Update 2/6/17: So… the entire premise of this post is incorrect. I flubbed this one, guys.

Because you get 2 credits and 1 charge so in the end, you really do get to keep your credit. My mind has been hazy this week and I apologize for the incorrect information, though it was well-intentioned guidance. Anyhoo, nothing to see here.

Huge thanks to my readers who pointed out my mistake in a guiding and gentle way. It means a lot to me – kind of super emotionally sensitive right now. You guys really are the best.

Oy. I had a slip-up with my Chase Sapphire Reserve $300 annual travel credit last week. Luckily, it wasn’t that bad.

But here’s a PSA of what NOT to do.

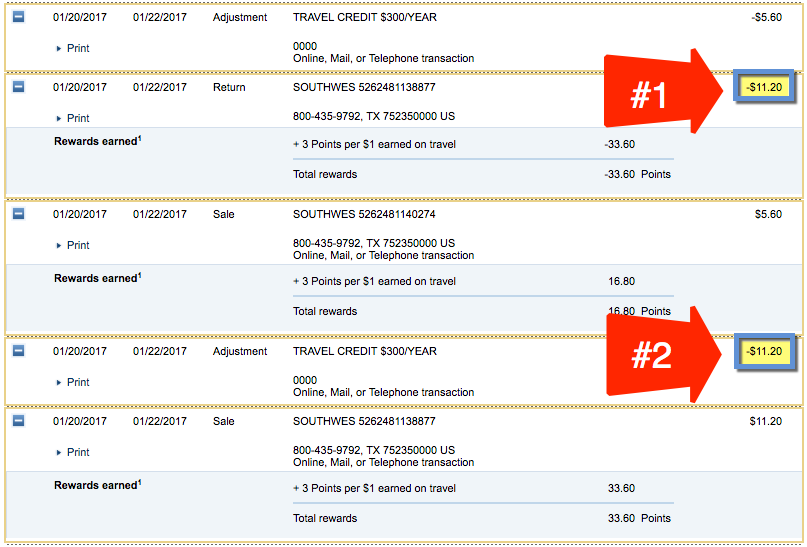

I booked a round-trip award flight on Southwest with my Sapphire Reserve. The taxes were $11.20.

Immediately after, I thought it better to have the trip as 2 one-ways so could lock in the price if plans didn’t change. Or have the option to change either (or both) legs down the road if needed. So that was another $11.20.

When I canceled the first ticket, I had the option to get a refund or store the money in my Southwest bank. I didn’t think it through, and impulsively hit “Refund.” Not good.

A couple of days later when the charges and credits hit, I realized what I’d done. I did get the $11.20 refund. But I lost $11.20 of my travel credit. It’s not a huge loss, but what if it was an entire paid flight?

A similar thing almost happened to me again this week at a hotel!

Another time I messed up

| Chase Sapphire Reserve® | 60,000 Chase Ultimate Rewards points |

|---|---|

| • 3X Chase Ultimate Rewards points per $1 spent on travel & dining • 1X Chase Ultimate Rewards points per $1 spent on all other purchases |

| • $550 annual fee | • $4,000 on purchases in the first 3 months from account opening |

| • Why this is my favorite card for travel and dining | • Compare it here |

I was in Austin all last week for work. And switched hotels mid-way to earn my full IHG Accelerate offer this quarter (the hotels were also a stone’s throw from where I needed to be). #TravelNerd

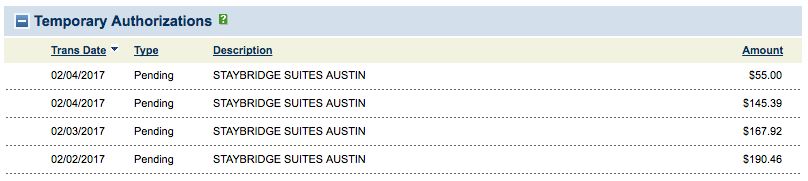

But I was in a hurry and left my Citi Prestige card in my backpack at the office. The desk agent said I could switch the card at checkout but “I need to swipe something.” So I handed over my Chase Sapphire Reserve… again.

