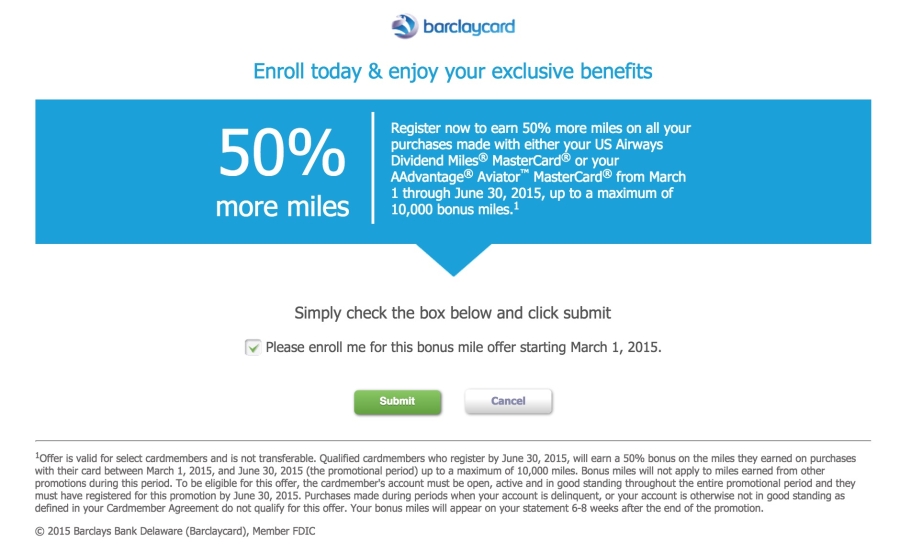

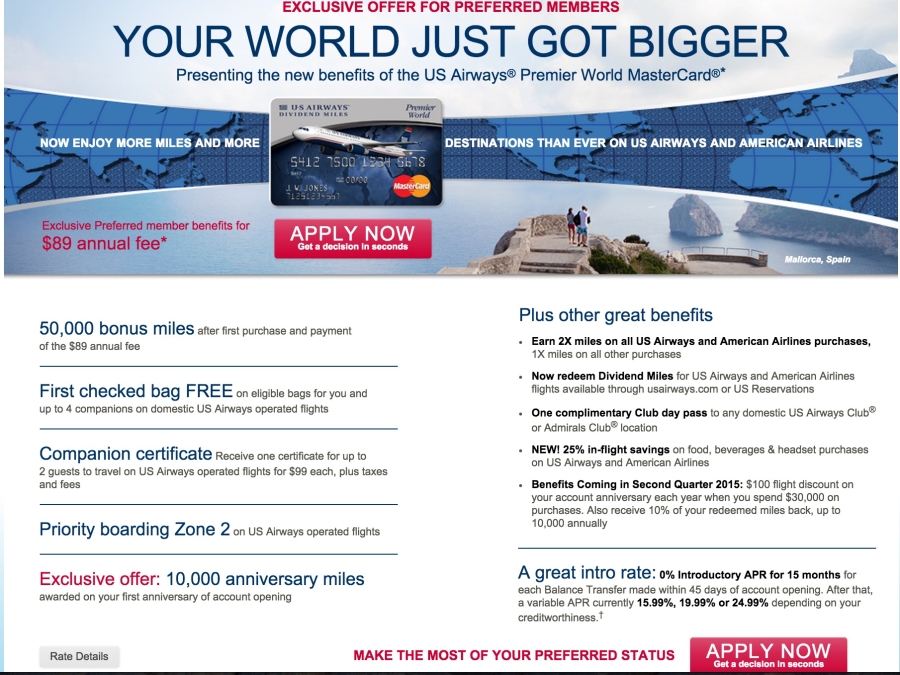

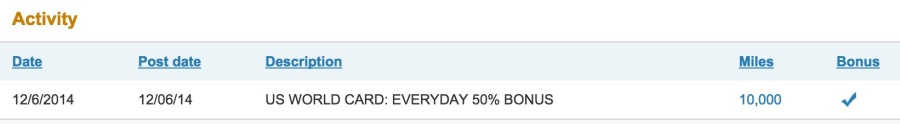

Very cool. Barclays is offering a 50% bonus on all spend for March through June for up to $20,000 in spend. This equates to 1.5 miles per dollar, which is a pretty nice rate of return for an airline cobranded card.

