Also see:

A few of you guys have asked for an update on my Airbnbs. There is a strong, thriving, and supportive community of Airbnb hosts here in NYC that I am happy to be a part of. My original articles about my foray in Airbnb were meant to analyze the financial investment/business sense behind setting it up, and were met with a good amount of interest. I received some messages spurred by curiosity, some seeking advice, and others that were downright nasty (which is fine).

The atmosphere surrounding Airbnb in New York is definitely a hot topic, and I deal with that on a daily basis. For the purposes of this article, I’m gonna treat it as I do daily: as a business, by a passionate traveler for other passionate travelers.

Tax time

For those doubting whether this is a legit business, my accountant says otherwise. Airbnb sent me a 1099-K form and you better believe I had to do something with that form.

The first year, 2014, was for the tail end of October, November, and December – so really only 2 months. In those two months, I broke even on my investment. I made back everything I paid out, including furniture, decorations, rent, utilities, etc. I wrote about the initial investments in exact detail.

In 2014, I started one in November and one in December. In 2015 so far, I am starting up a third next month, which I’m really looking forward to.

Moving forward, I am putting 20% of all profits into a high-yield savings account (this one by American Express actually, although I also considered this one by Barclays. I wouldn’t get too caught up in the interest rates. It’s a difference of about $10 per year paid out in interest – just go with a company you like and feel safe with).

Why 20%?

This is the amount I expect to pay in for taxes in 2015, and I can easily set up a payment to the IRS from this account for quarterly tax payments. If I route 20% of all profits into that account, I’m essentially withholding tax from and for myself.

The numbers

A note about the numbers. To kick off Q2, I am getting a 3rd Airbnb, so the numbers are a little skewed.

It’s also March 25, not the end of the month obviously, and I still have 2 bookings that cross over into April. For this purpose, I’m lumping them into Q1 because I get paid on them in Q1. However, I am also including them in Q2 because my estimates go all the way to the end of August and I can reasonably expect to earn similar amounts across the Q2/Q3 divide.

Cool? OK.

So how’d I do in Q1?

- Rent: $13,350 ($2,150 x 3 + $2,300 x 3)

- Utilities: $900 ($150 x 3 x 2)

- Consumables: $200 (toilet paper, cleaning supplies, laundry service, extra dishes, etc.)

- Upgrades: $250 (new sheets, new comforter, extra mattress pad, new decorations)

Total: $14,700

So I made in Q1… about $500!

Which is dismal. Not even $300 a month. But I’m optimistic for the rest of the year.

Let me explain.

January and February were brutal. They nearly slaughtered me.

As I paid the rents and utilities, I seriously second-guessed myself. Wondered if I’d made some huge mistake with all of this. Got down on myself. As I cleaned and prepared the apartments, I realized acutely that I was making less than minimum wage for doing the job.

It was a long winter here in the Northeast. Not as bad as last winter, but bitterly cold for long spells. And occupancy rates were down. Real estate was tough as well, so for nearly 3 months, I survived in a vacuum, which is always hard.

And I didn’t want to lose money. I wanted to at least break even. My tactic was to severely undercut every hotel in the city, and every other Airbnb rate as well. It paid off. Even though my calendar was full, I was charging the absolute minimum to scrape by.

And then a great thing happened. I started getting inquiries about spring and summer. I actually got so many I had to raise my rates. I worked hard in Q1, broke even, got some great reviews, and made some great connections. It was hard, but it was also worth it. Hindsight, eh?

Now, at the beginning of Q2, I’m poised to raise rates again, as well as start a 3rd location.

So just know that winter was hard this year and will probably be hard again next year. But at least this time around, I’ll be coming down from a huge high instead of meeting it right after breaking even in 2014. That was hard. But the plus side is that an apartment that would ordinarily rent for $2,600 in the summer was rented to me for $2,150 – a massive savings of over $5,000 a year. So there is a huge advantage to renting in the winter. Just be prepared to eke by for a few months.

Also, despite the cash flow issues, I continued to invest into the Airbnbs as businesses. I made them better. I use high-quality products and have always refused to skimp around the edges. I buy consumables in bulk, and stockpile extras in my apartment at home to save a little money.

And Q2 into the end of August is already looking great.

