Time to update my FoundersCard review for 2022! I’ve been a member for 8 years by now. Each year, they add more (and more useful) benefits, keep the best ones, and refine their partnerships based on member demand and use.

The upshot is making the most of even ONE perk can outweigh the $495 membership – and the rest is gravy. And when you sign up with my link, your rate will never go up.

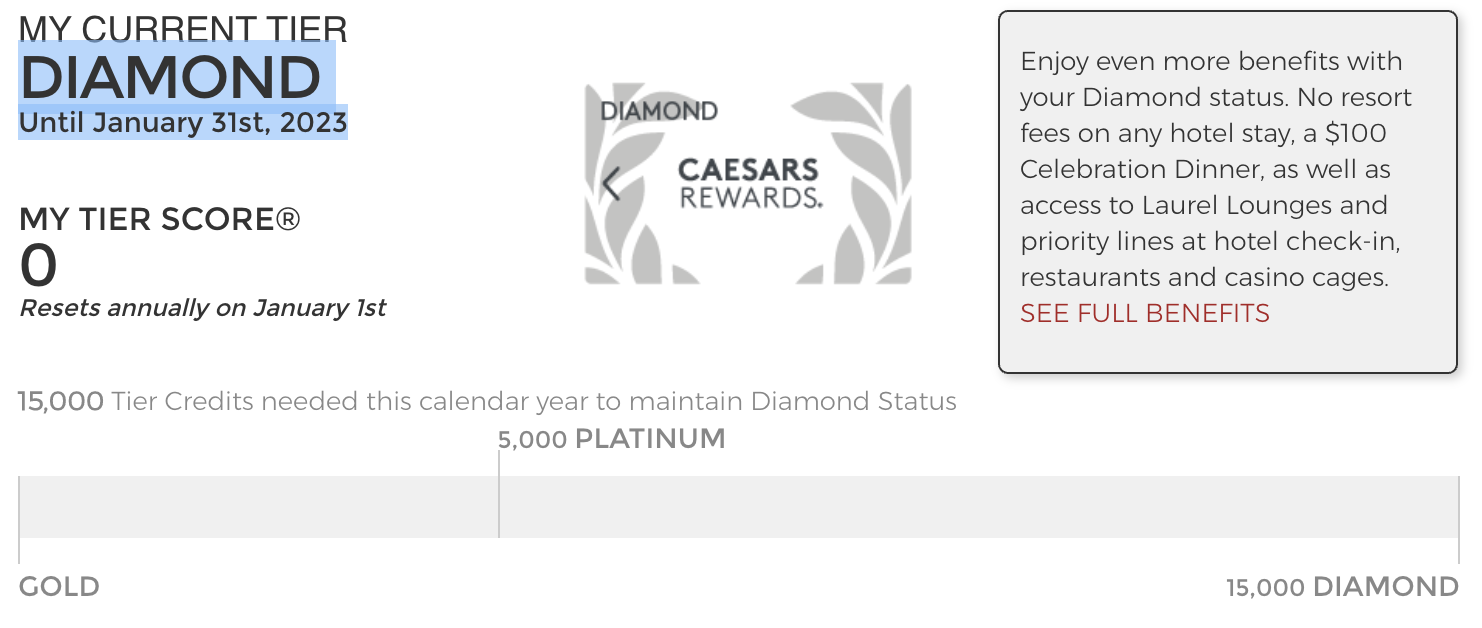

I’ve used the 15% AT&T discount, Hilton Gold elite status, and Caesars Total Rewards Diamond status (which is back this year through January 2023!) to cover and exceed the membership cost.

And there are new benefits for 2022, mostly focused on business and lifestyle. A couple of the travel benefits have gone away, but I believe that’s reflective of where we currently are with Covid-19 and that they’ll return. Until then, what’s left is still a long list of benefits.

Has it really been 8 years? Just renewed my FoundersCard membership again as a Charter Member

Here’s everything to know before you apply for membership.

FoundersCard Review 2022

FoundersCard is a membership built for small business owners and entrepreneurs. And the benefits reflect that – especially in 2022.

But many of them, particularly travel and lifestyle benefits, would be useful to most people. Definitely if you’re a frequent traveler. And if you’re not traveling this year, a fresh crop of small business benefits can easily make up for it. It just depends on what you personally find useful.

