Also see:

- Citi Offers to Compete With AMEX Offers “Soon”

- Swapping AMEX for Citi: Bye Platinum, Hello Prestige? And Bye, EveryDay Preferred, Hello ThankYou Premier?

- Citi Prestige: No Luck Getting a $350 Annual Fee In-Branch, and Why to Apply ASAP

I wrote before about seeing hints that Citi might compete with AMEX Offers “soon.”

Looks like it’s here!

This is the first I’ve seen of this, so I’m excited to see what Citi will continue to do with Citi Smart Savings offers.

Here’s what I got on my accounts.

What’s Citi Smart Savings?

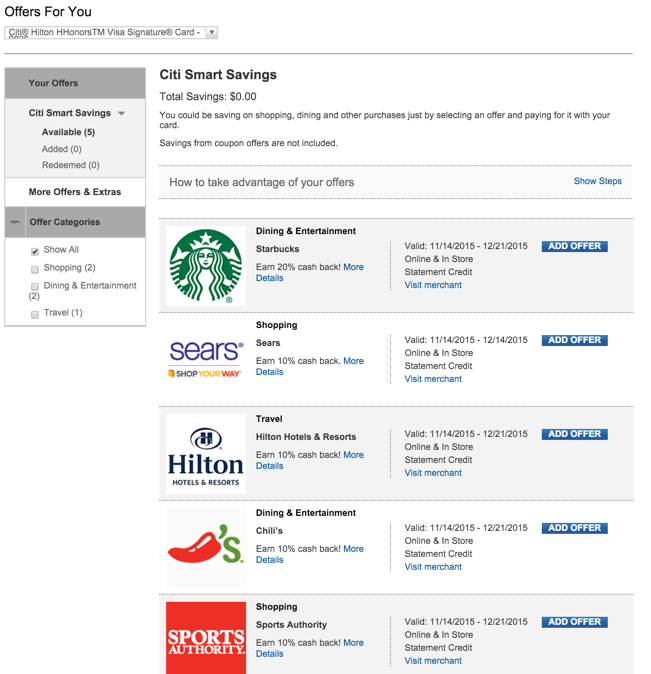

When I checked, my offers were:

