Most of my thoughts recently have been on money instead of travel. Now that I have aggressive financial goals, I want to meet at least a few milestones before I take another big trip.

I’m seeing the juncture of points & miles with personal finance so clearly. I’m understanding how much you can really save on travel by accumulating credit card rewards – and sinking the extra funds into investment accounts.

Of course, I’ve always known how awesome points are if you’re passionate about travel. And you bet your bottom dollar I’m gonna treat myself to a nice big award (!) trip to celebrate soon enough.

Travel will always be my #1 passion. Now I’m wondering: where is the intersection of traveling cheap and living frugally?

This month, I was waiting for the right time to post this update. But there is no perfect time and things will always be in flux.

With that in mind, let’s dive into what happened in January!

January 2020 Freedom update

There’s no magical time to post these updates. I was waiting for that time when:

- All credit card payments have posted

- Direct deposits are in

- Transfers are in and done

- 401k contributions have posted

- Mortgage is paid for the month

- All balances are updated to reflect activity

I managed to kinda sorta catch it for previous updates, but it wasn’t happening this month. But that’s OK, because it’s also given me time to ponder my overall strategy as I inch ever closer to my goals.

Switching focus to Roth IRA instead of credit cards

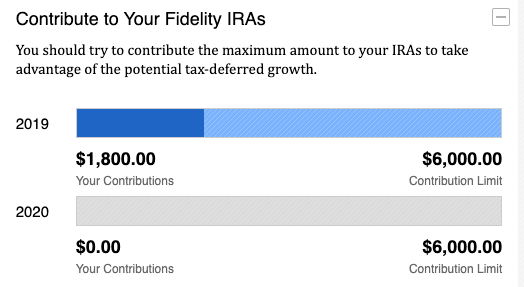

Even though I still have a balance on my 0% APR card, the cutoff to contribute to 2019 Roth IRAs is April 15 – less than three months away!

My 0% rate also expires in April, but you know what? I get those balance transfer offers all the diddy dang time. And I don’t want to lose the opportunity to invest in my Roth IRA. It’s an important retirement vehicle.

Gotta get those 2019 contributions in NOW

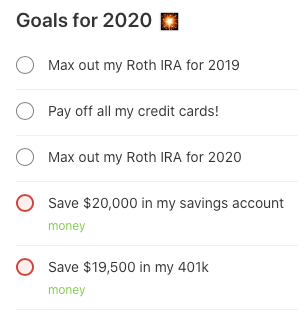

With that thought, I’m hitting the pause button on paying down my credit cards until after I max this out for 2019. Then I’ll go back to paying them (once and for all!). Afterward, I’ll max out my 2020 Roth IRA. Then I can focus on padding out my emergency fund of $20,000.

This isn’t the end. But it sure ain’t where I began

The stock market has been doing so well. I don’t want to miss getting in on this historic bull run. But even with the recent slight downturns, I wouldn’t want to miss the chance to buy more stocks at a discount – the other side of the coin. Whichever way it flips, I don’t want to miss my shot. I’m putting every penny into my 2019 Roth IRA until it’s maxed. Here’s the fee-free Fidelity fund I’m investing in.

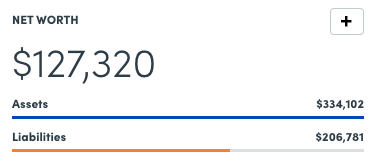

I’m up over $11,000 toward net worth!

Yussss! I have to remind myself that paying off my credit cards *is* building my net worth. Because losing debt cuts down liability, even though if feels like stalling progress.

Assets up, liabilities down. Ebb, flow

My ultimate goal is to reach a $500,000 net worth. And I don’t think the way there is to focus on one thing at a time. Rather, a hybrid model of saving, investing, and paying down debt – a little all at once – seems to keep things chugging along nicely.

For all the times I feel like I’m stalling out or not progressing quickly enough, I…

I think of all the (literal) mountains I’ve climbed. Those moments when you can’t see much in front of you because of all the switchbacks. Am I getting anywhere? How many miles have I climbed by now? But then you turn around and…

Climbing more mountains

…I’ve really gotten so, so far.

