Also see:

- I broke down and got the Chase IHG Rewards Club credit card

- Should I go to a different state for my IHG Set Your Sights Promo?

- Chase IHG MasterCard Sign-Up Bonus Counts Toward Spire Elite Status!

- IHG Accelerate Promo

In case you guys haven’t heard, IHG has a new fall promo called Accelerate.

This is a GREAT promo if you don’t have an IHG Rewards Club account because you can earn 2 free nights at ANY IHG hotel (1 free night for 2 stays, up to 2).

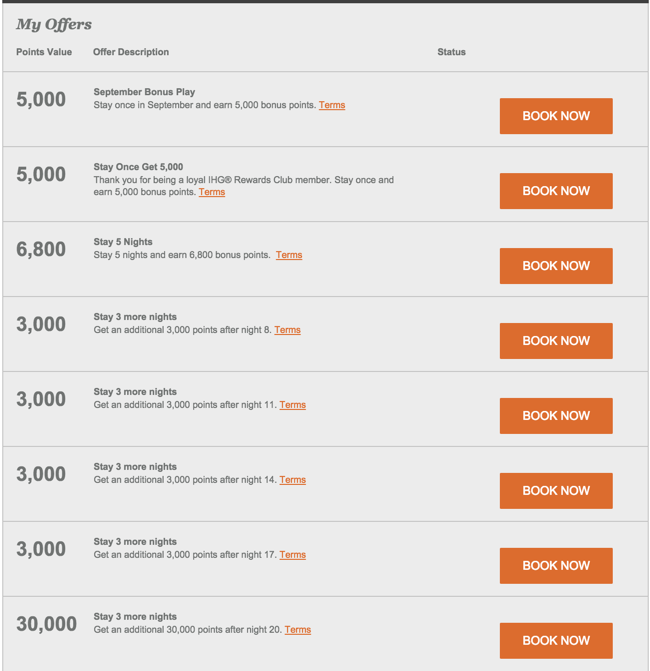

But if you’re an existing member, or Spire Elite, the offers vary from OK to “thanks for nothing.”

Compared to the “Set Your Sights” offer that had me contemplating travel to another state, this one is kinda meh.

Though you can sign up now, the promo runs through September 1st to December 31st, 2015.

My offer basically said spend a month in IHG hotels and we’ll give you a free stay at a Category 9 hotel (earn ~58,000 IHG points).

So I’m like thanks but no thanks.

I wonder if it has to do with my recent accidental acquisition of Spire Elite status.

Peeps on FlyerTalk have been busy posting their offers today, and they’re all really different from one another. Which is kind of interesting.

Newbies take the cake

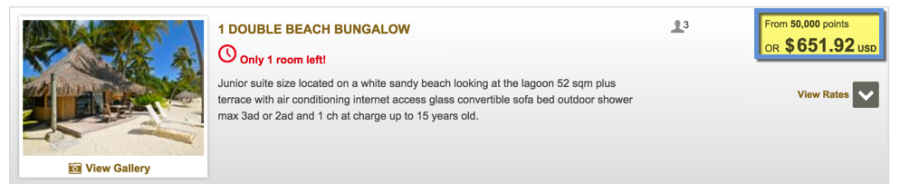

But the real treasure is for newbies. If you don’t already have an IHG Rewards Club account, you can earn 2 free nights at ANY IHG hotel when you complete 4 separate stays. ANY!

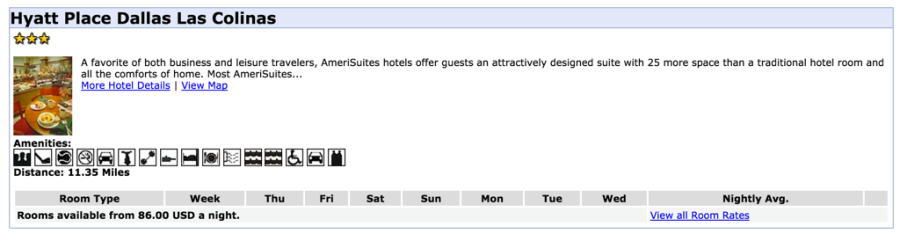

So… you could spent $75 per night ($300) and then get 2 free nights at a hotel that goes for $600+ a night, essentially turning $300 into $1,200?!

