Micro-investing platform Stash introduced a debit card this week with an interesting proposition – earn .125% rewards on every purchase in the form of stock. If you spend at a publicly traded company, you’ll get a slice of their stock.

And if they’re a private company, your rewards go into a low-cost Vanguard ETF.

That’s great, but if you want to earn stocks, just get a Fidelity Visa (learn more here) for 2% back and buy whatever fund you want. Right?

Stash says they make it easier by delivering your rewards instantly and automatically. And sometimes bonuses go up to 5% back.

Today I got an email with the subject line: “Forget points. The Stash debit card has something better.” 😲 That got my attention.

Me? Forget points? I think not, especially for such low earning rates

But it does raise an interesting question: travel rewards for Now You, or invest for Future You? And I dunno, but getting 5% back as stock might be worthwhile sometimes. But I wonder how much I could really earn from that…

Stash Stock-Back review – is it worth it?

- Key link: Sign-up for Stash and get $5 free

Their email says:

At some point in history, banks invented points. Those were cool. But the problem? It’s hard to know what they’re really worth and their value doesn’t really grow over time.

With the Stash debit card, you can earn something more powerful when you spend: stocks and ETFs that can actually grow.

Interesting. It’s that whole debate of if you bought Apple stock in 1990, it would be worth a zillion smackaroonies today.

So if you spend a lot at a publicly traded company, you’ll earn more of their stock – automatically.

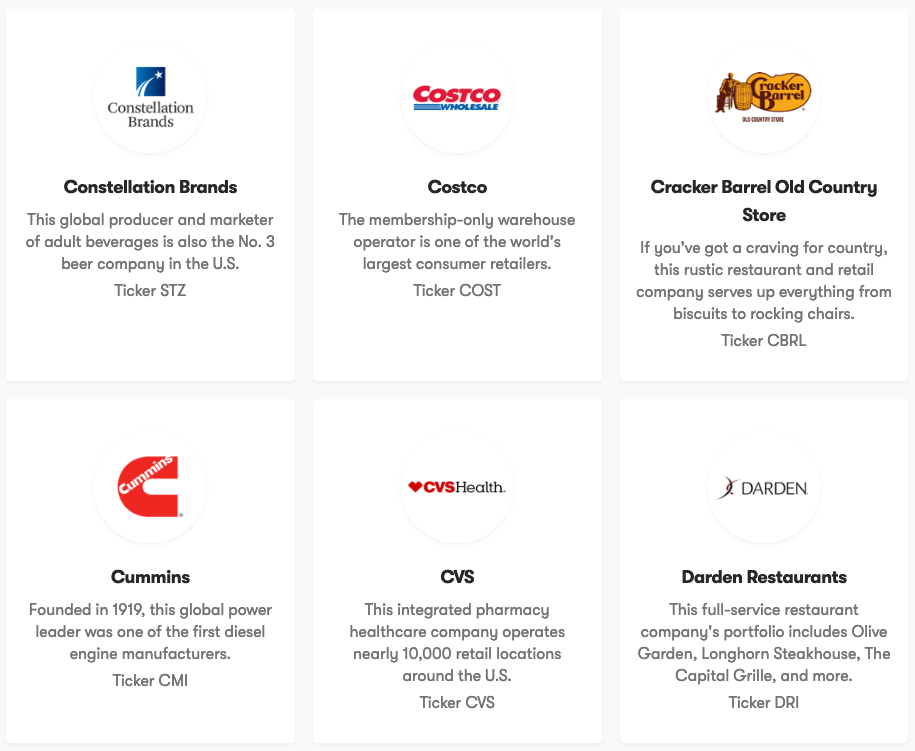

Earn fractional shares in tons of companies

That includes restaurants, gas stations, grocery stores, you name it – they’re on the list. And if not, your reward goes into shares of Vanguard Total World Stock ETF, which is a pretty good fund with very low fees.

But better than points? I dunno about that one…

By the numbers

At .0125% back, you’d have to spend $4,000 (!!!) to get $5 in a fractional share of a company’s stock.

Whereas with a 2% cashback credit card (like this one), you’d get $80 in rewards for the same spending.

Stash says:

Upon a qualifying debit card purchase, you will earn a fractional share of Stock. Stock reward amounts will be a dollar amount equal to 0.125% of the aggregate amount of the qualifying purchase, or, if greater, a fixed dollar amount of $0.01 per qualifying purchase.

Which means for that $5 coffee purchase, you get a penny, and for a $500 Costco run, you’d get… 63 cents. HARD PASS.

If you spend a lot, the cumulative rewards are higher with a good ol’ 2% cashback card, like the Fidelity Visa (learn more here), which also has a $100 cash bonus when you spend $1,000 within the first 90 days. Plus, you can auto-sweep the rewards into an IRA account. So why not get that one and be done with it?

Two parts.

One – convenience.

With Stash, your rewards are delivered automatically and invested right away. With a cashback rewards card, you have to wait for them to build. And with the Fidelity Visa, once the funds are in your account, you still have to go in and buy the fund you want. So there’s a bit more to keep track of.

Two – it’s a debit card.

No credit inquiry, and accessible to peeps with a low credit score who can’t otherwise access points or cashback credit cards.

That’s a HUGE plus for a bank account that’s free to keep and use. I wish my little brother would get this until his credit is good enough to open travel rewards credit cards.

Most of us in the points hobby don’t consider this aspect of earning rewards, but there’s a whole subset of people who have less-than-great credit. I always say to earn some type of reward for your spending. This could be a great gateway for a lot of people.

And because it’s an investment, you have the potential to get a bigger return down the road.

The points angle

OK but Stash said to “forget points.” Say you eat at a restaurant chain. Would you rather earn 3X or 5X flexible bank points, or .0125% back for a portion of their stock?

