Update: The Starwood AMEX 35,000 cards are NO LONGER available.

There, I said it.

In 2013, I famously said (typed), “I don’t care about Starpoints.” At the time, my grievances were:

- 1 point per $1 spent was too low of an earn rate

- You have to spend so much to earn a meaningful reward

- The earn rate with other hotel programs is better, so why bother with Starwood?

But a lot has changed since then. The merger with Marriott opened a few cool new opportunities, like:

- The ability to earn the Southwest Companion Pass with 90,000 Starwood points (through March 31st, 2017)

- Instant transfers to Marriott at a 1:3 ratio – and some hotels are a total steal with points!

- 1:1 transfers from Amex Membership Rewards to Marriott (by way of Starwood)

- If you have Starwood Platinum status, you can match to Marriott, then get United Silver status

- Amex desperately scrambling to get new cardmembers and throwing out Starwood points like candy

And, I’ve been putting a non-bonused spend on my Amex Starwood card, to the chagrin of my previously beloved Fidelity Visa.

In fact, I think I’m…. over cashback cards. For now, at least.

Drinking the Starpoints Kool-Aid

- Link: Personal Starwood Amex 35,000 point offer

- Link: Small business Starwood Amex 35,000 point offer

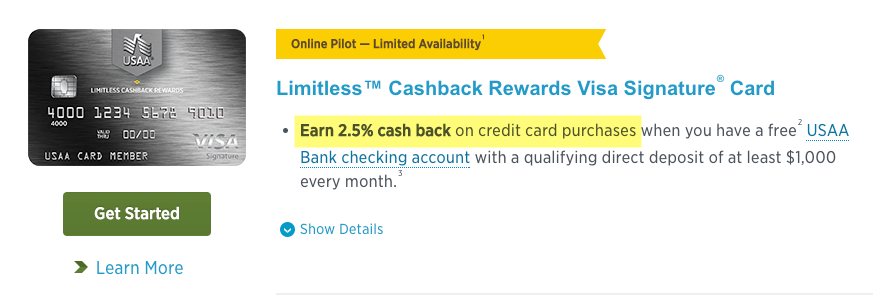

When I saw the USAA Limitless card with its allure of 2.5% cashback I thought holy moly, this is it – this is better than the Fidelity Visa!

Note: You can only get the card if you’re a USAA member.

But then I thought, 2.5%? I can do better with Starwood points. That was new for me – a real “a ha” moment.

Because I calculated the Companion Pass deal made each Starwood point worth at least 6 cents each. Or 6% back.

Plus, if I transfer the points to airlines with a 1:1 transfer ratio, I’ll get 5,000 bonus miles for every 20,000 points transferred. Which means the earning rate is 1.25 miles per $1 spent.

BUT. I only use miles if they’re worth at least 2 cents each. By that standard, 1.25 X 2 = 2.5% back – the same as the USAA Limitless card. And I often get even more value than that.

You can also do well using the points at Starwood hotels, obvi.

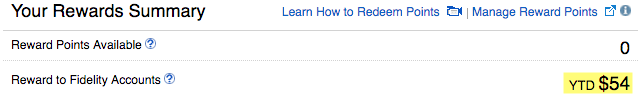

I also realized the Fidelity Visa puts you on a bit of a treadmill. Cuz you have to spend $2,500 to earn 5,000 rewards points – the minimum needed to get a $50 cashback redemption.

That’s not a lot in general, but it’s a lot for non-bonused spending. And at this point, I think I’d rather put it on the Starwood Amex and have 2,500 Starwood points instead.

Not to say that doesn’t also put you on a spending treadmill to reach another redemption threshold. But 2,500 Starwood points is enough for a weekend night at a Category 1 hotel. Or swap it for 7,500 Marriott points, which can also be meaningful. Or just save them for bigger award.

The good and the bad

If I go ahead and open that USAA card, it would incur a new hard pull on my credit report. And appear on my personal credit report.

That’s fine, as it’s no fee, and everyone should have at least one no annual fee card.

But the business Starwood Amex doesn’t appear on my personal credit report and doesn’t count for the Chase 5/24 rule. And I don’t wanna open a card I may never even use…

Also, USAA could pull this card at any moment (it’s still in “pilot”). If I don’t get it soon, my opportunity might pass. And who knows if I’d ever like to have it down the road. The Starwood cards may have a time limit, too. So might as well use them while you still can.

