Just a few bits and baubles to follow up on recent posts.

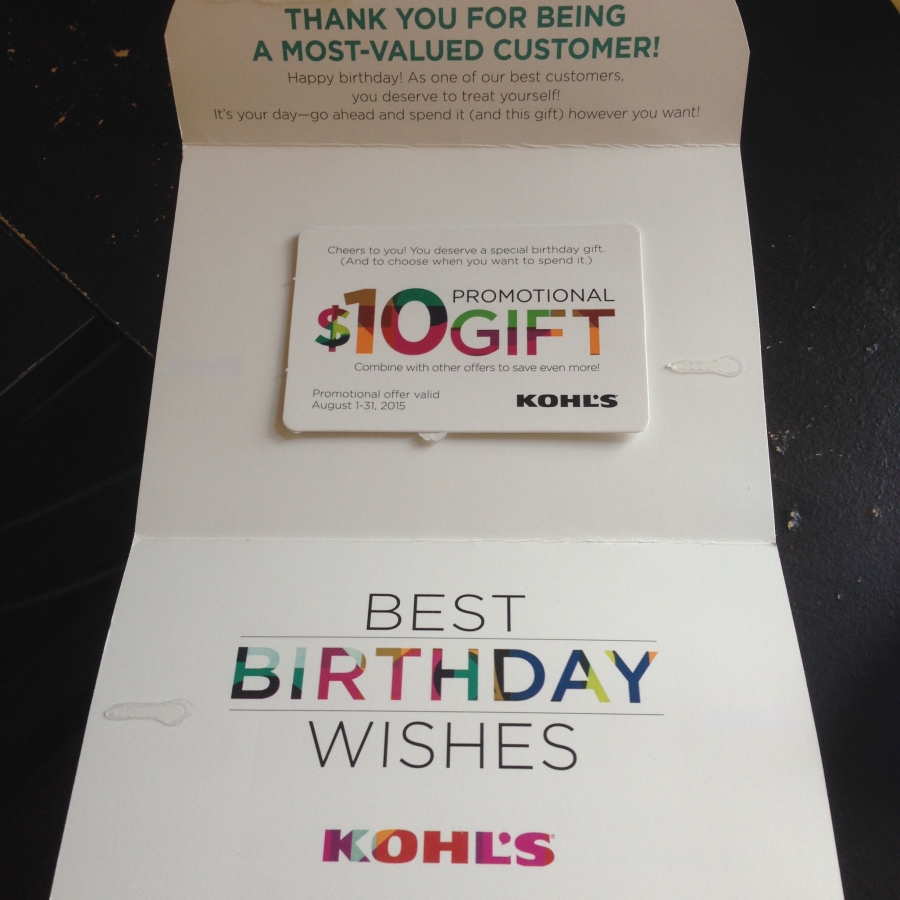

1. Kohl’s $10 Birthday Gift

Also see:

- Holy crap I love Kohl’s

- Confession: I Got a Kohl’s Card

- Yay! Just got Discover It and Citi Hilton 75K cards!

August is my birthday month, and Kohl’s got their timing perfect.

Because today, in the mail, was a card/gift from Kohl’s. Right after I mentioned how much I love them this morning.

I also just received my Yes2Rewards this morning as an email, too.

Kohl’s has a great thing going. Their rewards program is more straightforward than Sears Shop Your Way Rewards and their website is way better, they have frequent discounts (usually 30% off) and promotion codes, often free shipping, and now I get a $10 bonus.

I wish their portal payout on the Discover Deals shopping portal was 10% cashback like Macy’s, Sears, and Kmart (it’s 5%).

But free money is great. I can always buy some new sheets and towels for my Airbnbs.