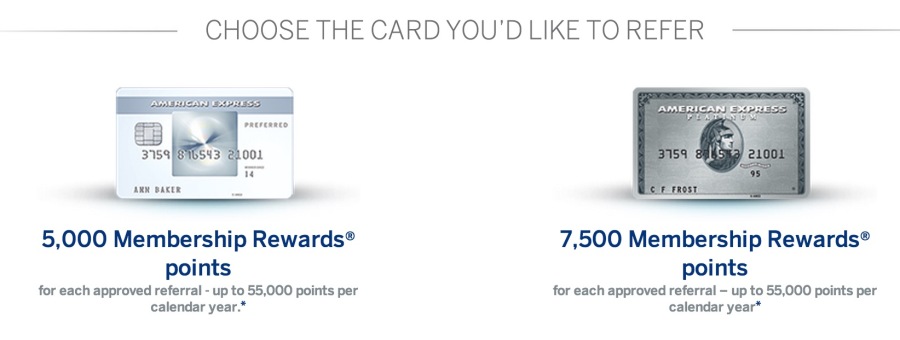

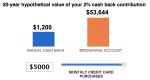

I value all my miles at 2 cents per dollar, so this is effectively 3% back if you value your miles the same way. At 1.5 miles per dollar, this matches what you’d earn by meeting the minimum transactions on an Amex EveryDay card for non-bonused spending, and obviously exceeds cards where you only earn one mile or point per dollar

