With over 30 credit cards in my sock drawer wallet now, I have a lot to keep track of. Especially minimum spending requirements and limited-time promotions. I’ve long advocated everyone use Mint.com to track transactions on all their accounts.

Especially because you can see your transactions at a glance – that’s helpful to monitor any unwanted activity if you have several accounts.

But there’s another extremely helpful use: you can track your spending on a particular account based on date or timeframe. Which helps you know how close you are to meeting a spending threshold. Here’s how.

Mint.com – an easy way to track your spending

- Link: Mint.com

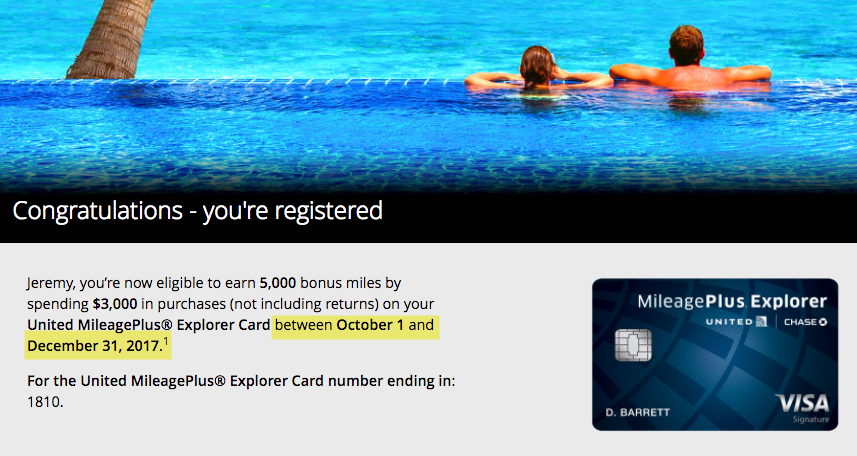

Recently, I had a promotion on my Chase United Explorer card (which I never use 😬). But, the offer was pretty good, so I decided what the heck, and registered.

I had to spend $3,000 on the card between October 1st and December 31st. That’s cool and all but aside from manually adding up the transactions from my monthly statements, I wanted an easier way to see how much I spent within a certain timeframe. Enter Mint.com.