FoundersCard breaks down their perks into 4 categories:

- Travel

- Business

- Lifestyle

- Hotels

Over the years, I’ve saved with from discounts with AT&T, elite status and offers for travel, a cheap trip to the Bahamas, and perks like free magazine subscriptions, free TripIt Pro for a year, access to a free private jet flight, and an event in Dallas with drinks and gifts.

Basically, if you can find 2 or 3 perks that make sense, you can do well with a FoundersCard membership.

With that, here are popular benefits in each category.

1. Travel

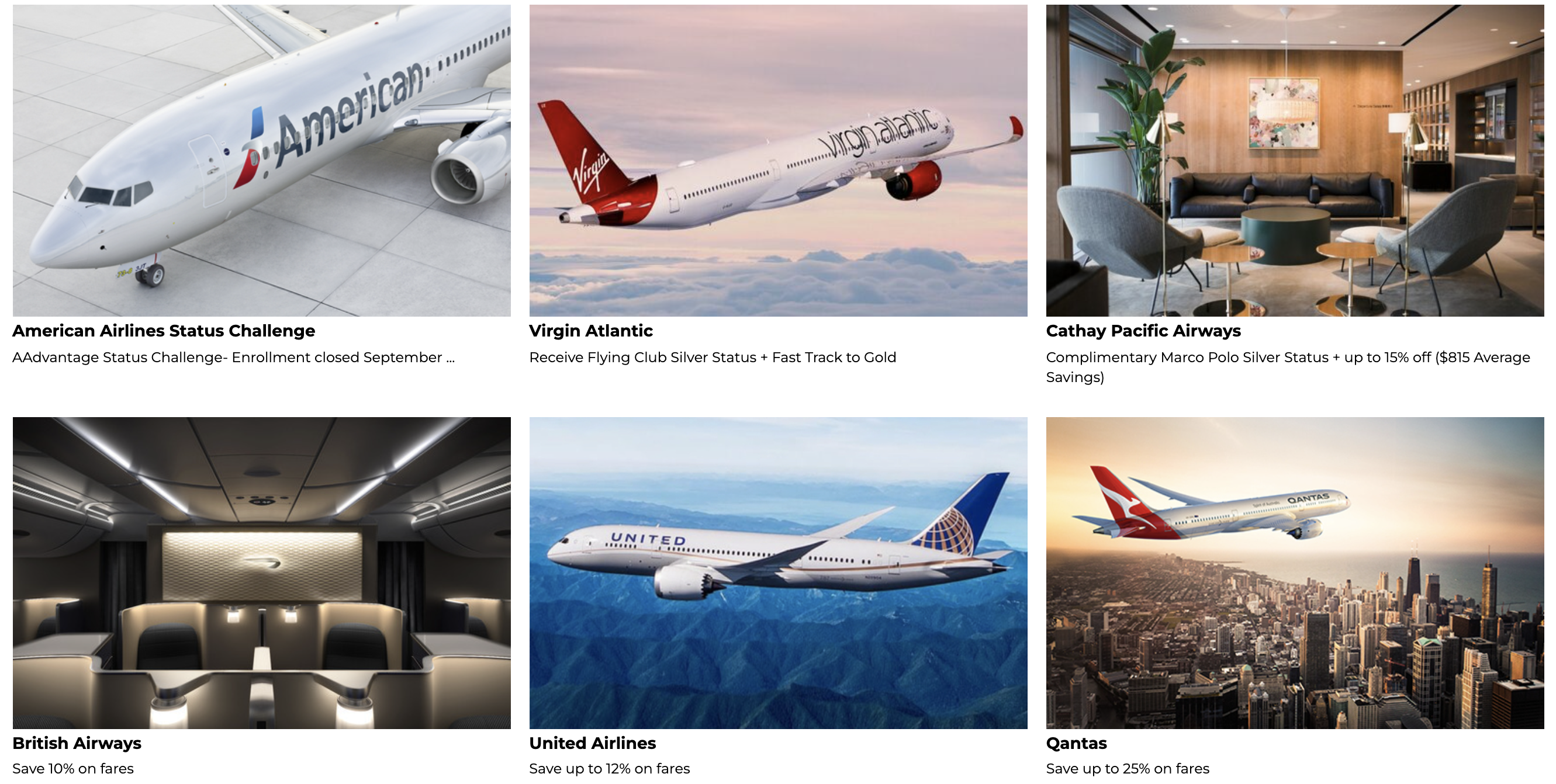

Airlines

- Alaska Airlines – 5% off most fares

- British Airways – Up to 10% off most fares between the US/Canada and the UK (this is also a perk of the Chase British Airways card)