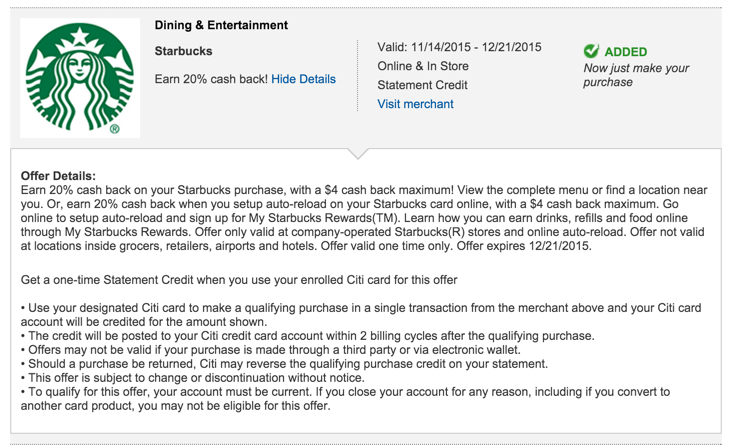

- 20% cash back from Starbucks

- 10% cash back from Sears

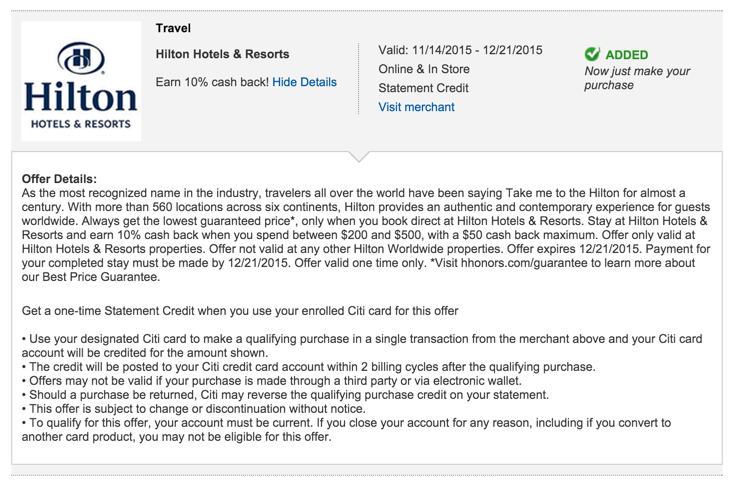

- 10% cash back from Hilton

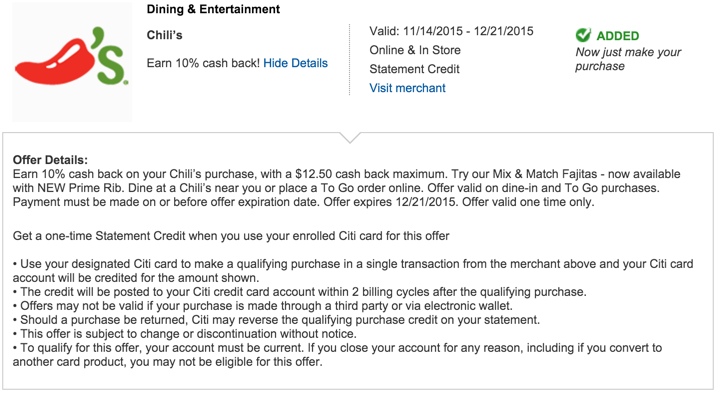

- 10% cash back from Chili’s

- 10% cash back from Sports Authority

It’s interesting that it’s in a cashback format as a percentage instead of having to spend “X” amount and get “X” amount as a statement credit, like AMEX Offers does.

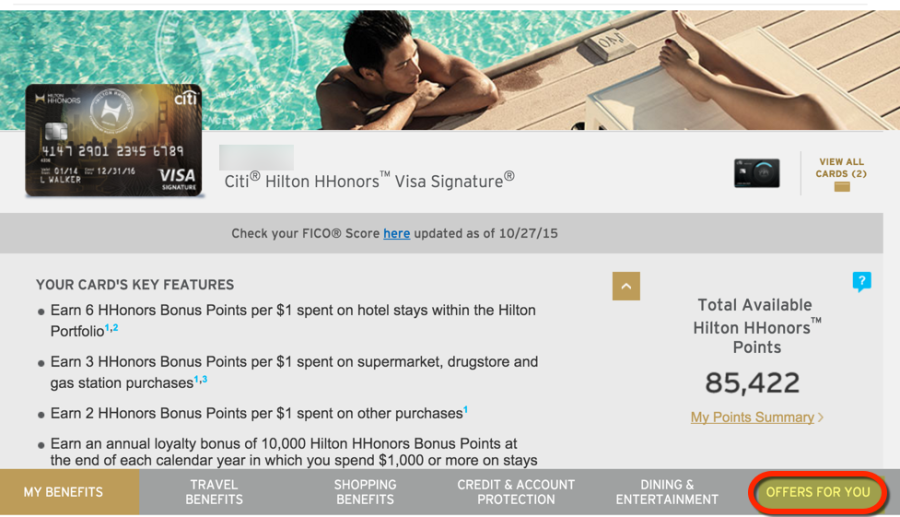

To see what’s on your account, click “Card Benefits” after you log in, and look at the bottom right corner to find “Offers For You.”

