Chase has 3 Ink cards targeted at small business owners:

- Preferred

- Cash

- Unlimited

Each accomplishes a different business goals by way of awarding bonus points in certain categories. And they all earn Chase Ultimate Rewards points – one of, if not the, most valuable rewards currency.

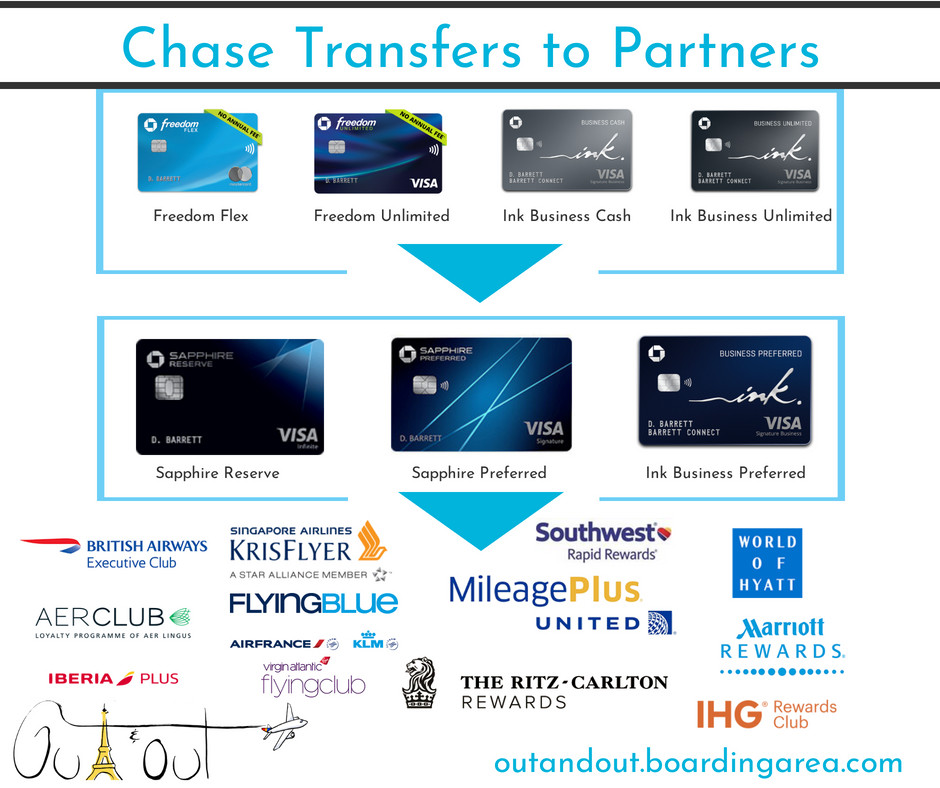

But only 1 of them gives you direct access to Chase’s travel transfer partners (it’s also the only one with an annual fee – the Ink Preferred).

Let’s look at what makes these cards compelling.

Chase Ink Business Cards – What’s Alike and Different

Before we begin, every small business should run their expenses through a business credit card. If you’re paying with cash or debit, you’re giving up rewards that could go right back to your bottom line. Or get you an award vacation trip.

My favorite small business credit card is the Amex Blue Business Plus (learn more here – and my review). That card has no annual fee, earns a flat 2X Amex Membership Rewards points on every purchase (up to $50,000 per calendar year), and has direct access to transfer partners.

Cool. So why consider a Chase Ink card? The HUGE sign-up bonuses.

I gifted myself a relaxing trip to Puerto Vallarta earlier this year, all paid with Chase Ultimate Rewards points

They’re worth $500 (for the Ink Cash and Unlimited), or a staggering $1,000 toward travel (with the Ink Preferred).

While that might make you sit up and take notice, be aware Chase won’t approve you for these cards if you’ve opened 5+ cards from any bank in the previous 2 years (except certain other small business cards, including Chase’s own).

Now here’s each card – and who it matches.

1. Chase Ink Business Preferred

| Chase Ink Business Preferred | 100,000 Chase Ultimate Rewards points |

|---|---|

| • 3 Chase Ultimate Rewards points per $1 on the first $150,000 spent on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines each account anniversary year • 1 Chase Ultimate Rewards point per $1 on all other purchases • Bonus is worth $1,250 toward travel booked through Chase |

| • $95 annual fee | • The minimum spending requirement is $15,000 on purchases in the first 3 months from account opening |

| • Amazing small biz card with best-ever offer right now | • Compare it here |

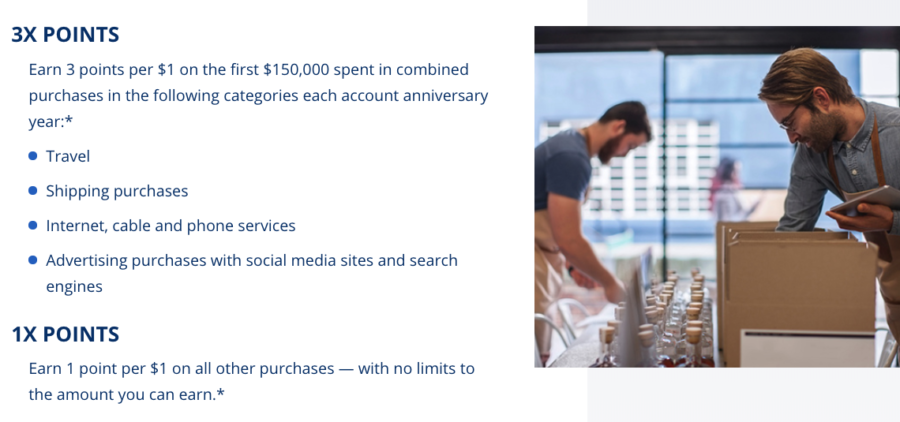

Bonus categories:

- 3X Chase Ultimate Rewards points on the first $150,000 spent on travel, shipping, internet, cable, phone service, and advertising, each account anniversary year

- 1X Chase Ultimate Rewards point on all other purchases

The signup bonus of 100,000 Chase Ultimate Rewards points after meeting the minimum spending requirements is worth $1,250 toward travel booked through the Chase site.