- Cathay Pacific – 5 to 15% off flights and Marco Polo Club Silver elite status

- Emirates – 5% off fares from the US

- Qantas – Up to 25% off fares between the US and Australia/NZ, depending on flight direction

- Singapore Airlines – Up to 15% off select flights from the US

- Surf Air – Round-trip trial flight for $650 and two round-trip guest flights when buy an All-You-Can-Fly membership

- United – Up to 12% off select flights booked directly through United.com

- Virgin Atlantic – Flying Club Silver elite status after completing one flight, and a fast track to Gold status

If you pay for flights with partner airlines, these are easy savings

These aren’t huge discounts in most cases, but they’re certainly nice when you can use them. Especially if you get travel reimbursed or fly those airlines a lot.

Again, these aren’t as bountiful as they once were. Notably absent in 2022 is the American Airlines partnership, which has been around for as long as I can remember. I really hope they get back on board soon.

Hotels

- Caesars – Free Diamond status through January 2023 (waived resort fees on any hotel stay, VIP lines, $100 Celebration dinner, 20% off select room rates, free parking at most hotels)

- Hilton – Free Gold elite status through March 2023 (breakfast credits, upgrades when available, late check-out, 25% extra points on paid rates)

- IHG – Free IHG Rewards Gold elite status (must register by February 28, 2022)