Freaking nuts!

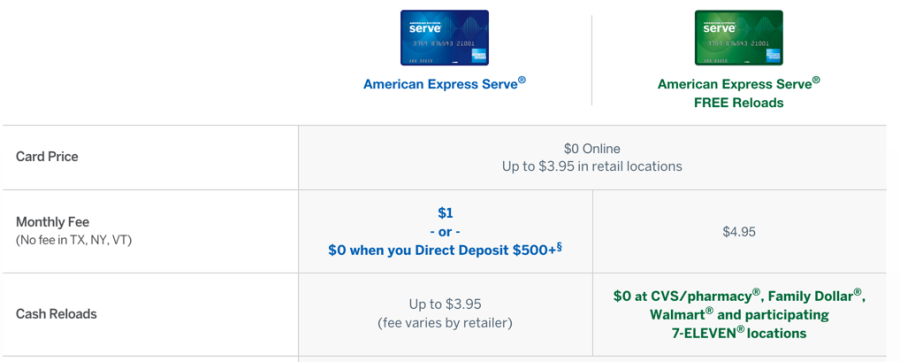

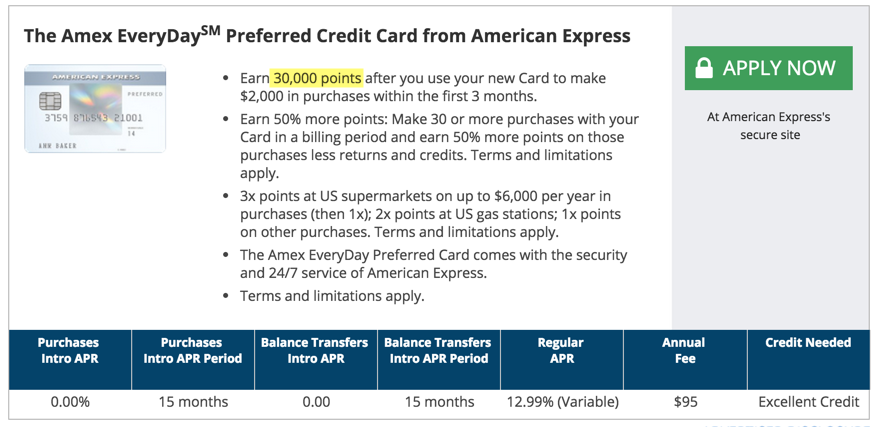

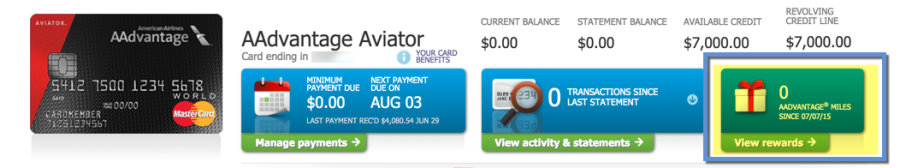

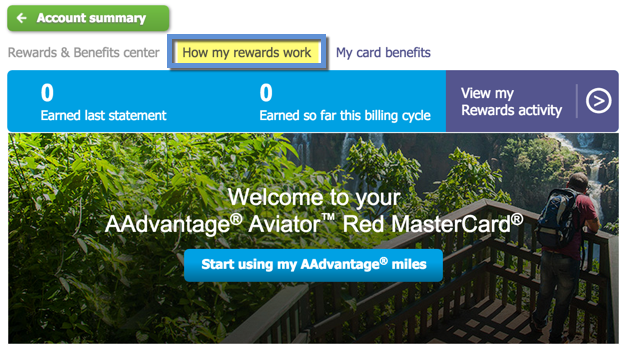

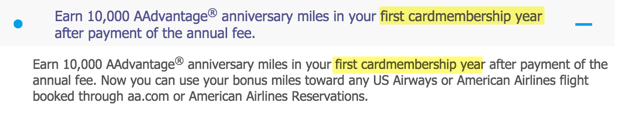

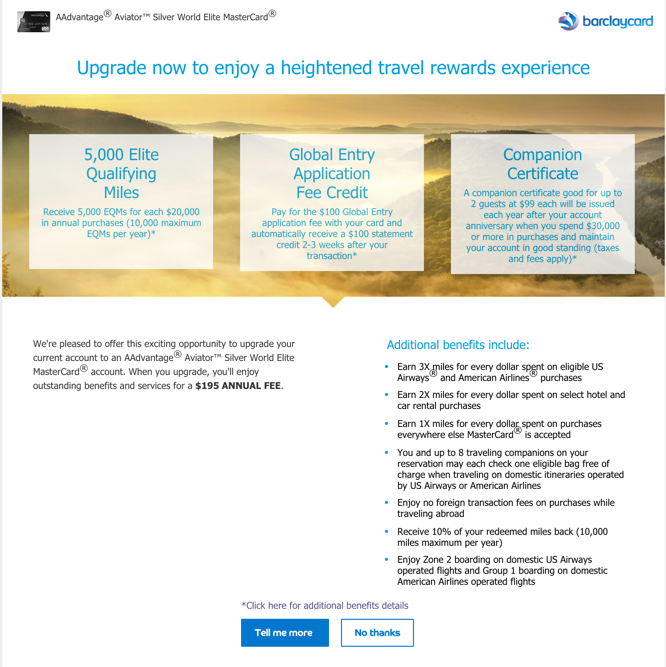

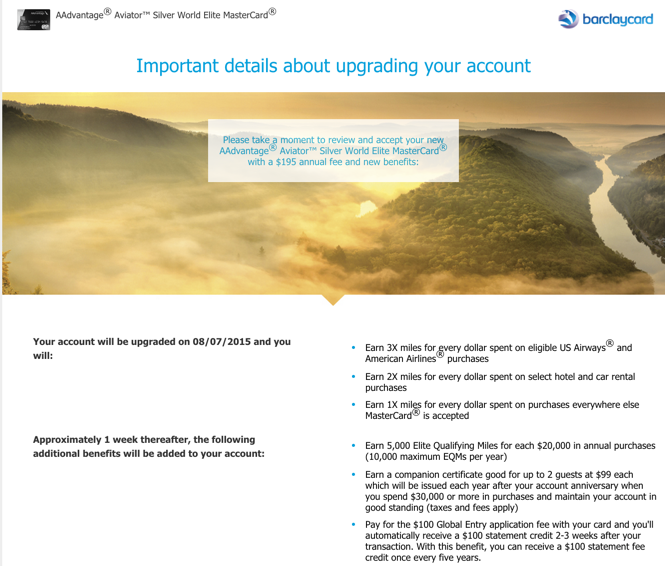

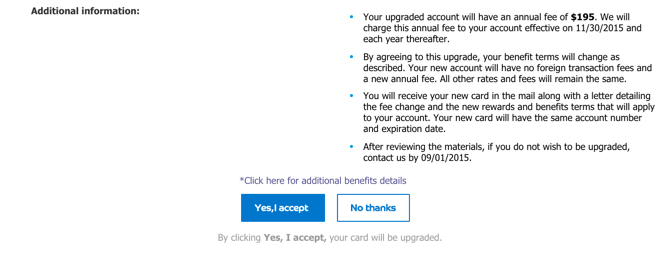

And remember you earn a free night certificate when you open the Chase IHG MasterCard. The annual fee is a paltry $49 and comes with IHG Platinum status, which is usually totally worthless, but does earn 50% bonus points on paid stays.

I recently broke down and opened the card and all I’ll say is that 3 free nights in a year is a lot better than just 1. And if you pick hotels that costs $600+ per night like:

- InterContinental Le Moana Bora Bora

- InterContinental Park Lane London

- InterContinental Paris Le Grand

… you can get damn near $2,000 of value of that – not to mention the vacation experience of a lifetime.

So if you know anyone uninitiated to IHG Rewards Club… and you can make a new account… definitely get in on this! Dang newbies. (Bitter, party of one, right here!)

Bottom line

IHG has a new fall promotion called Accelerate. It’s great for newbies/new accounts but various levels of sucky for current members.

That being said, if you have stays coming up anyway, you might as well register (or let someone else book the room for you).

Keep in mind you should sign up before you stay – IHG doesn’t credit stays after the fact.

This will be helpful for some. Between this promo and wanting to burn Hilton points, I’m torn between where to stay on an upcoming trip.

Does this promo rock your world at all?