Also see:

- Confirmed: RadPad Earns 3X ThankYou Points With Citi AT&T Access More Card

- The best card for shopping at Costco is… Citi AT&T Access More?

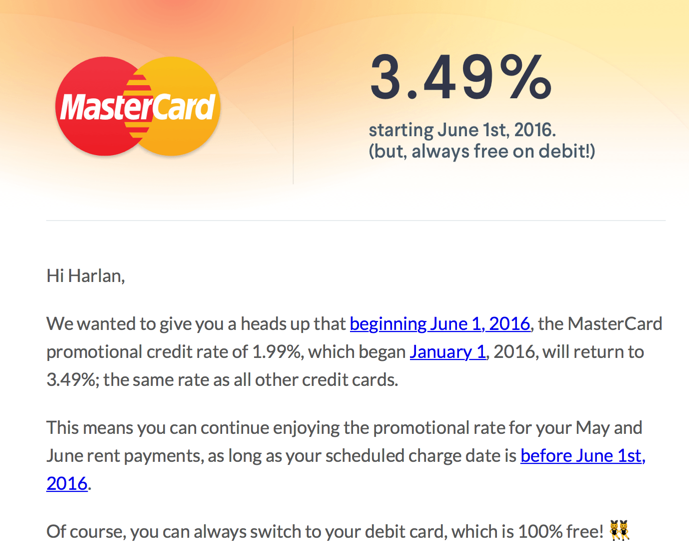

- Bye to RadPad, Hello to Plastiq for 2% Bill Payment Fees With MasterCard (Including Mortgages and Utilities)

Here’s my experience to add to the mix.

Getting the Card and Buying an iPhone

- Link: Citi AT&T Access More card

- Link: AT&T cell phone shop

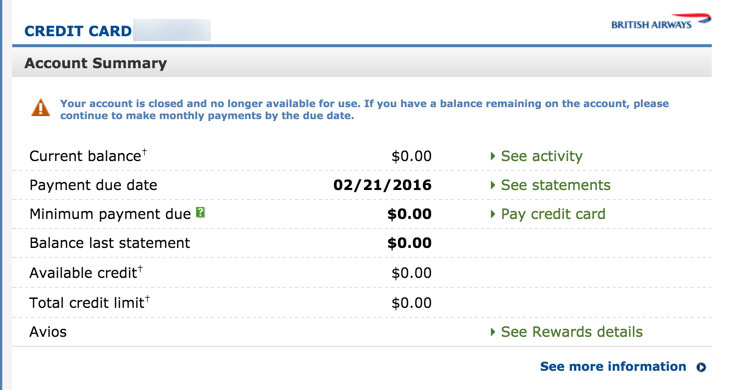

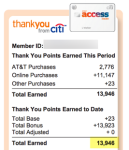

I applied for the Citi AT&T Access More card in late January, and received the card on February 2nd, 2016. That same day, I bought an iPhone.

Here’s the link Citi gives you to shop for a new phone – it won’t work unless you click through from your Citi account because it tracks your purchase, much like a shopping portal. With that in mind, it’s a good idea to turn off your ad blockers so the purchase is tracked correctly.

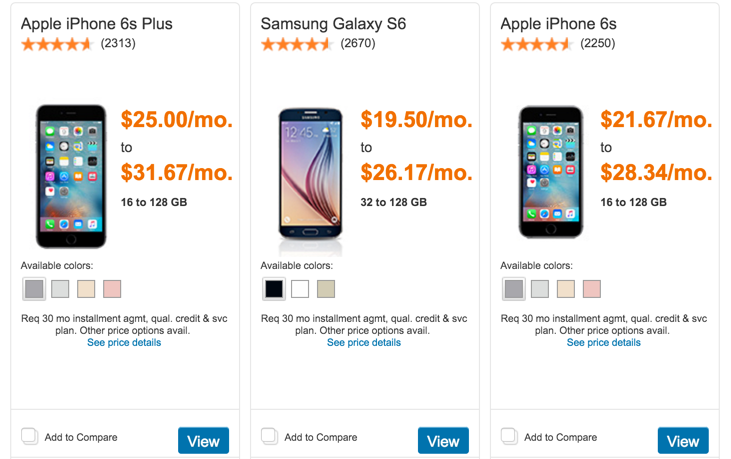

The selection of phones is the exact same as if you navigate to AT&T’s cell phone shop.

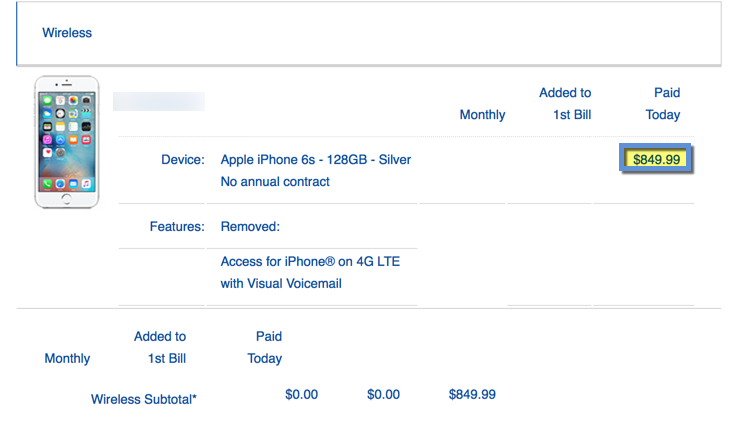

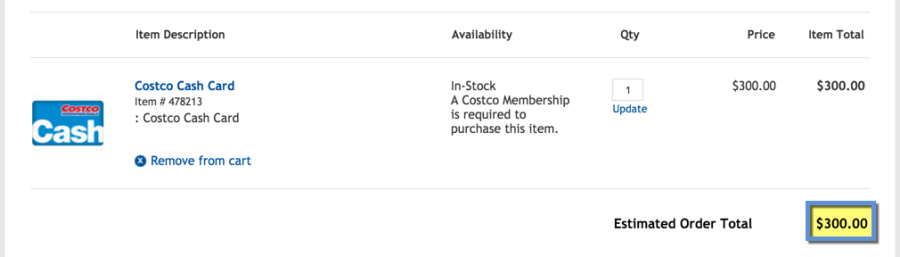

I sprang for an iPhone 6S with 128 GB of memory. The taxes for New York were ~$75. After the phone credit, that’s like paying ~$275 for a brand new phone with a lot of memory to burn through.

I had an iPhone 5 with 16 GB and was tired of deleting apps/pictures/the entire phone every time it needed an update.

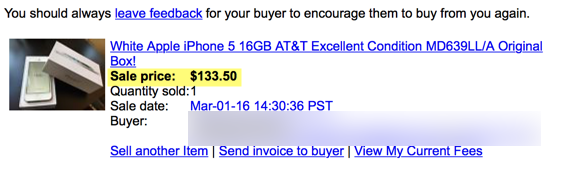

I sold it on eBay for ~$134.

There’s a FedEx ship center 2 blocks away. So I popped in and sent it. It took maybe 10 minutes to list and 10 minutes to ship.

Plus, the sale brought my out-of-pocket cost for the new iPhone down to ~$141 after taxes, which is a screaming good deal.