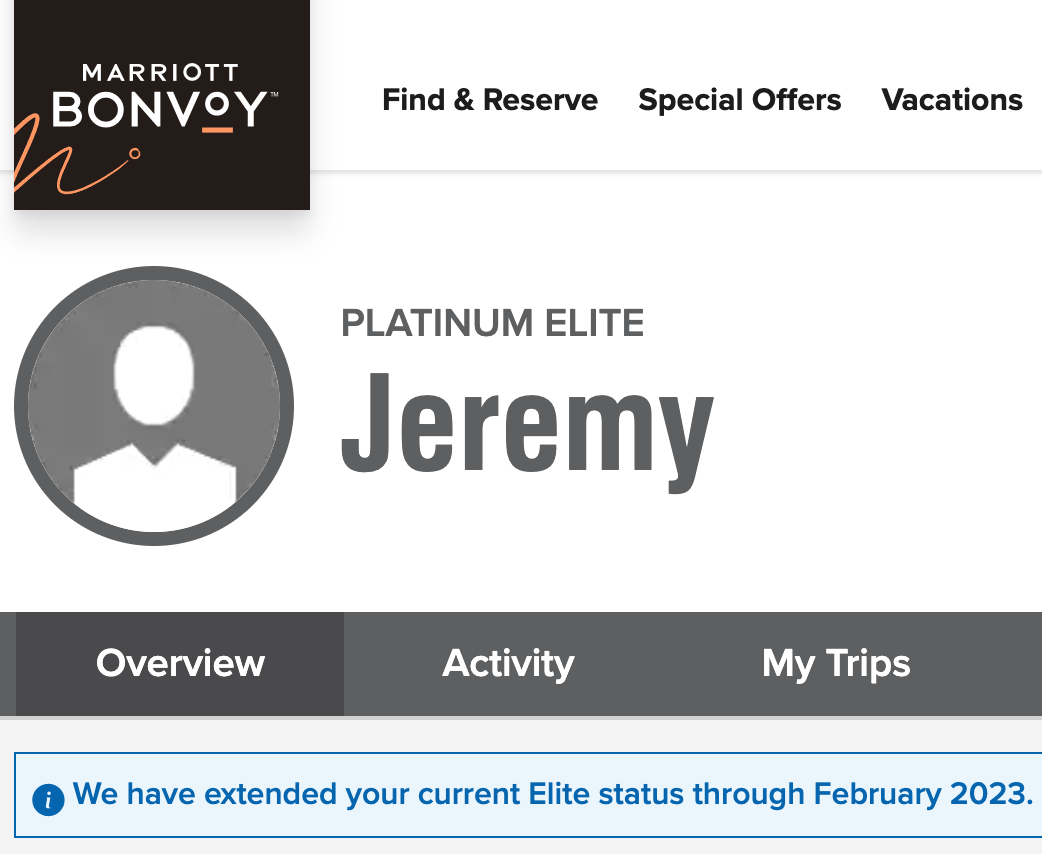

- Marriott – Fast track to Bonvoy Platinum elite status (stay 15 paid nights within 3 months of enrollment, and get status for up to a year)

I’m Platinum with Marriott Bonvoy thanks to this FoundersCard promotion

I love Hilton Gold status for the breakfast credit. And if you stay at Hilton hotels often, you can get:

- Bonus points

- Free breakfast

- Late checkout

- Room upgrades

- Possible lounge access, if you score a Club floor room

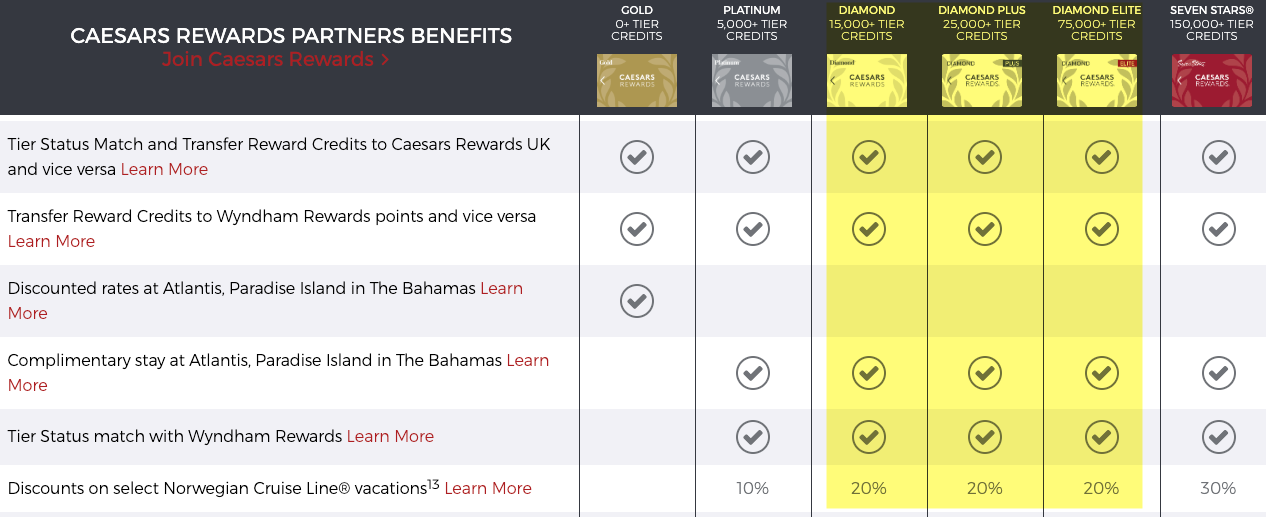

Caesars Diamond is back for 2022

This year, Caesars Total Rewards Diamond status is back, which gets you:

- $100 celebration dinner

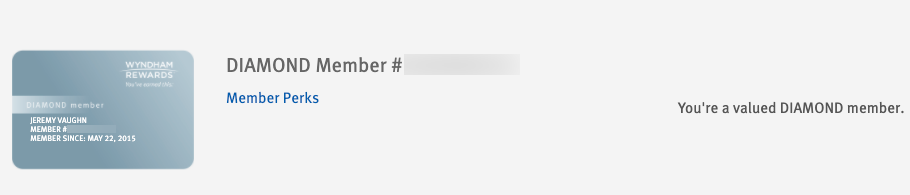

- Tier status match to Wyndham Diamond elite status

- NO resort fees

- 15% off best available room rates

- Occasional free nights at Caesars hotels

- 4 free nights at the Atlantis hotel in the Bahamas

I had a $100 Celebration Dinner at the Horseshoe Casino in Tunica, Mississippi, over Thanksgiving break.

