Update: American’s shitty response when I tweeted this post:

@harlanvaughn Harlan, we can understand your frustration. We studied the industry trends and policies of your competitors.

— American Airlines (@AmericanAir) April 8, 2014

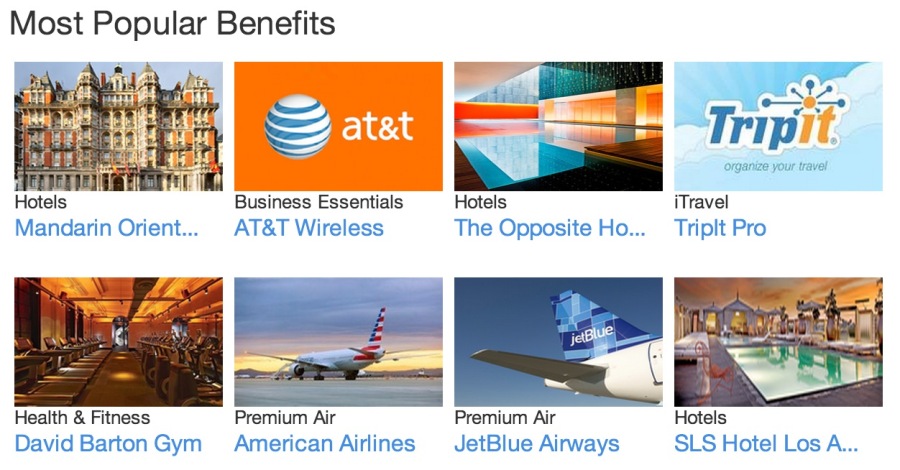

Did you feel it this morning? The quake that rippled through the blogs regarding American’s sudden overhaul of award redemptions? They also eliminated the beloved Oneworld Explorer Award AND stopovers at North American “gateway” cities – two features I really loved about the AAdvantage program. It’s a veritable mAAsacre.

I have to admit, I was really down about it. I don’t really care about the new five-tired award redemption system. I only ever booked SAAver awards anyway. The others are pure capacity controls, nothing more.

I was really looking forward to booking an Explorer Award in the near future. American recently introduced an unprecedented 100K bonus on the Executive AAdvantage card, which was enough, or nearly enough, to book a decent Explorer Award. I know a lot of people were looking into it and beginning to plan one of their own, including me.

And now, overnight, it’s gone. No advance notice. No, “hey you might want to book this soon”. Just a complete, unannounced overhaul.

The other thorn was the elimination of the free one-way that you could tack onto an award redemption. I was planning on doing that too, to get back from Oktoberfest, then onward to somewhere else. Now, the “somewhere else” prices as a completely separate award.