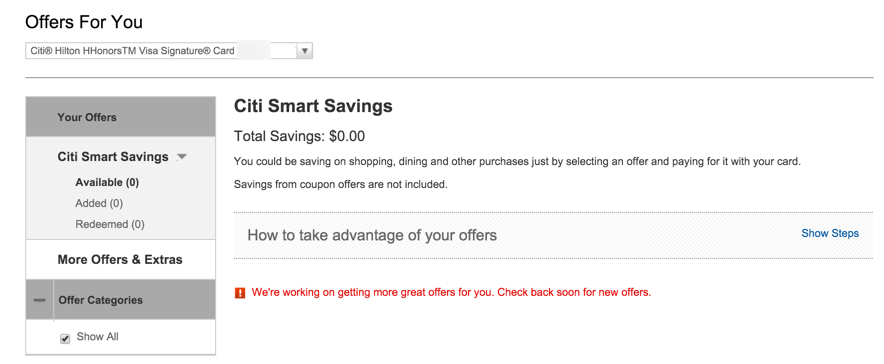

Also interesting to note, I only had Citi Smart Savings for my Citi Hilton Visa, not for my brand new Citi Prestige card or Citi AAdvantage AMEX.

I had an inkling this would come along before Black Friday and the busy holiday shopping season, because when I logged in a few days ago I saw this message under my Citi Hilton Visa account:

How it works

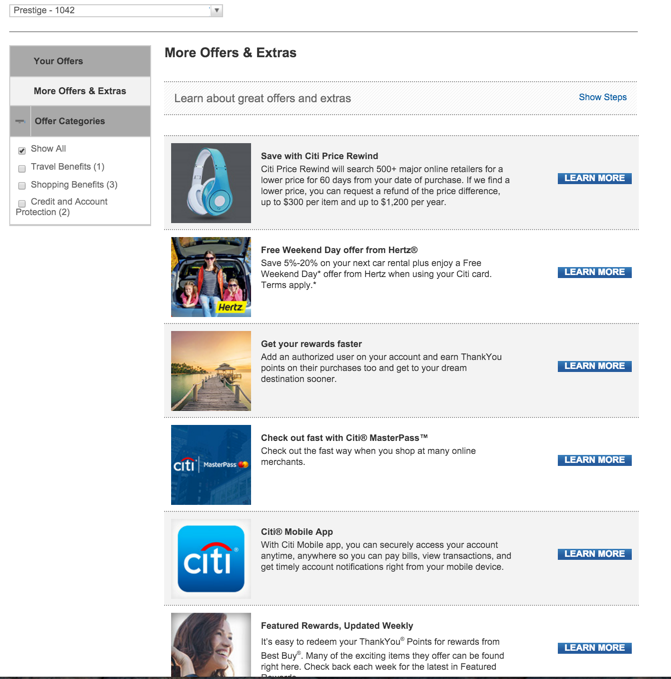

It seems to be like AMEX Offers in that you simply select the offers you want, and add them to your card.

I added the Starbucks offer to my Citi Hilton Visa, and saw I could earn a max of $4 back from a single purchase by December 21st, 2015.

And, it works for loading up your Starbucks card online.

The Hilton offer is better. You have to spend between $200 and $500, and can earn up to $50 back. Same expiration date of December 21st, 2015. But only valid at Hilton Hotels, so not any of their sub-brands. Might be useful for my upcoming trip to Barcelona!

And at Chili’s, you can earn up to $12.50 back. Not bad!

Same expiration date, and also valid online.

What’s next?

All of the offers I saw expire on December 21st, 2015, so they’ll likely be adding more before then, with expiration dates further into the future.

I expect to see frequent offers for Hilton, because Citi issues a couple of Hilton cards, and so does AMEX. So Citi will probably aggressively try to direct business toward their own cards.

It’s nice to see offers at Starbucks, Sears, Chili’s, and Sports Authority: it’s a nice variety of department stores, speciality stores, and restaurants. And it shows Citi is already interested in a variety of offers.

Maybe they’ll rapidly add more next week to prepare for the onslaught of shopping at the end of the month.