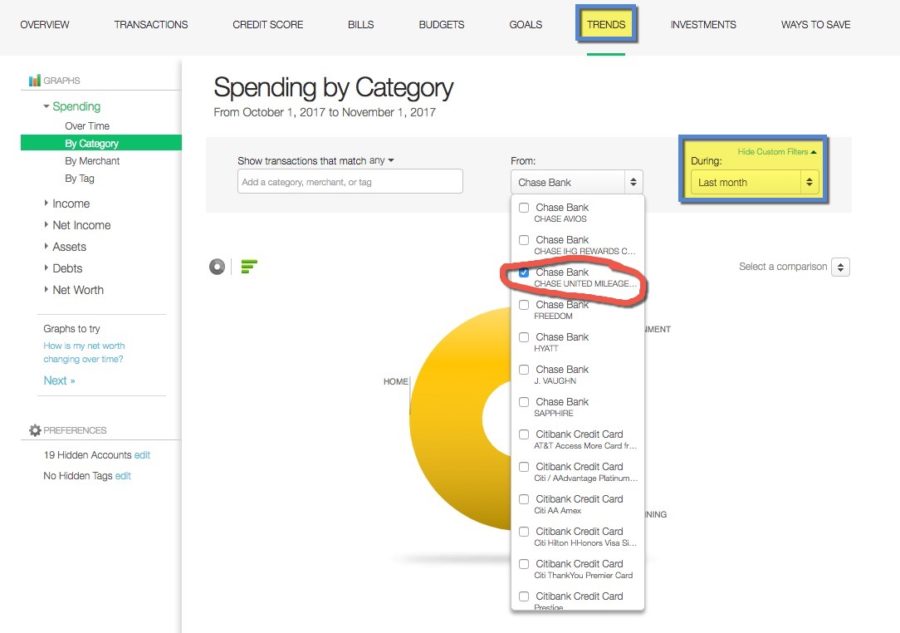

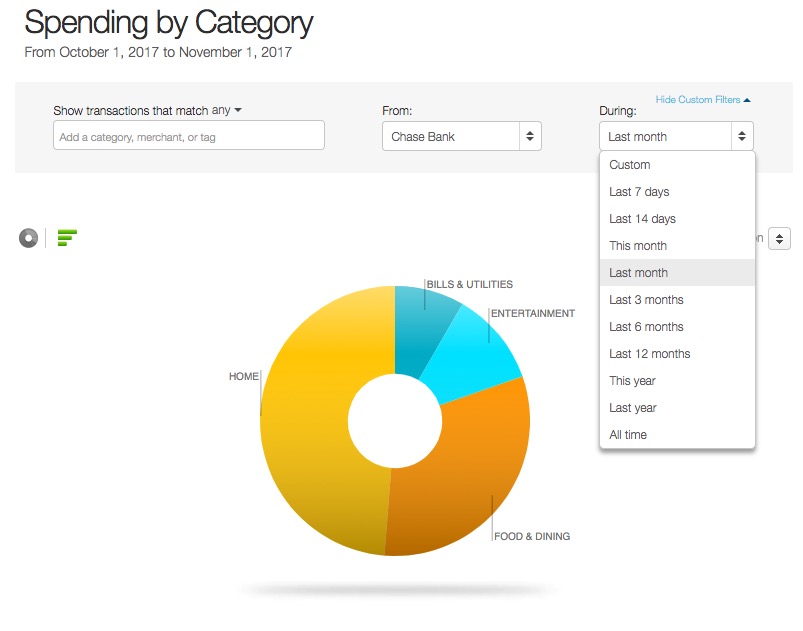

After you login, click the “Trends” tab at the top. You’ll see a screen with a few dropdown menus. I like to select “Spending By Category” and then the card in question from the menu (you can de-select them all then scroll to find the one you want). And then you can pick your timeframe under “During.”

If you have a promotional offer like I did from October 1st to December 31st (or whatever), enter those dates in the “Custom” field.

Or if you just got a new card within the past few weeks, choose “This month” to see how close you are to a minimum spending requirement.

I needed to spend $3,000 to get the bonus miles and yup… I spent $3,005. Time to put that card back in the pile where in belongs lol.

This is also extremely handy if you’re trying to meet a spending threshold to earn elite status, a free night, a companion certificate, bonus points, etc. by spending a large amount on a certain card. Because you can set the timeframe to start at the beginning of the calendar or cardmember year to know how close you are – or when you can expect your reward to post.

Mint tracks it ALL, though

Mint will also count your annual fee when it adds up your transactions. This matters because annual fees are NOT included in minimum spending, threshold spending, bonus categories, etc.

So if you have a card with a big annual fee, that’s important to keep in mind. Even if the annual fee is small, it would suck to miss a reward because of a low amount if you’re cutting it close. Cash advances or cash-like transactions don’t count, either. So if something counted as a cash advance (which sucks), be sure to subtract that, too.

Bottom line

I’ve been using Mint.com for years to track my credit card accounts. And found the “Trends” feature doubles as an easy way to track spending on particular credit cards. This is helpful when you’re:

- Meeting minimum spending requirements

- Spending for a promotion or limited-time offer

- Trying to earn a bonus for spending a certain amount throughout the year

Just keep in mind annual fees are included in your total and deduct them.

I also use Mint to scan my recent transactions and make sure nothing is out of order. Once or twice, I’ve found fraudulent transactions and reported them.

Mint will tell you when your bills are due, make budgets for you, and help you set financial goals, too. I don’t use every feature, but I have found a few of them to be extremely helpful for tracking lots of credit cards. So it’s worth getting the free account and setting it up one good time with all your card account.

Just thought I’d share! 😸

Do you have another way of tracking your spending that’s easy as this?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I go to chase (or whichever bank is of interest), download the transactions in the date range of promotion and use excel to sum up the total spent (using and if<0 command to sort out payments from purchases).

I primarily use mint to track when annual fees post (then I know when to cancel cards).

That certainly works, too!

And cool idea about using Mint as an annual fee tracker…!