Hi lil lovies. The holidays were wild, eh? I’m writing this in a medicated haze with flu-like symptoms. But I wanted to write. And I’ve been meaning to talk about is how I’m using balance transfer cards to:

- Meet my current financial goals (which I need to update)

- Smooth out large, unexpected expenses (like when my AC quit in July and I had to get a new HVAC system)

- Give myself a jump-start to purchase big items when I want them (I bought myself a rowing machine because I really really wanted one and I’ve been using it regularly)

This is because I didn’t have enough in a savings account, which will change this year. So hopefully I won’t have to rely on them in the future.

But for now, they’ve helped me consolidate a lot of balances spread over several cards with big interest rates. I paid a one-time balance transfer fee, and have a 0% APR rate through April 2020. So I haven’t paid a dime of interest since. And honestly? It’s been the one thing that’s given me time to get caught up.

Balance transfer cards aren’t a perfect solution. But they’ve bought me time and helped me avoid a ton of interest while I got my plans together

The test, of course, is paying them back before the 0% promotional rate expires. If you don’t, you’re right back to where you started. 🌀

The good thing is these rates are a year or more (usually more). A lot can happen in a year.

While I’m glad balance transfer cards have been available to me as a financial tool (which is absolutely how I think of them), moving forward I want to depend on savings rather than having to buy myself time.

Balance transfer cards 2020 – should you, could you, would you?

First things first, balance transfer cards have a balance transfer fee which varies by card, and 0% interest for a set amount of time on balances you transfer in. Whereas 0% APR card offers have 0% APR for a set time for new purchases only. 💥

I’ve used both in the past.

0% APR cards

0% APR cards are good for:

- Big purchases where you need wiggle room (appliances, car repairs, medical bills, tuition payments, etc.)

- Daily expenses when waiting for a job or contract to begin so you can pay it back

- Repairs or upgrades to sell a home or car (and you can repay after selling it)

- Investing in a new business you expect to be profitable relatively fast

I wanted a rowing machine and didn’t want to delay my fitness goals

I got a 0% APR when I moved to Austin to give me some padding until I could get on my feet (I’m back in Dallas now). And then I really wanted to row again. It was always my fave machine when I had a gym membership. They cost like $1,000.

I called my mom and Gramma and asked if I should get one or if it would be irresponsible seeing as how I’d depleted my savings. They said to wait.

In the end, I decided it was worth it – even if I had to pay interest – to start working toward my overall fitness goals (sorry mom). I thought I might grow tired of it, but the bet paid off. I love that thing and use it two to three times each week for over a year now.

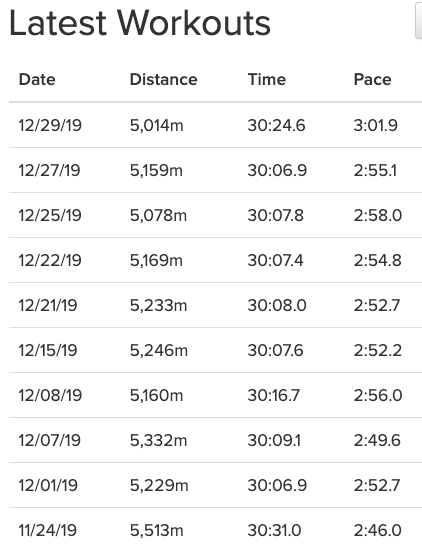

Rowing is a meditation for me and I go 5K meters in 30 minute increments pretty regularly

This was something I treated myself to with a 0% APR card. Not to mention all it’s done for my health during the time I’ve had it.

Balance transfer cards

These guys are good for consolidating balances spread out over a few different cards. The most common intro offer is a 3% fee on however much you transfer, up to your available credit limit – although some cards require you to leave some space and NOT use your entire available credit line. That varies by card, too.