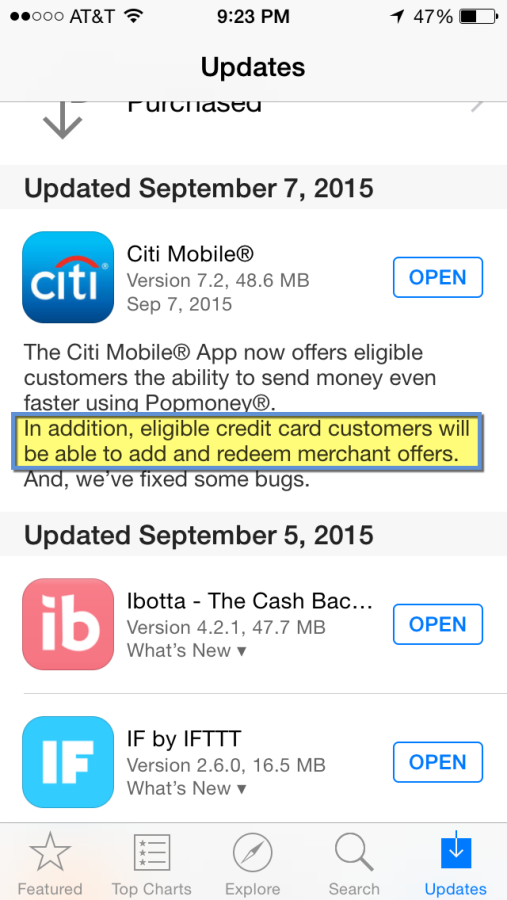

I also got a message in September that Citi was working to add this to their mobile app. I’ve noticed more updates in the past few weeks, and expect this functionality on their mobile app soon, too.

Again, just like AMEX.

Bottom line

It seems Citi Smart Savings is intended to be Citi’s direct competition with AMEX Offers.

I’ve always, always said, when banks compete, you win.

Citi Smart Savings are nothing earth-shattering – yet – but it’s a nice, modest start, and hopefully they’ll ramp up efforts soon enough.

The Citi Hilton Visa is a no annual fee card, so all of these offers are easy moneymakers, assuming you’re going to spend the money with the participating merchants anyway.

I’ll continue to keep an eye on it and hope the 5 on my account are the first of many!

Check your Citi accounts! Please comment if you have different or better offers, because AMEX is known to target certain cards.

Because this program is new, it’ll be interesting to see what offers are available, and who’s being targeted for them.

Do you have any Citi Smart Savings offers?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

I guess they;re just starting this out. None on any of my cards.

I only had it on 1/3 cards. Bet we’ll see more about this next week.

Lucky you, but I didn’t have it on Citi Thank You Preferred, Thank You Premier, or AT&T Universal cards

I bet you will soon enough. It’s been a slowww roll-out.

Nothing on my CITI Hilton card at all, much less the AA affiliated cards. Judging by your pictures (as well as the procedure I followed) CITI needs to redesign this so that the offers are immediately accessible on your login page like American Express. Too much clicking to various pages. By making it so much effort, many people will only check CITI when blogs like yours alert them to something special.

I agree, the process is very around-the-world and a redesign is in order (as well as better offers) before this can really take off.

I mark it “developing” for now, but it’s good to see they’re taking steps and releasing it in some way, even if it is a bit inconvenient for the moment.

I got the same offers on my Prestige card. My other two Citi cards and my spouse’s three Citi cards didn’t have these offers.

i have it on my Citi Premier, but not Hhonors or Prestige.

I have it on my Citi Premier, but not Hhonors, AA, or Prestige.

Thanks for sharing! Here’s hoping they eventually target several cards (like AMEX Offers does)!

It’s on my Citi Dividend, but not AAdvantage Platinum, Prestige, Premier or AT&T Access More. Nice start. I hope it applies to all of them eventually, as my Dividend Card mostly lives in the sock drawer.

Agreed, nice start. Here’s hoping they come out swinging!