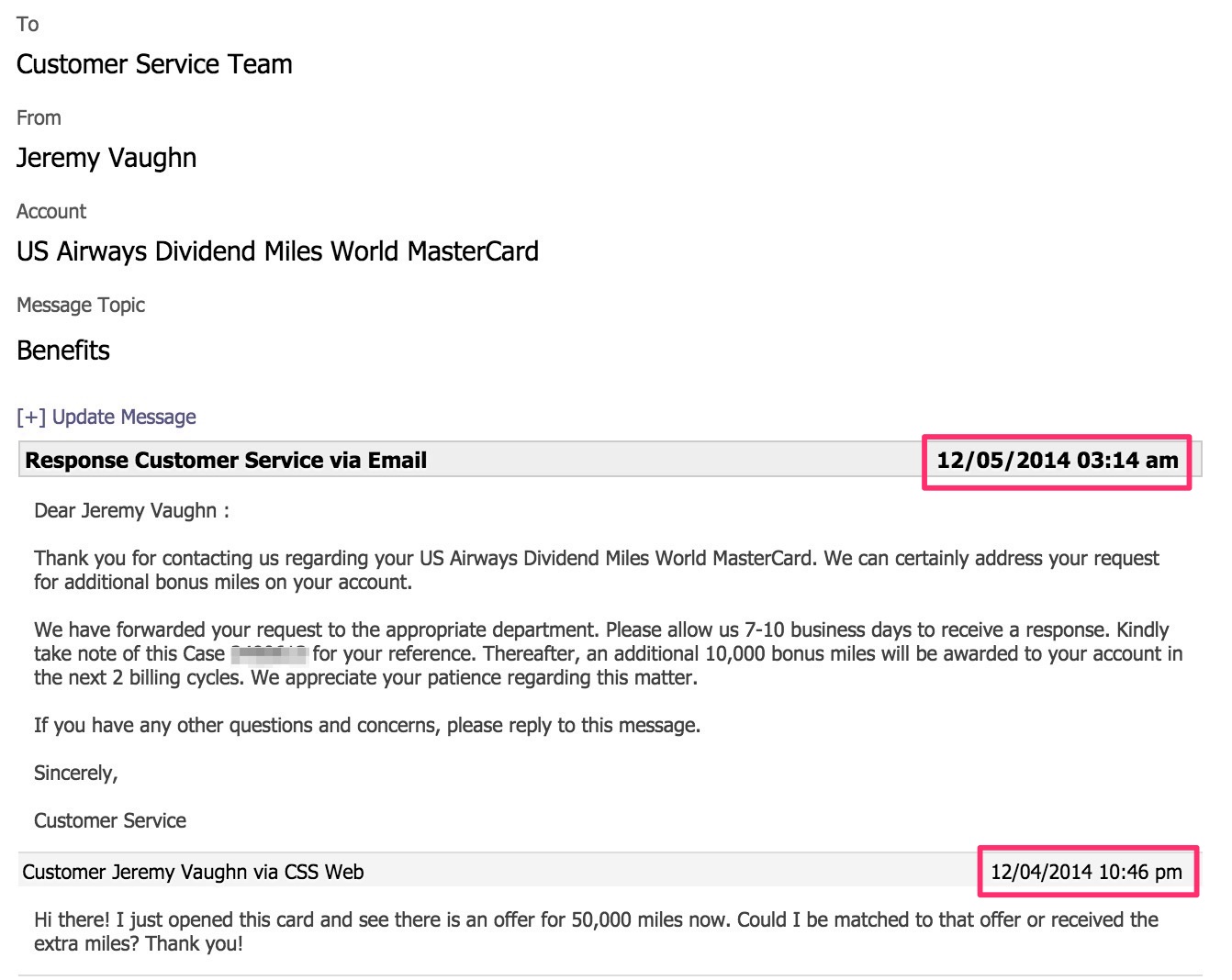

With the merger between American and US Airways happening quickly, these miles will be incredibly useful on American pretty soon.

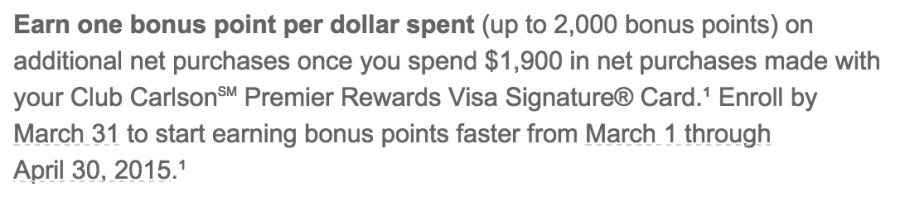

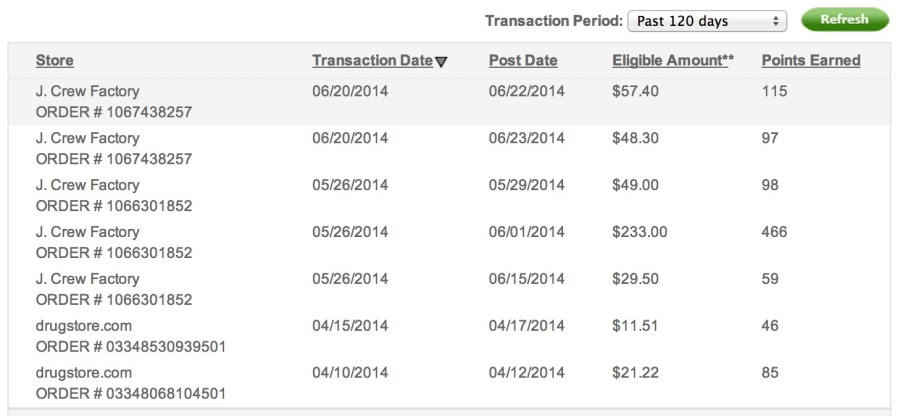

I’ll still give preference to my cards with category bonuses (groceries on the Chase Freedom this quarter, phone bill on the Chase Ink Plus, etc.), but will probably filter some spend onto this card after I max out the bonus I recently got on my US Bank Club Carlson Visa, which also begins in March – and it’s great to see credit card companies rewarding ongoing spending!

