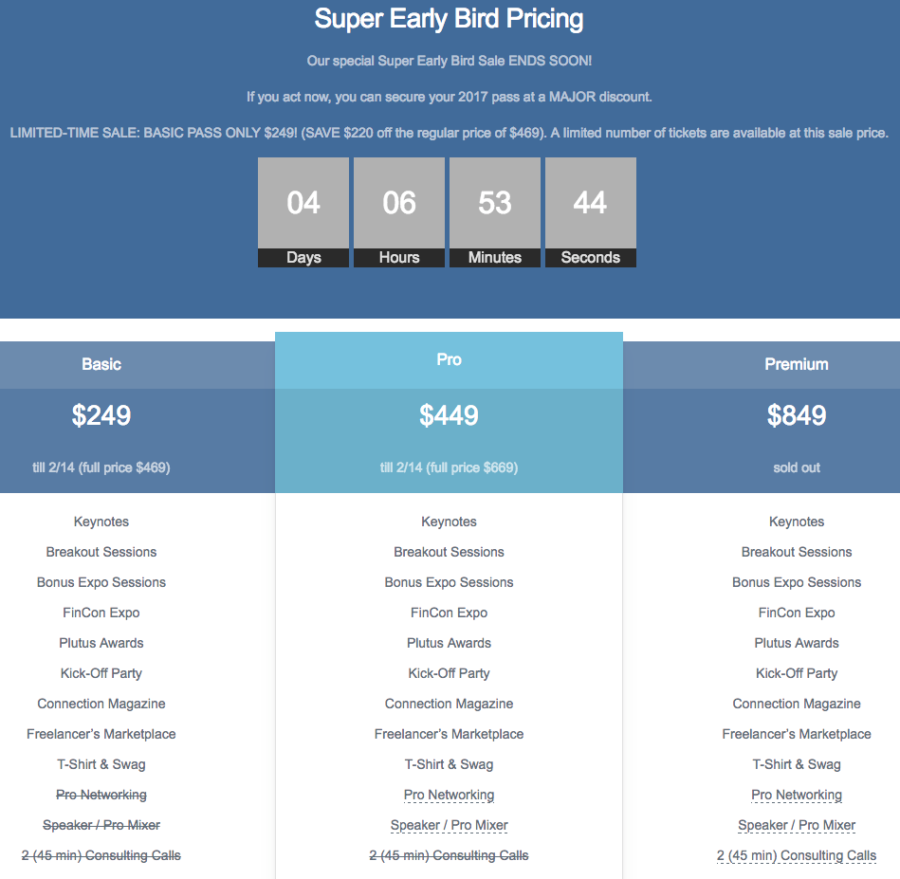

Well, the day is finally here – tomorrow begins FinCon 2017 in Dallas! I got early bird tickets back in February and it seemed the day would never arrive. I’ve been looking forward to attending my first FinCon expo for a while!

I know a lot of fellow bloggers and readers will be there – so if you see me around, say hey! Read More