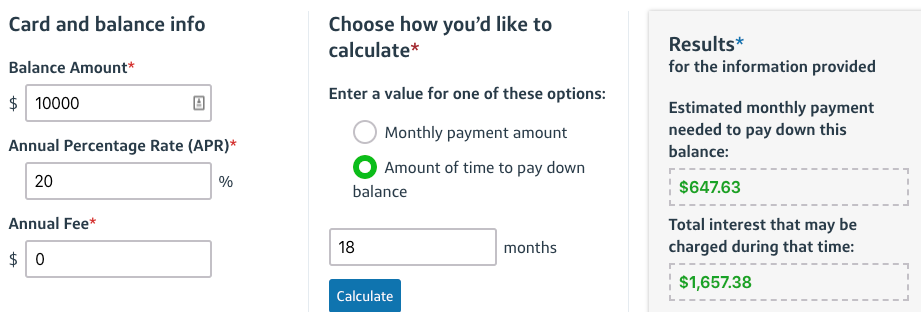

Say you have $10,000 in balances on a few of your cards. With a 3% balance transfer offer, you’d pay a one-time fee of $300 ($10,000 X .03) to transfer them to your card. Depending which offer you choose, you’d then have 12 to 18 months to pay it off – and during that time, wouldn’t accrue another dime of interest.

Assuming your card APRs are 20%, you’d otherwise pay:

- ~$1,116 in interest over 12 months

- ~$1,657 in interest over 18 months

It can definitely be worthwhile to consolidate your credit cards into one place

The main factors that determine if a balance transfer is right for you are:

- Amount you plan to transfer

- Interest rates on your current cards

- Length of promotional rate

- Cost of balance transfer fee

- If you like the card enough to keep long-term after the promotion is over

In the example above, your total fees are $300, but you’d stand to save between $816 and $1,357 even if the fee included. That’s better than most sign-up bonuses!

And if there is a sign-up bonus on the card you want, note that balance transfer will NOT count toward the required minimum spending. But if you want earn a welcome offer AND a balance transfer rate, that’s a double win and can make it that much more worthwhile.

Note: New purchases made with a 0% APR offer WILL count toward welcome offers.

The best balance transfer card offers right now

Here are a few to consider, all with 0% APR and $0 annual fee:

- Capital One Quicksilver – 15 months – 3% fee – Read more here

- Amex Blue Cash Everyday – 15 months – 3% fee ($5 minimum)

- Wells Fargo Cash Wise – 15 months – 3% fee for 120 days, then 5% – Read more here

- Amex Blue Business Plus – 12 months – 3% fee ($5 minimum)

You can find all the cards above, and many others – all nicely laid out with a helpful table for each one – at this link.

Are there downsides?

Ayup. The big unknown is if the credit line you’re approved for will be enough to accommodate all your balances. It would be crappy to get a card with a $3,000 limit if you have say, $7,000 you want to transfer over.

The other thing to watch out for is being lulled into a false sense of security. “15 whole months!” you might think to yourself (depending which card you get). “That’s so far away!” But it creeps up on you.

I monitor those dates like a dang hawk. I make notes about them in a few different spots and check often to see how much time I have left.

I’m aware of my obligation to repay. Otherwise the cycle repeats. It’s best if you view balance transfer cards as a stepping stone rather than the final destination.

And beyond that, they’re a band-aid. A quick fix. The real fix is you probably need a well-funded savings account so expenses don’t surprise you when they pop up. This was definitely my case so I am speaking to myself here. But padding out my savings is one of my big financial goals this year.

All that to say, I’m grateful for the (very long) time balance transfer cards have given me to get it together.

It helps if you already have cards with the bank

Many (most, I’d say) banks will let you move credit lines between your cards. So if you open a new Chase card, for example, but only receive a $2,000 limit, you can transfer available credit from another card (or cards) you already have open. You can NOT move a credit line between business and personal cards. Only between personal cards to another personal card or business cards to another business card.

