Update: One or more card offers below are NO LONGER AVAILABLE. Please check here for the latest deals!

OMG, cringe. Did I just write that headline? Me, Mr. “I Don’t Care About Starpoints?”

I did. A lot has changed since that proclamation nearly 3 years ago. Devaluations, tougher approval rules, and a vastly different landscape for points and miles.

In particular, you can only get an AMEX sign-up bonus once per lifetime on all their cards.

This is the highest bonus there’s ever been – and likely will ever be – on the AMEX SPG cards. I took the bait.

Last days to lock in the bonus

I pulled the trigger on the small business version of the card. I had no plans to get the personal version.

But then I figured, between the 2 of them, that’s a lot of free nights at Starwood – worth well over $1,000 for each card.

Or, between the 2 cards, that’s equal to 100,000 airline miles, including Alaska and American.

The annual fee is waived for both cards the first year.

If you haven’t had either card, this is your best chance to get the sign-up bonus. The offer ends tomorrow, March 30th, 2016.

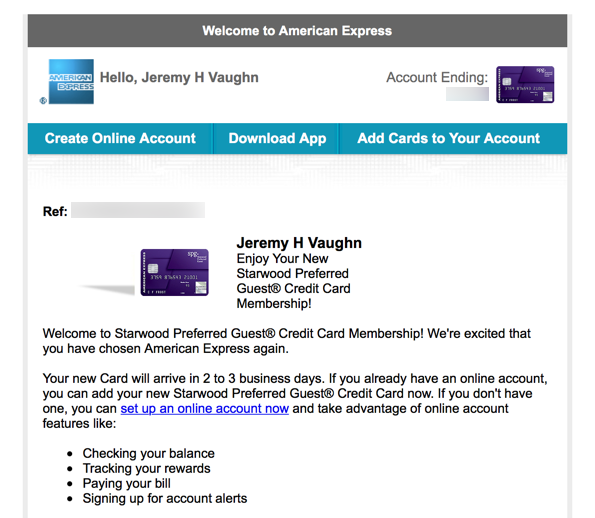

With all of that in mind, I applied for the personal version, too.

My experience getting the 2nd card

I actually applied last week.

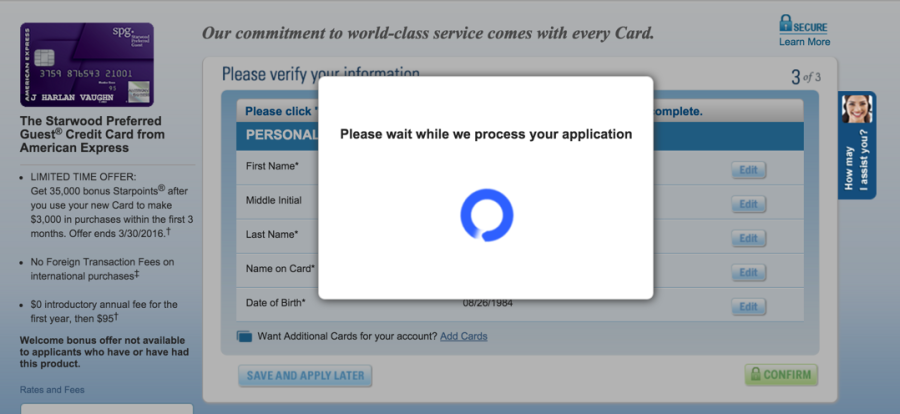

There’s no feeling quite like waiting for a card decision. Heart goes ba-bump ba-bump.

