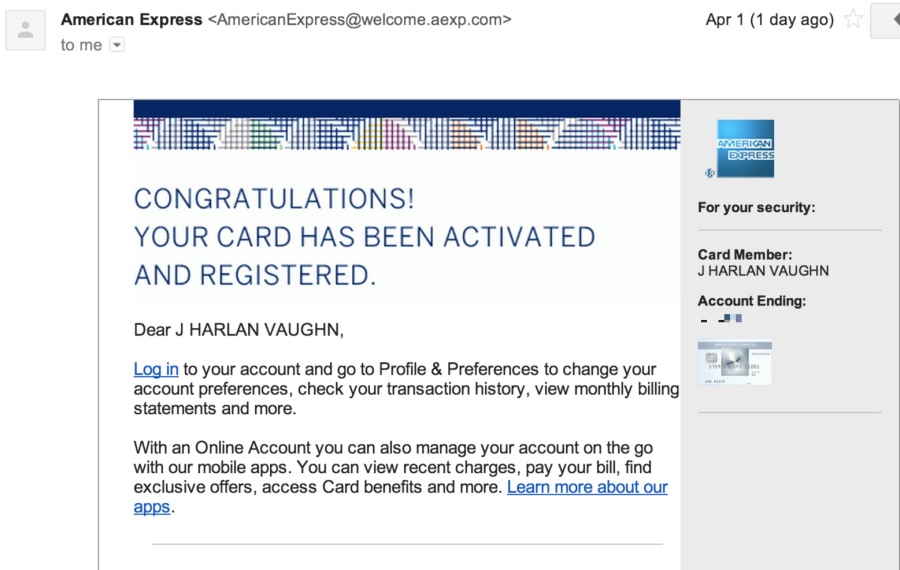

I got my new Amex EveryDay Preferred card the other day. Instead of being really excited about, like usual, I was sorta like, “Hrmph.” My credit limit was not… where I wanted it to be. I wasn’t satisfied by how low it was. Not to worry, I can just switch around lines of credit, right?

Denied again

I have two consumer lines of credit with Amex that are not charge cards: the Delta Skymiles Platinum card and now, the EveryDay Preferred card.

On the Delta card, let’s say I have a $10,000 credit limit, and on the EveryDay, let’s say they gave me $2,000. I have $12,000 in total to switch around however I want, in theory. $6,000 for each, for example. No problem, I thought, I’ll give Amex a call.

I was told by the rep that I’d have to wait 60 days before I can move credit around. Or, she offered, I can apply for a credit line increase. I asked if that would require another hard inquiry on my credit report. Yes, she said, it would. Well then, no I didn’t/don’t want to do that.

Down the internet rabbit-hole

I seem to remember that moving around credit on an Amex used to be a self-serve function directly on the website. And, it was, according to Brad’s Deals. Don’t bother checking any more though, because that tool is no longer there.

Then I read a recent comment on the Amex support forums where someone had an experience very similar to mine. They got a standard corporate-babble response.

By the way, this took me down into the pit of the internet for about an hour to get those two links. Whew!

Customer non-service

This is just another strike against Amex in my little book:

- The quality of their customer service reps vary wildly

- They will tell you anything to get you off the phone even if it’s false

- They will botch your accounts and screw you out of signup bonuses

- They will straight up tell you there is NOTHING they can do for you and then sit there, silently and awkwardly, for 30 seconds or more while you’re pondering how and to what level you’re being fucked over

- The whole time you have to listen to that annoying little “ding” that means you’re being recorded which they should fix

- And they keep detailed records of every time you call and complain – I truly think this is used against the consumer to some degree

Chase still wins

Yep, and so does Barclays for that matter.

Chase will let you shift around lines of credit, on the phone, from multiple cards, BEFORE you even open a new account. AND they will match a signup bonus if a better one comes along within a reasonable amount of time. Their reps are better and there are NO phone prompts – just an immediate answer. They have a great portal (Amex killed theirs off in 2012) and their points post much faster.

And, overall, they are doing what they can to reward and win over the consumer with their products instead of punish them and say there’s nothing they can do. It is just so dispiriting to hear from a rep that there are NO OPTIONS and if you don’t like it, to cancel the card. Seriously. My Amex rep was eager to close my brand new account on a brand new product. With Chase, the feeling I’m left with is so much better than the feeling I get when I’m on the phone with Amex reps.

I’m disappointed because I really wanted to get excited about this new card. I feel my credit limit is prohibitive of me putting major purchases on this card. I’ll use it for groceries and tiny purchases just to get the 30 transactions a month in. But for my big spending, you guessed it, going right to Chase.

At this point, I’ll be surprised if I get the paltry 15K Membership Rewards signup bonus.

Bottom line

You can’t switch credit allocations online any more. You have to wait 60 days to do it on new cards, and can’t do it more than once every 6 months.

Other bottom line

I still like Chase much better and think Amex needs to majorly improve their customer service and the way they treat their customers. Was really hoping this new card would be some sort of turning point but still have a bad taste in my mouth about this company. If it weren’t for the card perks, I wouldn’t even bother.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply