Update: The Starwood AMEX 35,000 cards are NO LONGER available.

There, I said it.

In 2013, I famously said (typed), “I don’t care about Starpoints.” At the time, my grievances were:

- 1 point per $1 spent was too low of an earn rate

- You have to spend so much to earn a meaningful reward

- The earn rate with other hotel programs is better, so why bother with Starwood?

But a lot has changed since then. The merger with Marriott opened a few cool new opportunities, like:

- The ability to earn the Southwest Companion Pass with 90,000 Starwood points (through March 31st, 2017)

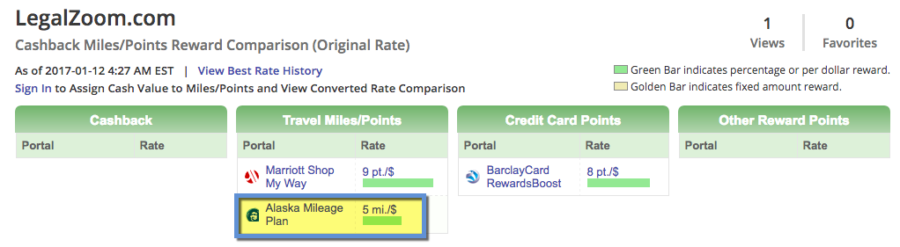

- Instant transfers to Marriott at a 1:3 ratio – and some hotels are a total steal with points!

- 1:1 transfers from Amex Membership Rewards to Marriott (by way of Starwood)

- If you have Starwood Platinum status, you can match to Marriott, then get United Silver status

- Amex desperately scrambling to get new cardmembers and throwing out Starwood points like candy

And, I’ve been putting a non-bonused spend on my Amex Starwood card, to the chagrin of my previously beloved Fidelity Visa.

In fact, I think I’m…. over cashback cards. For now, at least.