About a year ago, I started seriously tracking my net worth. And every month, I’ve posted what I call Freedom updates. Obviously, 2020 has been a wild ride and a lot has happened. I’ve had months where I’ve been way up and way down. Sometimes by tens of thousands from month to month.

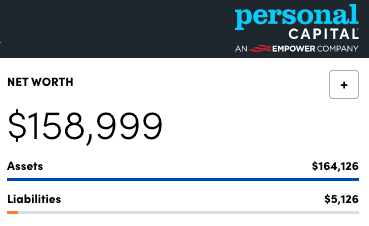

After bouts of whiplash, I want to look back at where I started – before I sold my condo in Dallas and Covid-19 hit – and compare where I am now. As of today, my net worth in Personal Capital is $158,999 (darn that extra dollar lol). I’m up over $60,000 from the end of last year. And currently at 31.8% of my goal of a $500,000 net worth.

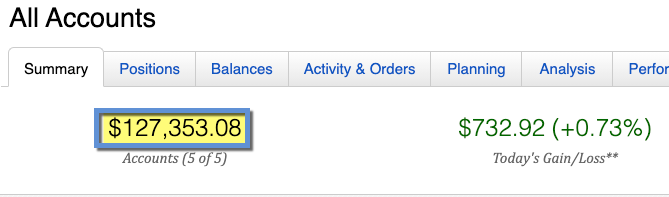

“They” say investing your first $100K is the hardest. And now my investments are sitting at $127,353. I’m contributing 30% of my paychecks to my 401k. And come January 2021, I’ll dip into my savings account to max out the $6,000 Roth IRA contribution early in the year.

This sure ain’t where I began. Ain’t where I end, either!

But before I get into all that, I just want to celebrate my overall progress. Despite everything, I averaged $5,000 per month in net worth gains over the last year. And now that I have momentum built, I’m hoping it’s just a short jump to the next $100K. Onward!

November 2020 Freedom update

Last year, my goals for the following five years were to:

- Buy as many investment properties as I can (probably two) – $TBD

- Max out my 401k every year – $95,000 ($19K x 5)

- Max out my Roth IRA every year – $30,000 ($6K x 5)

- Save $20,000 in a savings account

- Pay aggressively toward my mortgage and build more equity – $50,000

- Pay off my car loan – $10,000 (my car is holding its value really well)

- Hope for continued appreciation on my condo and returns on my investments – $???

- Save and/or invest my bonuses, any blog income, and tax refunds – $???

Wow, a lot has already changed (but we knew that the entire time, eh?). I no longer have any interest in buying property, I’ve hit my first savings goal, and sold my condo (and therefore have no more equity). I’ve also paid my car loan down to ~$3,400.

This image is here to give your eyes a small break

I’ve tried to catalogue the evolution, but for 2021, my goals are to:

- Max out my 401k – $19,500

- Max out my Roth IRA – $6,000

- Save $30,000 in a savings account (I want to be cash heavy and currently have $20,000, so $10,000 more)

- Finish paying off my car loan – $3,400

- Put any extra income into a taxable brokerage account – $???

I find it fascinating how goals evolve. I’m also proud of myself for letting my goals evolve and not being so rigid as to prevent that from happening. The calibrations are clearly working, and compound interest is starting to double down and work in my favor.

As good as reaching ~32% of my goal feels, I can already imagine how good reaching 50% of it will feel. And it’s so within reach!

Where I’m at

Last month, I declared I was at my best-ever net worth.

Boom shaka laka

This month, it’s true again. As long as I can maintain, I’ll expect each month to be better than the previous one, so I’ll retire that “best-ever” phrase and just keep rolling. If 2020 was any indication, that won’t always be true. But at least I can be less surprised and butt-hurt about it.

Up and up, out and out

Of my overall net worth, over $127,000 of that is tied up in index funds. This is where the compound interest gets to work its magic, and where I’ll be focusing most of my efforts in the upcoming year.