That’s because each point is worth 1.25 cents on travel (100,000 X 1.25 = $1,250). And wow, $1,000+ for getting a credit card is a lot of money.

This is the ONLY Ink card whose points transfer directly to travel partners at a 1:1 ratio.

Pair Chase cards to earn even more points

Having access to these partners is total gold. My favorite partners are British Airways, Hyatt, and Singapore Airlines.

Hyatt and Southwest are 2 partners with no blackout dates to think about. If a room or seat is for sale with cash – you can book it with points. And you can often get a great deal by simply transferring your points first. Transfers are instant, so you can book as soon as you find the time or date you want.

You also get $600 in cell phone insurance when you pay your phone bill with the card.

You should consider this card if you:

- Like the 3X bonus categories and spend a lot on travel, shipping, advertising, or on internet/cable/phone

- Want the ability to transfer your points

- Don’t mind the $95 annual fee (the points you earn will be worth much more)

You should NOT get this card if you:

- Don’t want to pay an annual fee

- Aren’t a fan of the bonus categories

That said, this sign-up bonus is so good, it’s worth getting for that reason alone. I mean, $1,000 to use however you want for a trip is amazing.

2. Chase Ink Business Cash

| Ink Business Cash® Credit Card | |

|---|---|

| • 5X Chase Ultimate Rewards points on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2X Chase Ultimate Rewards points on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year |

| • $0 annual fee | |

| • Excellent 5X categories and best-ever offer right now | • Compare it here |

Bonus categories:

- 5X Chase Ultimate Rewards points on the first $25,000 spent on internet, cable, phone service, and at office supply stores, each account anniversary year

- 2X Chase Ultimate Rewards points on the first $25,000 spent at gas stations and restaurants, each account anniversary year

- 1X Chase Ultimate Rewards point on all other purchases

The signup bonus is worth $500 as a statement credit, or you can book travel with it. This card has NO annual fee, so it’s free to keep forever.

If you have another premium Chase card, you can combine the points (see image above). But on its own, this card earns cashback in the bonus categories.

Speaking of which, look at them closely because earning points for gas, dining, and office supply stores is unique to this card.

If you’re looking for a good “starter card” which excellent bonus categories, I’d definitely recommend this one!

You should consider this card if you:

- Like the 5X and 2X bonus categories and spend a lot on internet/cable/phone, office supplies, gas, or eating out

- Don’t want to pay an annual fee

You should NOT get this card if you:

- Want transferable points

3. Chase Ink Business Unlimited

| Ink Business Unlimited® Credit Card | |

|---|---|

| • 1.5X Chase Ultimate Rewards points on all purchases with no cap |

| • $0 annual fee | |

| • Compare it here |

Bonus categories:

- None. This card earns a flat 1.5X Chase Ultimate Rewards points on all purchases

The name of the game here is simplicity. There are no bonus categories to think about. You simply earn 1.5% cashback on every purchase.

And while there are 2% cashback cards out there, many of them are personal – not small business – cards. And a couple of them have annual fees (I’m looking at you, Capital One).

Set it and forget it. This card earns a flat 1.5% cashback and has a $500 signup bonus, so you can get back to important things like naps with puppies

Plus, it’s hard to find a signup bonus of $500 on a card with NO annual fee. That’s a heck of a deal.

There’s not much more to say about this card. And that’s a good thing.

You should consider this card if you:

- Want a dead simple rewards program

- Don’t want to pay an annual fee

You should NOT get this card if you:

- Spend a lot in the Ink Cash’s bonus categories – because it also doesn’t have an annual fee

- Want transferable points

All this to say, if you pair this card with a premium Chase Ultimate Rewards card, you’re earning 1.5X Ultimate Rewards points on every purchase – and that’s a sweet deal. But don’t worry, you can always start here and add another one down the road.

Bottom line

- Key Link: Chase Ink Business Preferred – Compare it here

- Link: Chase Ink Business Cash – Compare it here

- Link: Chase Ink Business Unlimited – Compare it here

It might sound complicated at first, but once you break it down, it’s pretty simple.

There are 3 Chase Ink cards – Preferred, Cash, and Unlimited – and they are all worthwhile for small business spending. It all comes down to:

- If you want points that transfer or cashback rewards

- Want an annual fee or not

- Which sign-up bonus you want to earn

- How useful you find the bonus categories for your spending

I would personally go for the Chase Ink Business Preferred for the biggest sign-up bonus. You can always change to a different card in a year if you don’t like it and bank a sweet $1,000 trip now.

Which Ink card do you think is best?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Hi Harlan!

It was great meeting you at cardcon. My husband signed up for the chase ink unlimited for our biz and he’s happy with it – he doesn’t have to think of bonuses and of course, no annual fee! We do have the sapphire reserve right now so transferring the UR earned from unlimited to partners won’t be so hard 🙂

That’s amazing – y’all definitely have the right idea.

I loved hanging out with you – adding you to my Feedly right now. Let’s please keep in touch! <3

I hope to see you next year!! I just got approved for Citi Premier too, so yay. Looking for another card to get for my husband but it’s proving difficult!