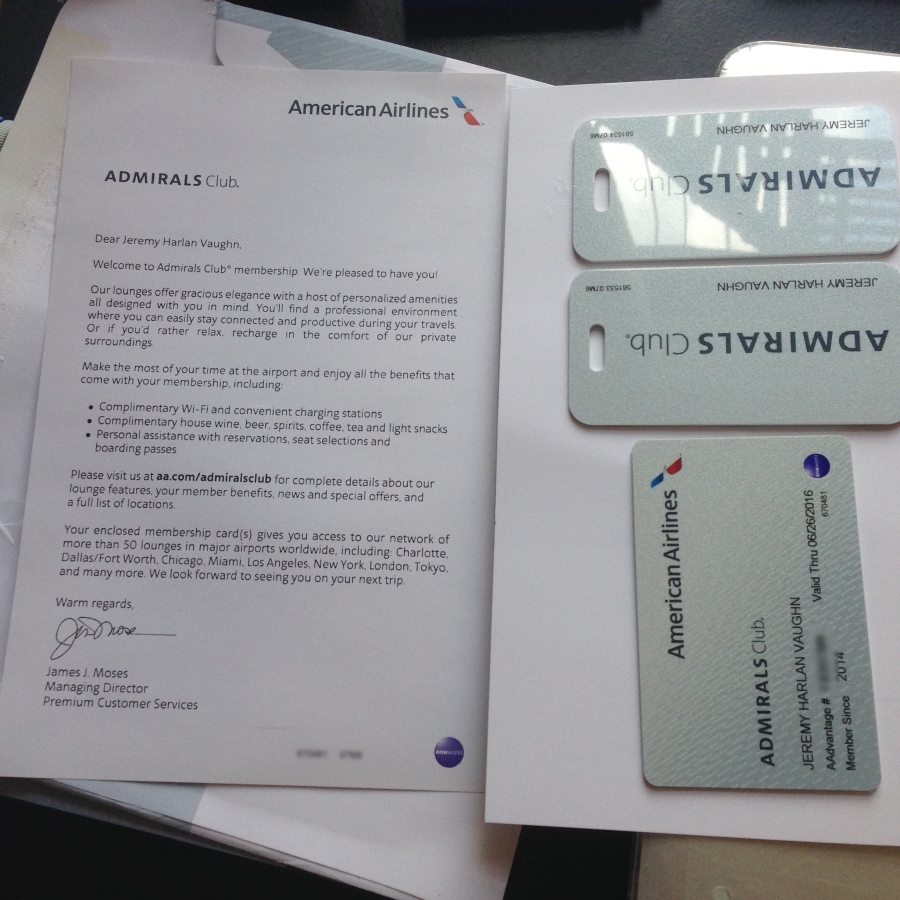

2. Admirals Club Membership Materials Are In

Also see:

If you fly on American Airlines, like, ever, sign up for Business Extra.

Then link your Business Extra account to your AAdvantage account.

When you fly, you’ll earn points. Earn enough points, and you can get a free Admirals Club membership.

I got my membership materials in today. So it does take 4-6 weeks to get them in (although my membership has been active in the system since my signup date).

There were also some schmancy luggage tags.

If you don’t have a Citi Prestige or Citi Executive AAdvantage card, this is by FAR the easiest way to get into the Admirals Club.

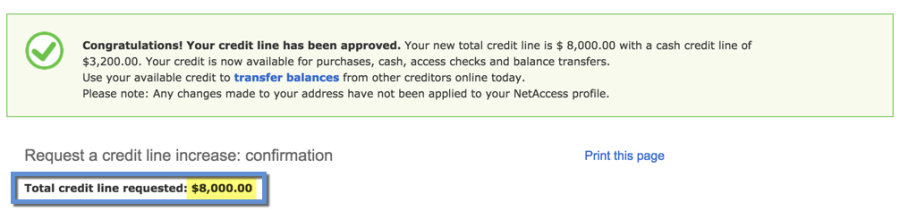

3. FIA Credit Line Increase + Inquiry – Both Instant!

Also see:

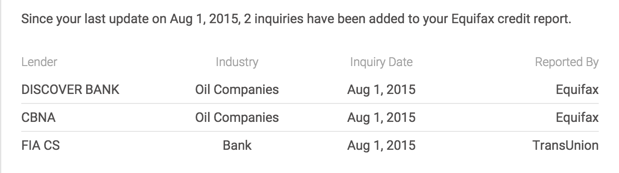

So I only got 2 new cards today, the Discover It and Citi Hilton Visa.

But then I thought, “Why stop with new cards?”

When I login to the Fidelity AMEX site, there’s a link that says, “Request a credit line increase.”

While I was on a roll, I clicked it.

They asked how much credit I wanted. I’d been approved by Citi for a $7K credit line earlier in the day, so I went for $8K.

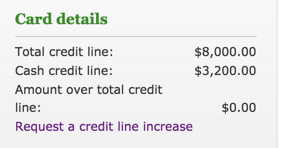

10 seconds later, I had it. I logged out and back in again, and the new credit line was there.

I kinda wondered if I should’ve gone for higher. But nah, I don’t even need $8K, really.

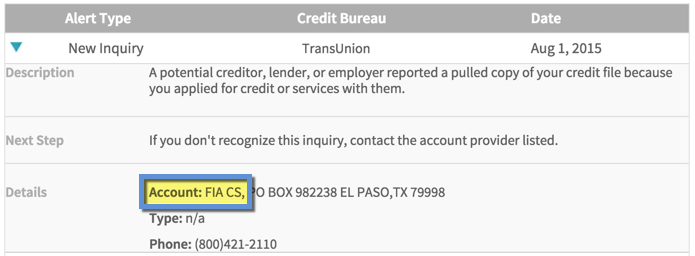

Not 2 seconds later, I got an email alert from Credit Sesame.

It was FIA (instead of, ya know, Citi or Discover).

They use TransUnion, in case anyone’s interested.

I did the same for my Kohl’s account. With a few clicks, I lowered my debt-to-available-credit ratio and am on my way to an improved credit score. I don’t think Kohl’s pulled my credit. If they did, it was soft. I wasn’t asked to confirm any info like with FIA.

Are there other banks that will approve a credit line increase instantly via online banking?

Interesting how these things are reported and work on practical terms.

Update: All inquiries are in. Citibank and Discover pulled from Equifax.

(And now to give my credit report a break. Next time, I’m gonna get the Citi Prestige.)

Anyone else have anything exciting going on this weekend?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Leave a Reply