I have a below 5/24 plan. How’d that happen?

I can’t get most Amex cards because I’ve already earned the welcome offer, or Citi cards because of their 24-month “family of brands” rule. Plus, I got busy baby-making.

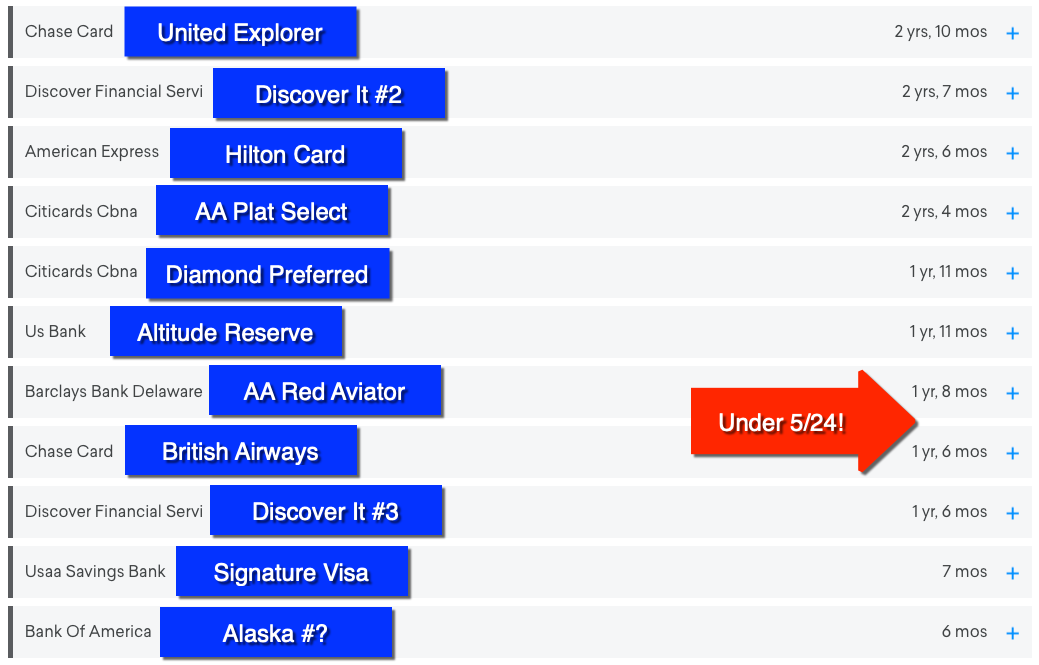

So when I checked Credit Karma, I had to blink again. For the first time in years, I’ll be below 5/24 as of July 19, 2019 – only 4 months away!

I mean yeah, there are non-Chase cards I’d looove to get (I’m drooling for the Amex Hilton Aspire). But heck, if I’m this close, I may as well keep trending. And you bet I’m running right for the Ink Business Preferred® Credit Card.

When I think of UR points, alls I see is Hyatt hotel stays. First stop: Ink Business Preferred® Credit Card

More broadly, this might be the beginning of a long-needed credit card overhaul.

My Below 5/24 Plan

Q: When one falls below 5/24, what do they do?

A: Fill in around the edges.

My focus is clearly on earning more Chase Ultimate Rewards points.

Here’s my post on how to decide which Ink card is best for your situation.

My next Chase card(s)? I’ll have to have a marg about it (sandy-footed friends welcome)

But the question remains…

What to do with the Chase Sapphire Reserve®?

The Ink Business Preferred® Credit Card offers:

- 3X Chase Ultimate Rewards points on the first $150,000 spent on travel, shipping, internet, cable, phone service, and advertising, each account anniversary year

- 1X Chase Ultimate Rewards point on all other purchases

Note that it duplicates one of Sapphire Reserve’s 3X bonus categories – travel. And I can get 5X on dining with another card.

Which would make my beloved Chase Sapphire Reserve® obsolete – so I could downgrade it. And open the Sapphire Preferred in its place to get another big bonus. That complicates things.

Because I only need to keep one Ultimate Rewards card with an annual fee to keep access to partner transfers. And honestly, I haven’t used my Chase Sapphire Reserve® much lately. 😲

And especially wouldn’t if I got the Ink Business Preferred® Credit Card.

It’s been rad, but ya might gotta go, ol’ chap

So it looks like the Chase Sapphire Reserve® might have to go. As much as I like the card, Chase needs to step it up now that:

- United is going rogue

- Korean Air left

- You can’t pay for Southwest flights with points

- Singapore is devaluing their Star Alliance award chart

- Flying Blue no longer has an award chart

- Marriott is a turd

The 1.5 value for booking travel through Chase is nice, but I get that through the US Bank Altitude Reserve. And travel insurance? Got the same coverage with other cards. Priority Pass? Check. Really, why would I keep it?

The strategy

I’m operating under the assumption I can only get one – maybe two – new Chase cards. Under that lens, I’d like for both to be small business cards. But if I can only get one, then I’ll try for one more personal card.

I don’t want to attempt more than that, as that might set Chase into review status – and I do NOT want that.

Either way, some juggling will have to happen. I don’t want duplicate benefits or multiple annual fees.

And more importantly, I’m rolling in so many Citi ThankYou points (and getting 10,000 of them back a year) that Chase Ultimate Rewards points isn’t my focus any more.