Banks I’ve personally done this with include:

- Chase

- Citi

- Amex

- Barclays

That’s why I was fine opening a new Citi card with a balance transfer offer. My limit wasn’t all I needed, but I called ’em up and moved some credit over and was on my merry little way.

Even better if you can keep and use the card long-term

I personally love and use my Amex Blue Business Plus all the time because you earn a flat 2X Amex Membership Rewards points on all purchases, up to $50,000 per year. And I definitely carried a balance on it for a while.

Same with my Citi Double Cash, which is also on the list above (with an 18-month intro rate!). That card earns a flat 2% cashback, which converts to 2X Citi ThankYou points when you have the Citi Prestige or Citi Premier. And your earnings are unlimited.

Wells Fargo Propel Amex is on the list, too (I reviewed it here). It’s a snazzy lil card with lifestyle-focused bonus categories.

Despite the times I’ve juggled balances, my credit score has been made better for it. I’m currently at 841!

Again, ALL of these cards have a $0 annual fee, so they’re free to open and keep forever.

As an added bonus, if you don’t already have a card with $0 annual fee, they’re a great way to boost your credit score long-term by increasing the age of your overall accounts AND they’re a great financial tool to save on interest AND many of them have welcome bonuses.

My credit score has definitely benefitted from responsibly using my available credit, and is now sitting at 841. These things really can help if you use them with a payoff plan in mind.

Bottom line

There’s no doubt in my mind that balance transfer cards haven’t saved me hundreds of dollars in interest and helped me adjust the repayment timeline. I also can’t overstate how good it was for me mentally, simply knowing I had more time and wasn’t accruing extra debt. After all, I felt bad enough carrying a balance in the first place. But stuff happened, it added up, and spiraled out. I took control of it and am finally getting my finances together in a responsible way. 💪

I wouldn’t recommend transferring your balances around with no real plan to pay them down (this is what my Gramma does). And they’re no substitution for having a safety net in an interest-bearing savings account.

But January is tough for lots of folks. The holidays add up. Seeing all the line items can be a shock. I’m all for anything that softens the blow. Even better if the card you choose has a:

- Rad sign-up bonus

- Long 0% APR period

- Rewards system (that you’ll actually use)

- $0 annual fee

- Place in your wallet to boost your credit score long-term

As I’ve dealt my credit and credit cards over the past several years, I see these as the tools they are. They’re almost like a personal loan but you end it with a card in hand you can use over and over.

If balance transfer cards are a stop on your financial journey like they were for me, more power to you. Just make note of when the intro period expires and remember it’s just a band-aid. The long-term solution is up to you.

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

A couple of points to bear in mind – the balance transfer fee counts like a purchase so you do pay interest on it. To pay it off right away, you have to pay the amount of the fee on top of the minimum payment – payments are allocated to the highest interest balance first, but only after the minimum payment has been made.

Also, in my experience the promo period typically ends at the statement close – not on your payment date, but beforehand. I always call and get the exact date it ends.

Useful as a safety net for sure though.

That is awesome advice, Audrey! My exact date is April 1st, so I have until that day to get my balance as low as possible – or completely paid off.

While this has been great to give me some wiggle room, to be honest it hung over my head the entire time. I never forgot about it. I don’t ever want to have to rely on this again. That said, I’m grateful for the function it served and the time it gave me. Definitely learned my lesson for sure.

It’s so good to hear from you. I hope you’re well. Thank you for sharing your insights!

So if you have the money in savings it’s better to use that than do a balance transfer? I hate that 3% fee, I get the saving aspect but still can be a lot.

Would definitely depend on the person and situation, but savings are a lot easier to replace than having to make payments back on a card with set times and deadlines. With savings, you can pay yourself back whenever – as long as you replace it eventually. I’m targeting to have 6 months of expenses saved in an account in case anything major pops up down the road – and something definitely will eventually!

Your right about that payoff deadline it comes fast!

15 months seems so long and luxurious in the beginning, but then it gets super real super fast! Thank you for reading and commenting, Boonie!