This is the short game vs. the long game.

That .0125% can grow to be worth much more (in 10+ years) than 5X earning today.

But that’s where I’m caught up. If you’re really that concerned with your future self, wouldn’t you go through a little hassle to use a 2% credit card instead (assuming you can open credit cards) for better earning?

And if you’re not, then… wouldn’t you want the travel rewards now?

So who would want the Stash Stock-Back?

They got my attention when they said they’d have bonuses up to 5% stock-back. If I were to pit 5X points against 5% back as stock, that’s a harder choice. And would definitely get me running the numbers.

As it stands, you might sign-up for Stash if you:

- Can’t open premium travel credit cards

- Want a rewards debit card

- Are interested in potential 5% back as stock with limited-time promotions

- Want to save and like the ultimate convenience of automatic rewards

I do like the idea of making investing open to everyone

There’s a $1 monthly fee for balances under $5,000.

Granted, Fidelity and TD have fee-free funds with no minimums, but I get how it can be intimidating to begin. But ultimately, I’d rather have someone start investing than put it off. And if Stash is the catalyst that gets you going, then I’ll all for it.

I might sign-up for the debit card just to see what the promotions are like. Cuz Future Me might like 5% stock-back. I don’t think I’d keep money in the account, though – would just make a transfer if something good popped up.

Bottom line

Stash stock-back certainly introduces an interesting gedankenexperiment: earn .0125% as automatically invested stock every time you make a purchase, or earn points?

Would you rather save long-term with your rewards, or get a return now in the form of travel or cashback?

Ultimately, I see this as a great beginner tool aimed at the unbanked. If that’s you, I say go for it. Although as a points fan, I’ll say I’m interested in any promotions they might run. I don’t think I’d use it often because there are so many great ways to stack travel discounts with points.

Fun to consider, but I’ll stick with points TYVM. I will keep an eye on this though – here’s my link to sign-up and get $5 free if you want to check it out, too.

Before I sign off, I’m glad to see investing discussed and marketed toward millennials. We don’t have pensions, and Social Security will not might not be around by the time we’re 70. We have to build our own retirement. If Stash is a step in the right direction because it’s approachable / cool app / easy to use – then I’m all for it.

Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

It says the stock back is only .125%, not 1.25%. “You’ll earn 0.125% Stock-Back on all of your purchases every day and up to 5% Stock-Back at certain merchants with Stock-Back bonuses. For a full list and more details, see the terms and conditions.”

Oy, that’s even more rough. I’ve updated the post. Thanks for the catch!

You still the math correctly though.

$5 Starbucks = $0.01.

$500 Costco spree = $0.63.

This is not a good deal. Better off with Discover debit 1% or Empower

Miss the author’s point? Yes, for him Airline miles today are better than .125% ETFs 10 years down the road. But, Stash is an investment app targeting new investors who don’t have a lot to invest. A lot of folks like the convenience & benefit of everyday purchases turning into shares of stocks with growth from compound int and automated purchases on a regular basis.

Benefits to Stash’s Stock Back debit card’ features:

• automatic, no steps to take, no transfers, etc

• Stock Back is 0% interest forever, Credit cardholders pay interest on a ‘points card,’

• A few things I buy on a daily/monthly basis are recurring stock investments in Disney, Apple, Amazon, Sprint, Netflix, Hulu, Walmart, Uber & Xfinity. Every month!

• .125% in 10+ years is more than 1% today.

Totally agree. I haven’t seen any 5% back promotions yet – that’s about the only reason I’d be interested, but even then… yeah… #teampoints

Very irresponsible to push people to a credit card you know most won’t pay that off in a month. It’s 1% another 1% if you do direct deposit and another 1% if you do the plus plan. No credit cards point scam is better than that 10 years those socks will be with more than points with credit card with 24% interest rates. Right now u pay hulu bill if you already have the 3% they match it.

Exactly, Chuck. I think some of these posters miss the point that Stash is an ‘investment’ app. Most people using it aren’t worried about 1% of anything today, but are more concerned with finding creative ways to save & invest their money.

Like you said, whats the point in earning 1% when you pay 7% – 24% in interest every month? The way I see it, the 1% points earned are worthless once you pay any interest.

I’d much rather be ‘paid’ .125% of recurring stocks in Disney, Apple, Amazon, Sprint, Netflix, Hulu, Walmart, Uber & Xfinity every month for 10+ years than be ‘paid’ 1% today for purchases that also ‘charge’ me 17% interest.

Your article has tons of typos that say .0125% so you should remove the 0 so it says .125%.

Also you are incorrect in your calculations because you will get 5% for shopping at any company that is traded on Stash. Costco and Starbucks are traded on Stash so you will get 5% back in the form of a stock. If you want to you can sell that stock and put it in a mutual fund or withdraw the money.

5% back at Walmart, Amazon, Target, Starbucks, and gas stations is pretty huge and your article is misleading because you didn’t take the time to look up which companies are traded on stash. I would love to see an updated version with more accurate calculations.

I can see a use for it – I have a bunch of chase cards and I try to keep my balance low and pay it off every month as I don’t hold a monthly balance! Paying 26% apr negates any points earned! So when my credit cards start getting out of hand mid month and I see it’s getting away I start to pay it down and I switch to using my debit card – id rather use this which offer some sort of reward than my chase debit card let’s say that offers nothing lol – I am a strict philosophy where I try to keep my credit card as if I’m spending cash . So if I have to keep a balance I switch – I got the stash debit card I threw a couple hundred bucks on it and used it a few times

from september 1st its possible earning free shares on all consumer brands you spend money with via http://www.bitsofstock.com ; i think this is much better than what stash is offering. With bits you get around 1-5% stock back on all purchases …. i’d choose that one