The next 5 months

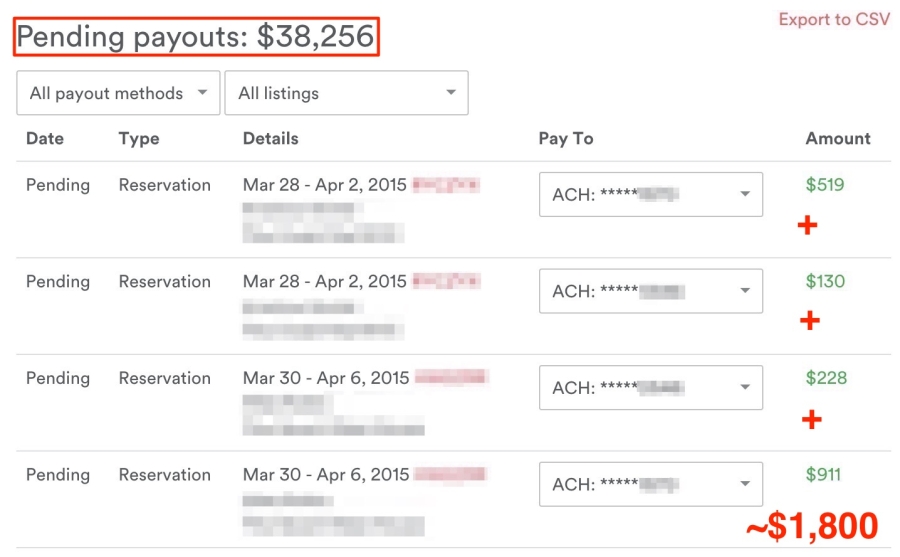

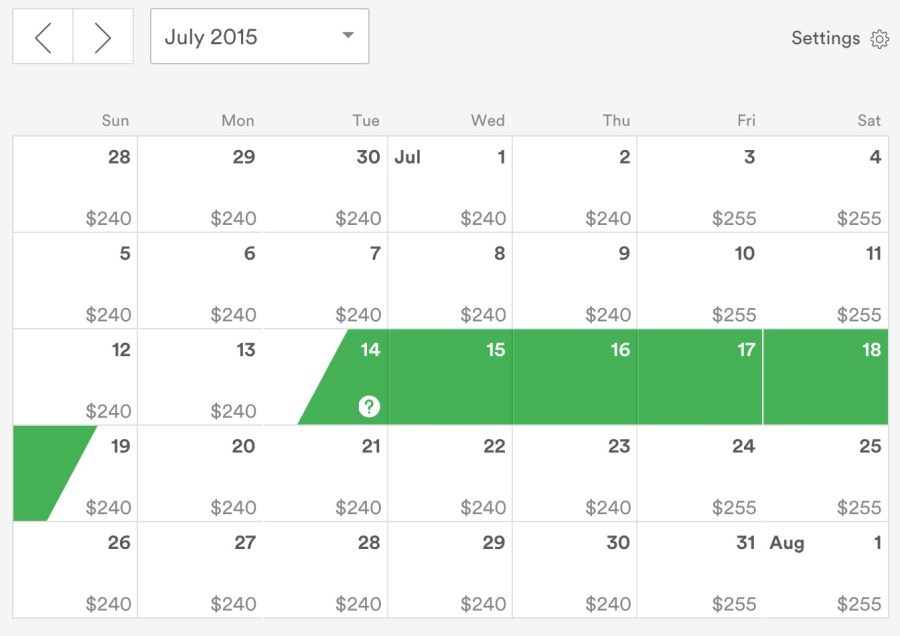

Pending payouts through the end of August – and remainder of payouts for Q1 (for the sake of completeness)