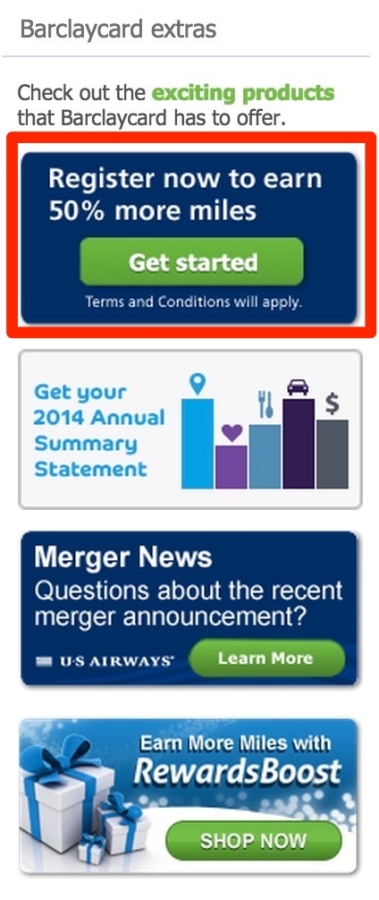

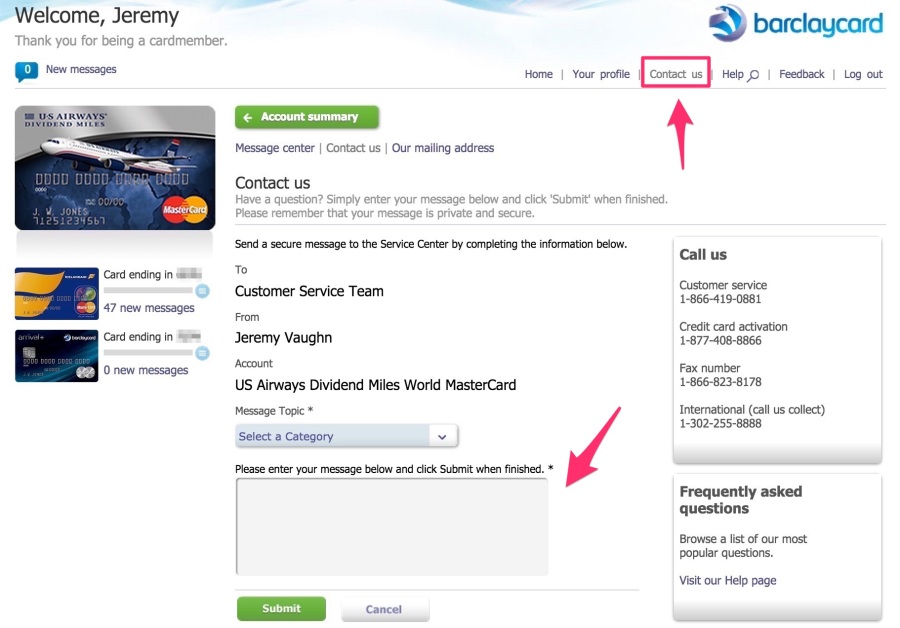

To check if you were targeted look under “Barclaycard extras” after you log in to the Barclays website:

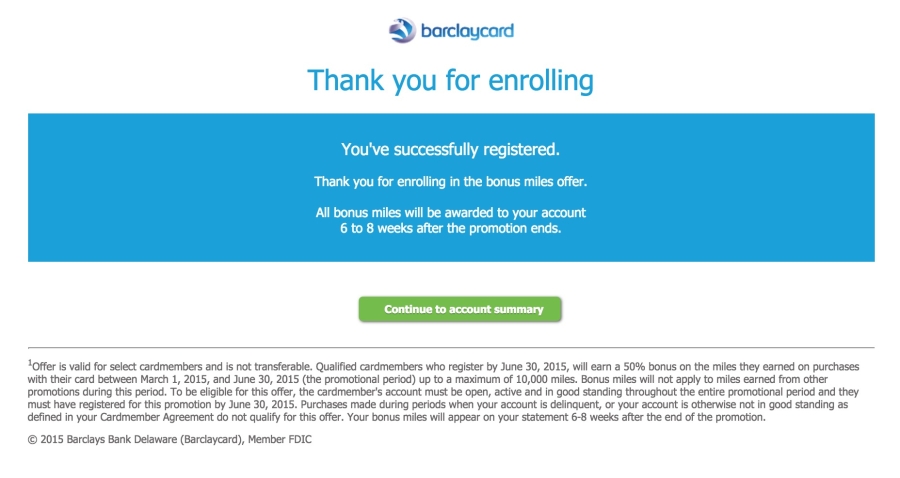

Then just check the box and click “Submit” – easy peezy.

Bottom line

It seems like a lot of US Airways MasterCard holders are being targeted for this offer without regard to account age, so if you’re new to the card or have had it for a while, it might be worth checking.

Were you targeted for this bonus? Will it encourage you to shift spend over to this card for a while?