If you like Caesars hotels, FoundersCard membership can pay for itself with one trip to Vegas

And when you go to Caesars casinos, you can skip most lines – and you never pay resort fees. In places like Las Vegas, that can save you a ton of time and money. Plus, if you like Wyndham hotels, you can match your status to top-tier elite status with them.

If you stay at Wyndham hotels, you can check in as a Diamond member there, too

I’ve always found a fun way to use my Caesars status, whether it’s just popping into one of their hotels for a free dinner, or trying my luck getting into the lounges (which is not guaranteed to work any more, and you may have to pay). But if they’re slow, they might just let you in. Never hurts to try – I’ve gotten in a time or two despite their official policy.

This is by far one of FoundersCard’s most popular perks

Car rentals

- Avis – Free Avis Preferred Plus Membership and up to 25% off rentals

- Hertz – Free Hertz Gold Plus Rewards membership and up to 20% off rates

- Silvercar – 20% off rentals (this discounts also comes with the Chase Sapphire Reserve card)

- Sixt – Platinum status and 15% off rentals

Save on your car rentals and get status that lets you walk right to a car and drive away

Again, these are all perks of certain cards. I usually rent through Priceline/Costco/Chase Ultimate Rewards. But it’s worth checking every time for the best deal (and I always do – I sometimes find cheaper rates with Hertz status than I find anywhere else, FWIW).

Other travel savings

Couple extra lil bennies.

- ZipCar – Waived setup fees for small business owners, $50 toward your first drive, and $35 annual membership fee

- TripIt Pro – Free year of Pro, then $39 annual rate for three years

TripIt Pro has become a must for me. Try it free for a year

I had a Zipcar membership when I lived in New York and loved saving on the initiation fees. Plus you get $50 in credits.

I’ve also gotten hooked on TripIt Pro. It’s become part of my travel organization and flow thanks to alerts for gate changes, delays, and connecting flights – often before the airline itself will ping you.

2. Business

Shipping, phones, and data backup

- AT&T – 15% off most wireless plans OR up to $10 off per line, per month on the AT&T Unlimited Elite plan

- Dropbox – 40% off new annual plans

- Phone.com – 1 free year

- UPS – Big discounts on shipping (up to 47% off)

- Zoom – 20% off Zoom services (10 license minimum), one free Zoom Rooms license, 10% off Zoom phone

Save 40% off a Dropbox annual plan

Promotion and documentation

- Moo – 20% off business printing

- Constant Contact – 15% off marketing tools and emails and a 60-day free trial

- Shopify – 20% off for a year after a 14-day trial, to have your own e-shop

- BizFilings – 25% off services

- Stripe – $20,000 in fee-free payments (!!!)

- Salesforce – Free 14-day trial and 50% off first annual subscription of Essentials

- Docusign – 15% off annual plans for the first year for a minimum of 5 seats

- HelloSign – 30% off first year of an annual Essentials or Business subscription

- Squarespace – 20% off first annual website plan

- Hubspot – 30% off software and a free CRM

- Namecheap – 20% off services (domain registration and web hosting)

Save on promotional materials, email services, and business filings – indispensable. And the Stripe $20K deal is pretty sweet

I’ve personally used these combined discounts several times. It really does add up. I’ve incorporated LLCs, written a will, and gotten business cards for the blog with the participating companies.

And the $20K in fee-free Stripe payments can pay for a FoundersCard membership all on its own, considering the fee is 2.9% + 30 cents per transaction. On $20,000 in payments, that’s $580 saved – at least.

These benefits are super-focused for where we are in 2022. Discounts on electronic signature services like Docusign and HelloSign, cheap domain registration through Namecheap, personal websites through Squarespace, and email marketing through Constant Contact. These are big, recognizable names and discounts many businesses and entrepreneurs can actually use.

Other business savings

- Dell – Up to 40% off Dell branded products

- Google Workspace – 20% off Standard and Plus plans

- Lenovo – Up to 60% off select Lenovo and Think products

- Office Depot – Preferred pricing up to 55% off in-store and online, and free next-day shipping of orders of $50+

- 1Password – 40% off Teams service

- Zendesk – 6 months free of sales and support service

- Slack – 30% off plan upgrades for the first 12 months

I’ve gotten unexpected heavy usage from FoundersCard’s business discounts

You’ll find most of the discounts and offers, especially this year, in the business category – and there are lots more. You can poke around with a preview to see them all.

