Welp, that’s it. Now that all SoFi Money ATM fees are gone, SoFi Money is officially the best checking account available today. It’s great right out of the gate, requires no futzing or maintenance, and now, they’ll even reimburse Visa’s forex fees internationally – so you get free withdrawals with absolutely zero fees worldwide.

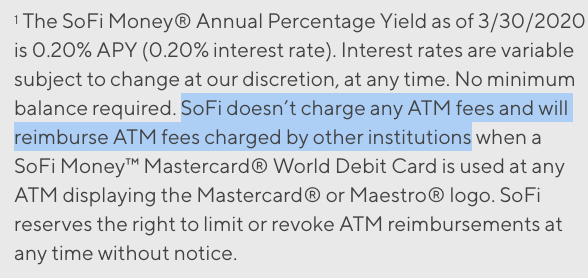

They’ve tried hard to overcome any hurdle to be the best checking account around. You get:

- Free, unlimited, and INSTANT ATM withdrawals worldwide. Even if Visa charges you a forex fee, they’ll reimburse that too

- 0.2% APY on any balance you carry

- Zero fees, no minimums

- Easy to use app and website

- $75 bonus when you open an account and make two direct deposits of $500 each – bonus appears in a day or two and it takes 2 to 3 minutes to set up

I’m proud of their efforts. And I’m switching to make this my full-time checking account after my next pay cycle.

Well how ’bout that?

Yes, I’ve had a Chase checking account for over a decade. And I’ll keep it because it’s free, and for the incredibly rare times I need to do something in a branch. But for everyday banking, bill payments, and my financial clearing house, I’m going all-in with SoFi Money. #officiallyconverted

SoFi Money ATM fees – nothing to see here!

One of the biggest bones of contention for these types of fully free checking accounts has been the 1% foreign exchange fee when withdrawing funds overseas. Schwab explicitly says they don’t charge them, Fidelity doesn’t charge them in practice, and now SoFi is making the official claim to reimburse them.

But unlike Schwab and Fidelity, SoFi also has a 0.2% APY on any balance you carry. In practice, that’s not a lot – but considering the others provide nothing, it’s better by default.

Also, it takes Fidelity a few days to reimburse your ATM fees, and Schwab an entire billing cycle. But not the case with SoFi Money – fees are reimbursed instantly. These features, combined with no fees, and a debit card, are all I need in a checking account.

<3 bae <3

And now for what I want in a checking account:

- Transactions that post fast

- A nice app and website – make it intuitive

- Fully integrate with Mint and Personal Capital cuz that’s where I track my net worth

- Integrate with Venmo/PayPal

Everything I want AND need

SoFi seems to’ve fixed their Mint connection recently because it now updates fast and flawlessly. No issues on any of those things in the few weeks I’ve been using SoFi. Now I’m ready to make the leap and switch my direct deposits over. I even added the debit card to my wallet’s “permanent” slot.

It doesn’t get more real than this

OK, so is like, anything missing from SoFi Money?

Before I make it sound like the best thing since sliced bread, there are a few limitations you should know:

- SoFi Money doesn’t support Zelle payments. I’ve used it a few times in the past with other account and really liked the ease of instant payments

- You can’t deposit cash into the account – so it’s NOT good for cash heavy users

- You can’t deposit money orders

- SoFi Money supports Apple Pay and Samsung Pay but the debit card is not contactless, if that matters to you

- There are no physical branches. It’s all online, baby!

- There are no wire transfers, although they say this is coming soon

SoFi isn’t FDIC-insured. This means if they went bottoms up, you wouldn’t qualify for government insurance. However, once the balance is transferred to a partner bank you ARE FDIC-insured, but it’s that middle ground that’s murky. This doesn’t matter to me because I keep my checking account balances low, but it’s certainly something to be aware of.

Bottom line

I never really cared about the 1% fee to withdraw money internationally – it’s tantamount to $1 per $100. Because I hardly ever withdraw more than a couple hundred, and paying $1 or $2 for the privilege never seemed that big of a deal. But there are those who withdraw more, and that Visa 1% fee was a big deal for them – especially in the crowded checking account space.

So now SoFi has officially removed that concern from their SoFi Money account – and catapulted it to the top of my best checking account list.

0.2% APY, no fees, free ATMS anywhere – everything!

I wholeheartedly recommend this checking account – and its super simple $75 bonus when you open it. Plus, you can stack ongoing promotions to potentially get way more back. Their marketing budget must be insane. Beyond that, it’s actually a great, industry-leading product. I’m making the full switch after next week.

Most importantly, I see them trying and evolving. The few minor drawbacks I’m sure will get resolved soon. That said, it’s an ideal checking account for 90% of users, free to have, there’s no hard credit pull, a $75 bonus, and no fees. If you haven’t already, you can sign-up here.

Will this change be the tipping point for you to convert?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I signed up for SoFi a couple of weeks ago. Can you tell me how you found the Direct Deposit bonus offer? Was it an email sent to you or an ‘ad’ in the app/website? I haven’t seen that offer yet unfortunately.

Hey Ben! I got an email about it on 11/7 and again on 11/15 saying it was extended. I opened my account on 10/26. Hope that helps.

Perfect. Thanks! I’ll be on the look-out for that email.

Schwab seems to say they refund the Visa fee, but the terms can actually be read both ways. Similar with Fidelity. Someone did an experiment with Fidelity, Schwab, and Ally back to back to back, they all yielded exactly the same net cost.

So, SoFi may in fact stand alone on this.

Hey! I used your referral link but sofi is asking for your name and email address to confirm. “Justin” is on the invite, let me know if you can send over your full name and email, and we’ll both get the referral 🙂

Happy holidays!

Hey Andrew! Interesting! It’s Jeremy Vaughn and my email is zynner -at- gmail. Thank you for alerting me to this, I appreciate it!