The USAA card doesn’t have a sign-up bonus. Then again, if you’ve ever had either version of the Starwood Amex you can’t earn the bonus again on the version you had. So that’s a net-net.

All told, I can’t find a single compelling reason to get the USAA card. For ongoing non-bonused spending, I think I’ve finally gone to the dark side. Of Starwood points.

It took a while, and I may be riding the last wave here. But if it weren’t for Starwood points, I wouldn’t have had the chutzpah to dump American and Delta and switch to Southwest and Alaska this year. So there’s always that.

If you’ve never had either Starwood card, I highly recommend opening it before April 5th, 2017 to earn 35,000 Starwood points as a sign-up bonus.

Bottom line

- Link: Personal Starwood Amex 35,000 point offer

- Link: Small business Starwood Amex 35,000 point offer

I loved taking a contrarian stance re: Starwood points for a long time. The airline and hotel industry, loyalty programs, opportunities, the way we spend – it’s all shifted these past few years.

I debated getting the new USAA Limitless card. But I can’t convince myself it’s worthwhile. And I’ve been putting most of my non-bonused spending on the business Starwood Amex.

In a broader scope, I also put a heavy amount of spending on my Chase Sapphire Reserve and Citi AT&T Access More cards – probably my top 2 heavy hitters. And the rest on the Chase Freedom for the 5% categories. And the rest on the Starwood card.

That means Chase and Citi have the bulk of my business. That’s a big shift from a few years ago when I was still trying to use the Amex EveryDay Preferred card all the time. And of course my Fidelity Visa (then an Amex, too) with the Serve card. Ah, remember that? Ch-ch-changes.

Are cashback cards worthwhile when you can do so much better earning and redeeming points? Is there a sweet spot here I’m totally missing?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I’m looking for a strategy as well. My professional situation is changing and I may not be traveling as much (or at all) for a while so I’ve downgraded my Citi Prestige card, cut my AAdvantage Executive card to the regular one, and am contemplating downgrading my AmEx Platinum to the Gold Premier Rewards card.

I used to use my AmEx charge card almost exclusively for years but I see much more value in the Chase Sapphire Reserve card. I do have an old Freedom card with them as well so I use that for the bonus categories every quarter as the points can be combined.

I’d go back to my AmEx card almost exclusively as I really do like their superior online presence, customer service, and annual summaries. The online tools are really nice and their chat feature is far and above what anyone else offers. The service is what has kept me with AmEx for nearly 20 years now. But…the value is not there compared to the Chase cards.

For your own entertainment, I’ve got the following:

-AmEx platinum

-Chase Sapphire Reserve

-Chase Freedom

-Chase Marriott Premier (gave me the 15 qualifying night bump to Platinum last year)

-Citi Preferred Thank You (the freebie)

-Citi HHonors Reserve Visa (not a bad card really as earning is a minimum of 3 points per dollar)

-Citi AAdvantage Platinum

-Capital One quicksilver (had it since I practically a newborn…shows great a long history on my credit)

-BMW Signature Visa

Any suggestions? I’ll likely stay between Chase and AmEx for most things.

Sounds like a good strategy. You could even dump the AA card, but that would reset your clock with Citi.

Can you work in the Freedom Unlimited somehow? That card is a workhorse and I’d use it exclusively for non-bonused spend if I could get it.

Definitely think Chase is where it’s at for now. But that would definitely change down the road if Citi decides to get back in this fight.

And I’d really think about dumping the Amex Platinum altogether with the upcoming changes. Especially if you aren’t going to travel as much.

I love hearing about other people’s strategies. Thanks for sharing this!

So I’ve been doing a bit of research and think I’m refining my strategy again a bit. I’ve always know that my Citi Hilton Reserve card earns 3 points for any purchase, 5 points for airfare and car rentals, and of course 10 points for Hilton charges. What I did not realize is that those points can convert into AmEx MR points at a fairly reasonable rate. The rate is 1500 Hilton points get converted into 1000 MR points. That’s pretty good considering that each purchase on the Hilton card is at least 3 points per dollar spent. It’s close to the SPG rate converting to AmEx. (I missed the boat on the SPG card but I really didn’t want another card at this point so let that fly by.)

Now what is also nice is that the HHonors (I still spell it the old way ha) can also convert into Citi ThankYou points at the same rate.

So my math is — if I spend $1000 on my Hilton visa, that’s 3000 points. Those 3000 points can go to AmEx as 2000 MR points. Effectively giving me double AmEx points for every day spend. Not too shabby eh? What’s even nicer is that if I want to use them for airfare, I can simply bring them to ThankYou points instead and get .0125 value for airfare versus the .01 on AmEx. For airfare purchase or any travel purchase I’ll likely stick with Chase as they have the best offering of course.

