There are a lot of promotions out there right now. Due to coronavirus, many banks added bonus categories to their cards to encourage more use – which is great! The downside is it becomes easy to forget your other cards.

I often recommend downgrading cards with annual fees to their no-fee counterparts to preserve the credit line and history. Older accounts in particular can age your overall credit and lower your utilization rate, which can help your credit score.

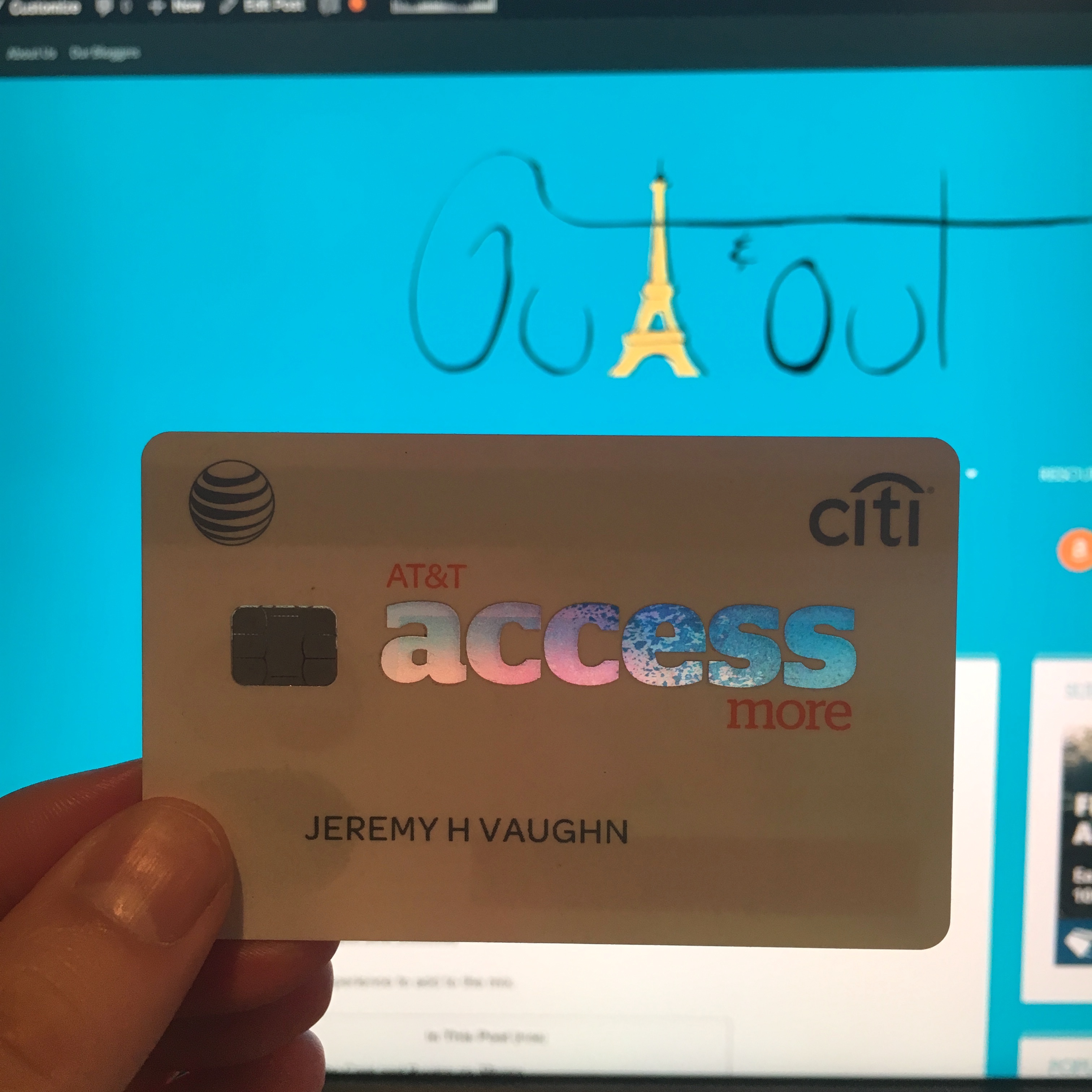

But! Because these cards are free to keep, it’s easy to stick ’em in a drawer and forget about them. Like I just did with my US Bank Radisson Rewards Visa. 🤦🏻♂️

I got a letter in the mail saying my card was closed effective immediately and to destroy it because the account was inactive. Dang, US Bank – you know how to break up, don’t you? Give a guy a warning!

Goodbye, valiant soldier

So this is your reminder to use ALL your credit cards. Especially if you have a couple dozen floating around out there like me.