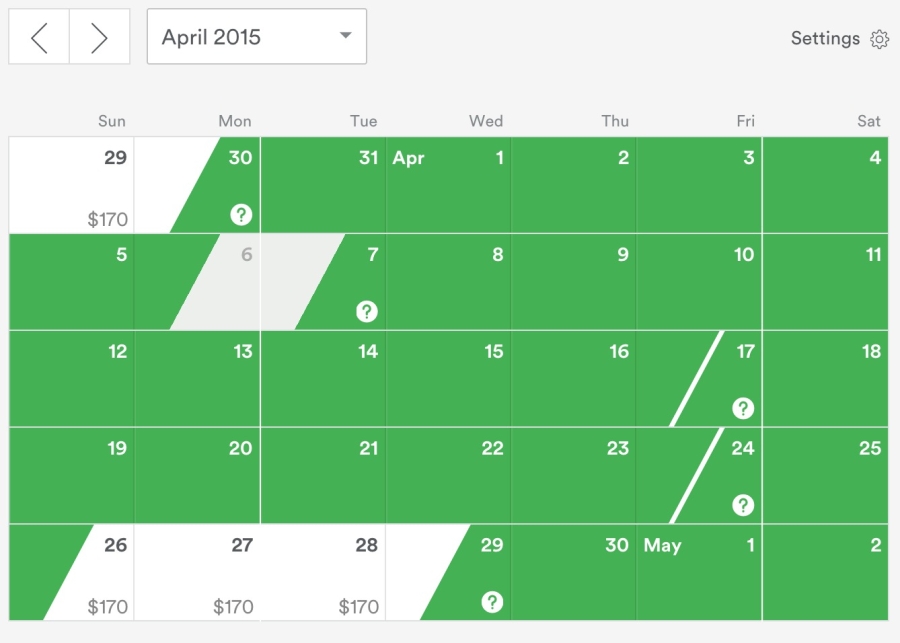

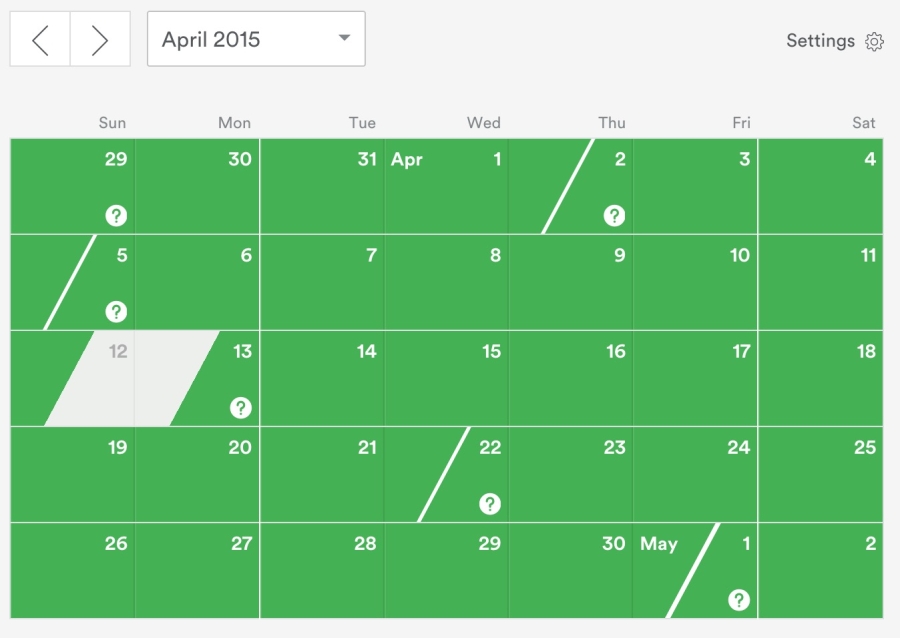

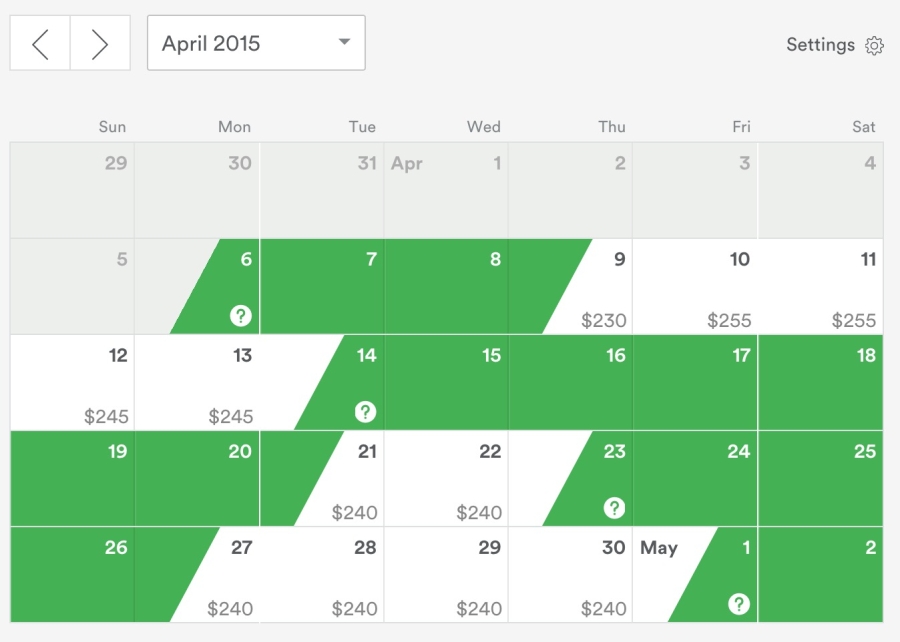

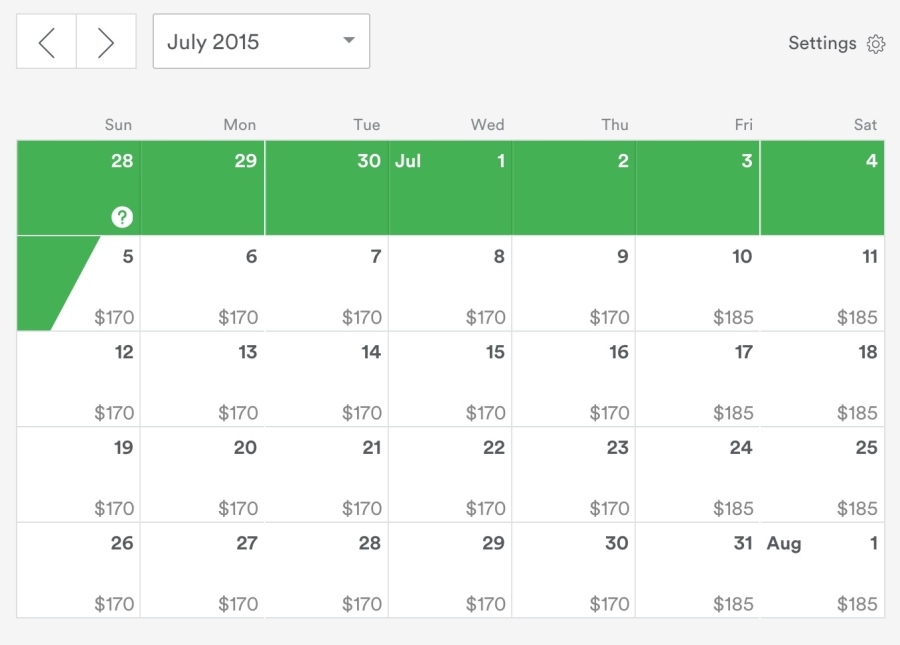

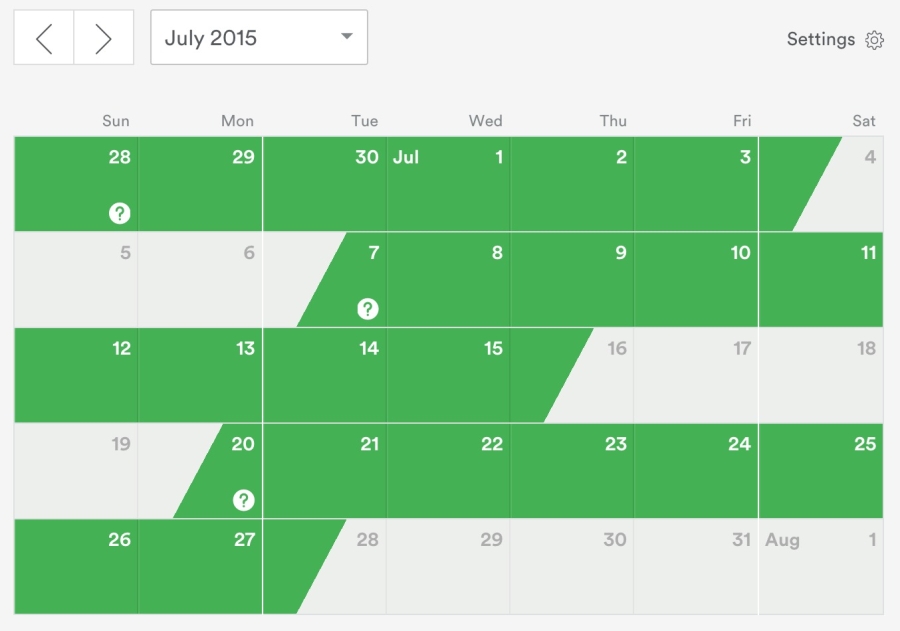

Before I get into the numbers, here are my calendars for April for all 3 places versus July for all 3 places.

April

July

Looking ahead

I wanted to make the distinction between April and July for a couple of reasons. For one, April is already off to a great start. And July is barely booked.

Even still, I get a lot of last-minute requests, as well as a few long-range requests, and I think both of those are demonstrated here.

There are elements of both preparation and patience that have to go into this.

Even still, my pending payouts for April through August are already $38,256, and I only see that number going up, if not tripling then surely doubling based on what I’ve already experience in 2014 and with Q1.