So here’s where I’m at:

| Current | Last month | Change | Goal | ||

|---|---|---|---|---|---|

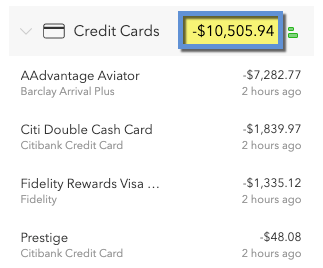

| Credit cards | $10,506 | $14,836 | -$4,330 | $0 | |

| Mortgage | $143,481 | $143,941 | -$460 | $0 | |

| Car | $6,147 | $6,511 | -$364 | $0 | |

| Roth IRA 2019 | $1,800 | $0 | +$1,800 | $6,000 | |

| Roth IRA 2020 | $0 | $0 | xx | $6,000 | |

| 401k | $5,425 | $3,331 | +$2,094 | As much as possible | |

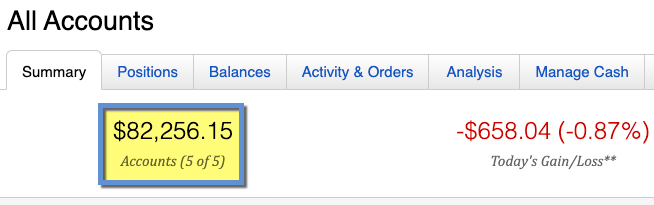

| Overall investments | $82,212 | $74,169 | +$8,043 | As much as possible | |

| Savings | $532 | $530 | +$2 | $20,000 | |

| Net worth in Personal Capital | $127,320 | $115,806 | +$11,514 | $500,000 | Track your net worth with Personal Capital |

I’m so excited to get started on my Roth IRAs, even if it means dialing back the credit card progress for a sec. I’m just gonna go down the list:

Can’t wait to check these off, one at a time

After all this is done, I will ramp up my 401k contributions to the max. And treat myself to an award trip as a reward for coming so very far.

Next steps

I’ve been thinking of picking up another Citi Premier card to add 60,000 more ThankYou points to my balance. Between Chase Ultimate Rewards points, Amex Membership Rewards points, Citi ThankYou points, and all my Hilton points I should have pleeeenty saved up to do something epic. Like bucket list epic. Already so excited thinking about it!

Can’t wait to get this to triple digits

Eventually, the bulk of my savings will be in stocks as opposed to property or cash – and I guess it already is. I just never want my value to be locked up in my primary residence, or one stock account. Again, I think a hybrid approach is best. Lil of this, lil of that.

It’s also cool to think of my stockpile of points as an investment of sorts – one with a very high risk and constantly declining, but also with the potential for big payoff. Especially if I think of it as supplanting/replacing my cash travel budget.

I’m so over HOAs and thinking of leaving Dallas

Yeah. Dealing with a property management company and a BOARD has been hell recently. I currently have two leaks in my bedroom that need repair and getting it done is through a COMMITTEE of people and bureaucracy. My whole complex needs basic shit done that’s constantly neglected. And I’m soooo over it, dude. If I had a single family home, I could do whatever I wanted to with it. Instead, I can’t even rent out my place without PERMISSION.

This whole condo thing has done wonders to show me what I don’t want. I sure as hell don’t want this any more. Freaking stupid.

Thank you, Dallas

Which leads me to… life. I’ve been in Dallas for 5 years by now. I feel like I grew into my final adult form here. It’s been a great chill down after leaving New York. If I sell this place, I’d probably rent for a while. And I can rent anywhere. I’d basically just be in Dallas to work at a job.

My current job is fine. But if I’m gonna go rogue, I wanna go really rogue. And explore every option.

But nothing is going to happen any time soon. I have too many financial goals keeping me in place here. Head down, go to work, pay down cards, save save save. That’s prolly gonna be my life for another year or so.

In that time, hopefully my property value will rise even more than it already has. If I can cut and run with at least $50,000 tax-free dollars, I’ll consider Dallas a success.