3. Lifestyle

There are lots of discounts in this category, too:

- Mr Porter – $200 off your first $500+ order, free next-day shipping

- Entrepreneur magazine – Free 1-year subscription

- Adidas.com – 30% off most items

- Spafinder Wellness 365 – 15% off gift certificates

- ShopRunner – Free membership (although this comes with many credit cards, including all Amex personal cards and some Citi cards)

- Many gyms, including Crunch, Equinox, CorePower Yoga, and Pure Yoga – Preferred rates

Most of them are for online shopping at upscale clothing stores. But there’s also gyms, spas, flower shops, and lots more.

The lifestyle benefits are full of savings on gym memberships, clothes, and much more

I’ve used them here and there (like Mr Porter and an Equinox gym membership). And the free magazines were handy to toss in a bag to read during a flight or layover.

Everything here is a “nice to have” – not crucial, but a fun extra. And again, it adds up if you shop often at a few of the merchants.

4. Hotels

FoundersCard has relationships with hotel chains and independent/boutique hotels around the world. At 500+ hotels, you can get:

- Exclusive members-only rates

- Upgrades and extra perks

- More flexible cancellation policies

- No travel agent/booking fees

For example, at certain Marriott hotels, perks include:

- Complimentary welcome drinks

- More flexible cancellation privileges

- Spa discounts

- Free breakfast

- Discounts off the standard room rate

You get similar treatment at Park Hyatt hotels – although the specific perks are unique to each hotel.

Even better, you can book directly. So you’ll still earn credit toward elite status and enjoy your elite status benefits. The caveat is that only:

- 16 Marriott hotels participate (8 W hotels and 8 Ritz-Carlton hotels)

- 5 Park Hyatts participate

But there are many boutique hotels, including Arlo NoMad, Standard High Line, Ace, and YOTEL in NYC and Boston. And lots all over the world.

It’s aight

While this is a cool benefit, it’s certainly not all-encompassing. But if you have paid cash stays in a FoundersCard hotel city, you can get a few extras at places that don’t partner with Amex or Chase and their respective upscale hotel programs (Fine Hotels & Resorts and Luxury Hotel Collection).

The selection in Buenos Aires leaves a lot to be desired

I ran a search in Buenos Aires and turned up 2 hotels in the FoundersCard program. New York has 22. Tokyo has 6. Hong Kong has 5.

I don’t consider this a huge money-saver as it’s so limited, but nice to have in your back pocket. And worth checking the prices for paid stays at upscale hotels.

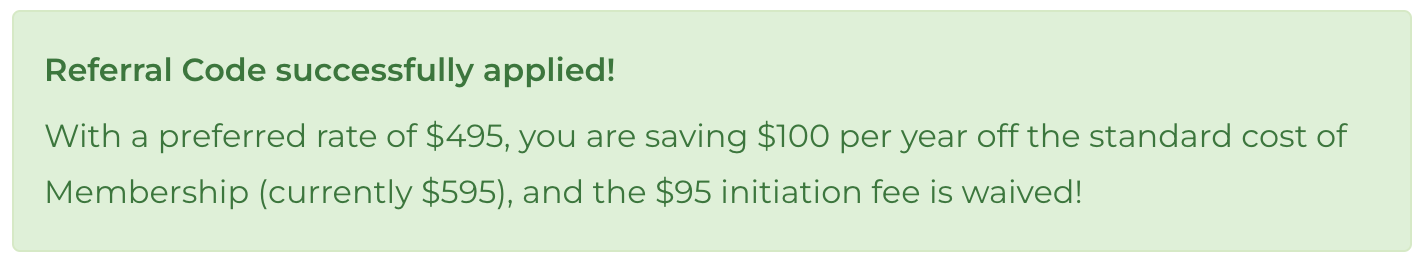

What’s it all worth?

As of writing, FoundersCard is $495 a year with waived initiation fees for Out and Out readers.

Boom

If you can make good use of 2 or 3 benefits, it can easily save you that much – and often more.