Assuming all factors remain the same, here’s how it stacks up:

- Rent: $30,250 ($2,150 x 5 + $2,300 x 5 + $1,600 X 5)

- Utilities: $1,125 ($150 x 5 + $75 x 5 )

- Consumables: $200 (toilet paper, cleaning supplies, laundry service, extra dishes, etc.)

- Upgrades: $250 (new sheets, new comforter, extra mattress pad, new decorations)

Total: $31,825

For a profit already of ~$6,400, or ~$1,300 extra per month for the next 5 months. However, I expect this number to triple and definitely double… let’s go with to 2.5 to round down and manage expectations, which is $16,000 in profit in the next 5 months, with an average of $3,200 per month.

Reasonable expectations

Now that January and February are over, and I am already solidly booked for April and May, I expect the momentum to stay strong through the end of the year (based on November and December of last year).

I can also reasonably expect:

- Higher rates due to good reviews and recommendations

- More bookings due to the same

- Based on the numbers, an extra $40K-$50K per year, of which I will take home $32K-$40K after paying taxes at a rate of 20% – and maybe more

- Possibly more as I might get a 4th/5th/6th property this year (thinking big here)

Not bad at all for a side hustle. This, combined with my real estate work is how I’m paying down student loans and investing for my future… and for my impending financial independence and homeownership. Dear god, I can’t wait to own a home.

I’m excited, and optimistic.

I also want to put in a quick note about intention.

Airbnb is a slippery slope with the laws/landlords/regulations/taxes/etc. here in NYC. I understand that, and also understand that it could all come to an end any time. So I am mentally prepared for that.

I started this to connect with travelers when I am not traveling myself, as travel is my biggest passion in life. I’ve tried to be smart about the financial side of things though, and it is paying off. I started this as sort of an experiment… and it seems to be going really well. So well, in fact, that I’d like to scale up even more.

But I wanted to be sure to include my intentions for this whole thing.

Bottom line

Real numbers, real data, real info.

As you can see, January and February just about killed me. So it is with the ebb and flow of business in the winter. But March was strong and April is even stronger. May through September are poised to be stellar, then we have October, November, and December, which have proven (to me) to be historically profitable.

If there is interest, I am happy to post a Q2 update in mid-summer.

I’d love love love to hear what you guys think and please feel free to ask questions. And always feel free to email me instead if you’d like. Is it interesting to read about “the other side” of the Airbnb experience?

Overall, I am happy I’m doing this, even if this first quarter was break-even. I tried to be smart about it, and I made it through. Now, upward and onward.

Stay scrappy out there!

* If you liked this post, consider signing up to receive free blog posts in an RSS reader and you’ll never miss an update!Earn easy shopping rewards with Capital One Shopping—just log in and click a link.

Announcing Points Hub—Points, miles, and travel rewards community. Join for just $9/month or $99/year.

BEST Current Credit Card Deals

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.

Not sure I understand why you think your income will double/triple for months that seem to already be solidly booked out? Interesting none the less, my worry would be that your extremely over extended if AirBnB decides to close down NYC rentals.

I’m solidly booked in April, so-so in May, and lightly booked in June, July, and August – it’s those last three months that I’m expecting to be super solid, and is where the income from the calculations is coming from. If they are all completely booked, it will be closer to triple, so I’ll see what happens and hope for the best.

As for getting shut down… it’s crossed my mind a time or two. I could always sublet or end the lease (one of them is month-to-month). It would suck, but I’d have options. As of right now, it’s all going pretty well. Fingers crossed.

I’m definitely interested in reading more!

Thank you, Edward!

William,

Airbnb will shut down in NYC when Uber shuts down in NYC.

…….. Never

Sorry if I missed the first parts of the story but you are renting apartments and then subletting them via Airbnb? Interesting. I have no comment on the legalities of it since I’m not really aware of what it is ( hopefully you are! :-D) but sounds interesting.

I have a few rental properties (regular single family homes) and they can be good investments but also time sinks and I totally know the despondent feeling when there’s nobody renting!

It’s definitely a fun time. I consider it a gigantic experiment. The tides are turning now (thank god!).

As a New Yorker struggling to find affordable housing for me and my family, I find it disgusting that you have rented apartments for Airbnb use. Your greedy actions are squeezing us further out from an already tight market. Shame on you.

Why not list on other sites too in order to maximize occupancy? For example, HomeAway or VRBO? You can list there for free if you go with the commission model and only pay a small commission if someone makes a reservation.

I thought about it. One of my friends lists on HomeAway and says the experience has been so-so. Maybe I’ll give it a go.

In the lease agreement, the landlord allows you to rent out via airbnb?

In a rider to the lease, yes.