Of course if I really want to go crazy I could take my AmEx points, dump them into Hilton, then move those points to Citi and get a higher return. That will take a bit of strategy, but not too far from reality really.

Of course this is on top of $10K annual spend is a free night at ANY Hilton property (very few exceptions). I was looking a free night at a Waldorf Astoria that had a $900 a night rate! And Diamond status with $40K annual spend.

I’ve always liked this card and just realized how much more I like it now.

Now from a Hilton vs Marriott perspective, thus far, I’m seeing that the restructuring of the Hilton program to be a bit of an advantage. I just booked a Doubletree a few nights when Delta stranded me and it cost a fairly normal 30,000 points. The going dollar rate was over $200. Marriott properties had a lower price in cash, but the points rate was just a high, some even higher. It seems that Marriott is requiring far more points these days when the earning rate has remained the same. Hilton has been high on the required points for some time, but the earning potential is a lot higher so I see that it evens itself out really.

Anyway, thought I’d share my updated wisdom 🙂

Where are you seeing the option to transfer HH to TYP? I’m only seeing the reverse. Would love a way to transfer HH points to a more useful currency. Thanks!

It caught me by surprise actually. But if you look on the same page as the AmEx transfer option, scroll all the way down and it was there. It showed the same redemption rate as well.

Interesting and a bit annoyingly, I had to change my browser settings to “accept third party” or “all” cookies to get anything to show up.

This place? http://hiltonhonors3.hilton.com/en/earn-use-points/exchange/credit-cards/index.html

I’m just not seeing the reverse options at all.

I think you’re right! I thought for sure it was a two-way transfer like with AmEx. Ok so scratch that off the list.

Still, for everyday purchases – when Chase would give one point, I can still get effectively double points sent into AmEx. I’ll use Chase when the points are higher, AmEx when those are doubled (or have offers on them) and likely Cit Hilton for everything else.

Does that make sense? Any other strategies out there?

Hilton & IHG Hotel cards exclusively for me. Hilton Diamond on $40K spend & IHG Spire on $37.5K spend in Grocery stores. Hilton is by far the easiest to rack up huge amounts of points and has hotels in Mexico & the Caribbean where I want to holiday. IHG Spire & Ambassador status gives you a double upgrade @ Intercontinental hotels & paid stays during promos get enormous pts.. The Spire 25K pts. bonus pays for Ambassador status. One hotel we love in Mexico treats us like gold w/ lounge access and Oceanfront for 15K pts. per night. We do the 50% off pts. IHG Mexico & Caribbean in May and September every year. Splurge over Thanksgiving & President’s Day w/ minimum ten night each @ a Hilton in Aruba, Barbados, Curacao, etc., and still continue to increase the number of points we have. Can’t do that w/ Hyatt, SPG, or Marriott. Use the Freedom Unlimited for Hyatt point transfer until status expires in 2018 and then I’m done w/ Hyatt. Will continue to spend on Freedom Unlimited to boost SW miles. Will not get any new cards in all of 2017 so I can drop to 3/24 in order to get the business & personal SW cards for companion pass in 2018 which I’ll continue to exploit for 6 years in a row. If UR looking for a Hilton bargain in the Caribbean, try Curacao. Stayed there for 12 nights last Thanksgiving for only 268K points. Had spacious oceanfront, lounge & the breakfast buffet was incredible. Lots to see & do in Curacao. How’d the transfer I recommended in Cancun work, Harlan?

Wow, that’s a whole lot of excellent info!

I love your strategy! You’ve narrowed down your travel goals and found a 2-card system that just works for you and where you want to visit. And you fill it around the edges with another card or two. And have a long-term goal to get the SW Companion Pass next year. I simply love it: sounds thoughtful, realistic, and like you’ve hit a stride with what you like. Your holidays sound sublime – I will definitely consider your tips!

Speaking of which, I shouted you out for your Cancun transfer recommendation:

http://outandout.boardingarea.com/hyatt-zilara-cancun-review/ 🙂

It could not have been simpler. I booked it shortly before my trip based on your suggestion and it went off without a hitch. Exited the airport and was at the Hyatt Zilara in about 25 minutes. Thanks so much for that, and for sharing your insights!

