Also see:

I wrote back in November how you can get an Ameriprise Amex Platinum Card with a $0 annual fee the first year. The fee on all personal Amex Platinum Cards has since gone up to $550 – but this deal is surprisingly still kicking.

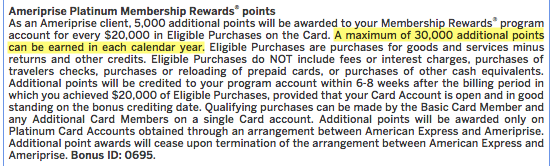

Even better, you get 5,000 bonus Amex Membership Rewards points for every $20,000 you spend on the card. You can earn 30,000 extra points this way – so it’s good for up to $120,000 in spending each calendar year. You also still get 5X points on airfare and travel booked through Amex.

Get the Ameriprise Amex Platinum Card while you can

I sorta can’t believe this is still available after the annual fee recently went up to $550 a year. Like all other flavors of the Amex Platinum card, you also get:

- 5X Membership Rewards points on airfare booked with airlines and travel booked through Amex

- $200 in Uber credits annually

- $200 airline fee credit per calendar year

- $100 fee credit for Global Entry

- All the other Platinum Card bennies

But it does earn 1.25 points per $1 if you meet the $20,000 threshold (25,000 points / $20,000 spent). Incidentally, that’s the best earning rate for regular purchases – all the others earn 1X on normal spend. The extra points aren’t earth-shattering, because have to spend a LOT to get them.

Overall, this card is still worth considering as it’s free the first year and you get all the other perks, too.

In fact, if you got it now, you could get the $200 airline fee credit now and $200 more in January – plus all the Uber credits and the Global Entry credit – and easily come out ahead by $600+.

You also get lounge access to:

- Centurion lounges

- Delta SkyClubs

- AirSpace lounges

- Priority Pass Select lounges

Depending on how often you visit, that can be a huge value-add, too.

So if your annual fee is coming up on another Amex Platinum Card, you could apply for this one and cancel the other.

I can also confirm it’s possible to have 2 Amex Platinum Cards simultaneously. And my friend Angie was able to get this card with no previous relationship with Ameriprise.

There’s no sign-up bonus on this card, but it costs nothing the first year. And if you make the most of the fee credits and lounge access, you can do quite nicely for yourself – especially if you visit lounges a lot.

Bottom line

Mostly, this is an easy way to get free lounge access and an extra $600+ worth of stuff in exchange for a hard pull. Just keep an eye on the renewal date, because the $550 annual fee will kick in the 2nd year. Although there’s evidence that you can reapply for this card shortly after closing it – just to put that out there.

The fee on my Mercedes-Benz Amex Platinum card is due next month. I might get $100 worth of M-B stuff like I did last year, cancel it, and hop over to the Ameriprise version to stay in supply of lounge access (I looove the Centurion lounge @ DFW). It’s a good strategy because the $0 annual fee the first year might not stick around – so get it while you can, if you’re interested.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I always want to say Shhhhhh! when I see someone writing about this card!

Lolol understandable! It’s a good thing I’m a tiny fish in this big ol’ pond then!

Harlan,

Appreciate the blog — thanks!

So you’re saying because the Ameriprise Platinum card is a different “flavor” than the MB or plain Platinum, so you can have two cards? Or is your other card a business card?

I guess since there is no Ameriprise enrollment bonus like the other cards, maybe they aren’t as strict…

In the past, I actually had two regular Platinum Cards at the same time.

But yes, the M-B version is considered different than the others. I’ve never had the biz version of the Platinum Card, only personal versions. But you can have two at the same time.

Thanks for reading!

Blue for business plus has a higher earning rate unless you spend a lot on flights.

If I apply for this card, will I still be able to get the bonus on the regular platinum Amex down the line? Just wanted to understand if the lifetime cap on earning bonus points is per card sub-product (Ameriprise, MB, personal platinum etc?)

Yes, you can! Because they are considered different card products.

Does this one offer no AF authorized users like the one earlier this year?

I don’t believe so. It says AUs are $175.

If I have the Ameriprise Platinum Card now, can I cancel this one and apply for a new one to get another year free?

You *should* be able to do that. But I’d give it some time between applications to be on the safe side – maybe a month?

I currently have some MR and my plat is due soon, If I apply for this card while I still have the platinum will I keep all my points when i cancel the ‘regular’ platinum?

Yes, you will!

do you have to be an Ameriprise Client? Can i cancel in a year if needed?

Nope and yes!