Did this work out OK for you?