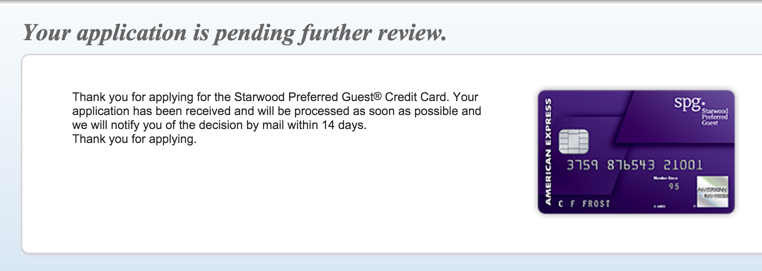

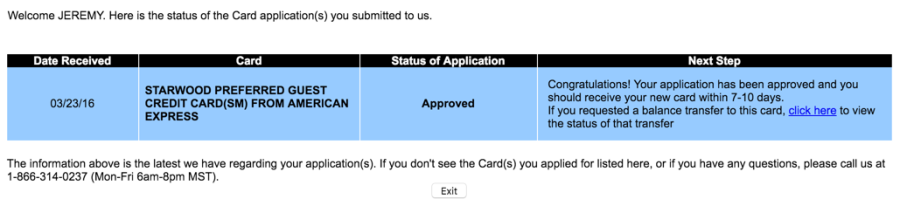

And then this hideousness:

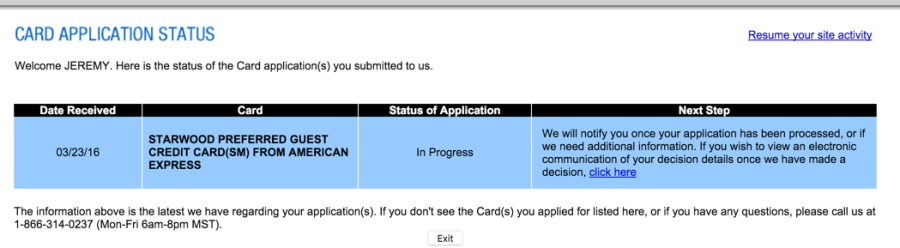

Thinking I could hurry along a decision, I called AMEX. They told me the application was flagged – they wanted to make sure someone hadn’t used my information without my permission.

I assured them that, nope, that was me – I want both cards. But the rep told me my best bet was to let it go through the right departments.

Crap.

“What about the sign-up offer? Will I still get the 35,000 points?”

Yes, she told me. The bonus is hard-coded into the application. As long as you apply before the offer ends, you’ll still get 35,000 points as long as you meet the minimum spending requirement – even if you’re approved after the offer is over.

The key is to apply before March 30th, 2016.

That was honestly my biggest reservation about getting both cards.

Bottom line

Keeping it short and sweet today. If you’ve never had an SPG card with AMEX, today and tomorrow (through March 30th, 2016) are your last days to lock in the 35,000 SPG point offer on the personal and small business versions of the card.

Note: Min spend on personal is $3,000 / min spend on small biz is $5,000 – both within first 3 months of account opening.

That adds up to, obvi, to 70,000 SPG points (closer to 80,000 when you factor in minimum spending). That’s well enough for many award nights at Starwood hotels. It’s also enough for 100,000 airline miles of your choice (you get 5,000 bonus miles for every 20,000 you transfer).

There’s no reason why you can’t make that be worth $2,000 – or more – depending on how you redeem them.

My biggest reservation was applying for both cards within a short timeframe. While the 2nd app got shot over to pending review status immediately, I was ultimately approved for both. The key to lock in the 35K bonus is to apply before tomorrow.

Looking forward to putting these points to good use. Adventures in Starwood and Hilton this year.

A far cry from the Hyatt/IHG/Club Carlson concoction I was on a year or so ago. My, my at the changes.

Oh, and feel free to leave your referrals for either card on this referral page!

Also see:

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Any tips on how you will meet the spend?

Oh, man. Easy. Taxes. Worth the fee to earn that many points. Fees in total will be about ~$150, but I figure it helps me knock out both min spends at once. And I get to float the repayment a few extra weeks, which will help me in a huge way.

Worth it in my book. Will also use them for regular spending until points post.