I forget where I saw the link. I think I clicked through something from Twitter and fell into the rabbit hole of the internet. But it ended up being a good thing, because I found this new service called Paribus.

What it is and how it works

Paribus is a service that monitors price changes for you at 18 (so far) popular merchants. If there’s a price drop, Paribus submits a price adjustment claim on your behalf. And the merchants included are some good ones:

- Athleta

- Banana Republic

- Best Buy

- Bloomingdale’s

- Bonobos

- Gap

- J.Crew

- Macy’s

- Newegg.com

- Nordstrom

- Old Navy

- Piperlime

- Sephora

- Staples

- Target

- Walmart

- Zappos.com

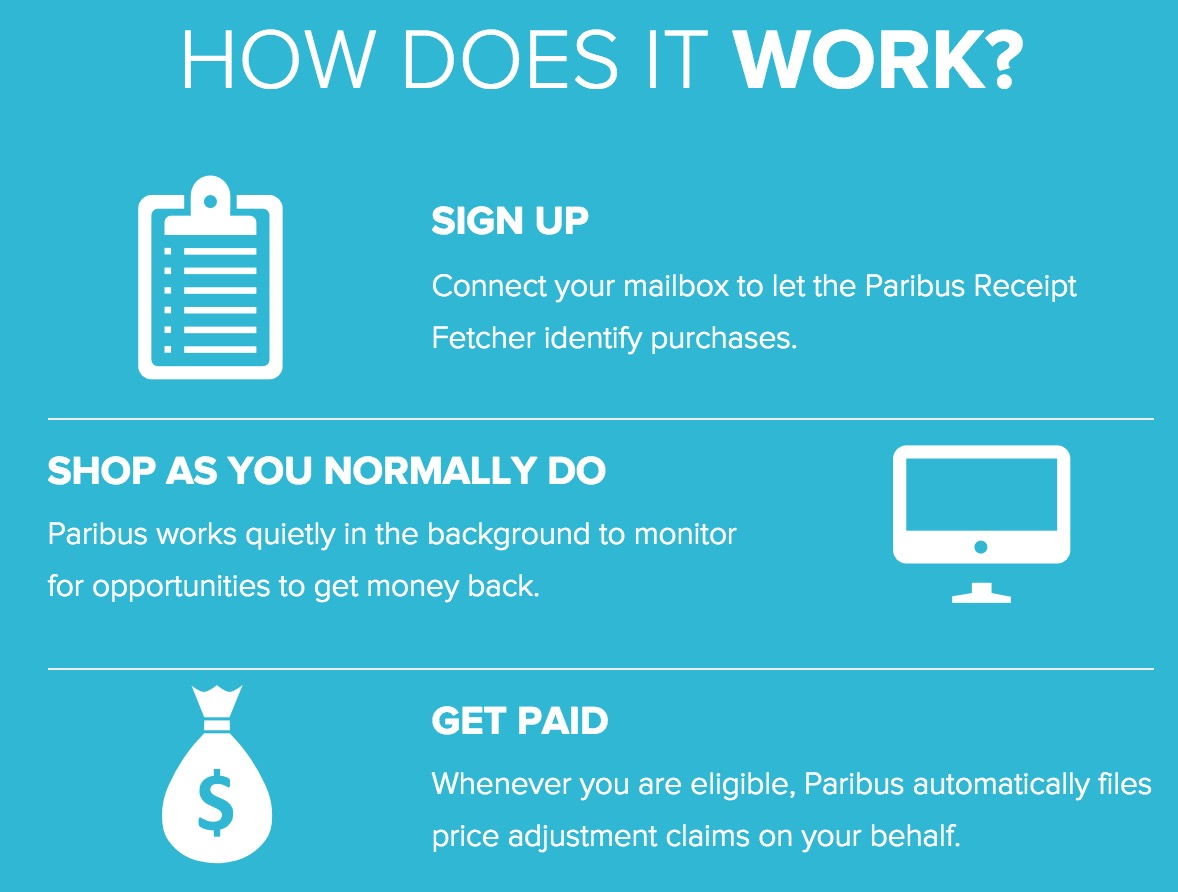

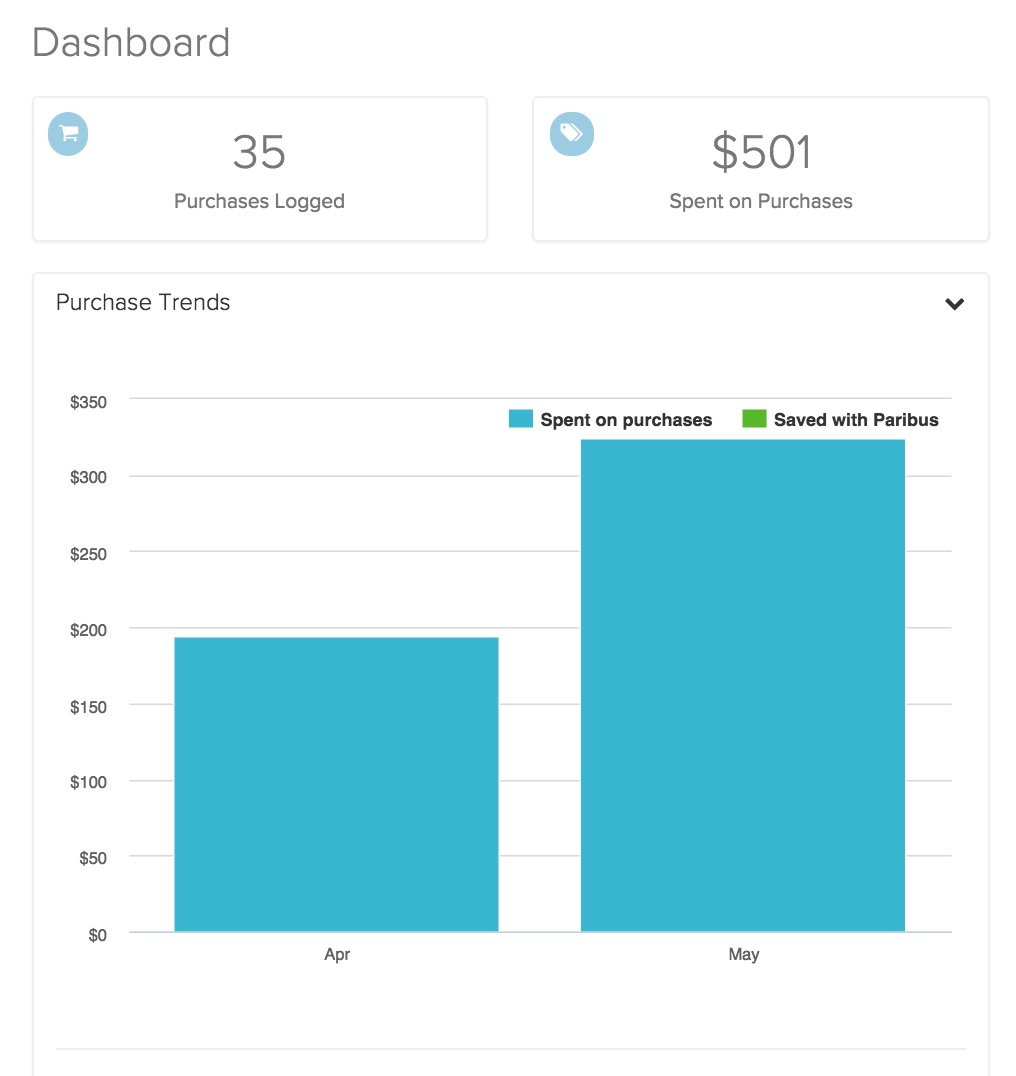

To get started, you can sign up for free. You connect the email account where you get your receipts. It monitors your inbox for receipts and keeps a log of your purchases.

If there’s a price change on anything you bought, they ask for an adjustment for you. The service is free to use. You link a credit or debit card to your account and they’ll issue the refund in the form of a statement credit (they use Stripe as a payment processor).

This can be easy – and maybe unexpected – money coming your way.

The fact that it’s free to sign up makes it a no-brainer. And I must say I’m impressed with the merchants they are starting with.

I could see this being super useful around the holidays when so many prices are being slashed left and right for Black Friday shoppers.

Keep in mind that Paribus still has to follow the price adjustment rules of each individual merchant.

The CamelCamelCamel angle

CamelCamelCamel is a website that tracks items for sale on Amazon.com. They keep records of historically low prices for everything. So you plug in the item you have your eye on and it tells whether or not the price might drop based on previous trends.

If you buy your things from Amazon while they’re at their lowest, you won’t have to even utilize Paribus. You’d simply save the money upfront, which is always good too. But even if the price of something you bought drops even more, Paribus would be there to get a price adjustment for you.

I can see these 2 services being super useful for savvy web online shoppers when used in conjunction with one another.

Bottom line

Thought I’d share what I learned about Paribus. It’s free and easy to sign up, so you really have nothing to lose.

Does anyone else already use Paribus or CamelCamelCamel to track prices and shop? Would love to hear thoughts about either service as I am still new to both. And of course any others that are super handy slash in the same vein as these. Let me know in the comments below!