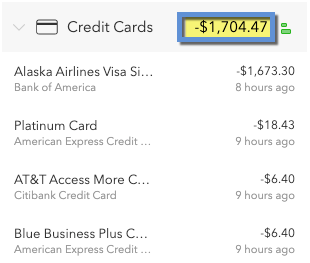

Yassss, it’s shrinking so fast

This time last year, I had $20,000 in credit card debt. But I bucked up and paid so much of it down. Now I’m so close to being done with it. I can’t tell you how relieved I am about this.

Even though I’m interest-free until September 2021, the psychological benefit is worth it to see this number at $0. Finally. One less liability causing friction to my momentum. ⚡️

What. A Year.

Finally, wow – what a ride 2020 was. The big dip in March, all the smaller dips, then increases felt like a rollercoaster. If you can imagine riding up and down all those bumps and peaks and dips. As mentioned, most of my cash is invested in index funds and I try, god do I try, to keep my eyes off my portfolio. But where I was a year ago and where I am now – that difference – I mean…

I’m glad I stayed the course and forded the rivers or whatever. It wasn’t easy. I’m still learning to keep my emotions out of my investments. It’s a lesson well worth learning, and a slow one. Maybe the biggest one I learned from such a volatile year. 🕯

By the numbers

I started a new table with updated goals for 2021. And later this month, I want to finish filling them in around the edges in my next update. 💘

| Current | Last Month | Change | 2021 Goal | ||

|---|---|---|---|---|---|

| LIABILITIES | |||||

| Credit cards | $1,704 | $3,023 | -$1,319 | $0 | |

| Car | $3,422 | $3,422 | xx | $0 | |

| ASSETS | |||||

| Roth IRA 2021 | $0 | $0 | xx | $6,000 | |

| 401k | $26,359 | $21,666 | +$4,693 | As much as possible | |

| Overall investments | $126,669 | $115,449 | +$11,220 | As much as possible | |

| Savings | $27,099 | $30,065 | -$2,966 | $30,000 | |

| Net worth in Personal Capital | $158,599 | $148,641 | +$9,958 | $500,000 | Track your net worth with Personal Capital |

Here you can see I’ve deleted previous goals that were completed, and updated everything across the board.

My liabilities are shrinking and assets growing. I’m down to just $1,704 in (0% APR) credit card debt, which I can wipe out completely with my next paycheck or two. And then, I’d like to get rid of my car note and be done with it.

I’ll also take some of my savings to max out my 2021 Roth IRA, then focus on filling it back up to $30,000. Finally, I’ll continue to route as much as I can into my 401k, and then send extra income into taxable investments. It sounds easy the way I’ve just typed it, but I expect it will take me all of 2021 to accomplish, especially based on my progress in 2020.

November 2020 Freedom update bottom line

I have much more news I can’t wait to share in the next update. Life continues in its way to have new developments, and it’ll translate as moves and new opportunities next year.

2020 was about being patient and staying put. I hope 2021 is about movement and release because I, like most, am pretty pent-up. Especially in the travel department.

This is definitely a marathon

I have 1,360 days to reach my goal of $500,000 net worth. If this was any indication, I will hope to grow my net worth by another $50,000 by the end of next year. And with the magic of compound interest and some knuckling down, who knows – maybe I can reach $250,000, which is 50% of my overall goal.

Index funds, a strong cash position, and eliminating liabilities is the plan, as well as more developments I already know about but can’t mention just yet.

Thank you for reading this! If anything, I hope it inspires you to start investing, keep investing, or just give you food for thought. Stay safe and stay scrappy out there. ✨

Are you updating your financial plans for 2021? What are you fine-tuning in the upcoming year? And also like… was it a good year overall?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Great progress, Harlan!!

Thank you, Angie! <3

Congrats on your progress. But to nit pick – you aren’t earning compound interest. You are earning returns tied to your investments but it’s certainly not compound interest

You’re right! Nit picking is good – I’ll keep that in mind and be more specific in the future. Thank you for reading and commenting!

Congrats!

Thank you, John – for reading and commenting!