I’m loving 2.5% from USAA. Cashback posts as soon as transactions do, and I’m not skittish about maxing out my CL since they do call it Limitless after all. Starpoints are certainly valuable too, so I wouldn’t ever knock either card or approach.

Good to hear! I ain’t knockin’ anything at this point. Because who knows, this time next year, that USAA card might be *the* card to have. I think I might scoop it up while it’s still in pilot mode.

Thanks for sharing, I love hearing from you! 🙂

You’re lucky enough to be a resident of a state where USAA is piloting the “Limitless” credit card. Sadly, I’m a USAA account holder but not in one of the lucky states.

Hey Bill! It should be available in every state by April 2017, from what I’ve heard. So be on the lookout for when yours is added!

Great article Harlan. I have never thought about a grand strategy to using credit cards. My wife and I both use the SPG Amex for everything, and if they don’t take Amex, we just randomly throw a different card out that we have had for years.

2 years ago, I had a similar realization of travel cards vs cash back. I found myself buying random crap I don’t really need on Amazon vs saving up for an incredible vacation and unforgettable experiences.

Anyways, I am curious about your thoughts on my cards and if I can create a better spending strategy.

I have:

Cabela’s Club Visa (oldest card, 7 years): I only have my Spotify bill and auto pay on it every month so they don’t cancel me. I never use it.

Discover It: I like the US based customer service but it’s just Cashback..

Chase freedom: I got the chase slate in college to defer some payments without paying interest, switched it to the freedom last year since the slate became worthless.

Citi forward: got this one in college too. Used to use it on dining. Rarely use it anymore.

Bank Americard cash back: got this one cause of groceries and gas. I still rarely use it since I lost my desire for cash back. It’s one of my newest cards (2 years old) with a low limit so I should probably close it?

SPG amex: love it. Just transfered around 77k points to my 41k Marriott balance, then transfered for the 120k SW points and companion pass and the 7 night Marriott voucher (which I have no idea where to use). This card is my everyday, everything heavy hitter. I never really had a game plan, I just heard the SPG points were valuable.

I used to travel quite a bit for work, but now I’m down to a few nights per month and drive more often than fly.

I would love to hear your wisdom on a grand strategy and thrilled I came across your site!

Thanks!

Hey Michael!

Most of your cards have no annual fee. So there’s really not a reason to close them.

SPG points are valuable because they’re transferable. So if those are the only points you earn, you’re already doing great.

If you’re driving a lot, I’d look into a car that has gas as a bonus category, like the Citi ThankYou Premier. Or maybe another hotel card (Amex has a few cards with gas a category).

For all things travel and dining, you can’t beat the Chase Sapphire Reserve:

http://outandout.boardingarea.com/honest-review-chase-sapphire-reserve/

It’s the best all-around card on the market right now, in my opinion. Check out my review and see if it’s for you. It would also make your current Chase Freedom points worth a LOT more right off the bat.

It also comes with primary rental car insurance if you rent cars a lot.

The only other thing I can thing of is, if you want to go hard with Chase Ultimate Rewards, you could also get a Chase Freedom Unlimited and use that instead of or in addition to your SPG Amex. Because it earns 1.5 points on everything – which would be super valuable if you added a Sapphire Reserve or Preferred to your wallet.

Here’s my page with links if you decide to apply for any of them:

http://outandout.boardingarea.com/get-travel-rewards-credit-card/

I’d love to hear what you think and what you decide – sounds like you’re flexible and could go in a couple of different directions.

Thank you for reading and commenting!

I think having one cash back card is reasonable, at most as a backup for anytime you have non-bonused spend and no minimum spend to meet (especially if you already have it open from before starting really going after it)

For a long time I was very anti any card with a first year annual fee. Then I had both platinum cards, the prestige, and the Ritz Carlton card over the course of a year.

I was anti spg and Alaska miles, but then I ran out of other new cards, got a few of each, and in a few weeks I’m flying Cathay first for the second time, with a 2 day stopover, and then business class on my way to Dubai.

When I saw the ridiculously cheap fares to Europe this fall, even out of my home airport in Omaha, I thought more about using cash back cards to cover a $450 rt flight. Then reality hit, and I realized I’ll never again chose to fly that far in economy.

We evolve in how we think of cards as we learn more, and do things our friends and family have no ability to really understand. But that’s what makes us awesome.

I’d never pay $20k/person to fly 20,000+ miles in premium class in ten days, but I’ll gladly sign up for a few cards and memorize a few details to do it and take a friend on a life changing trip.