Until then, I’m dreaming of meeting my goals, that next award trip, and the next iteration of the funniest, weirdest, twistiest-turniest thing I’ve ever experienced: ya know, life.

January 2020 Freedom update bottom line

I’m that benign office worker with lofty goals and big dreams. I daydream about being in mountains while I’m in my cubicle. Music transports me to other worlds. My energy goes into living, mostly. And sometimes creating. Writing. I love writing here so much and always want to approach it with humble energy.

I started this blog back in New York, and it’s been with me through extreme profit, depressive episodes, adrenal fatigue, multiple jobs, burnout from said jobs, and countless trips (I guess I could technically count ’em, but suffice it to say a LOT of trips). What’s happening to me now is both a settling down and a growth period all at once.

I’m finding my WHY. As long as I stay grateful and gentle, it’s gonna be pretty cool. For now, plugging away. ⚡️

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great post Harlan. Really liking this get it done attitude to wipe out your debt. Being debt free is so liberating. Seriously, it’s amazing. I paid off our last debt a few months ago, my student loan. We’re back from our overseas pet sitting adventure and doing a US road trip via pet sits and hotels. Right now we’re in St George, UT and going to as many national parks and hiking our butts off thanks to the $80 nat’l park pass. We don’t have any plans past Feb 5th except for a Vegas meetup for a few days at the end of the month. We sure do miss having an income from a paycheck, so if you can get those income streams going you could travel too and still save. We’ve got dividends and bank interest, but it’s not enough to pay our way. Trying to get a job and settle for a year or two so we can get more income streams going.

RE: your Roth, keep in mind that contributions won’t lower your taxable income or save you on taxes. Contributing to your 401k will.

Send me an email/FB some time if you wanna chat. Been a while.

Hell YES! That’s amazing. I can’t WAIT to get this credit card OFF my plate foreverrrr. Every time I look at it, I just want it GONE. I am feeling a digital nomad/petsitting/hiking/traveling kind of life so much right now, just like what you and Kim are doing now. Looks so amazing.

I LOVE St. George and Utah in general. What a gorgeous state. Where will y’all settle down for a year or two? And yes, income streams along the way are def good to pad things out.

That’s OK about the Roth write-off. I’m putting a lot in my 401k now, so adding to a regular IRA won’t help me much, really. And I want to diversify as much as I can.

I’m keeping up with you on Insta and FB – will def hit y’all up and can’t wait to see where you land here in a bit. Congrats again on your adventures. You’re an inspiration to me. <3

I enjoy reading your posts, as always. My own debt consolidation takes hold this week, when I refi my 4% mortgage down to 3%, with no closing costs, and once the ink is dry, I’ll be paying off and/or refinancing the student loans from their 6%+ rates.

The trick with balance transfer offers is sometimes the fee to perform the transfer. The Slate card is one of the few that offer a no-fee balance transfer when the account is opened. With rates the way they are, below 2% on FDIC/NCUA insured funds, I might forego the six-months of savings for a month or two, to avoid the upfront balance transfer charge that can be up to 5% of the transfer.

That’s amazing, Bill! I go back and forth on my student loans all the time. If I set about paying them down, I’d lose so much progress investing and getting cash earning compound interest. But of course the student loans are accruing interest of their own. Anyway.

I did some reflecting about balance transfers and realized I don’t like how they affect me psychologically. I know I’m not paying interest, but I just don’t like knowing I have outstanding debt balances out in the world. And I don’t want to set up a precedent of transferring balances around. I’d rather just have it gone and be done with it. I think the most important thing after all this is to have a hefty savings account to avoid getting back to this point again.

And it’s cool in that way – I’m learning lessons and thinking more about money and goals and where I want it all to go.

That said, if it’s between paying interest and transferring the balance then yes – definitely transfer them. You’ll save money guaranteed. That’s a lot going on between your refi, student loans, and balance transfers. Huge congrats on your progress – so happy to hear this! Thank you for sharing and reading!