Here at Out and Out, I had this idea to make February “Manufactured Spend Month.”

With the impending blizzard, and then frigid single digit temps on the horizon, I used this nearly 50-degree day to manufacture some spend ahead of schedule.

First, I went to CVS with my Chase British Airways Visa Signature and got $1,000 worth of PayPal My Cash cards. The transaction went through flawlessly. And later this evening, I will pay my first round of rent utilizing RadPad.

After CVS, I dared to face the Target at Atlantic Terminal in Brooklyn, New York.

My heart was pounding as I went in. It’s perhaps the busiest Target store in the entire United States and some say one of the busiest in the Northern Hemisphere (Target does not officially publish their busiest locations), so I wasn’t sure what their stance would be on ol’ REDbird. Would it be par for the course or the one store where credit cards were NOT accepted for reloads?

My experience

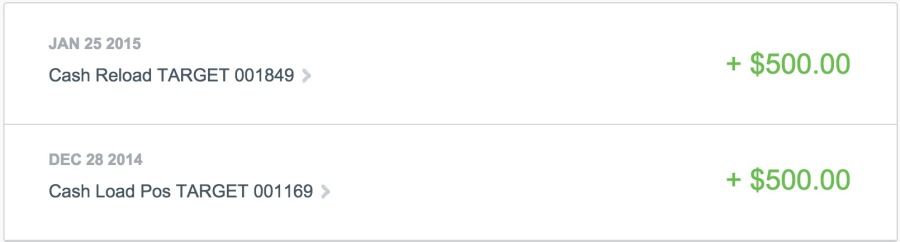

It was crazy busy, as are most Sundays, but after 10 minutes, I was up. As I neared the register, I actually saw a sign for the REDbird card in the store – in Spanish. I pulled out the REDbird card and asked to load it up for $500.

The cashier treated it like any other transaction, pressed a few buttons and told me to swipe my card. I pulled out the Chase Sapphire Preferred and swiped it. It went through perfectly.

The receipt printed out, and the reload appeared right away in my account. I had no issue whatsoever with the loading of REDbird at the Brooklyn Target.

I pass this train stop literally every day so this is a boon for me. Twice a month, I will round up my cards and load up REDbird for $2,500.

Between REDbird and PayPal My Cash cards, I am set on my MS for a second. And as long as both of these things are in play, I will be maxing it out as much as I can. This by far better than Vanilla Reloads ever were. So easy.

Now that I know it works, I want to spend some time thinking about how to optimize and maximize this even better… There must be an opportunity in here somewhere.

Bottom line

I don’t know why, really, but I was very trepidatious about the Brooklyn Target. I guess it’s because of the huge opportunity loss if it didn’t work. But, I am happy to report, it does!

If it worked in Brooklyn, I can say with near certainty that it will work at the Manhattan location (117th St) as well.

Any other New Yorkers out there been holding out on REDbird? If you want to get one, I’d recommend closing your Serve or Bluebird account (or figuring out how to keep both) and dig it while the getting is good. Nothing like a boatload of completely free points and/or miles.

Also, please feel free to leave data points or ask questions in the comments below. Has anyone else been having a good experience with REDbird so far?

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

You can get the redbird prepaid card here in NYC now? I’ve had one since the fall and never had any problem with any Target in the tri-state area.

Joe, I should’ve just asked you when I saw you yesterday!

I imported the temp card from a Target in Mississippi. They are not selling the temp cards here yet, so you still have to bring it in from somewhere else – for now.

Has any cashier ever said anything about the $2,500 max? Just curious.

Thank you!

No cashier talked about the $2500 but then again I never asked and I never went over $2500 per day. I got my temp card in MA and haven’t had any problems with it. I have heard though that if there is an issue, the likely culprit is an automated block from the bank faud dept (so call them beforehand that you’re about to make large purchases at the big red dot. 😉

Thanks for the heads up. I’ve heard US Bank is the worst about blocking these transactions.

Thanks for the update!

You are welcome! So glad it works!!!

Thx, Harlan, was trying to go today, but work got in the way. Hopefully tomorrow at some point I can make do.

Has anybody tried Bronx and white plains? This would be awesome, I currently drive to white plains to load my bluebird at Walmart every weekend after purchasing visa debit cards. This would be obviously a more efficient way to ms spend.

Not sure why you needed to confirm this. I’ve always reloaded my redbird at a New York City Target without problem.

A couple of people asked me about this specifically, so I figured I’d make a post about it in case anyone else was in the same boat about being unsure.

Did you buy your temp on ebay?

I got my temp card at a Target in Mississippi when I went to see my Mom for Christmas, but I’ve heard that you can get them off of eBay!

I’m going to blame you for this, since you are an evil blogger who ruins everything 😉 The Atlantic Center Target now requires that Redcard loads be done at the service center and the supervisor will insist on debit or cash only. The register still accepts credit, but you essentially have to sneak it past them. I’d been loading with credit cards in regular lines for months and this change just happened last week. I been there twice in the last two weeks and got the same treatment both times. I was able to sneak one load past the cashier with a credit card, but it is not nearly as easy as it was before.

Gross. Kinda what I was thinking would eventually happen at this location. Thanks for the heads up!

Has anyone ever tried this at the Queens Target?

Has anyone tried in Harlem? Is this still working, generally? Was just approved for Chase Sapphire Preferred and need to celebrate 🙂 Thanks!

I’ve heard that it IS still working in Harlem. Please report back – would make a great data point. And congrats on the CSP!!!