But Chase has a few months to keep my affections, though the Chase Sapphire Reserve® is on the chopping block.

My last ~3 years of card openings

I’ve definitely been picking up a card or two every few months, but as of July 2019, it’ll be over 24 months with less than 5 cards opened. And 2 months after that, 2 more cards will fall off.

For now, I’ll bide my time – especially if it’s this close.

Other cards I want

I wrestled with the dilemma of having too many ultra-premium cards recently, but by gods I still want the Amex Hilton Aspire.

And I’d be down to entertain the Wells Fargo Propel card, because it has no annual fee and super solid 3% cashback categories, including:

- Eating out and ordering in

- Gas stations, rideshares, and transit passes/tickets

- Flights, hotels, homeshares (like Airbnb), and car rentals

- Popular streaming services

The Capital One Venture (learn more about it via my CardRatings link) is looking stronger than ever thanks to its hybrid 2% cashback / airline transfer capability. And the Capital One Savor (learn more here) has a great sign-up bonus and interesting 4% bonus categories.

Clearly, I’m at the bottom of the barrel here. But def want that Amex Hilton Aspire.

Bottom line

Thanks to a combination of changing rules, not being able to get many cards, and living life, I find myself soon slipping under 5/24 for the first time in a long time.

In a few months, I’ll decide what to keep and cancel, and refine my strategy. I really want the Ink Business Preferred® Credit Card though – that much I’m sure of. And I might close out my Chase Sapphire Reserve® in the process – something I never thought I’d consider.

I also never pictured myself without an Amex Platinum card, because I love Centurion Lounges, but here we are – I’m a Priority Pass guy these daze.

If you fall (or currently are) below 5/24, the best strategy is to get all the Chase small business cards you want (because opening them doesn’t affect your 5/24 status, even though they’re subject to the rule), then any Chase personal cards. Basically, fill in the gaps – then move on to other banks.

And that’s exactly what I’ll do in a few months, though which card combination remains to be seen. On a higher level, I want to see Chase adding value to their Ultimate Rewards program – it’s taken hits recently and could use a shine.

But yeah, I’m excited! It’ll be good to finally have the Chase card lineup I always wanted, although at this point I can’t help but feel it’s too little, too late.

On an empirical level:

- Chase Ultimate Rewards = Hyatt hotel stays, other programs = award flights

And that’s how I’ve been cobbling together my trips for a while now. So far, so good.

One thing’s for certain: the landscape keeps shifting. Pull through, Chase.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Don’t the Sapphire cards have a 48 month rule now?

Yes, it’s been about 6 years since I earned a bonus though.

Hi Harlan – Very nice article. I love thought pieces about card strategy from a savvy blogger like you. Falling under 5/24 creates some great opportunities for sure. Consider multiple CIP cards, spaced out appropriately. I wrote an article on this a few weeks ago. That 80k UR bonus is sweet plus you can self-refer for #2 for an extra 20k UR (although you may already have that covered via affiliate link). I’m also totally on board with you on loving the Aspire. Maybe wait on it until you are 3/24 or less to preserve your under-5/24 status? You have an interesting dilemma on CSR. We use the 1.5 cent redemptions through the Chase travel portal a lot, so it’s a keeper for us. But if you use virtually all of your UR points with transfer partners, the equation changes dramatically. In your situation, downgrading CSR and picking up a new CSP bonus makes a ton of sense.

Hey Craig! Good idea about getting two of the CIP cards! Another angle to consider for sure.

After so long without any new Chase cards, it’s nice to finally have options again. Ol’ CSR is getting much use lately, whereas it used to be my favorite card. Funny how things shift so quickly. Which is the other thing – everything could be completely different in another few months. Will be interesting to see what develops. For now, I’ll hold tight and hope the CIP 80K bonus sticks around.

Hope you are well – thank you for reading and commenting!

I like the Ink Cash card. We have a Preferred Card, but it’s not getting used a lot these days.

As long as you’ve not had negative experience with Barclays, the Uber Visa offers a lot of the same features as the CapOne Savor. (without the triple pull)

I could see that. I have the Ink Plus, which is basically the same as the Cash card, just with higher 5X limits. All the cards mentioned would be just for the sign-up bonus, then closed/downgraded later.

As far as Savor vs Uber goes, the Cap One Savor has a $500 bonus (and AF is waived the first year), whereas the Barclays Uber Visa’s offer is for $100 (and has no AF).

I could always get both, close the Savor later and keep the Uber Visa forever. I don’t care about credit pulls, really.

So many options! Not gonna lie, waiting 4 months is gonna feel like forever though. :/

Thank you for sharing your thoughts!

Aaah, going back to the dark side, I see, young Jedi. 🙂

Actually, the easiest path in my mind towards Hyatt redemptions and UA miles is UR points.

Hehe, yup! I primarily use UR points for Hyatt stays and MR/TY points for award travel. UR = hotel stays, other points = flights. It’s working for now (until the next round of inevitable changes).

Good to be back on the dark side! 😉

Harlan,

You can use Chase points to pay for Southwest flights. You can either transfer, or nowadays, you can call the UR travel center to book a flight on Southwest. You can’t do it online though.

I thought you couldn’t call to book since the changeover to the Expedia travel platform. Thanks for the tip, Jeremy! I’ll have to look into this more.