I love when an annual fee posts on a Citi card. Because that means it’s time to pick up the phone and ask for Citi retention offers. While Amex is sometimes generous, I’ve found Citi is the best at giving incentives to keep their cards – especially those with annual fees.

I currently have 6 Citi cards (3 AA cards, Prestige, AT&T Access More, and Rewards+). And called because the fee on my Citi Prestige just posted.

While I’m excited about keeping that card this year, I figured I’d ask if they could scoot bonus points my way, especially since I depleted them to go to Puerto Vallarta again.

There was nothing available for that card, but then I asked the helpful agent to check the others.

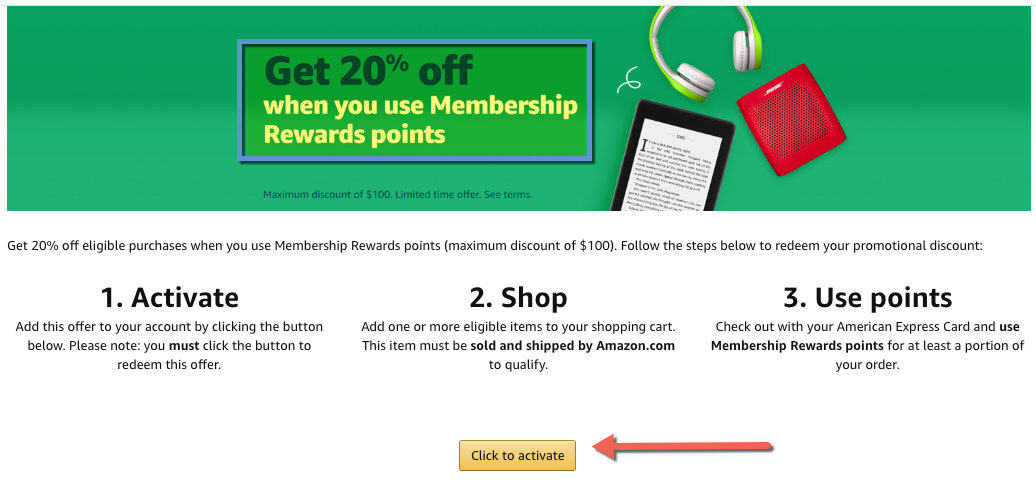

I call about once every 6 months – every single time, I’ve gotten at least 1, and usually more, worthwhile deals. This time was no exception.

If you have Citi credit cards, it’s always worth calling for a retention offer

Here’s my latest!