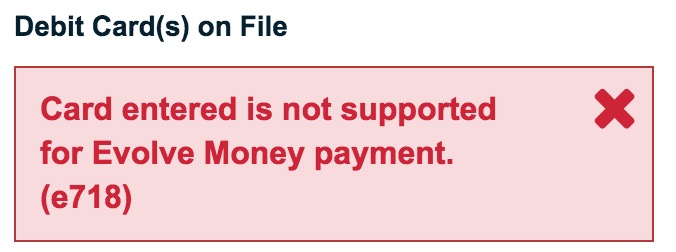

UPDATE 1/26/15: A few readers have reported that their PayPal Business Debit Cards no longer work with Evolve Money. Indeed, when I deleted the card and went to re-add it, I got this error message:

Apparently other users that added the card previous have been grandfathered in, but new users are not able to add the PayPal card as a new payment method. Major bummer. I have updated posted to reflect this. RadPad is still working great though!

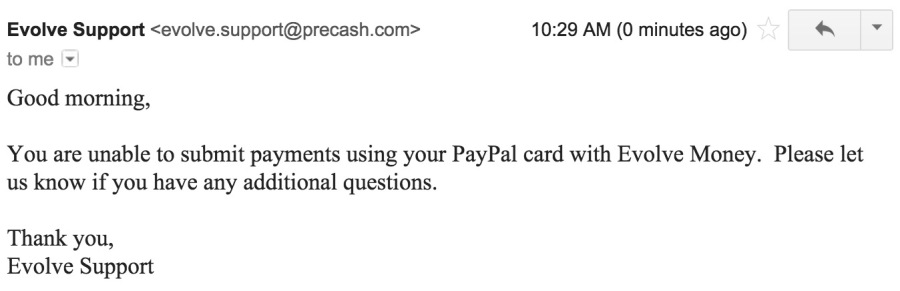

UPDATE 2: Just got this email from Evolve Money:

#deadinthewater

I’m going to dub February “Manufactured Spend Month” for Out and Out.

I still have the intention to make that data point about the REDbird (see link above), and I’ve been eyeballs deep in FT/Milepoint convos about it the past few days. All signs point to: it should work. I’ve been nervous about killing my Serve card only to find that it can’t be loaded in NYC – which is already kind of a barren wasteland for MS to begin with. If the Target in Brooklyn doesn’t let me load REDbird, the next closest Target is in Harlem, which is a bit far for me. But, positive vibes.

With the Serve card, I can reload $1,000 per month from my computer or phone without leaving home. With REDbird, I’d have to make at least two in-store visits per month. But I can reload 5 times more per month. And I won’t have to worry about cash advance fees, which means I am free to use any card I want (although I’ve heard US Bank is beasting about the reloads and flagging them all as fraud.)

With all of this in mind, and with all the other work I have going on, I have decided to make my data point in February and get one more round of loading out of the Serve card before I kill it. Hence February being declared MS Month.

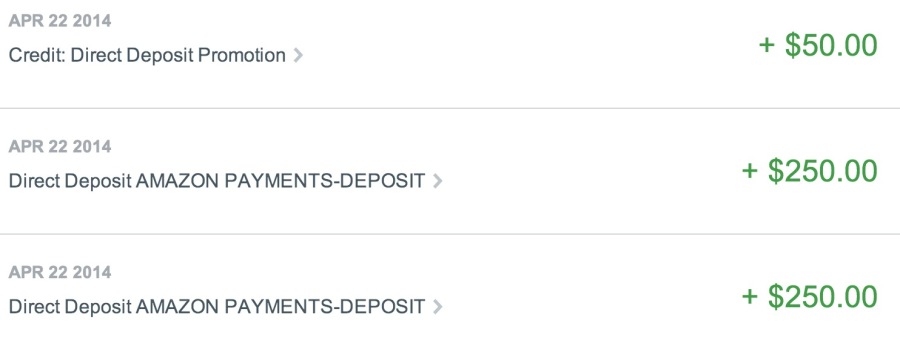

Anyway, aside from REDbird, I started adding up the ingredients for an addendum to the madness. It could be another way to run an additional $4,000 of MS through credit cards and a great way to pay rent, student loans, and everyday bills, or to load Serve or REDbird.

Stop! HT time.

Before I get any further, I have to stop and do some HTs:

- I found out about the PayPal business debit card from Travel With Grant.

- I found out about the PayPal My Cash cards from The Miles Professor (initially in person).

- I found out about RadPad from Doctor of Credit.

Finally, I thought I had coined the term “Perpetual Points Machine” (PPM). No. That would be Frequent Miler, who began using the term as early as 2011. It’s one of those terms that you read once or twice and it just gets stuck in your head. FM has lots and lot of great stuff about manufacturing spend, and I’m not surprised he is original user of this phrase.