FoundersCard has a Chrome extension so you won’t miss savings online

For example, my AT&T phone bill is ~$110 per month for 2 lines. I save $15 per month with the FoundersCard discount (applied before taxes). That’s $180 saved per year on something I need anyway – and brings the net cost of membership down to $215.

I have easily saved that much with the:

- TripIt Pro discount (free for a year, then $10 cheaper for 3 years)

- Total Rewards Diamond status with $100 Celebration dinners and trip to the Bahamas (huge discounts with this perk alone)

- Marriott elite status for upgrades, lounge access, and free breakfast

Also, if you value hotel elite status, you can get Gold elite status with Hilton.

FoundersCard has become an invaluable part of my life, travels, and blogging business

The airfare discounts are also handy to save, if you fly those airlines often.

Using the deals = savings, not using them = not saving

It’s easy to completely cover the cost of the annual membership. But the real value is when you can use the benefits. If you do, you come out way ahead – $1,000s ahead, in some cases.

And if you don’t find the discounts useful, then skip it. 💥

The goal of FoundersCard is to give small business owners access to discounts typically enjoyed by huge corporations. In that way, it gets you more access, savings, and perks than you’d ordinarily have with a small company.

I’ve had my FoundersCard membership for 8 years. And will definitely keep it as long as keep up the value proposition.

Ready to dig in and explore?

Preview the membership here. If you like it, use promotion code “FCHARLAN818” to lock in the special $495 a year rate for life.

FoundersCard review 2022 bottom line

I hope this is a balanced review of FoundersCard. The upshot is: if you use the benefits, you can do well to recoup the entire annual membership fee – and much more. If there’s nothing that appeals to you, skip it.

I get enough return on my membership with the AT&T discount, which saves me $180 a year (this is irrelevant if you don’t have AT&T, of course). And all the other savings are easy and fun – which is the feeling I get from FoundersCard membership. It’s easy and fun. I love checking the new perks and using the various discounts that appear through the year.

Many of the built-in benefits are ancillary with co-branded credit cards. But here, you can access them without signing up for lots of cards.

As long as the value remains, I’ll keep FoundersCard. The savings are easy, discounts pop up often, and they’re engaged in the end product and user experience. It’s excellent for small business owners looking to access many of the same travel, hotel, lifestyle, and business benefits usually given to large corporations.

Interested? Preview the membership here. And if you want to apply, use promotion code “FCHARLAN818” to lock in the reduced membership rate.

If you have FoundersCard, what do you think of it? Have you gotten outsized value from your membership like I have?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You love Hilton for the breakfast credit? What does that mean? You love that you now are forced to spend the breakfast credit on crap from their food pantry? You love having 65% of your breakfast paid for using the breakfast credit whereas in the past 100% was covered? You love checking in as a room for 2, getting bfast credits for 2, and still not having enough to cover breakfast?

It sucks that Hilton downgraded the breakfast situation. But through the lens of FoundersCard, you get free Gold elite status, which gets you something for free as opposed to nothing if you don’t already have status.

Hi Harlan, this is probably really random but I saw your post recently from handful of years ago about starting a smaller slack group. Is that something that is still around? Any chance you would accept new member — I would be interested in contributing to smaller community on points and miles. Thanks!

Hi Dan! This didn’t really get off the ground, but glad to know there’s interest! I will look into this again and see what I can come up with. Really appreciate it!

Hi Harlan, thanks much for the quick response and confirmation. I’m definitely interested if that proceeds at some point. Thanks for all the good content here otherwise as well — I am now mulling over founders card. 🙂

Hi! Do you use the airline discounts? I am a recent member and can’t find how to book travel with British airways to get the discount ? Thanks

For British Airways, just click the link through the FoundersCard site. You’ll see “FoundersCard” near the search box and the discount is automatically included. Hope that helps!

Harlan

The current promotion for Caesars Rewards gives you upgrade to Diamond Elite status through Jan 2023, is that automatic or has to be requested upon joining Founders Card?

It’s not Diamond Elite, just Diamond, and you have to request it through FoundersCard.

This is what you have on your site:

Hotels

Caesars – Free Diamond elite status through January 2023 (waived resort fees on any hotel stay, VIP lines, $100 Celebration dinner, 20% off select room rates, free parking at most hotels)

I updated and removed the word “elite.” It’s regular Diamond status that you get. You can only get Diamond Elite by gambling or otherwise earning it.