Well I’ll be diddy danged if they didn’t post not only a hold, but the daily room rate for each day as separate charges. I stopped by and asked how it would work.

“Oh, we’ll just reverse the charge and give you a credit,” she said all casually. But it would’ve slurped up the remainder of my $300 travel credit – I would’ve lost the rest of the entire thing.

Had this been my first time using it this year, I might’ve lost it all. Because Chase has no way of “uncrediting” once it’s applied.

Luckily, I caught it in time to apply the final charges to the correct card. But sheesh, that got my heart rate up for a second there.

Don’t lose a cent of your annual travel credit

There are many situations where you could lose your travel credits.

For the Chase Sapphire Reserve, anything that comes back as a refund to your card can waste the $300 credit, like:

- Refundable hotel stays

- Refundable flight tickets

- Anything that codes as travel that you change or alter

And for Citi Prestige, the same thing would’ve happened in my earlier Southwest scenario. Now I’ve seen first-hand how easy it is to trigger the credit – and to lose it altogether.

The solution is to only use it for things you are sure you’ll use: flights you’ll definitely take, airport transfers for trips 2 days out, or plans that are absolutely firm. Because if you get a refund for unused travel experiences, you’ll get your money back… but not your travel credit.

Bottom line

- Link: Honest Review: Chase Sapphire Reserve 100,000 Point Offer

- Link: Honest Review: Citi Prestige 40,000 Point Offer

Yeah, it seems very “duh.” But anyone can make a mistake, especially if you’re rushed, tired, or not thinking clearly. Heck, it happened to me twice in one week.

Peeps always talk about how the annual fee on the Chase Sapphire Reserve is “really $150” after the $300 travel credit. And “really $250” for Citi Prestige after the $200 airline credit’s applied. But if you lose the credit because of a silly mistake, you’re paying full price. Don’t do that!

My advice is to use the credits as soon as possible. That way you get your money’s worth and get to offset the annual fees. Or if you decide to wait, use it for firm travel plans that are unlikely to change. Because it would suck to waste this otherwise valuable perk.

Has this happened to you? Any luck appealing to the Chase or Citi overlords?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!- Capital One Venture X Rewards—Earn 90,000 Venture miles once you spend $4,000 on purchases within the first 3 months from account opening, plus a $300 annual statement credit for travel booked through Capital One

- Ink Business Preferred® Credit Card—Earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first 3 months and 3X bonus points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year

- Amex Blue Business Plus—Earn 15,00 Membership Rewards points once you spend after you spend $3,000 in purchases in the first 3 months of Card Membership and 2X bonus points on up to $50,000 in spending per year with NO annual fee

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Wouldn’t it just be like being refunded twice, instead of losing the travel credit? You paid $11.20 to Southwest, then Chase refunded you the same amount. Southwest also refunded you when you canceled. So you got 2 refunds of $11.20. You’re still pocketing an extra $11.20.

That’s how I’d think about it… Or am I missing something?

You know what, you’re right. I flubbed this one. I haven’t been thinking clearly lately.

I’m gonna update the post because yes, you would end up with 2 credits and 1 charge in the end and therefore pocket one of them.

Thanks for commenting, appreciate it!

It’s actually a good way to get the credit without real spending.

Ya know, I just realized that. Then you could use the credit for anything, not just travel. Tricksy!

I’m in a similar situation but my credits for the Prestige hadn’t posted yet. I was thinking about it and looking at your photos when I came to that conclusion. Glad to have helped! Keep up the fantastic work you put into this blog 🙂

Thank you thank you thank you.

I’m shitting myself because I made this mistake. Booked a flight on Expedia and decided to canceled a day later. No fee charged from Expedia, but I noticed it used up my $300 dollar Chase Travel Credit.

Am I screwed? Or did I just get double refunded for the travel credit as mentioned by David? What’s your experience almost two months later?

Thanks!

So there was no fee ever charged from Expedia?

I *was* charged by Southwest and then credited from Southwest. If I wasn’t charged though, I think I’d be out of luck and would’ve lost the credit.

It worked out well for me but curious about your experience now. Any updates so far (I expect it might take a couple of days)?