Hi Handsome, do you know how long it took to get the Caesar status this year? the website went from 3 to 4 weeks but was wondering if it’s being done faster.

There’s also been a lot of talk this month about Caesar not matching unearned Wyndham and people not getting the dining credits. Do you know if that’ll affect memberships through FC? Thinking about signing up for trip

Why hello! I’m already Diamond through 2023, so it looks like they’re working their way through it. Hopefully it’ll be soon!

My personal feeling is that status from FC won’t be affected as it’s a partnership and advertised benefit, but they did add this to their site:

Important Note: Some Diamond benefits may require earned Tier Credits, including Caesars Bluewaters Dubai, Atlantis Paradise Island, and the Celebration Dinner.

So it’s hard to say, but I’m thinking they’ll let you keep the dinner just based off of my previous experience with the benefit.

Hi Harlan. I am sure you know by now but worth repeating. Your code does not access the 395. Fee you stated.

They state that 495. is the best deal they offer. I declined.

Hi Harlan. I am sure you know by now but worth restating. Your code does not access the 395. Fee you stated.

They state that 495. is the best deal they offer. I declined.

Hi Will! I didn’t realize it had gone up. I will go through and update this information throughout the post. Thank you for sharing and sorry that happened!

Can you share what the Equinox rates look like?

Hey James! IIRC, it’s a percentage off the normal rate – I think 20% or 25%. In Dallas, which is usually $160 a month, I got $30 off per month. So $30 X 12 = $360, which just about covers the FC membership for the year. Plus you get waived initiation and some other new member freebies like a free Pilates session, meeting with a trainer, etc.

It does vary a bit by market, but seems to be around $300 savings up front plus the ongoing discount. Hope that helps!

Appreciate the insight and information. I’m in NYC, does it show any of those rates? I think weighing if I should try FC and Equinox savings would definitely help in my decision.

It doesn’t show the individual clubs – you’ll have to specifically ask. I joined the one in Dallas, so that’s how I found out. This old TPG article suggests it’s around the same amount of savings:

https://thepointsguy.com/2017/02/maximizing-founderscard-2017/

Hello Harlan,

I signed up for the Founders Club card, however I do not see any of the airline discount links when I search under the travel benefits or united arilines. Did they remove the discounts, is there another place for me to find the discount on the homepage?

Hey JP, when you’re logged in, all the links are here: https://founderscard.com/browse_by_category/travel

That should work!

How exactly do I get a Caesars Diamond card after getting the Founders card? Is it something I can do online or do I need to show the Founders Card at a Caesars Rewards desk? Thanks for any info you can provide!

I was considering this card. Then I saw your face, and thought, “fuck no. that’s the kind of bellend that has one of these cards to stay in shitty Marriots and drive a BMW”. Thank you for your help.

Then fuck off and don’t get it. You’re welcome.

A DOUBT. CAESARS REWARD DIAMOND VALID 01 FEBRUARY UNTIL 31 JANUARY 2025. I WANT TO USE THE CAESARS BENEFIT IN JUNE 2025. IF I SUBSCRIBE NOW IN OCTOBER 2024 WHEN IT IS IN JUNE 2025 THE CAESARS REWARD WILL BE EXPIRED. SO IT’S BETTER I SUBSCRIBE TO THE FOUNDSCARD ONLY ON FEBRUARY 1, 2025, WHICH WOULD BE ENTITLED TO CAESARS REWARD FOR FEBRUARY 1, 2025 TO JANUARY 31, 2026 (WOULD INCLUDE BENEFITS DURING THE MONTH OF JUNE 2025). RIGHT? OR IF I SUBSCRIBE TO THE CAESARS BENEFIT THIS MONTH, WHICH EXPIRES ON JANUARY 31, 2025, I WILL BE ABLE TO RENEW THE CAESARS REWARD TO COVER IT UNTIL THE FOUNDSCARD SUBSCRIPTION EXPIRES (OCTOBER 2025), TAKING ADVANTAGE OF THE BENEFITS I WANT FOR JUNE 2025.

I WAIT FOR THE BEST OPTION.